Recreational Oxygen Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Recreational Oxygen Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

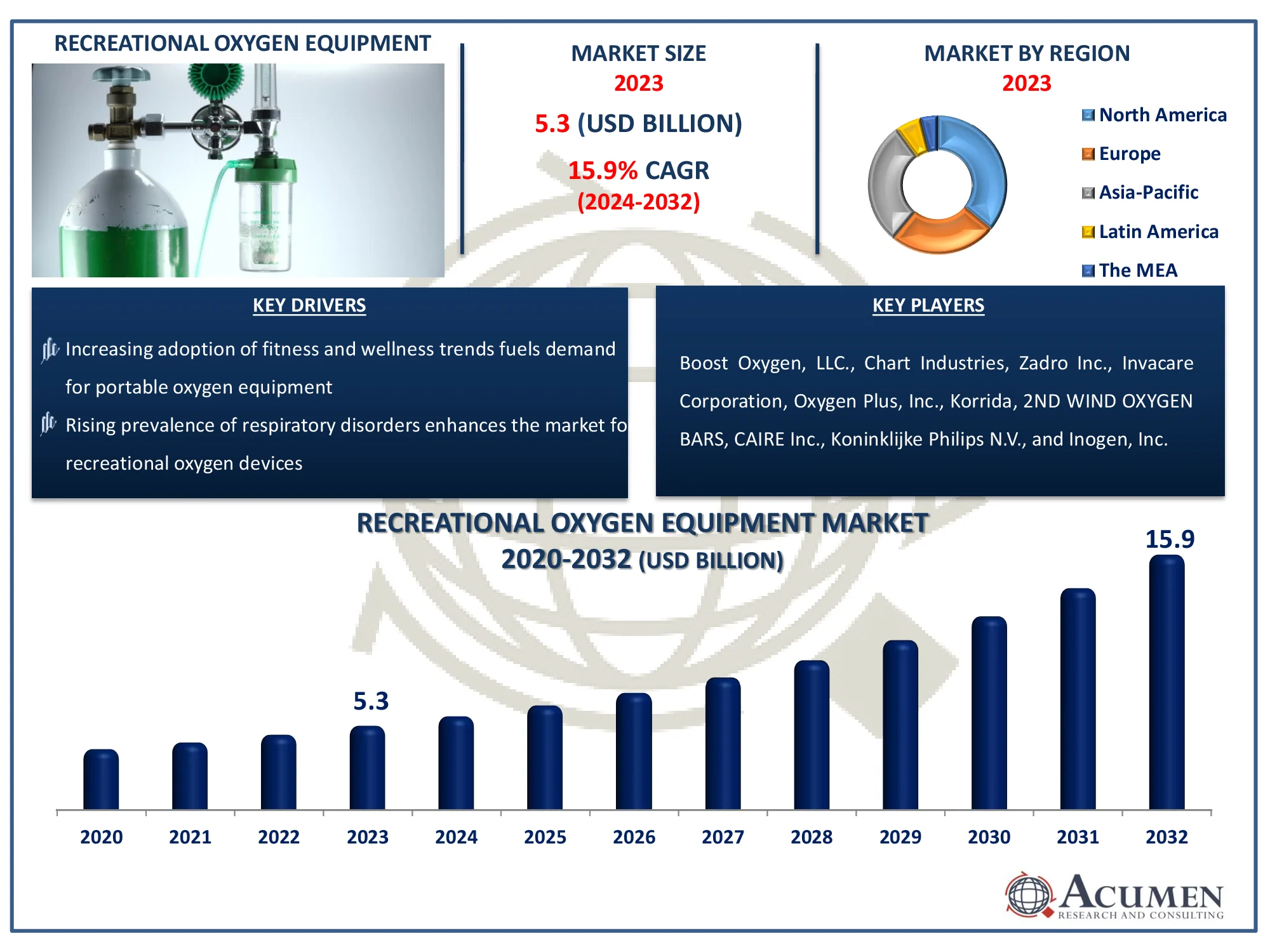

The Global Recreational Oxygen Equipment Market Size accounted for USD 5.3 Billion in 2023 and is estimated to achieve a market size of USD 15.9 Billion by 2032 growing at a CAGR of 13.2% from 2024 to 2032.

Recreational Oxygen Equipment Market Highlights

- Global recreational oxygen equipment market revenue is poised to garner USD 15.9 billion by 2032 with a CAGR of 13.2% from 2024 to 2032

- North America recreational oxygen equipment market value occupied around USD 1.9 billion in 2023

- Asia-Pacific recreational oxygen equipment market growth will record a CAGR of more than 14% from 2024 to 2032

- Among product, the concentrators sub-segment generated USD 2.2 billion revenue in 2023

- Based on application, the medical sub-segment generated 40% recreational oxygen equipment market share in 2023

- Increasing use of e-commerce platforms enables broader reach and consumer engagement is a popular recreational oxygen equipment market trend that fuels the industry demand

Recreational oxygen is also termed as consumer oxygen, which is used to enhance brain functioning and also to improve athletic endurance. Recreational oxygen can’t be replaced with the medical oxygen as medical oxygen is used for treatment purposes and is controlled by the FDA as a therapy. Along with this, equipment used for the delivery of recreational oxygen is called recreational oxygen equipment.

Moreover, recreational equipment includes concentrators and bar equipment among others. Oxygen concentrator does not create oxygen, whereas it separates oxygen from nitrogen and other gases which are present in the surrounding by a method called Pressure Swing Adsorption (PSA). Additionally, it doesn’t change the oxygen percentage in the surrounding instead it separates oxygen at the top of the machine and deposit nitrogen at the bottom, and delivers oxygen to the consumer from the top of the machine. The oxygen bar equipment is mostly used in festivals, tradeshows, corporate party, spa or shopping mall. These can provide 88 to 90% purified oxygen and can hook plastic nose hose to breathe.

Global Recreational Oxygen Equipment Market Dynamics

Market Drivers

- Increasing adoption of fitness and wellness trends fuels demand for portable oxygen equipment

- Rising prevalence of respiratory disorders enhances the market for recreational oxygen devices

- Growing awareness of oxygen therapy’s benefits for high-altitude sports

- Advancements in lightweight and user-friendly oxygen equipment drive consumer preferences

Market Restraints

- High costs of recreational oxygen equipment limit affordability for a broader audience

- Lack of regulatory standardization leads to consumer skepticism and market fragmentation

- Limited awareness in developing regions hampers widespread adoption

Market Opportunities

- Expansion into emerging markets offers growth potential for affordable recreational oxygen solutions

- Collaborations with fitness centers and wellness retreats can enhance product visibility

- Technological innovations in wearable oxygen equipment create lucrative growth avenues

Recreational Oxygen Equipment Market Report Coverage

| Market | Recreational Oxygen Equipment Market |

| Recreational Oxygen Equipment Market Size 2022 |

USD 5.3 Billion |

| Recreational Oxygen Equipment Market Forecast 2032 | USD 15.9 Billion |

| Recreational Oxygen Equipment Market CAGR During 2023 - 2032 | 13.2% |

| Recreational Oxygen Equipment Market Analysis Period | 2020 - 2032 |

| Recreational Oxygen Equipment Market Base Year |

2023 |

| Recreational Oxygen Equipment Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Boost Oxygen, LLC., Chart Industries, Zadro Inc., Invacare Corporation, Oxygen Plus, Inc., Korrida, 2ND WIND OXYGEN BARS, CAIRE Inc., Koninklijke Philips N.V., and Inogen, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Recreational Oxygen Equipment Market Insights

The rapidly increasing pollution across the globe due to various human activities is primarily driving the demand for recreational oxygen equipment. The increasing carbon footprints due to the abundant use of fuel-based vehicles across the globe are boosting the demand in the market. The benefits associated with the recreational oxygen equipment such as fast recovery from stress and improved stamina along with instant energy boost when required is further pushing the demand among professionals like actors and sports personality. In addition to this, high prevalence of Obesity Hypoventilation Syndrome (OHS) and respiratory diseases coupled with unhealthy lifestyle is also expected to create positive demand over the forecast period. Furthermore, the growing geriatric population is driving the demand for home-based oxygen therapy is likely to boost demand during the forecast period. Apart from these, the technological advancements associated with the equipment of recreational oxygen is further stimulating the growth of the segment.

However, high cost associated with the recreational oxygen equipment coupled with the lack of awareness in emerging economies across the globe about the health benefits of oxygen equipment is likely to hinder the growth over the forecast period. Whereas, the rising adoption of unhealthy habits in daily lifestyles such as smoking is expected to create potential opportunity for major manufacturers over the Recreational oxygen equipment market forecast period.

Recreational Oxygen Equipment Market Segmentation

The worldwide market for recreational oxygen equipment is split based on product, application, and geography.

Recreational Oxygen Equipment Market By Product

- Concentrators

- Bar Equipment

- Others

According to recreational oxygen equipment industry analysis, oxygen concentrators dominated the segment in the year 2013. The segment is growing owing to the advantage associated with the concentrator, that it eliminates the risk of catching fire. Along with this, the increasing involvement of people into activities, where the oxygen level is low such as high altitudes hiking and mountain climbing is also contributing to the market value. Medical use of recreational oxygen equipment is leading the application segment owing to rising prevalence of respiratory diseases such as COPD (chronic obstructive pulmonary disease), pulmonary fibrosis, pneumonia, a severe asthma attack, cystic fibrosis, and sleep apnea. Increasing the focus of manufacturers for the development of cost-effective products is further favoring the segment growth.

Recreational Oxygen Equipment Market By Application

- Athletics/Sports

- Medical

- Others

The medical segment leads the recreational oxygen equipment market as respiratory illnesses such chronic obstructive pulmonary disease (COPD), asthma, and other lung-related ailments become more common. As healthcare experts increasingly advocate supplementary oxygen therapy to treat these illnesses, the demand for dependable and portable oxygen equipment has grown. Moreover, the expanding aging population, particularly in developed countries, has supported the segment's growth, as the elderly usually require oxygen supplementation for better respiratory health.

The availability of enhanced oxygen devices for home and travel has sped up the adoption of medical oxygen equipment. Furthermore, post-COVID-19 rehabilitation therapy has promoted the adoption of such devices. As consumers emphasize their health and well-being, the medical application area continues to enjoy strong demand, outperforming athletics/sports and other categories in terms of revenue generation and market share.

Recreational Oxygen Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Recreational Oxygen Equipment Market Regional Analysis

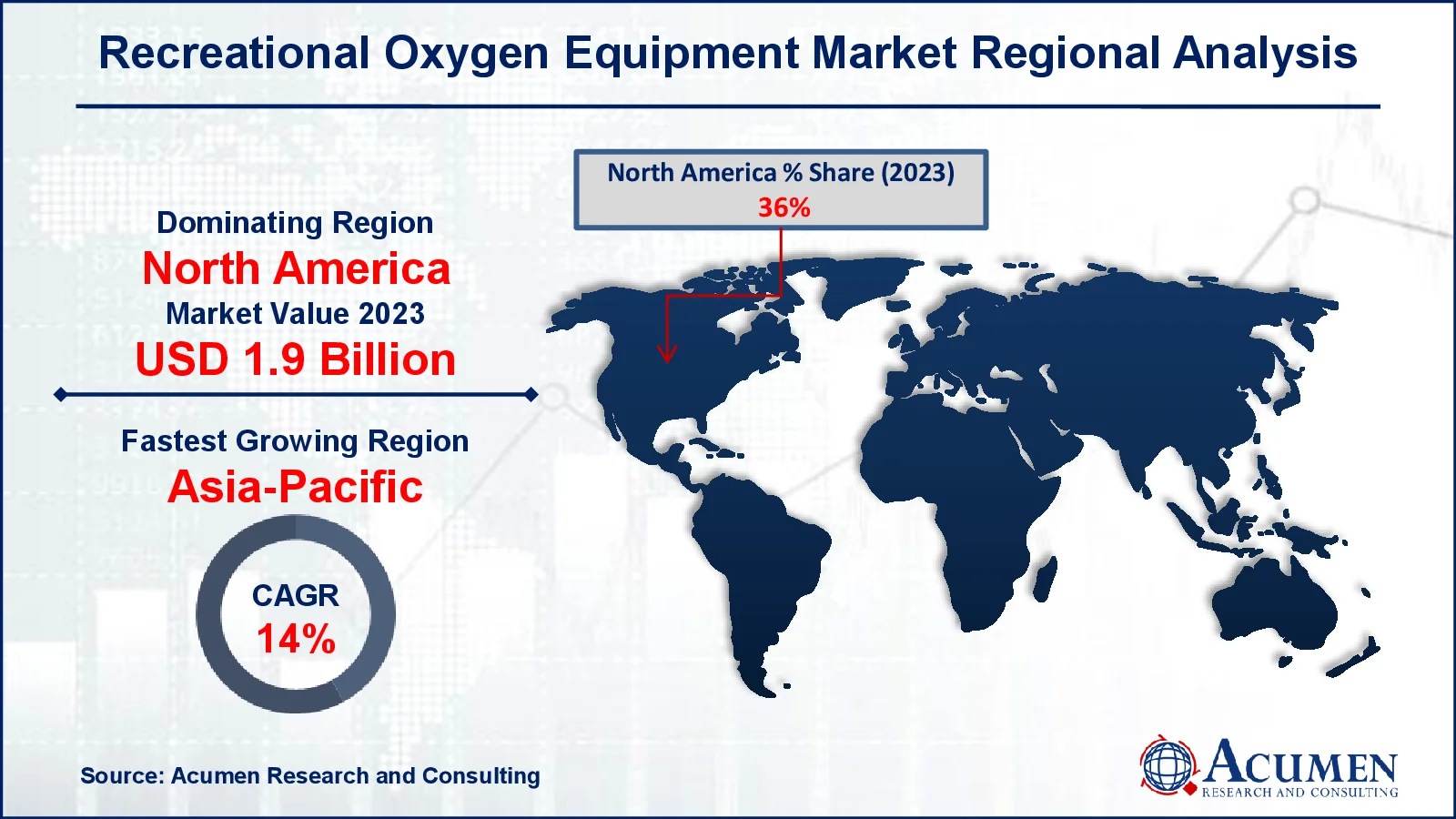

The global recreational oxygen equipment market is studied across the regions including North America, Europe, Asia Pacific and Middle East and Africa. North America dominated the regional segment and the region is also expected to maintain its dominance during the forecast period. The region is primarily gaining positive growth owing to well-established healthcare infrastructure in developed economies of the region coupled with the increased spending in the healthcare industry by major players.

The recreational oxygen equipment market of Asia-Pacific is also anticipated to fastest growing over the forecast period owing to increasing disposable income high spending on healthcare products. Along with this, the key players are also investing in the healthcare industry in emerging economies of the region including China and India is expected to propel the demand over the forecast period. The ongoing R&D activities and government initiatives for improving the healthcare infrastructure are further expected to create potential demand over the recreational oxygen equipment market forecast period.

Recreational Oxygen Equipment Market Players

Some of the top recreational oxygen equipment companies offered in our report includes Boost Oxygen, LLC., Chart Industries, Zadro Inc., Invacare Corporation, Oxygen Plus, Inc., Korrida, 2ND WIND OXYGEN BARS, CAIRE Inc., Koninklijke Philips N.V., and Inogen, Inc.

Frequently Asked Questions

How big is the recreational oxygen equipment market?

The recreational oxygen equipment market size was valued at USD 5.3 Billion in 2023.

What is the CAGR of the global recreational oxygen equipment market from 2024 to 2032?

The CAGR of recreational oxygen equipment is 13.2% during the analysis period of 2024 to 2032.

Which are the key players in the recreational oxygen equipment market?

The key players operating in the global market are including Boost Oxygen, LLC., Chart Industries, Zadro Inc., Invacare Corporation, Oxygen Plus, Inc., Korrida, 2ND WIND OXYGEN BARS, CAIRE Inc., Koninklijke Philips N.V., and Inogen, Inc.

Which region dominated the global recreational oxygen equipment market share?

North America held the dominating position in recreational oxygen equipment industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of recreational oxygen equipment during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global recreational oxygen equipment industry?

The current trends and dynamics in the recreational oxygen equipment industry include increasing adoption of fitness and wellness trends fuels demand for portable oxygen equipment, and rising prevalence of respiratory disorders enhances the market for recreational oxygen devices.

Which application held the maximum share in 2023?

The medical application held the maximum share of the recreational oxygen equipment industry.