Rainscreen Cladding Market | Acumen Research and Consulting

Rainscreen Cladding Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

The Global Rainscreen Cladding Market Size accounted for USD 142.7 Billion in 2023 and is estimated to achieve a market size of USD 267.8 Billion by 2032 growing at a CAGR of 7.3% from 2024 to 2032

Rainscreen Cladding Market Highlights

- Global rainscreen cladding market revenue is poised to garner USD 267.8 billion by 2032 with a CAGR of 7.3% from 2024 to 2032

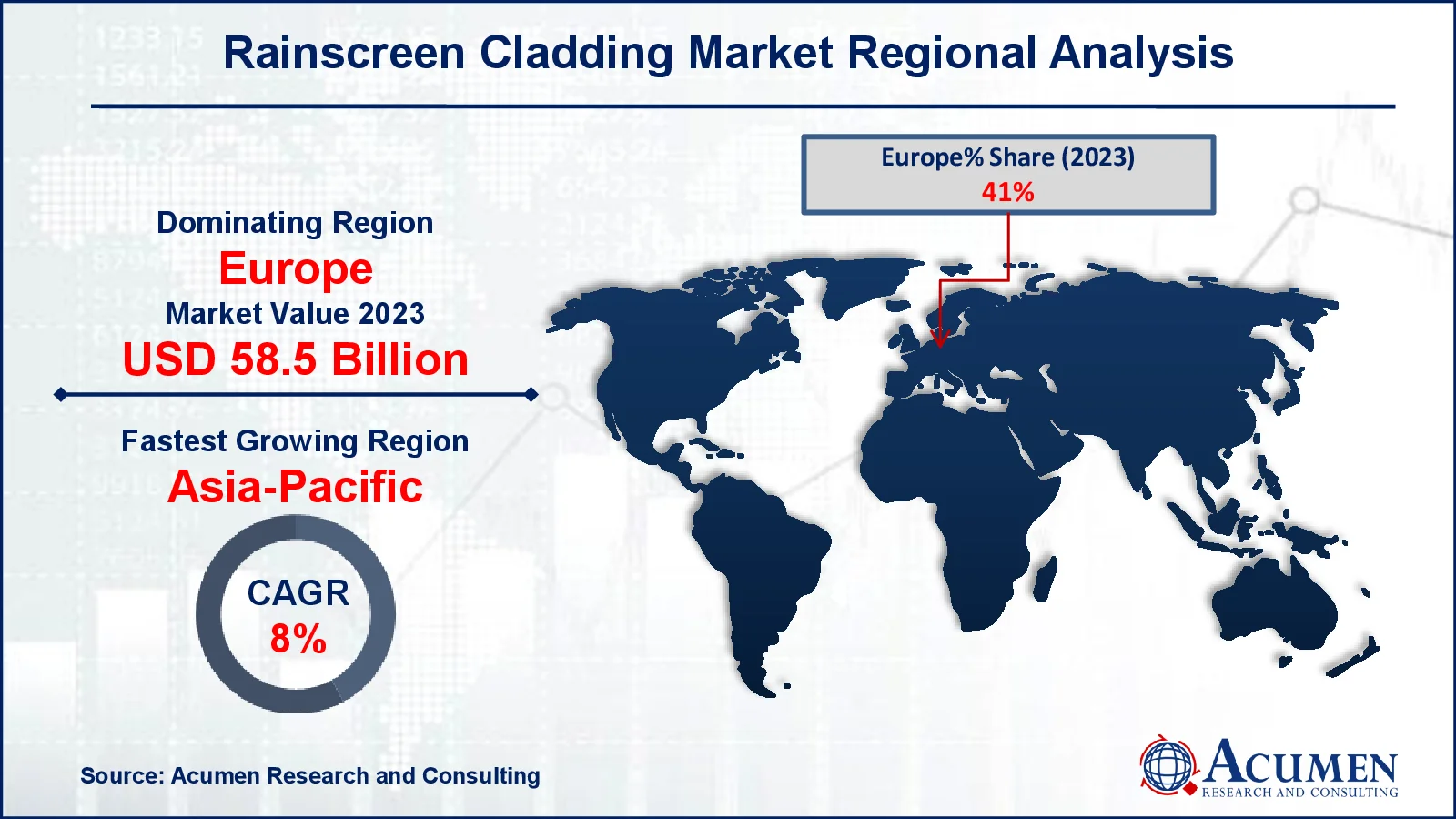

- Europe rainscreen cladding market value occupied around USD 58.5 billion in 2023

- Asia-Pacific rainscreen cladding market growth will record a CAGR of more than 8% from 2024 to 2032

- Based on raw material, the terracotta sub-segment expected to generated 36% market share in 2023

- Based on application, the official sub-segment shows 33% growth in 2023

- Advances in cladding technologies, including improved thermal insulation and weather resistance, enhancing building performance is the rainscreen cladding market trend that fuels the industry demand

Rainwater cladding systems provide the greatest solution for improved wetness across the board and vitality-effective thermal insulation for buildings. Changing construction industry patterns to consolidate reasonable condition well-disposed arrangements with minimal vitality utilization and product waste is expected to drive growth over the forecast period.

The market is highly competitive due to product variation among a large number of companies, most of who are centered in North America and Europe. These regions have stronger product penetration than Asia Pacific, owing to stricter government regulations, increased consumer spending power, and increased knowledge of the benefits of rainscreen cladding.

Global Rainscreen Cladding Market Dynamics

Market Drivers

- Increased demand for energy-efficient buildings

- Rising focus on building aesthetics and exterior design

- Growing adoption of sustainable construction materials

Market Restraints

- High initial cost of installation

- Potential issues with maintenance and durability

- Regulatory and compliance challenges in different regions

Market Opportunities

- Technological advancements in cladding materials

- Expansion of construction activities in emerging markets

- Increased awareness and incentives for green building certifications

Rainscreen Cladding Market Report Coverage

| Market | Rainscreen Cladding Market |

| Rainscreen Cladding Market Size 2022 |

USD 142.7 Billion |

| Rainscreen Cladding Market Forecast 2032 | USD 267.8 Billion |

| Rainscreen Cladding Market CAGR During 2023 - 2032 | 7.3% |

| Rainscreen Cladding Market Analysis Period | 2020 - 2032 |

| Rainscreen Cladding Market Base Year |

2022 |

| Rainscreen Cladding Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Raw Material, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Dow Building Solutions, OmniMax International, Inc., Kingspan Insulation plc, Carea Ltd., Centria International, M.F. Murray Companies, Inc., Rockwool International A/S, Everest Industries Ltd., Trespa International B.V., Celotex Ltd, Middle East Insulation LLC, and FunderMax. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Rainscreen Cladding Market Insights

The cladding structure is a popular choice for large multi-story structures because to its suitability for both new builds and rehabilitation projects. In the case of older constructions, these features improve the structure's appearance while also increasing thermal efficiency. The systems appear to be an acceptable and viable option for new structures.

The three most common types of rainscreen cladding structures available in the market are drained systems, vented systems, and pressure-equalized. Modern open and ventilated structures are expected to provide builders and draftsmen with a variety of plan options over the projection period.

The rising emphasis on energy-efficient buildings is significantly boosting the rainscreen cladding market. Rainscreen cladding systems help improve insulation and reduce energy consumption by providing an additional layer of protection against the elements, which enhances the thermal performance of buildings. As energy regulations become stricter and building codes evolve, the demand for such cladding solutions grows. This shift aligns with the broader trend towards sustainable construction practices and reduced carbon footprints. For instance, rainscreen cladding technology will advance in November 2023, according to the market. This could include the use of self-cleaning coatings or smart materials to improve building performance. These developments meet the demand for high-performance, sustainable construction solutions.

Rainscreen Cladding Market Segmentation

The worldwide market for rainscreen cladding is split based on raw material, application, and geography.

Rainscreen Cladding Raw Materials

- Fiber Cement

- Composite Material

- Metal

- High Pressure Laminates

- Terracotta

- Ceramic

- Others

The terracotta segment dominates the rainscreen cladding market due to its durability, aesthetic appeal, and thermal insulation properties. Its natural resistance to weathering and low maintenance requirements make it a preferred choice for exterior cladding. Additionally, terracotta's ability to provide a range of colors and finishes enhances its popularity among architects and builders. As a result, it stands out as a leading raw material in the rainscreen cladding industry.

Rainscreen Cladding Applications

- Residential

- Commercial

- Official

- Institutional

- Industrial

According to the rainscreen cladding industry analysis, the official application segment leads due to its critical role in building facade systems, providing essential protection against weather elements and improving energy efficiency. This dominance is driven by the increasing demand for durable, aesthetically pleasing, and energy-efficient building solutions. Official applications, including commercial and high-rise buildings, prioritize these factors, enhancing the segment’s market share.

Rainscreen Cladding Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Rainscreen Cladding Market Regional Analysis

For several reasons, Europe dominates market, and is expected to grow at a highest CAGR over the projected period. This regional market is expected to benefit from the retrieval in both residential and commercial settings. Also, strict regulatory guidelines for the real estate and construction industries are expected to boost product growth.

Asia-Pacific is fastest-growing region in rainscreen cladding market due to its booming construction sector and increasing urbanization. Countries in this region are rapidly building new infrastructure and renovating existing buildings, which boosts the demand for rainscreen cladding.

The requirement in North America shows notable growth in forecast year. Government initiatives for infrastructure and commercial projects boosted the manufacturing sector and are expected to fuel the North American rain screen cladding market.

The Qatari government aims to create the largest significant number of green or carbon-neutral buildings in the Middle East and North Africa region by 2030. This action is consistent with the country's critical strategy to reduce carbon footprint and achieve sustainable development. As a result, the regional need for rain screen structures is expected to increase over time.

Rainscreen Cladding Market Players

Some of the top rainscreen cladding companies offered in our report include Dow Building Solutions, OmniMax International, Inc., Kingspan Insulation plc, Carea Ltd., Centria International, M.F. Murray Companies, Inc., Rockwool International A/S, Everest Industries Ltd., Trespa International B.V., Celotex Ltd, Middle East Insulation LLC, and FunderMax.

Frequently Asked Questions

How big is the rainscreen cladding market?

The rainscreen cladding market size was valued at USD 142.7 Billion in 2023.

What is the CAGR of the global rainscreen cladding market from 2024 to 2032?

The CAGR of rainscreen cladding is 7.3% during the analysis period of 2024 to 2032.

Which are the key players in the rainscreen cladding market?

The key players operating in the global market are including Dow Building Solutions, OmniMax International, Inc., Kingspan Insulation plc, Carea Ltd., Centria International, M.F. Murray Companies, Inc., Rockwool International A/S, Everest Industries Ltd., Trespa International B.V., Celotex Ltd, Middle East Insulation LLC, and FunderMax.

Which region dominated the global rainscreen cladding market share?

Europe held the dominating position in rainscreen cladding industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of rainscreen cladding during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global rainscreen cladding industry?

The current trends and dynamics in the rainscreen cladding industry include increased demand for energy-efficient buildings, rising focus on building aesthetics and exterior design, and growing adoption of sustainable construction materials

Which raw material held the maximum share in 2023?

The terracotta held the maximum share of the rainscreen cladding industry.