Real Time Payment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Real Time Payment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

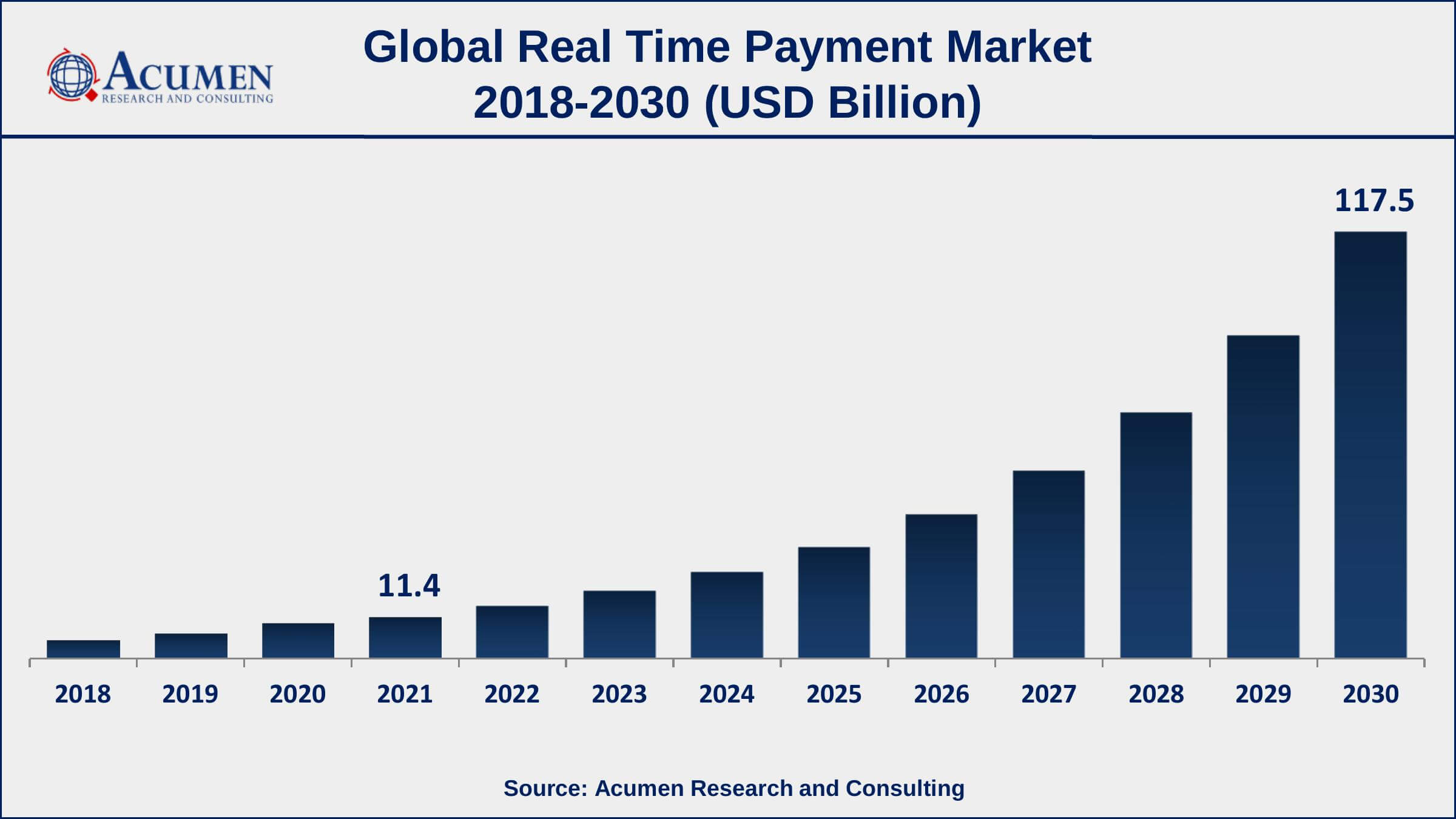

The Global Real Time Payment Market Size accounted for USD 11.4 Billion in 2021 and is estimated to achieve a market size of USD 117.5 Billion by 2030 growing at a CAGR of 30% from 2022 to 2030. The growing adoption of Smartphones and the acceptance of cloud-based payment solutions can be attributed to the expansion of the real time payment market value. Furthermore, increasing consumer demand for easy payment solutions and growing demand from financial companies and organizations to encourage the use of real-time payment systems are expected to fuel the real-time payment market growth.

Real Time Payment Market Report Key Highlights

- Global real time payment market revenue intended to gain USD 117.5 billion by 2030 with a CAGR of 30% from 2022 to 2030

- Asia-Pacific region led with more than 39% real time payment market share in 2021

- North America real time payment market growth will observe strongest CAGR from 2022 to 2030

- By Payment, P2B segment generated about 63% market share in 2021

- By enterprise, the large enterprise segment engaged more than 65% of the total market share in 2021

- Growing consumer demand for easy payment solutions, drives the real time payment market size

Real-time payments (RTP) are electronic/digital payments that permit the quick transfer of funds progressively through a secured payment gateway. Developing web-based businesses such as the e-commerce segment and adoption of cell phones combined with the rising requirement for quick and advantageous payment solutions in substantial and Small and Medium Enterprises (SMEs), are expected to fuel the RTP market growth.

Global Real Time Payment Market Trends

Market Drivers

- High proliferation of smartphones

- Growing consumer demand for easy payment methods

- Increasing government initiatives to support digital payments

- Rapid adoption of cloud-based solutions

Market Restraints

- Interoperability issues between systems

- Security threats related to payment solutions

Market Opportunities

- Increasing digitalization and modernization over the globe

- Progressive change in the regional regulatory framework

Real Time Payment Market Report Coverage

| Market | Real Time Payment Market |

| Real Time Payment Market Size 2021 | USD 11.4 Billion |

| Real Time Payment Market Forecast 2030 | USD 117.5 Billion |

| Real Time Payment Market CAGR During 2022 - 2030 | 30% |

| Real Time Payment Market Analysis Period | 2018 - 2030 |

| Real Time Payment Market Base Year | 2021 |

| Real Time Payment Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Payment, By Component, By Deployment, By Enterprise, By End-use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Volante Technologies, Inc., Worldpay, LLC, Wirecard AG, ACI Worldwide, Inc., Mastercard Incorporated, Nets A/S, Finastra, Capgemini SE, Montran Corporation, Visa, Inc., FIS, Inc., Worldline, Temenos AG, PayPal Holdings, Inc., Icon Solutions Ltd., and Fiserv, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

The real-time payments infrastructure can fundamentally improve the payments partners understanding of disbursements and refunds a continuous issue for vendors and shoppers alike as card discounts for the most part take no less than a couple of days to process and clear. Real-time payment solutions are by and large broadly embraced crosswise over different ventures, for example, retail and internet business, BFSI, and IT and telecom, inferable from their advantages as far as speed, security, and transparency. Rising demand for improved analytics for payment-related information from traders and corporate clients is additionally driving the real-time payment market size.

The market is significantly determined by the rising utilization of cell phones over the globe and the developing demand for promptness and fast clearings and repayments of money transactions among buyers and vendors. Also, the rising appropriation of RTP solutions among web-based business retailers and retail location proprietors is assessed to support the real-time payment market development. These solutions convey benefits, for example, quicker transaction speed when contrasted with most other electronic techniques, real-time messaging, broad data transaction, and every minute of every day/365 accessibility to vendors and corporate organizations.

Moreover, rising volumes of moneyless transactions (achieved in excess of 500 billion in 2018), combined with the developing shopper inclination for systems like net and mobile banking, will help market development. The market is likewise prone to profit from the developing notoriety of FinTech administrations, for example, Samsung Pay, Google Pay, and Apple Pay. Moreover, rising coordinated efforts of these services/service organizations with provincial banks to bring developments, for example, the provision of speedy advances and moneyless payments will drive the real-time payment market growth.

Real Time Payment Market Segmentation

The worldwide real time payment market segmentation is based on the payment, component, deployment, enterprise, end-use industry, and geography.

Real Time Payment Market By Payment

- P2B

- P2P

- B2B

According to a real-time payment industry analysis, the P2B segment dominates the market and has the highest share in 2021. P2B payments are monetary transactions that occur among customers and businesses. The segment's growth is likely to be driven by the continued popularity of digital shopping and e-commerce transactions. Businesses can boost customer satisfaction by accepting P2B payments.

Real Time Payment Market By Component

- Solutions

- Service

In terms of components, the solutions segment lead the global market in 2021. The segment has also been subsequently segmented into security, payment processing, and fraud management. Merchants all across the world are collaborating with online payment service providers to extend their companies into new markets. Since merchants handle a significant number of transactions, gateway systems have been integrated into existing retail channels.

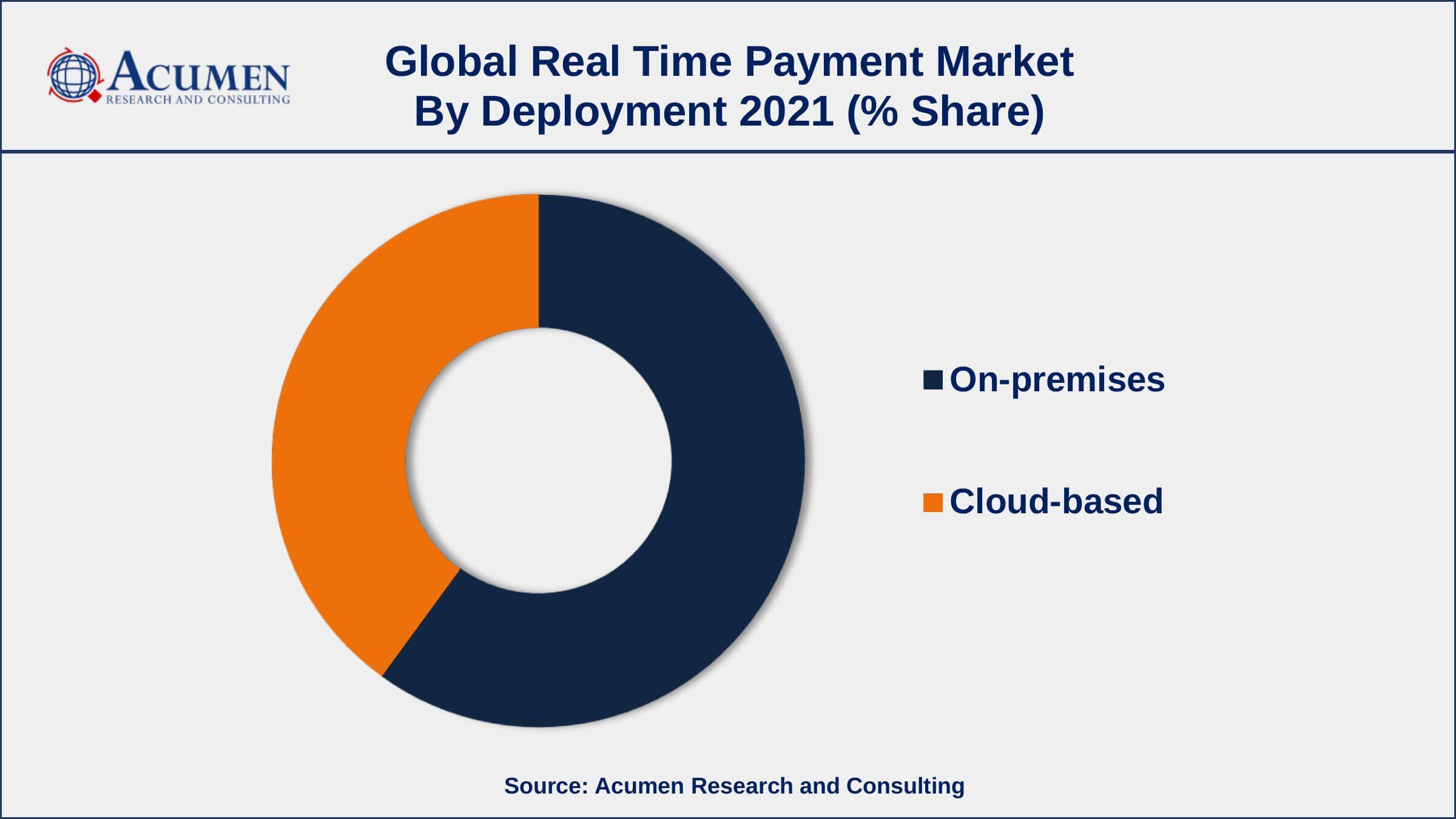

Real Time Payment Market By Deployment

- On-premises

- Cloud-based

According to the real time payment market forecast, the cloud sector is expected to grow at the fastest rate over the forecast period. The global usage of mobile-based payment systems is propelling the expansion of this segment. Furthermore, many financial institutions are improving existing cross-border payment platforms by integrating them with cloud-based systems in order to deliver a better consumer experience.

Real Time Payment Market By Enterprise

- Large Enterprises

- SMEs

Based on the enterprise, the SMEs segment is expected to develop at the fastest rate during the projected period. Numerous SMEs throughout the world are making the switch from conventional paper-based accounting to electronic invoicing. Furthermore, in order to thrive in the market, these businesses are anticipated to widely use cost-cutting technology such as cloud-based services.

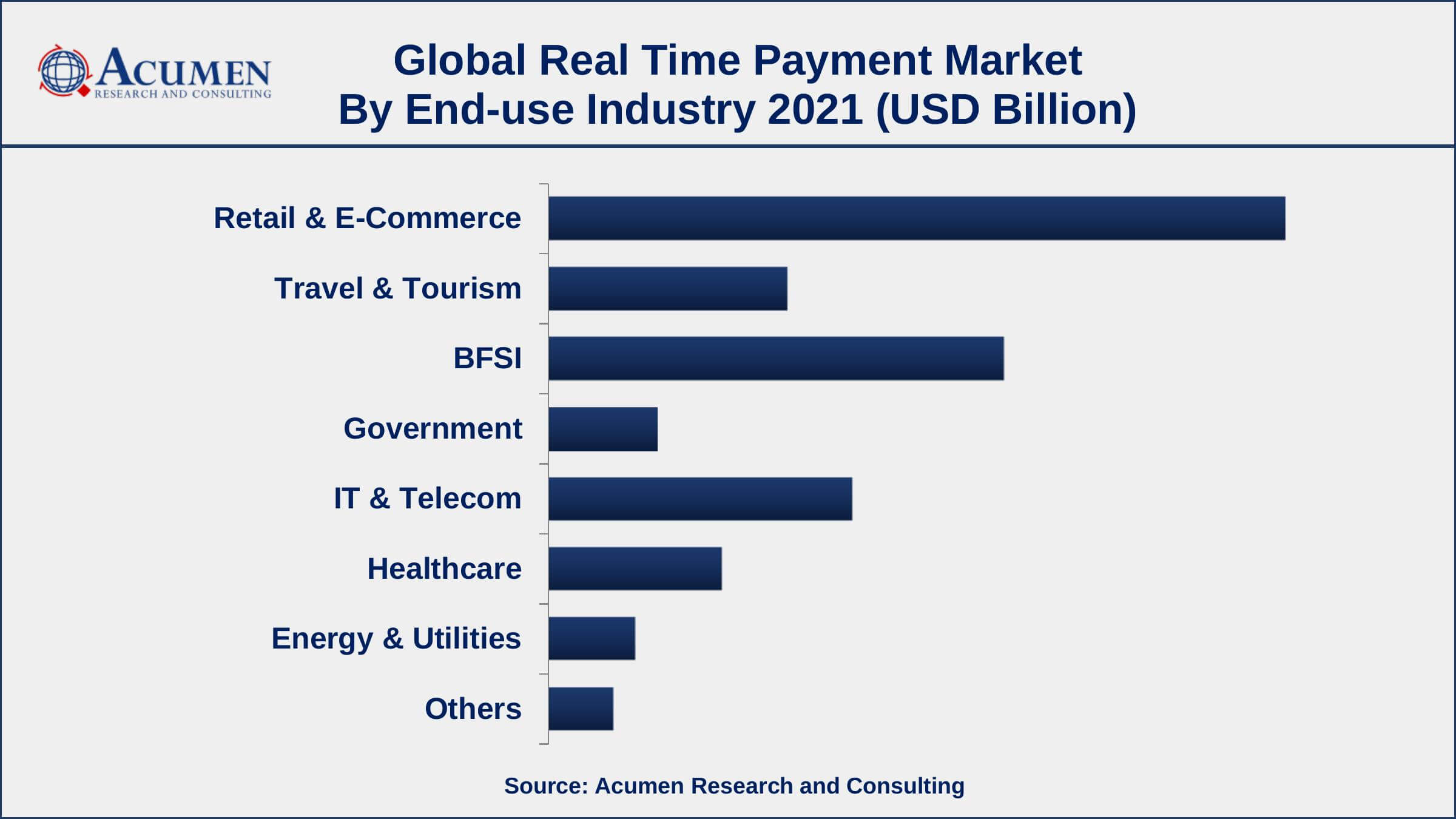

Real Time Payment Market By End-use Industry

- Retail & E-Commerce

- Travel & Tourism

- BFSI

- Government

- IT & Telecom

- Healthcare

- Energy & Utilities

- Others

In terms of the end-use industry, retail and e-commerce segment are expected to hold the largest market shares of real-time payments in 2021. This growth is owing to retailers and traders having a strong demand for speedy payment settlements, and real-time payment services and solutions have become widely adopted. Real-time payment systems provide a competitive edge to retail and e-commerce businesses by private procurement quicker and cheaper. Furthermore, due to their hectic daily schedules, customers nowadays prefer internet purchasing drives the segment growth.

Real Time Payment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Asia-Pacific Holds Dominating Share Of Real Time Payment Market

Geographically, the Asia-Pacific region market held the largest market share in 2021 and is said to extend at the most elevated CAGR over the figure time frame. This is credited to factors, for example, expanding use of cell phones in developing economies and positive government activities identified with advanced transactions. Besides, raising the quantity of web-based business clients alongside the developing appropriation of RTP systems crosswise over SMEs in rising economies like India and China is relied upon to drive the development further.

Real Time Payment Market Players

Some of the top real time payment companies offered in the professional report include Volante Technologies, Inc., Worldpay, LLC, Wirecard AG, ACI Worldwide, Inc., Mastercard Incorporated, Nets A/S, Finastra, Capgemini SE, Montran Corporation, Visa, Inc., FIS, Inc., Worldline, Temenos AG, PayPal Holdings, Inc., Icon Solutions Ltd., and Fiserv, Inc.

Frequently Asked Questions

What is the size of global real time payment market in 2021?

The estimated value of global real time payment market in 2021 was accounted to be USD 11.4 Billion.

What is the CAGR of global real time payment market during forecast period of 2022 to 2030?

The projected CAGR real time payment market during the analysis period of 2022 to 2030 is 30%.

Which are the key players operating in the market?

The prominent players of the global real time payment market are Volante Technologies, Inc., Worldpay, LLC, Wirecard AG, ACI Worldwide, Inc., Mastercard Incorporated, Nets A/S, Finastra, Capgemini SE, Montran Corporation, Visa, Inc., FIS, Inc., Worldline, Temenos AG, PayPal Holdings, Inc., Icon Solutions Ltd., and Fiserv, Inc.

Which region held the dominating position in the global real time payment market?

Asia-Pacific held the dominating real time payment during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for real time payment during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global real time payment market?

High proliferation of smartphones and growing consumer demand for simple payment methods drives the growth of global real time payment market.

By payment segment, which sub-segment held the maximum share?

Based on payment, P2B segment is expected to hold the maximum share real time payment market.