Quantum Dot Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Quantum Dot Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

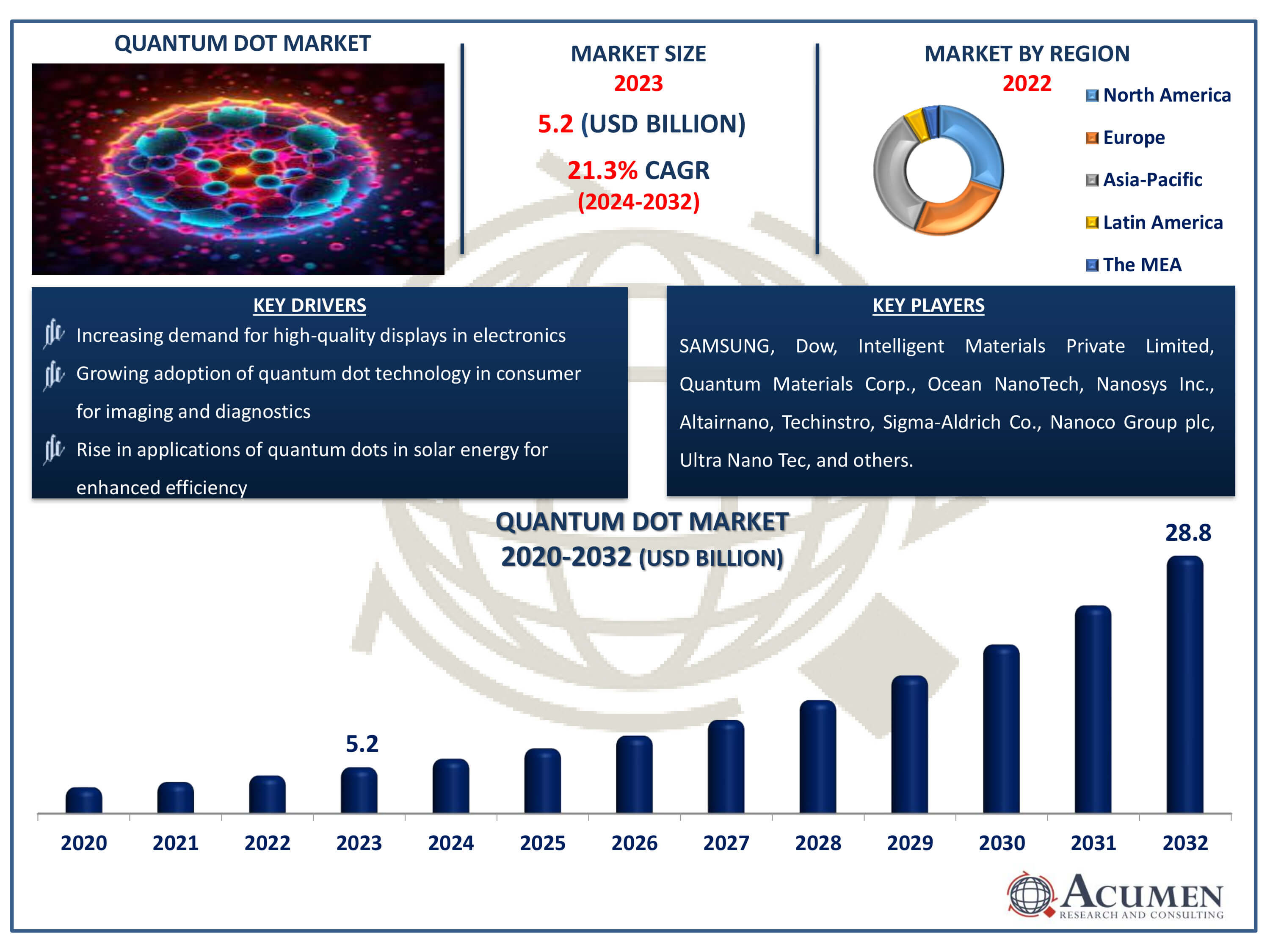

The Quantum Dot Market Size accounted for USD 5.2 Billion in 2023 and is estimated to achieve a market size of USD 28.8 Billion by 2032 growing at a CAGR of 21.3% from 2024 to 2032.

Quantum Dot Market Highlights

- Global quantum dot market revenue is poised to garner USD 28.8 billion by 2032 with a CAGR of 21.3% from 2024 to 2032

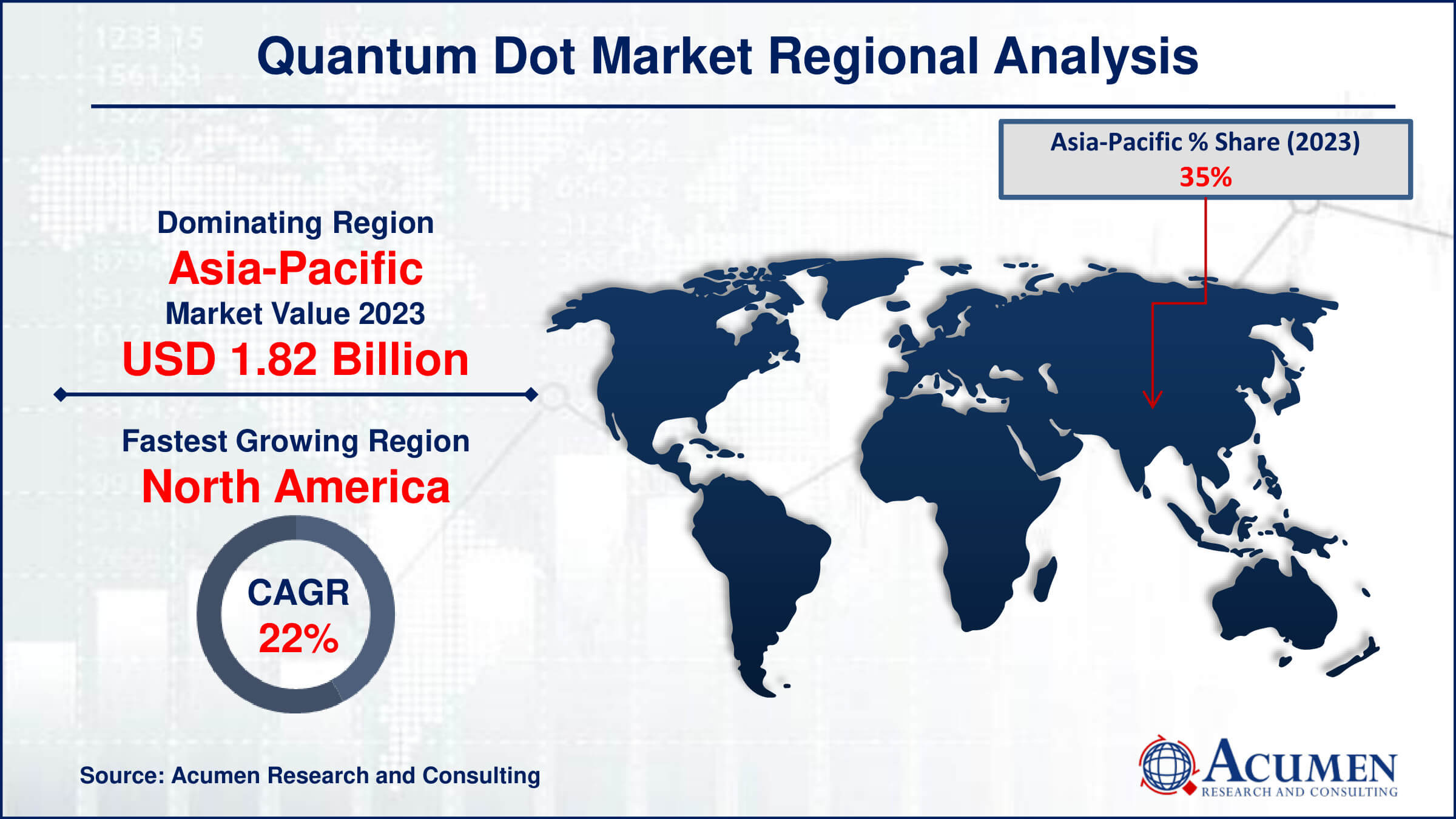

- Asia-Pacific quantum dot market value occupied around USD 1.82 billion in 2023

- North America quantum dot market growth will record a CAGR of more than 22% from 2024 to 2032

- Among material, the cadmium free quantum dots sub-segment generated significant of the market share in 2023

- Based on processing techniques, the colloidal synthesis sub-segment generated notable market share in 2023

- Growing demand for quantum dots in display technologies such as QLED TVs and monitors is the quantum dot market trend that fuels the industry demand

Quantum dots are nanoscale semiconductor particles that exhibit unique optical and electronic properties due to quantum mechanics effects. Their size-dependent properties make them promising in various applications. In display technology, quantum dots are used to enhance color reproduction and efficiency, leading to brighter and more vibrant screens with improved energy efficiency. They also find applications in biomedical imaging, where their fluorescence properties enable highly sensitive detection of biomolecules and cellular structures. Quantum dots are utilized in solar cells to increase light absorption and enhance energy conversion efficiency. Moreover, they hold promise in quantum computing due to their ability to trap and manipulate individual electrons, paving the way for advanced computing architectures. These versatile nanoparticles continue to drive innovation across multiple fields, offering solutions for next-generation technologies.

Global Quantum Dot Market Dynamics

Market Drivers

- Increasing demand for high-quality displays in electronics

- Growing adoption of quantum dot technology in Consumer for imaging and diagnostics

- Rise in applications of quantum dots in solar energy for enhanced efficiency

Market Restraints

- Regulatory challenges related to toxicity and environmental concerns

- High production costs limiting mass adoption

- Competition from alternative technologies such as OLEDs

Market Opportunities

- Expansion into emerging markets with rising consumer electronics demand

- Research and development leading to novel applications in quantum computing

- Collaborations with other industries for diversified applications, such as automotive displays and LED lighting

Quantum Dot Market Report Coverage

| Market | Quantum Dot Market |

| Quantum Dot Market Size 2022 | USD 5.2 Billion |

| Quantum Dot Market Forecast 2032 |

USD 28.8 Billion |

| Quantum Dot Market CAGR During 2023 - 2032 | 21.3% |

| Quantum Dot Market Analysis Period | 2020 - 2032 |

| Quantum Dot Market Base Year |

2022 |

| Quantum Dot Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material, By Processing Techniques, By Product, By End Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | SAMSUNG, Dow, Intelligent Materials Private Limited, Quantum Materials Corp., Ocean NanoTech, Nanosys Inc., Altairnano, Techinstro, Sigma-Aldrich Co., Nanoco Group plc, Ultra Nano Tec, Apple Inc., Thermo Fisher Scientific Inc., and Sony Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Quantum Dot Market Insights

The quantum dot market is experiencing robust growth propelled by the escalating demand for high-definition displays across various electronic devices. Quantum dots, with their exceptional optical properties, are revolutionizing display technologies by enhancing color accuracy, brightness, and energy efficiency. This surge in demand is primarily fueled by the rising consumer preference for vibrant and immersive visual experiences in smartphones, televisions, and monitors. Additionally, the adoption of quantum dot displays by manufacturers seeking to stay competitive in the market further propels its expansion. As the technology continues to advance, quantum dots are poised to play an increasingly pivotal role in shaping the future of display technologies.

The quantum dot market faces significant regulatory challenges due to concerns surrounding their toxicity and environmental impact. Quantum dots are often made of heavy metals like cadmium, posing risks to human health and the environment if not properly managed. Regulations governing the disposal and use of these materials can hinder market growth by increasing costs and limiting market access. Additionally, concerns about potential leaching of toxins from quantum dot-containing products into the environment further complicate regulatory compliance. Addressing these challenges will require collaboration between industry stakeholders and regulators to develop and enforce stringent safety standards while fostering innovation in less toxic alternatives.

The expansion into emerging markets with rising consumer electronics demand presents a significant opportunity for the quantum dot market. For instance, in April 2022, Nanosys and Bready announced the mass production of xQDEF™ Laminate, an innovative laminated quantum dot film that eliminates the need for barrier films. This breakthrough is anticipated to be adopted by leading consumer electronics brands, providing enhanced display performance, cost reductions, and broader market opportunities in the display industry. As these markets experience rapid economic growth and increasing disposable incomes, the demand for high-quality displays and advanced electronics is on the rise. Quantum dots offer superior color reproduction, energy efficiency, and brightness compared to traditional display technologies, making them particularly appealing for consumers in these markets. Moreover, the compact size and versatility of quantum dots make them suitable for a wide range of electronic devices, further fueling their adoption. Leveraging this trend, companies can tap into these burgeoning markets to drive growth and establish a strong presence in the quantum dot industry.

Quantum Dot Market Segmentation

The worldwide market for quantum dot is split based on material, processing techniques, product, end-use industry, and geography.

Quantum Dot Material

- Cadmium Based Quantum Dots

- Cadmium Selenide Quantum Dots

- Cadmium Sulphide Quantum Dots

- Cadmium Telluride Quantum Dots

- Cadmium Zinc Selenide Quantum Dots

- Cadmium-Free Quantum Dots

- Indium Arsenide Quantum Dots

- Silicon Quantum Dots

- Graphene Quantum Dots

- Lead Sulphide Quantum Dots

- Carbon Quantum Dots

- Perovskite Quantum Dots

- Lead Selenide Quantum Dots

- Others

According to the quantum dot market forecast, cadmium-free quantum dots are anticipated to dominate the quantum dot market due to growing environmental and health concerns associated with cadmium toxicity. These eco-friendly alternatives, made from materials like indium phosphide, offer comparable performance in terms of brightness and color purity. Regulatory pressures and consumer preferences for safer products are driving manufacturers to adopt cadmium-free technologies. Additionally, advancements in production techniques are reducing costs and enhancing the viability of these quantum dots for widespread use. For instance, in March 2019, Nanoco introduced new quantum dots that boast increased energy efficiency and environmental friendliness. According to the company, these quantum dots enable displays to be up to 50% more energy-efficient compared to conventional displays. Additionally, Nanoco's quantum dots are cadmium-free, making them less toxic and more sustainable than traditional quantum dots. As a result, industries such as display technology, solar cells, and bio-imaging are increasingly integrating cadmium-free quantum dots into their products.

Quantum Dot Processing Techniques

- Colloidal Synthesis

- Fabrication

- Viral Assembly

- Electrochemical assembly

- Bulk-manufacturing

- Cadmium-free quantum dots (CFQD)

According to the quantum dot industry analysis, colloidal synthesis is the leading processing technique in the quantum dots market due to its versatility and efficiency in producing high-quality nanocrystals. This method allows precise control over the size, shape, and composition of quantum dots, resulting in superior optical and electronic properties. The process involves the chemical reaction of precursors in a solution, which facilitates large-scale production at relatively low costs. Its adaptability to various materials and ability to create highly uniform and monodisperse quantum dots make it indispensable in applications ranging from displays to medical imaging. Consequently, colloidal synthesis remains the preferred choice for researchers and manufacturers in the quantum dots industry.

Quantum Dot Product

- Display

- Lasers

- Solar cells/Modules

- Medical devices

- Photodetectors/sensors

- LED Produts

- Others

Historically, display quantum dot as a product anticipated to dominates quantum dot market. Their ability to emit pure, precise colors with high brightness and energy efficiency makes them ideal for display technologies, such as QLED TVs, enhancing image quality significantly. The rapid advancement and cost reduction in manufacturing processes are driving their widespread adoption. Furthermore, their potential in medical imaging, solar cells, and quantum computing underscores their versatility and market appeal. As demand for high-performance display and advanced technological applications grows, quantum dots are set to become a cornerstone of next-generation technology.

Quantum Dot End Use

- Consumer

- Commercial

- Healthcare

- Defence Telecommunications

- Others

According to the quantum dot industry, consumer sector is anticipated to dominate the quantum dot market due to the increasing demand for advanced display technologies in devices such as TVs, smartphones, and monitors. Quantum dots enhance color accuracy and brightness, providing superior visual experiences, which drives their adoption in consumer electronics. Additionally, the growing popularity of high-definition and 4K content requires advanced display solutions that quantum dots can deliver. The integration of quantum dots in consumer products also offers energy efficiency benefits, aligning with the rising consumer preference for eco-friendly technologies. As a result, the consumer electronics segment is poised to be the largest verticals market for quantum dots.

Quantum Dot Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Quantum Dot Market Regional Analysis

For several reasons, the Asia-Pacific region leads the global quantum dot market due to its robust electronics and display industries, particularly in countries like South Korea, China, and Japan. These nations are home to major consumer electronics manufacturers who heavily invest in advanced display technologies that utilize quantum dots for superior color performance and energy efficiency. The region's strong emphasis on research and development, coupled with supportive government policies and funding, accelerates innovation and commercialization of quantum dot applications. For instance, in April 2023, Samsung Display and Ferrari entered into a memorandum of understanding to work together on developing a display solution for upcoming Ferrari vehicles. Additionally, increasing consumer demand for high-quality display devices in smartphones, televisions, and monitors fuels market growth. This dominance is further durable by the region's extensive supply chain and manufacturing capabilities, which ensure competitive pricing and widespread product availability.

The North American market is anticipated to generate substantial revenue, driven by strong demand from the healthcare sector. Furthermore, the presence of numerous companies in the region and a trend towards the introduction of innovative products contribute to the market's growth. Companies aim to expand their customer base and boost revenue through mergers, acquisitions, and strategic partnerships, which enhance their distribution channels. For instance, the collaboration between UbiQD and SmartKem focuses on integrating SmartKem's organic semiconductor formulations with Nanosys's microLED and quantum dot nano-LED technologies. The objective is to create durable, flexible, and lightweight displays that consume less power, these factors are expected to bolster the growth of the regional market.

Quantum Dot Market Players

Some of the top quantum dot companies offered in our report include SAMSUNG, Dow, Intelligent Materials Private Limited, Quantum Materials Corp., Ocean NanoTech, Nanosys Inc., Altairnano, Techinstro, Sigma-Aldrich Co., Nanoco Group plc, Ultra Nano Tec, Apple Inc., Thermo Fisher Scientific Inc., and Sony Corporation.

Frequently Asked Questions

How big is the quantum dot market?

The quantum dot market size was valued at USD 5.2 billion in 2023.

What is the CAGR of the global quantum dot market from 2024 to 2032?

The CAGR of quantum dot is 21.3% during the analysis period of 2024 to 2032.

Which are the key players in the quantum dot market?

The key players operating in the global market are including SAMSUNG, Dow, Intelligent Materials Private Limited, Quantum Materials Corp., Ocean NanoTech, Nanosys Inc., Altairnano, Techinstro, Sigma-Aldrich Co., Nanoco Group plc, Ultra Nano Tec, Apple Inc., Thermo Fisher Scientific Inc., and Sony Corporation

Which region dominated the global quantum dot market share?

Asia-Pacific held the dominating position in quantum dot industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of quantum dot during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global quantum dot industry?

The current trends and dynamics in the quantum dot industry include increasing demand for high-quality displays in electronics, growing adoption of quantum dot technology in healthcare for imaging and diagnostics, and rise in applications of quantum dots in solar energy for enhanced efficiency.

Which Material held the maximum share in 2023?

The cadmium-free quantum dots held the maximum share of the quantum dot industry.