Pyrogen Testing Market | Acumen Research and Consulting

Pyrogen Testing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

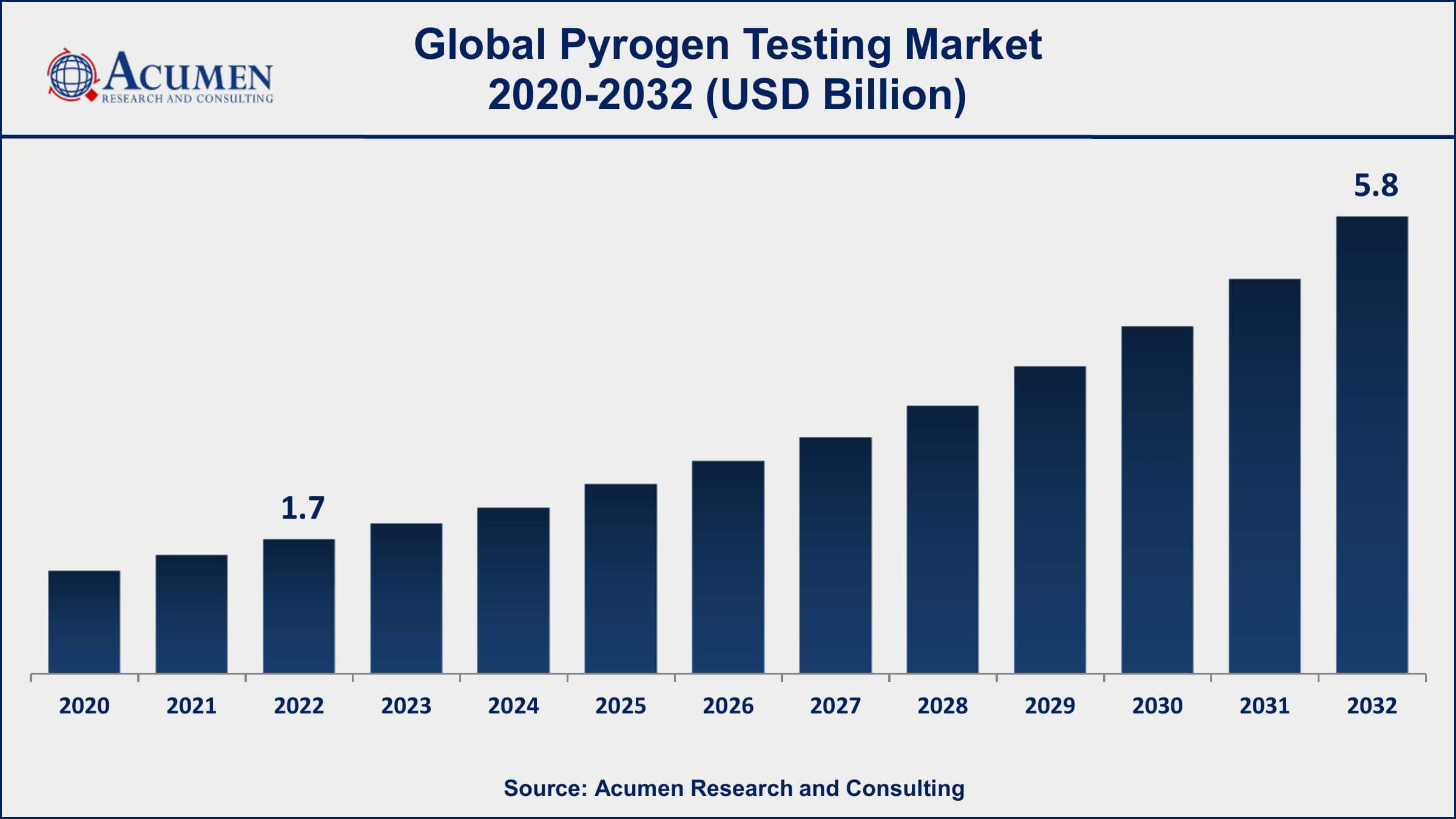

The Pyrogen Testing Market Size accounted for USD 1.7 Billion in 2022 and is projected to achieve a market size of USD 5.8 Billion by 2032 growing at a CAGR of 11.8% from 2023 to 2032.

Pyrogen Testing Market Highlights

- Global pyrogen testing market revenue is expected to increase by USD 5.8 Billion by 2032, with a 11.8% CAGR from 2023 to 2032

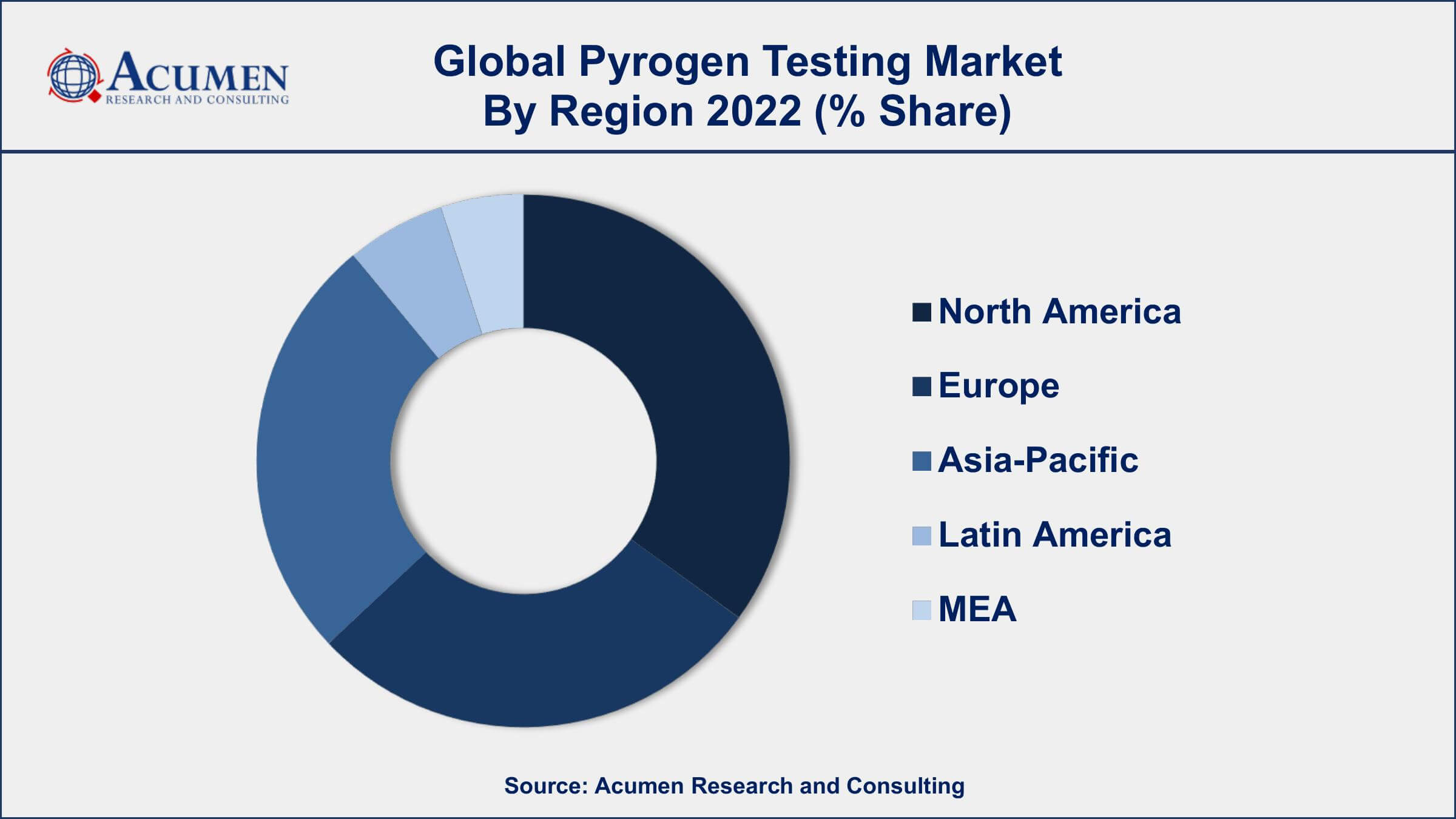

- North America region led with more than 36% of pyrogen testing market share in 2022

- Asia-Pacific pyrogen testing market growth will record a CAGR of around 12% from 2023 to 2032

- The Limulus amebocyte lysate (LAL) tests segment is the largest and fastest-growing segment in the market, accounting for over 70% of the total market share in 2022

- The pharmaceutical and biotechnology companies segment held the largest share of the market in 2022 and is expected to maintain its dominance throughout the forecast period

- Rise in chronic diseases and health complications, drives the pyrogen testing market value

Pyrogen testing is a process that is used to determine the presence of pyrogens in drugs, medical devices, and other pharmaceutical products. Pyrogens are substances that can cause fever in humans, and their presence in drugs or medical devices can lead to serious health complications. Pyrogen testing is essential to ensure that pharmaceutical products are safe for human use.

The market for pyrogen testing is growing at a steady pace due to the increasing demand for pharmaceutical products worldwide. The rise in chronic diseases, such as cancer and diabetes, has led to an increase in the use of drugs and medical devices. As a result, the need for pyrogen testing has become more critical than ever before. Furthermore, the stringent regulatory guidelines set by the government authorities for the pharmaceutical industry have also contributed to the growth of the pyrogen testing market. The demand for pyrogen testing services is expected to increase in the future as the pharmaceutical industry continues to grow and innovate.

Global Pyrogen Testing Market Trends

Market Drivers

- Increasing demand for pharmaceutical products

- Stringent regulatory guidelines set by government authorities

- Rise in chronic diseases and health complications

- Growing awareness of the importance of pyrogen testing

Market Restraints

- High costs associated with pyrogen testing

- Limited awareness in developing countries

Market Opportunities

- Growing demand for endotoxin testing in biotechnology and medical device industries

- Increasing adoption of automated and rapid pyrogen testing methods

Pyrogen Testing Market Report Coverage

| Market | Pyrogen Testing Market |

| Pyrogen Testing Market Size 2022 | USD 1.7 Billion |

| Pyrogen Testing Market Forecast 2032 | USD 5.8 Billion |

| Pyrogen Testing Market CAGR During 2023 - 2032 | 11.8% |

| Pyrogen Testing Market Analysis Period | 2020 - 2032 |

| Pyrogen Testing Market Base Year | 2022 |

| Pyrogen Testing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Test, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Charles River Laboratories International, Inc., Lonza Group Ltd., Merck KGaA (Merck Millipore), Thermo Fisher Scientific Inc., Wako Chemicals USA, Inc., Ellab A/S, Associates of Cape Cod, Inc., GenScript Biotech Corporation, Hyglos GmbH, Microcoat Biotechnologie GmbH, and BioMérieux SA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Pyrogens refer to those substances which cause fever after administration of the injection. Rise in the temperature of the human body as well as body aches are some of the major reactions caused owing to the injection of harmful pyrogens in the body. Pyrogen testing helps in the determination of the presence of endotoxin substances present in the human body. The pyrogen testing market can be segmented on the basis of application, test type, end-user, and region. The rising support especially from governments of various economies in order to launch new and more innovative drug options to fight several new types of diseases has bolstered the overall demand for pyrogen testing products in the recent past. In addition to this, pyrogens are widely known as a major cause of body aches and fever after being injected into the human body. This testing of pyrogens helps in the easy identification of the presence of endotoxin substances and is being widely used especially in the development of improved and new drugs across the globe.

The increasing growth of the global pyrogen testing market is primarily anticipated to be the result of the increasing number of biotechnology and pharmaceutical companies across the globe. In addition, increasing investments in research and development activities as well as rising approvals for new and improved drugs is another major factor bolstering the market growth, globally. Also, other factors such as the increasing prevalence of chronic diseases, rising healthcare expenditure, and favorable government support programs and initiatives are further augmenting the growth of the global market over the forecast period. However, factors such as the high barrier for new market entrants are one of the key aspects anticipated to hamper the market growth over the forecast period. On the other hand, increasing medical tourism, especially in developing regions such as Latin America and Asia-Pacific, coupled with a rapidly growing healthcare industry in emerging economies such as India, China, Japan, Indonesia, Argentina, and Brazil among others are considered to be the future landscape for global market over the forecast period. Moreover, increasing discovery of new and more innovative drugs along with huge investments in overall sunk costs, especially by biotechnological and pharmaceutical companies, coupled with rising support by the governments of various economies across the globe in the healthcare sector are some other elements fueling the growth of pyrogen testing market.

Pyrogen Testing Market Segmentation

The global pyrogen testing market segmentation is based on product, test, end user, and geography.

Pyrogen Testing Market By Product

- Kits and Reagents

- Instruments

- Services

According to the pyrogen testing industry analysis, the kits and reagents segment accounted for the largest market share in 2022. Pyrogen detection kits and reagents are used to detect endotoxins, which are one of the most common types of pyrogens found in pharmaceutical products. These kits and reagents offer high sensitivity, specificity, and reliability in detecting pyrogens, making them an essential component in the pyrogen testing process. The growing preference for rapid and automated testing methods is driving the demand for pyrogen detection kits and reagents. These kits and reagents are designed to provide accurate and reliable results in a short period, reducing the time required for testing and improving productivity. Moreover, the availability of customized kits and reagents that are specific to a particular pharmaceutical product is also driving the growth of the kits and reagents segment.

Pyrogen Testing Market By Test

- Limulus Amebocyte Lysate (LAL) Tests

- Monocyte Activation Test

- Rabbit Pyrogen Test

- Others

In terms of tests, the Limulus amebocyte lysate (LAL) tests segment is expected to witness significant growth in the coming years. LAL tests are widely used in the pharmaceutical and biotechnology industries for the detection of pyrogens in drugs and medical devices. The LAL tests are based on the Limulus clotting mechanism, which detects the presence of bacterial endotoxins. The increasing demand for LAL tests is primarily driven by the growing need for endotoxin detection in the pharmaceutical industry. LAL tests are widely accepted by regulatory authorities and are considered the gold standard for endotoxin detection. The increasing adoption of LAL tests in the biotechnology and medical device industries is also contributing to the growth of this segment.

Pyrogen Testing Market By End User

- Pharmaceutical and Biotechnology Companies

- Medical Device Companies

- Others

According to the pyrogen testing market forecast, the pharmaceutical and biotechnology companies segment is expected to witness significant growth in the coming years. These companies are required to comply with stringent regulatory guidelines set by government authorities to ensure the safety and efficacy of their products. Pyrogen testing is an essential component of the quality control process for drugs and medical devices, and failure to comply with these regulations can result in serious consequences, including product recalls and legal liabilities. Moreover, the increasing focus on research and development activities in the pharmaceutical and biotechnology industries is also driving the market growth. As new drugs and medical devices are developed, the need for pyrogen testing services to ensure their safety and efficacy is becoming more critical than ever before. The pharmaceutical and biotechnology companies segment is expected to continue growing as these companies invest heavily in research and development activities to bring innovative products to the market.

Pyrogen Testing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Pyrogen Testing Market Regional Analysis

North America dominates the pyrogen testing market due to various factors such as the presence of well-established pharmaceutical and biotechnology industries, the increasing demand for safe and effective drugs, and the stringent regulatory guidelines set by government authorities. The pharmaceutical and biotechnology industries in North America are among the largest in the world, and these industries are required to comply with strict regulatory guidelines set by the US FDA and other regulatory bodies to ensure the safety and efficacy of their products. Pyrogen testing is an essential component of the quality control process for drugs and medical devices, and North American companies are increasingly investing in pyrogen testing services to ensure compliance with these regulations. Moreover, the increasing prevalence of chronic diseases, such as cancer, diabetes, and cardiovascular diseases, is also driving the market growth in North America. The demand for safe and effective drugs to treat these diseases is growing, and pyrogen testing is an essential step in ensuring the safety and efficacy of these drugs. The increasing focus on research and development activities in the pharmaceutical and biotechnology industries in North America is also driving the growth of the pyrogen testing market.

Pyrogen Testing Market Player

Some of the top pyrogen testing market companies offered in the professional report include Charles River Laboratories International, Inc., Lonza Group Ltd., Merck KGaA (Merck Millipore), Thermo Fisher Scientific Inc., Wako Chemicals USA, Inc., Ellab A/S, Associates of Cape Cod, Inc., GenScript Biotech Corporation, Hyglos GmbH, Microcoat Biotechnologie GmbH, and BioMérieux SA.

Frequently Asked Questions

What was the market size of the global pyrogen testing in 2022?

The market size of pyrogen testing was USD 1.7 Billion in 2022.

What is the CAGR of the global pyrogen testing market from 2023 to 2032?

The CAGR of pyrogen testing is 11.8% during the analysis period of 2023 to 2032.

Which are the key players in the pyrogen testing market?

The key players operating in the global market are including Charles River Laboratories International, Inc., Lonza Group Ltd., Merck KGaA (Merck Millipore), Thermo Fisher Scientific Inc., Wako Chemicals USA, Inc., Ellab A/S, Associates of Cape Cod, Inc., GenScript Biotech Corporation, Hyglos GmbH, Microcoat Biotechnologie GmbH, and BioMérieux SA.

Which region dominated the global pyrogen testing market share?

North America held the dominating position in pyrogen testing industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of pyrogen testing during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global pyrogen testing industry?

The current trends and dynamics in the pyrogen testing industry include increasing demand for pharmaceutical products, stringent regulatory guidelines set by government authorities, and rise in chronic diseases and health complications.

Which test held the maximum share in 2022?

The limulus amebocyte lysate test held the maximum share of the pyrogen testing industry.