Radar Sensors Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Radar Sensors Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

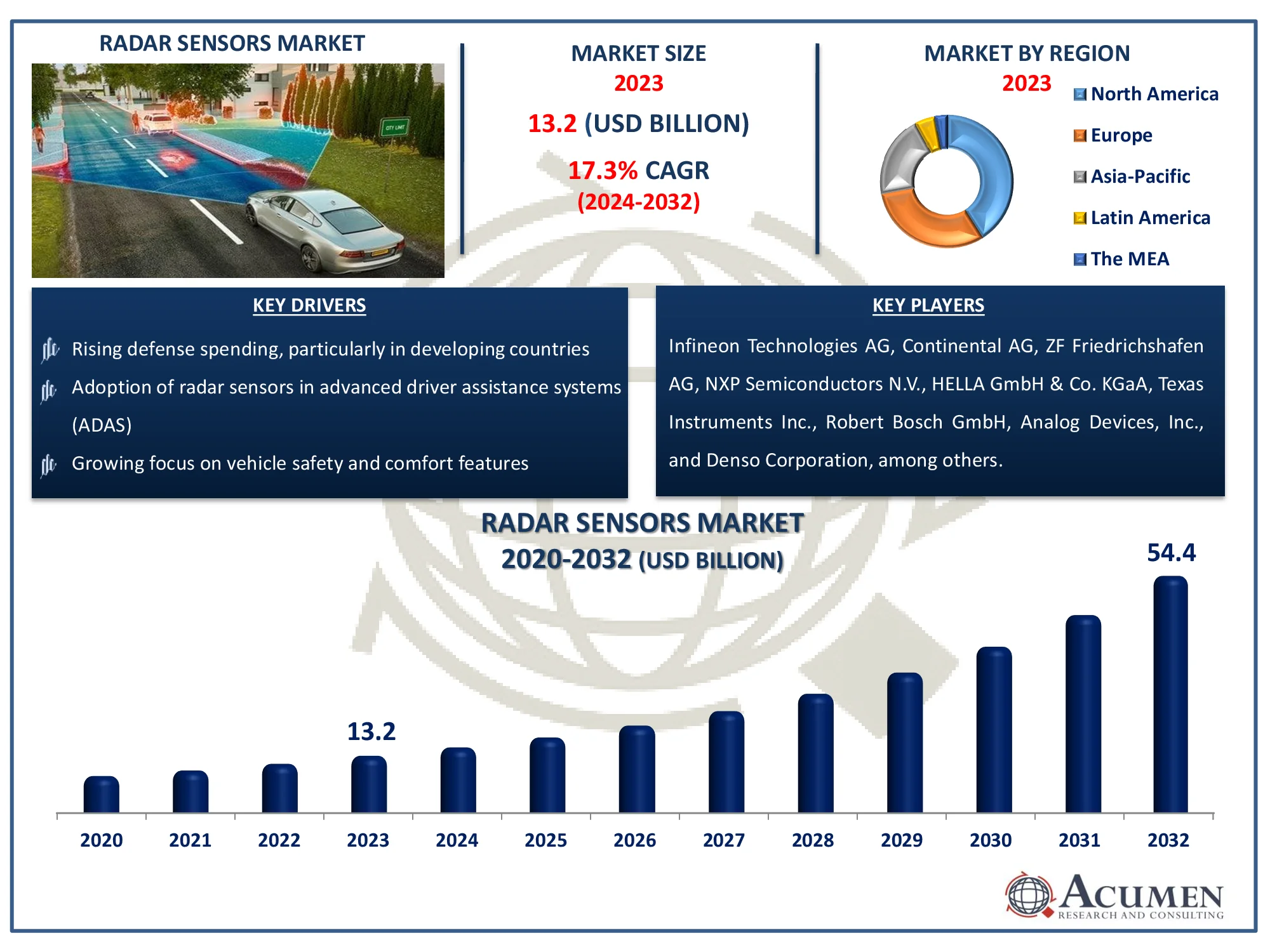

The Global Radar Sensors Market Size accounted for USD 13.2 Billion in 2023 and is estimated to achieve a market size of USD 54.4 Billion by 2032 growing at a CAGR of 17.3% from 2024 to 2032

Radar Sensors Market Highlights

- Global radar sensors market revenue is poised to garner USD 54.4 billion by 2032 with a CAGR of 17.3% from 2024 to 2032

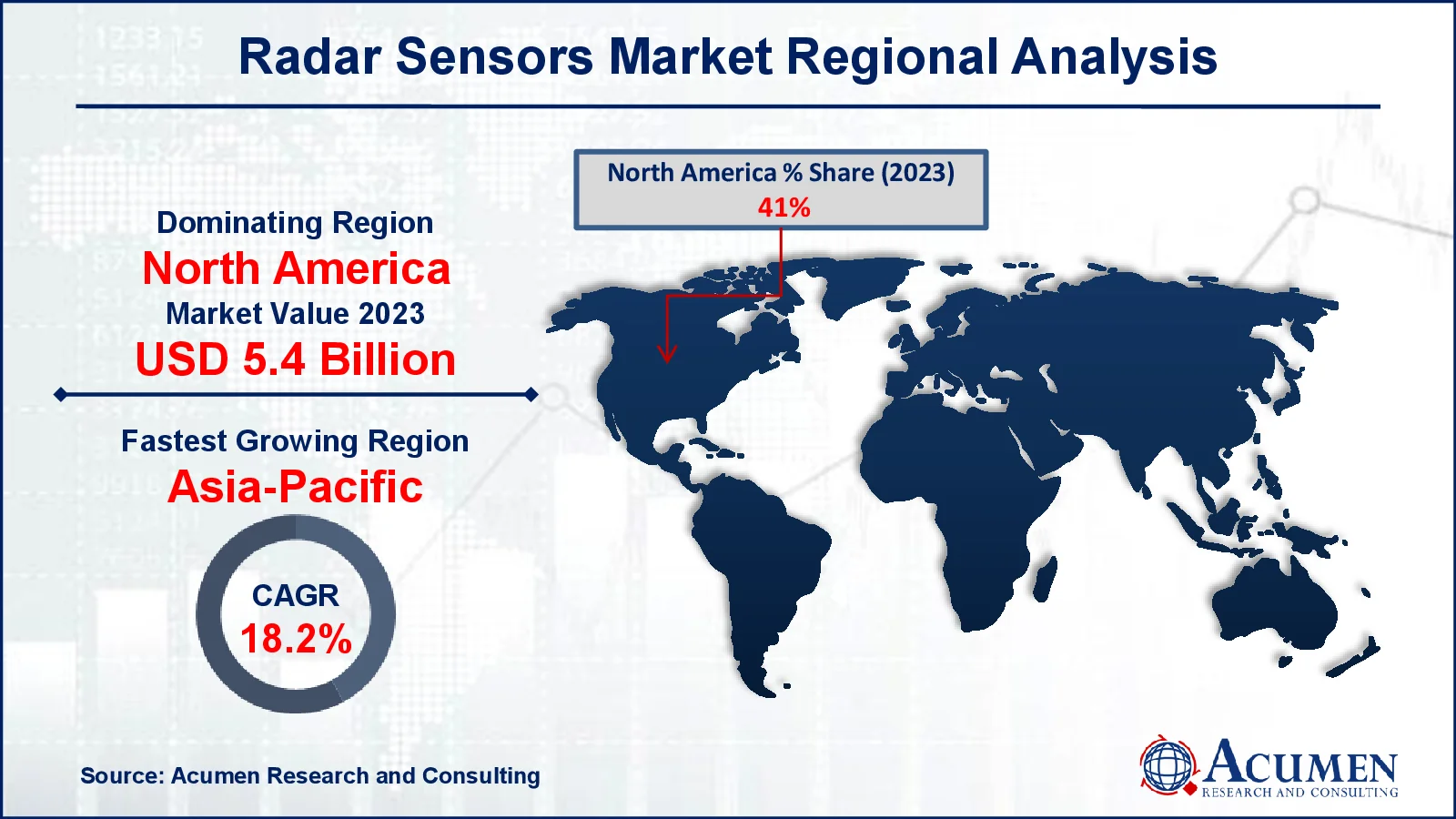

- North America radar sensors market value occupied around USD 5.4 billion in 2023

- Asia-Pacific radar sensors market growth will record a CAGR of more than 18.2% from 2024 to 2032

- Among type, the imaging radar sub-segment generated USD 8.2 billion revenue in 2023

- Based on range, the mid range radar sub-segment generated 43% radar sensors market share in 2023

- Potential advancements in radar sensor miniaturization and efficiency is a popular radar sensors market trend that fuels the industry demand

A radar sensor is an electronic device which has its application in detecting the velocity and position of an object located at a distance such as a ship, aircraft, motorbike, or vehicle. The basic working principle of radar sensors is to detect electromagnetic emissions with the help of a superheterodyne receiver and when the transmission is identified it alter the person in the vehicle. Also, the advanced development in the technology of GPS is embedded into radar sensors which provide the storage of locations impelled by the sensor when the user reaches their destination.

Global Radar Sensors Market Dynamics

Market Drivers

- Increasing territorial conflicts and geopolitical instabilities

- Growing focus on vehicle safety and comfort features

- Rising defense spending, particularly in developing countries

- Adoption of radar sensors in advanced driver assistance systems (ADAS)

Market Restraints

- High development and production costs of radar sensors

- Regulatory challenges and stringent government standards

- Limited adoption in cost-sensitive markets

Market Opportunities

- Expansion of autonomous and driverless vehicle technologies

- Growing demand for radar sensors in industrial automation

- Increased investment in space exploration and satellite technology

Radar Sensors Market Report Coverage

| Market | Radar Sensors Market |

| Radar Sensors Market Size 2022 |

USD 13.2 Billion |

| Radar Sensors Market Forecast 2032 | USD 54.4 Billion |

| Radar Sensors Market CAGR During 2023 - 2032 | 17.3% |

| Radar Sensors Market Analysis Period | 2020 - 2032 |

| Radar Sensors Market Base Year |

2022 |

| Radar Sensors Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Frequency Band, By Range, By Application, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Infineon Technologies AG, Continental AG, ZF Friedrichshafen AG, NXP Semiconductors N.V., HELLA GmbH & Co. KGaA, Texas Instruments Inc., Robert Bosch GmbH, Analog Devices, Inc., Denso Corporation, Autoliv Inc., STMicroelectronics N.V., and Rohm Semiconductor. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Radar Sensors Market Insights

The radar sensors market is expanding rapidly, propelled by a number of major reasons from various industries. One of the key factors is the rise in territorial wars and geopolitical instabilities around the world, which has resulted in increased defense spending. Nations are making significant investments in updating their military capabilities, including the use of new radar sensors to replace antiquated aging systems. This tendency is especially obvious in developing countries, where defense spending is increasing, fuelling the market's growth.

The growing emphasis on comfort and safety in the automobile industry has resulted in more radar sensors being integrated into vehicles. These sensors are critical to advanced driver assistance systems (ADAS), which improve car safety by enabling features like collision avoidance, adaptive cruise control, and parking aid. The rising demand for these safety features is considerably contributing to the market's expansion.

Another pivotal opportunity for the radar sensor market lies in the development of driverless cars. As the automotive industry shifts towards autonomous vehicles, radar sensors play a vital role in ensuring accurate detection and navigation, making them indispensable in the pursuit of fully autonomous driving.

Despite these favorable developments, the high development costs associated with radar sensor technologies limit market expansion. The enormous investment necessary for research, development, and production of these advanced sensors might be prohibitively expensive, especially for smaller enterprises and emerging countries. Nonetheless, the market is likely to continue to grow, fueled by continued technological improvements and rising demand across a wide range of industries.

Radar Sensors Market Segmentation

The worldwide market for radar sensors is split based on type, frequency band, range, application, end users, and geography.

Radar Sensor Market By Type

- Imaging Radar

- CW Radar

- Pulse Radar

- Non-Imaging Radar

- Speed Gauge

- Altimeter

According to radar sensors industry analysis, the imaging radar segment dominates the market due to its superior capability to provide high-resolution images for a wide range of applications. Unlike non-imaging radar, which only measures distance and speed, Imaging Radar can provide detailed 2D and 3D images, making it important in applications such as vehicle safety, military, and surveillance. In the automotive sector, imaging radar is critical for advanced driver assistance systems (ADAS), which enable features such as object identification, collision avoidance, and pedestrian recognition. Furthermore, in defense and aerospace, its capacity to operate in a variety of weather situations while providing exact imagery improves situational awareness and target identification. The increasing demand for these complex applications is propelling the Imaging radar segment forward.

Radar Sensor Market By Frequency Band

- HF, VHF and UHF Bands

- L, S, C and X Bands

- Ku, K, Ka, V and W Bands

The L, S, C, and X bands segment holds maximum share within frequecy band category due to its adaptability across a wide range of industries. These frequency bands are frequently utilized for radar systems in both the military and commercial sectors, providing a good blend of range, resolution, and penetration. These bands are critical in the defense sector for applications such as missile guidance, surveillance, and air traffic control, which require high precision and reliability. In the automotive sector, these bands are also employed in advanced driver assistance systems (ADAS) for collision avoidance and adaptive cruise control. Radar sensors that operate in these frequency bands are widely adopted and adaptable, which contributes to their market domination.

Radar Sensor Market By Range

- Short Range Radar

- Mid Range Radar

- Long Range Radar

The mid range radar type leads the radar sensors market, owing to its broad use in both the automotive and industrial sectors. These radars find the perfect mix between range and resolution, making them especially useful for activities requiring accurate detection across modest distances. Mid range radars are essential in automobile systems such as lane change assistance, blind-spot detection, and adaptive cruise control, which require dependable performance across a particular distance range. Furthermore, their usage in industrial automation for monitoring and managing processes at intermediate distances increases demand. Mid range radars' versatility and cost-effectiveness make them the favored choice for a wide range of applications, ensuring their market dominance.

Radar Sensor Market By Application

- Air Traffic Control

- Remote Sensing

- Ground Traffic Control

- Space Navigation and Control

- Others

The ground traffic control sector is likely to account for a sizable portion during the radar sensors market market forecast period due to its growing importance in managing vehicular and pedestrian traffic in metropolitan areas. Radar sensors in this category are increasingly used for traffic monitoring, speed enforcement, and automated traffic management systems. As cities become increasingly congested, the demand for efficient traffic control solutions grows, prompting the use of radar sensors to improve safety and minimize congestion. Radar sensors are crucial for current traffic management systems because they can operate well in a variety of weather conditions and offer accurate real-time data.

Radar Sensor Market By End User

- Aerospace & Defense

- Automotive

- Industrial

- Security & Surveillance

- Environmental & Weather Monitoring

- Traffic Monitoring & Management

The automotive segment is the main end consumer of radar sensors market, resulting in significant industry growth. This is primarily due to the rising use of advanced driver assistance systems (ADAS) and self-driving vehicles. Radar sensors are critical components of these technologies, providing precise data on the vehicle's surroundings and enabling capabilities such as adaptive cruise control, blind spot monitoring, lane departure warning, and collision avoidance. As automakers try to improve vehicle safety and convenience, demand for radar sensors grows, making it the dominating segment in the total radar sensor market.

Radar Sensors Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Radar Sensors Market Regional Analysis

In terms of radar sensors market analysis, the presence of large car manufacturers, aerospace and defense businesses, and advanced research institutions makes North America a key radar sensor market. The United States and Canada are major contributors to the regional market, focusing on radar sensor research and development, manufacture, and deployment.

Europe is another significant market for radar sensors, with a large automotive industry, superior manufacturing skills, and an emphasis on environmental sustainability. Germany, France, and the United Kingdom are major players in the European radar sensor market, driving innovation and acceptance of radar technologies across a wide range of applications.

The market in Asia-Pacific is rapidly expanding over the radar sensors industry forecast period, driven by increased industrialization, urbanization, and demand for innovative technology. China, Japan, and South Korea are large regional radar sensors market, with significant investments in R&D, manufacture, and deployment.

Radar Sensors Market Players

Some of the top radar sensors companies offered in our report includes Infineon Technologies AG, Continental AG, ZF Friedrichshafen AG, NXP Semiconductors N.V., HELLA GmbH & Co. KGaA, Texas Instruments Inc., Robert Bosch GmbH, Analog Devices, Inc., Denso Corporation, Autoliv Inc., STMicroelectronics N.V., and Rohm Semiconductor.

Frequently Asked Questions

How big is the radar sensors market?

The radar sensors market size was valued at USD 13.2 billion in 2023.

What is the CAGR of the global radar sensors market from 2024 to 2032?

The CAGR of radar sensors is 17.3% during the analysis period of 2024 to 2032.

Which are the key players in the radar sensors market?

The key players operating in the global market are including Infineon Technologies AG, Continental AG, ZF Friedrichshafen AG, NXP Semiconductors N.V., HELLA GmbH & Co. KGaA, Texas Instruments Inc., Robert Bosch GmbH, Analog Devices, Inc., Denso Corporation, Autoliv Inc., STMicroelectronics N.V., and Rohm Semiconductor.

Which region dominated the global radar sensors market share?

North America held the dominating position in radar sensors industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of radar sensors during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global radar sensors industry?

The current trends and dynamics in the radar sensors industry include increasing territorial conflicts and geopolitical instabilities, growing focus on vehicle safety and comfort features, rising defense spending, particularly in developing countries, and adoption of radar sensors in advanced driver assistance systems (ADAS).

Which end user held the maximum share in 2023?

The automotive end user held the maximum share of the radar sensors industry.