dPCR and qPCR Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

dPCR and qPCR Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

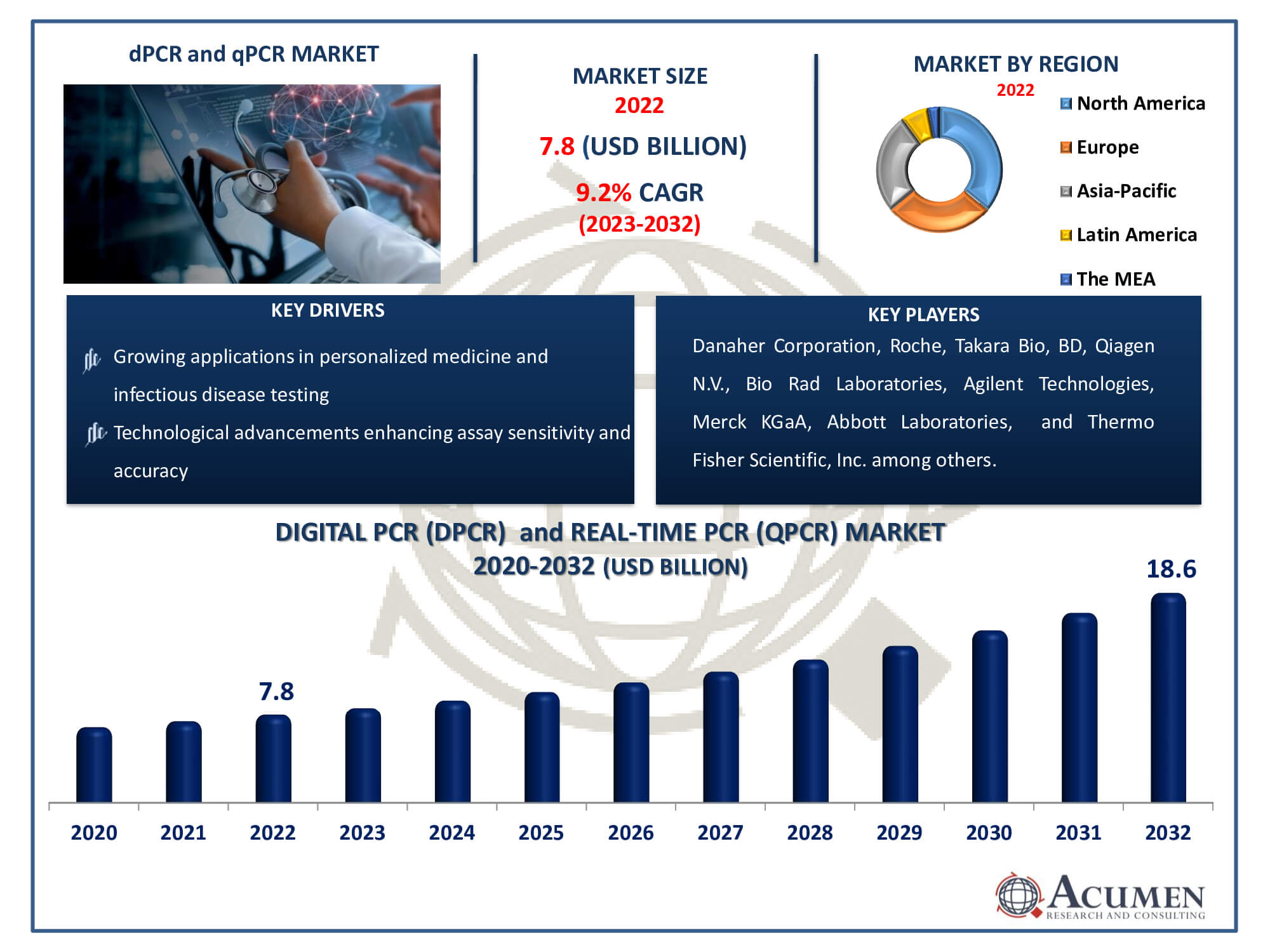

The dPCR and qPCR Market Size accounted for USD 7.8 Billion in 2022 and is estimated to achieve a market size of USD 18.6 Billion by 2032 growing at a CAGR of 9.2% from 2023 to 2032.

dPCR and qPCR Market Highlights

- Global dPCR and qPCR market revenue is poised to garner USD 18.6 billion by 2032 with a CAGR of 9.2% from 2023 to 2032

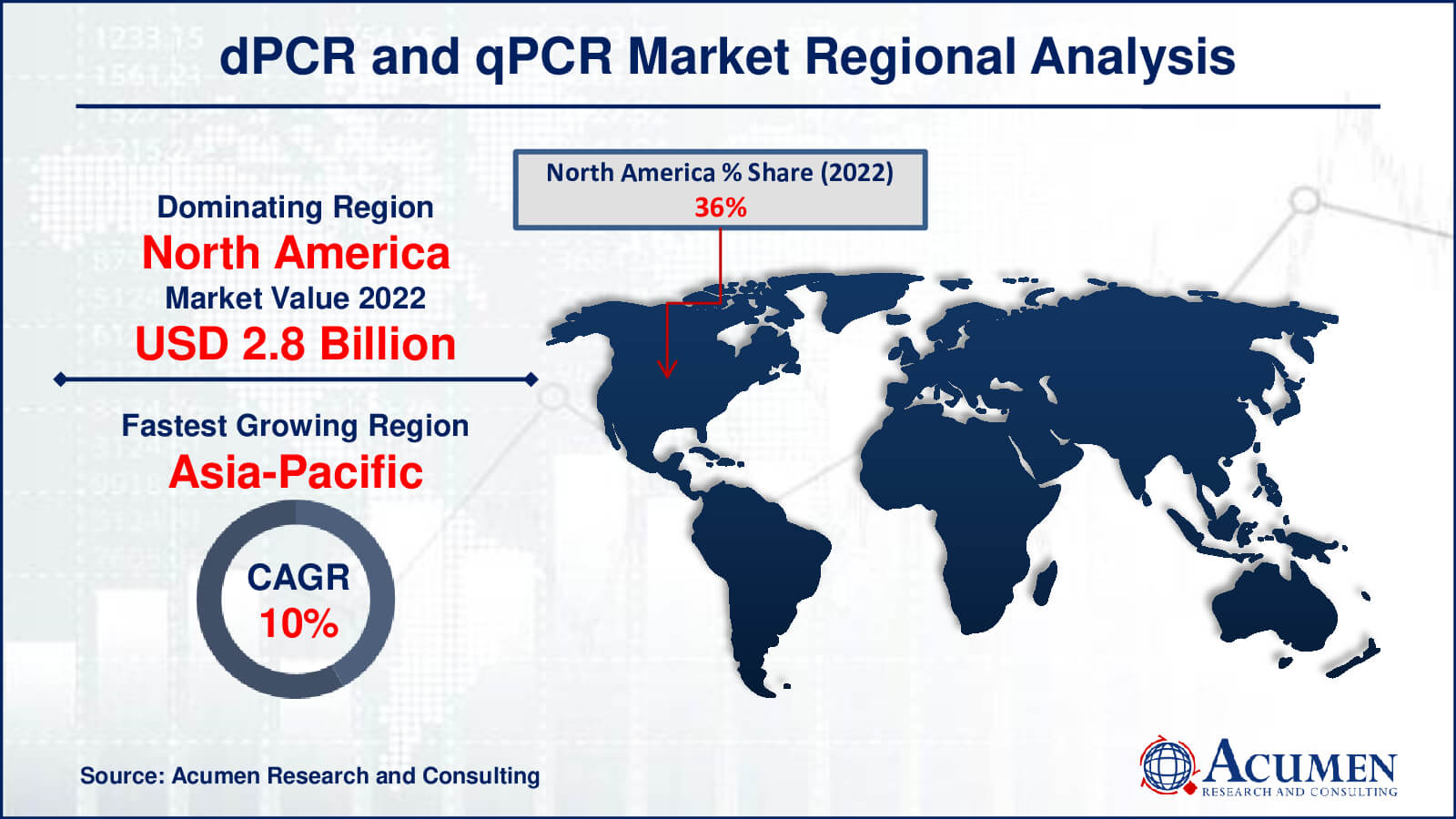

- North America dPCR and qPCR market value occupied around USD 2.8 billion in 2022

- Asia-Pacific dPCR and qPCR market growth will record a CAGR of more than 10% from 2023 to 2032

- Among application, the insulin delivery devices sub-segment generated over US$ 4 billion revenue in 2022

- Based on product, the reagents and consumables sub-segment generated around 61% share in 2022

- Increasing adoption in emerging markets due to healthcare infrastructure improvements is a popular dPCR and qPCR market trend that fuels the industry demand

To amplify or replicate specific deoxyribonucleic acid (DNA) sequences, polymerase chain reaction technology (PCR) is utilized. This technology encompasses various applications, including diagnosing genetic diseases, testing genes for paternity, detecting infectious diseases, and aiding forensic sciences. Two primary types of PCR technologies are digital PCR (dPCR) and quantitative PCR (qPCR). Digital PCR is a relatively recent technique employed for DNA amplification and quantification through a molecular counting protocol. It offers advantages such as not requiring responsiveness or the preparation of standard curves. It proves vital in distinguishing allele expression, monitoring virus infections in individual cells, quantifying cancer genes, and detecting fetal DNA in circulating blood. Quantitative PCR (qPCR), also known as effective PCR, calculates PCR amplification simultaneously with the reaction. This technology eliminates the need for post-amplification processing, reducing the analytical process turnaround time and the risk of DNA or RNA contamination during amplification.

Global dPCR and qPCR Market Dynamics

Market Drivers

- Increasing demand for high-throughput screening in research and diagnostics

- Technological advancements enhancing assay sensitivity and accuracy

- Growing applications in personalized medicine and infectious disease testing

- Rising investment and funding in genomics and molecular biology research

Market Restraints

- High costs associated with instrument procurement and maintenance

- Limited availability of skilled professionals for data analysis and interpretation

- Regulatory challenges and standardization issues impacting market adoption

Market Opportunities

- Expanding applications in oncology research and precision medicine

- Growing demand for point-of-care testing and diagnostics

- Development of innovative multiplexing and automation solutions

dPCR and qPCR Market Report Coverage

| Market | dPCR and qPCR Market |

| dPCR and qPCR Market Size 2022 | USD 7.8 Billion |

| dPCR and qPCR Market Forecast 2032 | USD 18.6 Billion |

| dPCR and qPCR Market CAGR During 2023 - 2032 | 9.2% |

| dPCR and qPCR Market Analysis Period | 2020 - 2032 |

| dPCR and qPCR Market Base Year |

2022 |

| dPCR and qPCR Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Danaher Corporation, F. Hoffmann La Roche Ltd., Takara Bio, Inc., Becton and Dickinson Company, Qiagen N.V., Bio Rad Laboratories, Inc., Agilent Technologies, Inc., Merck KGaA, Abbott Laboratories, Thermo Fisher Scientific, Inc., and Fluidigm Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

DPCR and qPCR Market Insights

The dPCR market key growth drivers in the are expected to include higher occurrences of target diseases and rapid technological advancements, such as the development of high-performance and advanced dPCR and qPCR systems.

According to the World Health Organization (WHO), cancer ranked among the leading causes of death globally in 2018, accounting for 9.6 million deaths. Additionally, WHO estimated that 36.9 million people were living with HIV infection in 2017. Infectious diseases were also reported as a leading cause of death in past year. The increasing prevalence of these diseases is expected to drive qPCR market growth.

Furthermore, PCR manufacturers continue their efforts in developing new systems and kits for molecular testing. For instance, QIAGEN N.V. announced in January 2019 its plans to develop next-generation dPCR systems, slated for launch in 2020. These new systems are expected to offer highly automated workflows and faster turnaround times compared to current digital PCR platforms. These advancements are likely to provide a significant competitive edge for the company.

Moreover, a broad spectrum of applications is anticipated to drive the adoption of qPCR and dPCR technologies across various scientific disciplines. These technologies have extensive applications in both basic research and diagnostics, being widely utilized in areas such as human genetic testing, forensic research, pathogen detection, and testing for infectious diseases. Further dPCR market growth is expected through expanded applications in fields like food microbiology and the veterinary industry, among others.

dPCR and qPCR Market Segmentation

The worldwide market for dPCR and qPCR is split based on technology, product, application, and geography.

Digital PCR and Real-time PCR Market Technologies

- Digital

- Quantitative

The technology-driven market is categorized into digital PCRs (dPCRs) and real-time PCRs or quantitative PCRs (qPCRs). In 2022, quantitative PCR market held the highest market share value. This segment is projected to be driven by continuous demand in areas such as gene expression analysis, genetic variation analysis, and genotyping, along with an increased focus on developing point-of-care (PoC) platforms. Digital PCR represents the next generation method for testing nucleic acids. These systems offer superiority over other PCR-based approaches, contributing to the segment's robust growth during the dPCR and qPCR idustry forecast period.

Digital PCR and Real-time PCR Market Products

- Instruments

- Reagents and Consumables

- Software & Services

According to dPCR and qPCR industry analysis, the market is segmented into consumer and reagent products, instruments, and software and services based on the product categories. In terms of value in 2022, consumables and reagents held the leading position. This segment is anticipated to experience robust growth compared to other segments, primarily driven by the introduction of new PCR test kits. For instance, in October 2017, the Official Analysis Method for Salmonella Species in Raw Meat was certified by AOAC INTERNATIONAL. This certification, developed by Biomotive Laboratories' iQ-Check (Real-Time PCR Kit), validated its use across various industrial applications within the meat industry.

Digital PCR and Real-time PCR Market Applications

- Research

- Forensic

- Clinical

- Pathogen Testing

- Oncology Testing

- Blood Screening

- Others

The clinical segment dominates the dPCR and qPCR markets because of its extensive use in the medical field. A wide range of applications are covered by clinical applications, such as disease diagnosis, treatment response monitoring, and research on different biological markers for diseases. These technologies play a critical role in clinical settings for the detection of genetic alterations, identification of infectious pathogens, and evaluation of patient response to therapy. In pathology labs, hospitals, and research facilities, their precision, sensitivity, and capacity to measure nucleic acids make them essential instruments. Furthermore, the ongoing development of digital and real-time PCR technology has simplified clinical workflows and made diagnoses faster and more accurate, which has eventually helped the clinical segment dominate this market.

Digital PCR and Real-time PCR Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Digital PCR and Real-time PCR Market Regional Analysis

In terms of dPCR and qPCR market analysis, the regional market was led by North America in 2022, attributed to the introduction of new PCR systems and test kits by manufacturers. Notably, Thermo Fisher Scientific Inc. unveiled the VetMAX MastiType in September 2018, a qPCR-based test kit designed to swiftly detect mastitis pathogens in milk samples. Additionally, the strong presence of leading PCR producers and the rising demand for rapid diagnostic testing in the region have contributed to its growth, with expectations of further expansion during the forecast period.

During the dPCR and qPCR market forecast period, Asia-Pacific is expected to witness the fastest growth, likely achieving a CAGR of over 11%. This growth can be attributed to an expanding patient pool resulting from a high prevalence of chronic and infectious diseases in the region. Moreover, the increasing awareness of the importance of early diagnosis among patients is expected to drive the demand for PCR products in the Asia-Pacific qPCR market and dPCR market.

dPCR and qPCR Market Players

Some of the top dPCR and qPCR companies offered in our report include Danaher Corporation, F. Hoffmann La Roche Ltd., Takara Bio, Inc., Becton and Dickinson Company, Qiagen N.V., Bio Rad Laboratories, Inc., Agilent Technologies, Inc., Merck KGaA, Abbott Laboratories, Thermo Fisher Scientific, Inc., and Fluidigm Corporation.

Frequently Asked Questions

How big is the dPCR and qPCR market?

The market size of dPCR and qPCR was USD 7.8 Billion in 2022.

What is the CAGR of the global Digital PCR and Real-time PCR Market from 2023 to 2032?

The CAGR of digital PCR and real-time PCR market is 9.2% during the analysis period of 2023 to 2032.

Which are the key players in the Digital PCR (dPCR) and Real-time PCR (qPCR) Market?

The key players operating in the global digital PCR (dPCR) and real-time PCR (qPCR) market are including Danaher Corporation, F. Hoffmann La Roche Ltd., Takara Bio, Inc., Becton and Dickinson Company, Qiagen N.V., Bio Rad Laboratories, Inc., Agilent Technologies, Inc., Merck KGaA, Abbott Laboratories, Thermo Fisher Scientific, Inc., and Fluidigm Corporation.

Which region dominated the global Digital and Real-Time PCR market share?

North America held the dominating position in digital and real-time industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of dPCR and qPCR during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global Digital PCR (dPCR) and Real-time PCR (qPCR) industry?

The current trends and dynamics in the digital PCR (dPCR) and real-time PCR (qPCR) industry include increasing demand for high-throughput screening in research and diagnostics, technological advancements enhancing assay sensitivity and accuracy, growing applications in personalized medicine and infectious disease testing, and rising investment and funding in genomics and molecular biology research.

Which technology held the maximum share in 2022?

The quantitative technology held the maximum share of the dPCR and qPCR industry.