Rapid Medical Diagnostic Kits Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 � 2030

Published :

Report ID:

Pages :

Format :

Rapid Medical Diagnostic Kits Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 � 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

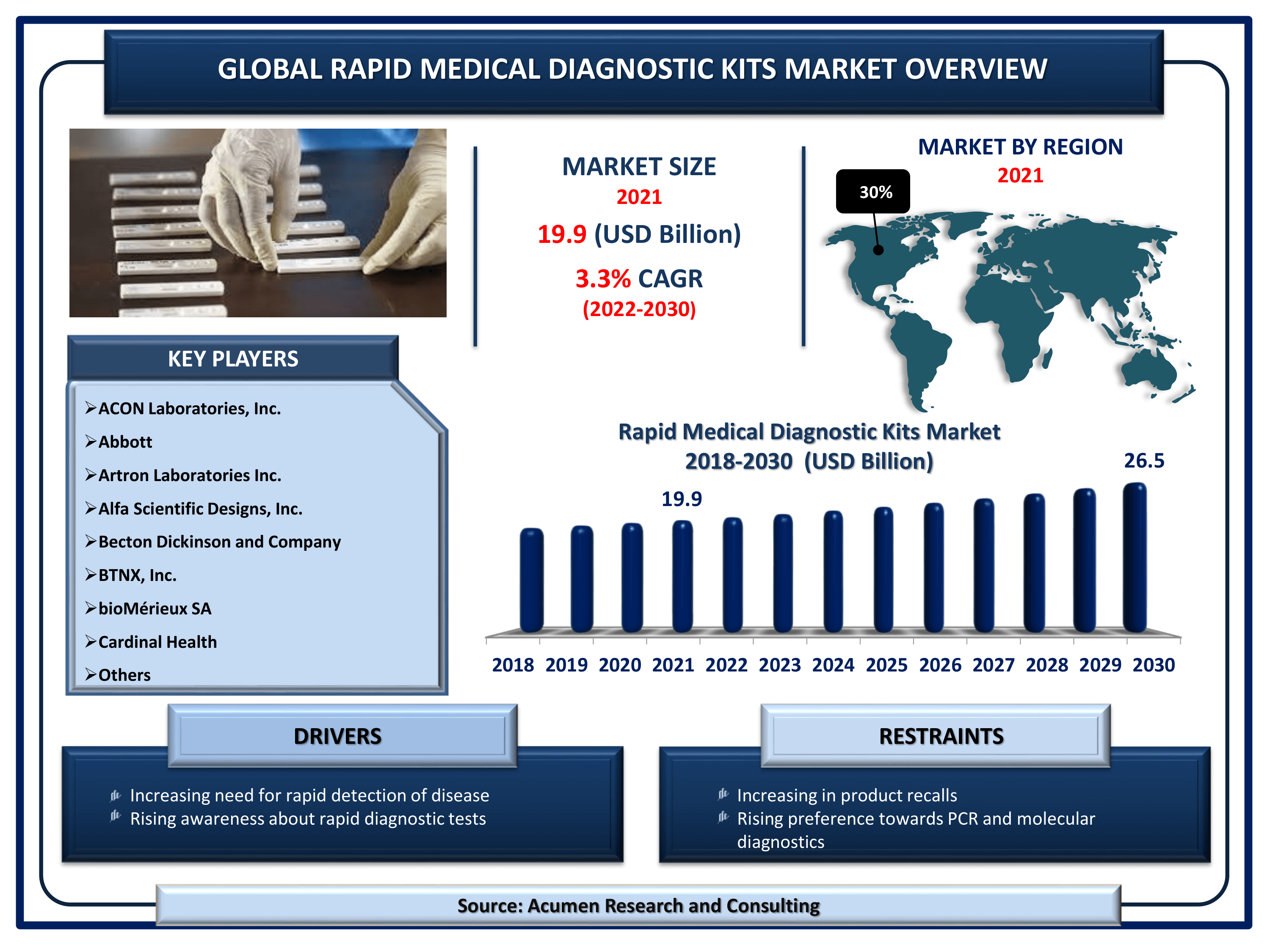

The Global Rapid Medical Diagnostic Kits Market Size accounted for USD 19.9 Billion in 2021 and is estimated to garner a market size of USD 26.5 Billion by 2030 rising at a CAGR of 3.3% from 2022 to 2030. The rapid diagnostic test kit is majorly preferred in the detection of infectious diseases and is generally described as a point-of-care (POC) test. It strongly relates to the lateral flow involving immunochromatographic tests for the detection of certain infectious diseases. Growing R&D in producing kits for novel viruses is one of the key rapid medical diagnostics kits market trends bolstering industry growth. Furthermore, rapid medical diagnostic test kits require confirmatory or supplementary testing through a conglomeration of complex laboratory techniques.

Rapid Medical Diagnostic Kits Market Report Key Highlights

- Global rapid medical diagnostic kits market revenue is estimated to reach USD 26.5 Billion by 2030 with a CAGR of 3.3% from 2022 to 2030

- North America rapid medical diagnostic kits market share accounted for over 30% regional shares in 2021

- According to the Our Health in Data Organization, the WHO delivered the Ministry of Health with 40,000 rapid antigen tests for COVID-19 in Jan 2021

- Asia-Pacific rapid medical diagnostic kits market growth will record fastest CAGR from 2022 to 2030

- Based on product segment, over the counter (OTC) kits accounted 54% of the overall market share in 2021

- Growing military involvement propels the rapid medical diagnostic kits market value in coming years.

Global Rapid Medical Diagnostic Kits Market Dynamics

Market Drivers

- Increasing need for rapid detection of disease

- Rising awareness about rapid diagnostic tests

- Growing incidence of chronic disorders

Market Restraints

- Increasing number of product recalls

- Rising preference towards PCR and molecular diagnostics

Market Opportunities

- Growing number of government initiatives

- Surging home diagnostic kits usage

COVID-19 response for rapid medical diagnostic kits market

Testing is a cornerstone for the COVID-19 response, enabling countries to trace the virus and prepare to roll out vaccines once available. Rapid test kits specialized to detect the presence of the virus coupled with trained professionals bolster the demand for the rapid medical diagnostic kits market. The effective testing strategy depends on the portfolio of test types that is well suited to appropriate diagnostic kits available in the commercial markets. Currently, there is a trend in the global market for rapid tests for detection and presence of the virus at the point of care, for faster results available at cheap prices. This is one of the prominent factors considered an asset in to fight against COVID-19. Moreover, with strong supporting test-trace-isolate strategies, appropriate tests conducted by rapid medical diagnostic kits help to identify and confirm new outbreaks, and support outbreaks through investigations by screening, monitoring disease trends, and potentially asymptomatic contacts

Rapid Medical Diagnostic Kits Market Report Coverage

| Market | Rapid Medical Diagnostic Kits Market |

| Rapid Medical Diagnostic Kits Market Size 2021 | USD 19.9 Billion |

| Rapid Medical Diagnostic Kits Market Forecast 2030 | USD 26.5 Billion |

| Rapid Medical Diagnostic Kits Market CAGR During 2022 - 2030 | 3.3% |

| Rapid Medical Diagnostic Kits Market Analysis Period | 2018 - 2030 |

| Rapid Medical Diagnostic Kits Market Base Year | 2021 |

| Rapid Medical Diagnostic Kits Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Technology, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ACON Laboratories, Inc., Abbott, Artron Laboratories Inc., Alfa Scientific Designs, Inc., Becton Dickinson and Company, BTNX, Inc., bioMérieux SA, Cardinal Health, Bio-Rad Laboratories, Inc., Danaher Corporation, Creative Diagnostics, Meridian Bioscience, Inc. and F. Hoffmann-La Roche AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Market Dynamics

Partnerships between the companies supported by the government flourish the demand for rapid medical diagnostic kits market. As per the reports by World Health Organization (WHO), Global Fund has offered an initial US$ 50 Mn as Covid-19 response for the utility of antigen-based rapid diagnostic tests, manufacturer volume guarantees for low and middle-income countries (LMICs), and enable countries to purchase at least 10 million of the new rapid tests at the fixed price. Agreements between the top pioneers involved in the manufacturing of rapid medical diagnostic test kits bolster the growth of the global market. For instance, agreements between the Bill & Melinda Gates Foundation and test manufacturers Abbott and SD Biosensor create a gateway for innovative tests priced at a maximum of US$ 5 for LMICs. Additionally, the Bill & Melinda Gates Foundation has executed separate volume guarantee agreements with rapid medical diagnostic test kits. This further enhanced to make the kits available in the commercial market at a low price. The rapid medical diagnostic test kit available in LMICs was priced at a maximum of US$ 5 per unit over a period of six months. The kits were specialized to give optimal results within 15-30 minutes rather than hours or days.

High Government Involvement Bolsters the Rapid Medical Diagnostic Kits Market Demand

To overcome the spread of the novel coronavirus, the government has taken several initiatives by introducing several government bodies. One such authorized body is the ACT-Accelerator Diagnostics Pillar. The ACT is co-convened by FIND and the Global Fund, by working closely with WHO and over 30 global health experts partners to accelerate innovation and overcome the technical, financial, and political obstacles to achieving equitable access to effective and timely testing. Such unprecedented global collaboration enhances the development and deployment of the first WHO EUL-approved Ag RDT within eight months of the first identification of the virus. In comparison, it took nearly five years to develop the first rapid diagnostic test kit (RDT) for the Human immunodeficiency virus (HIV). On the other hand, the ACT-Accelerator Diagnostic Pillar aims to facilitate the supply of 500 million tests to LMICs within 12 months. The diagnostic pillar of the ACT-Accelerator focuses on ensuring that everyone who needs the test will get one. Nearly 20 million tests have been procured with the Diagnostics Consortium, ensuring diagnostic access for LMCIs and readiness for test-and-treat implantation in the countries.

Rapid Medical Diagnostic Kits Market Segmentation

The worldwide rapid medical diagnostic kits market is split based on product, technology, application, end-use, and geography.

Rapid Medical Diagnostic Kits Market By Product

- Over the Counter (OTC) Kits

- Professional Kits

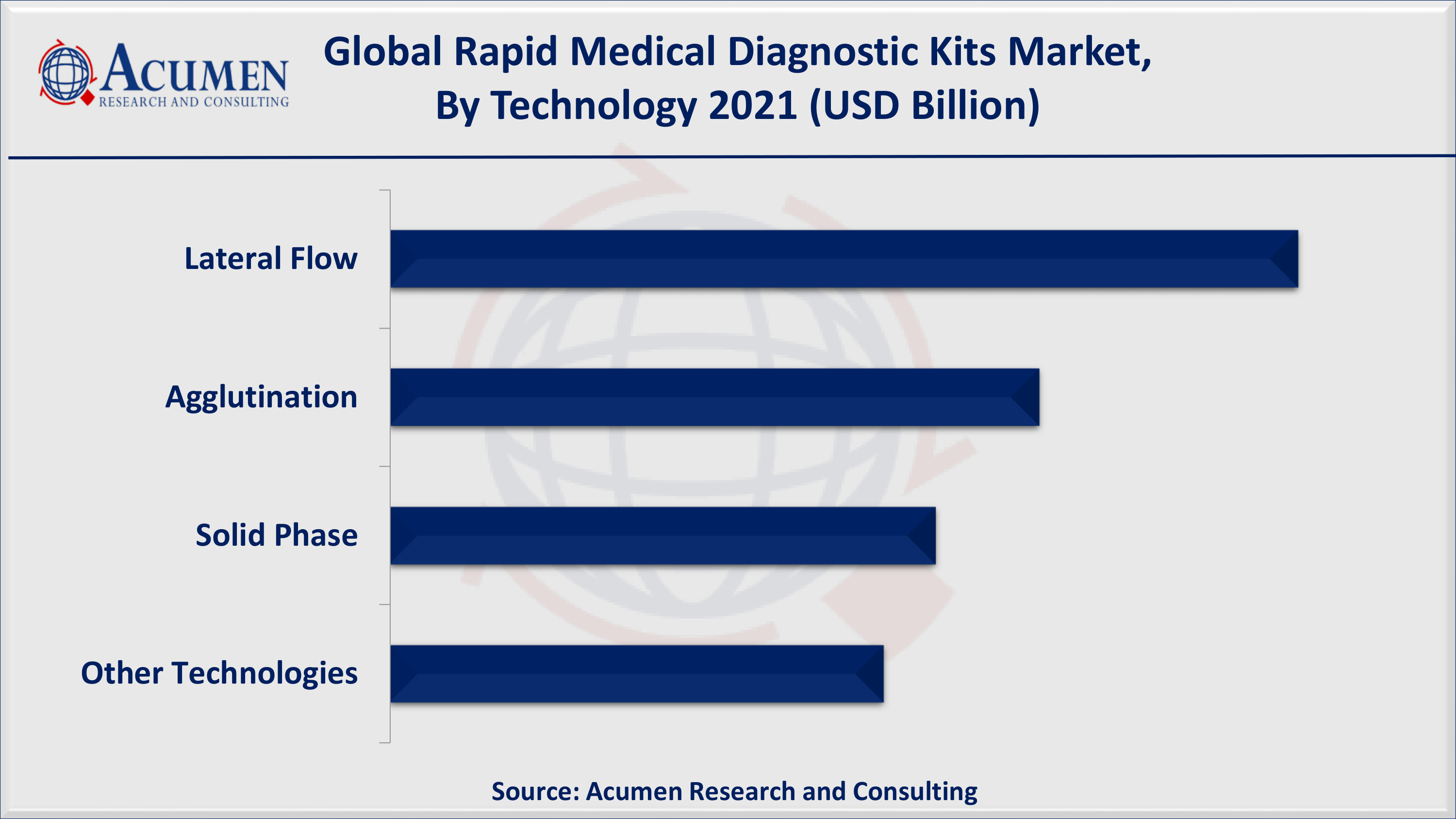

Rapid Medical Diagnostic Kits Market By Technology

- Lateral Flow

- Agglutination

- Solid Phase

- Other Technologies

Rapid Medical Diagnostic Kits Market By Application

- Blood Glucose Testing

- Infectious Disease Testing

- Cardio Metabolic Testing

- Pregnancy and Fertility Testing

- Fecal Occult Blood Testing

- Coagulation Testing

- Toxicology Testing

- Lipid Profile Testing

- Others

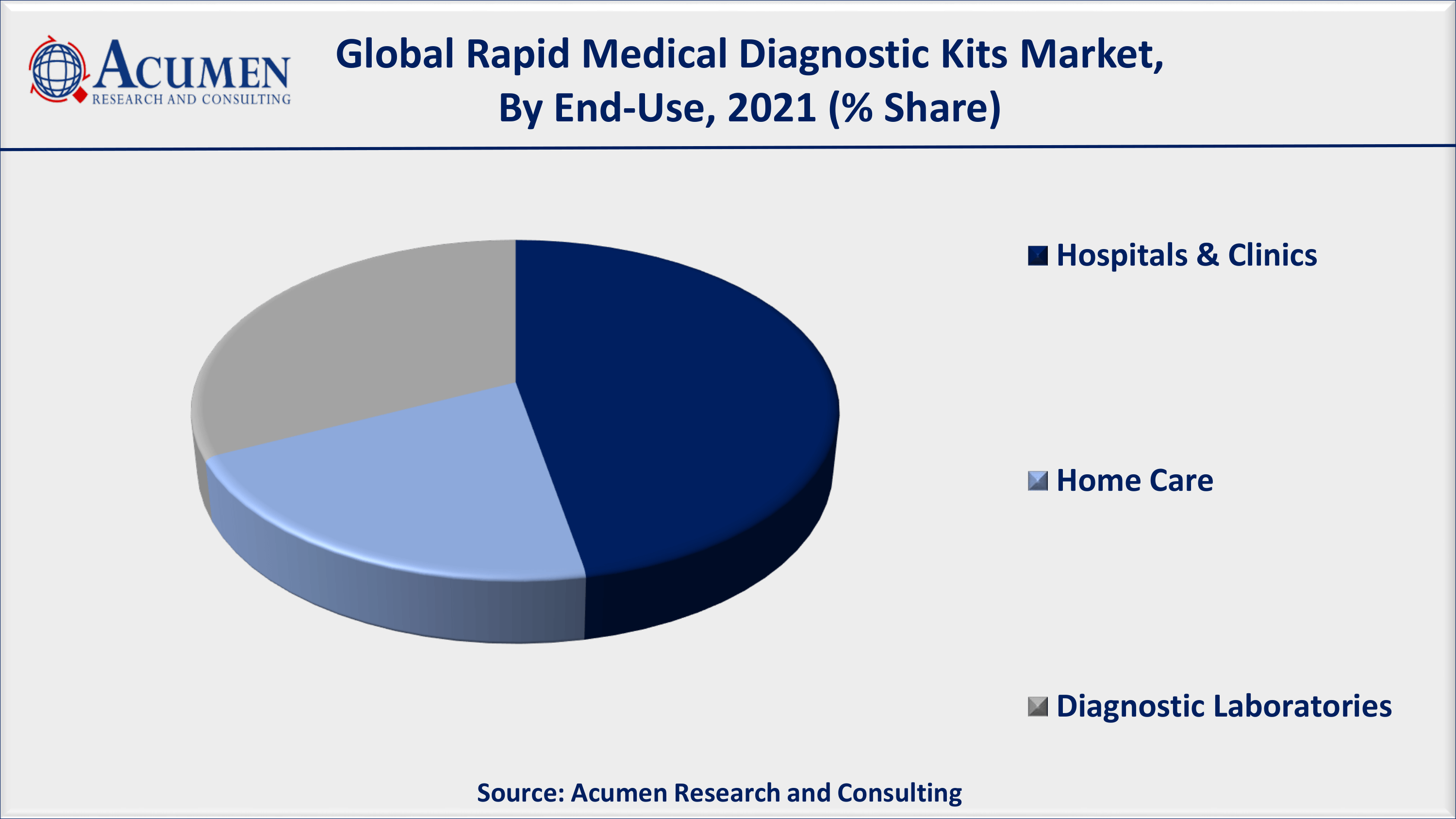

Rapid Medical Diagnostic Kits Market By End-Use

- Hospitals & Clinics

- Home Care

- Diagnostic Laboratories

Based on product, over-the-counter (OTC) kits holds the majority of the market share for the global rapid medical diagnostic kits market in the past and will continue the same trend in the forthcoming years. Easy availability, simpler to utilize in the "near-patient setting", and cost-effective alternative to laboratory testing are the prominent factors that contribute to the growth of the rapid medical diagnostic kits market globally. Additionally, the lateral flow technology segment will account for remarkable revenue in the forecast period. Low development cost and easy manufacturing of lateral flow assays resulted in the expansion of these tests into several rapid testing applications. Lateral flow technology has gained significant attention in the early detection of COVID-19.

For instance, in March 2020, Ozo Life announced the launching of its new product namely, "OZO COVID-19 Rapid Test Kits" a latex-enhanced lateral flow immunoassay for ensuring testing of novel coronavirus coupled with enhanced sensitivity. Also, rising public and private partnerships for the development of novel lateral flow tests targeting COVID-19 diagnosis spur the segmental growth of the rapid medical diagnostic kits market. Apart from that, based on the application segment, infectious disease testing will record remarkable market share contributing to the growth of the rapid medical diagnostic kits market worldwide. The outbreak of the novel corona virus created lucrative opportunities for rapid diagnostic testing to accelerate COVID-19 detection.

This further bolsters the demand for the global rapid medical diagnostic kits market. Furthermore, the hospital segment holds the maximum market share and will continue a similar trend till the forecast period. Dynamic culture or changes in the healthcare industry resulted in increasing the need for hospitals with enhanced diagnostic services.

Rapid Medical Diagnostic Kits Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Growth in Prevalence of Chronic Disorders Fuels the North America Rapid Medical Diagnostic Kits Market Share

Based on regions, North America leads the rapid medical diagnostic kits market. Growing healthcare sectors result in the adoption of diagnostic kits to detect various infectious diseases caused due to bacteria and viruses. On the other hand, Asia-Pacific is expected to witness the highest growth rate for the rapid medical diagnostic kits market owing to surging awareness among the healthcare sectors and ever-growing patient population about the rapid medical diagnostic tools.

Rapid Medical Diagnostic Kits Market Players

The global rapid medical diagnostic kits companies profiled in the report include ACON Laboratories, Inc., Abbott, Artron Laboratories Inc., Alfa Scientific Designs, Inc., Becton Dickinson and Company, BTNX, Inc., bioMérieux SA, Cardinal Health, Bio-Rad Laboratories, Inc., Danaher Corporation, Creative Diagnostics, Meridian Bioscience, Inc. and F. Hoffmann-La Roche AG.

Frequently Asked Questions

What is the size of global rapid medical diagnostic kits market in 2021?

The market size of rapid medical diagnostic kits market in 2021 was accounted to be USD 19.9 Billion.

What is the CAGR of global rapid medical diagnostic kits market during forecast period of 2022 to 2030?

The projected CAGR of rapid medical diagnostic kits market during the analysis period of 2022 to 2030 is 3.3%.

Which are the key players operating in the market?

The prominent players of the global rapid medical diagnostic kits market are ACON Laboratories, Inc., Abbott, Artron Laboratories Inc., Alfa Scientific Designs, Inc., Becton Dickinson and Company, BTNX, Inc., bioM�rieux SA, Cardinal Health, Bio-Rad Laboratories, Inc., Danaher Corporation, Creative Diagnostics, Meridian Bioscience, Inc. and F. Hoffmann-La Roche AG.

Which region held the dominating position in the global rapid medical diagnostic kits market?

North America held the dominating rapid medical diagnostic kits during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for rapid medical diagnostic kits during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global rapid medical diagnostic kits market?

Increasing need for rapid detection of disease, rising awareness about rapid diagnostic tests, and growing incidence of chronic disorders drives the growth of global rapid medical diagnostic kits market.

Which product held the maximum share in 2021?

Based on product, over the counter (OTC) kits segment is expected to hold the maximum share rapid medical diagnostic kits market.