PVC Plasticizers Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

The PVC Plasticizers Market Size accounted for USD 17.6 Billion in 2023 and is estimated to achieve a market size of USD 28.5 Billion by 2032 growing at a CAGR of 5.5% from 2024 to 2032.

PVC Plasticizers Market Highlights

- Global PVC plasticizers market revenue is poised to garner USD 28.5 billion by 2032 with a CAGR of 5.5% from 2024 to 2032

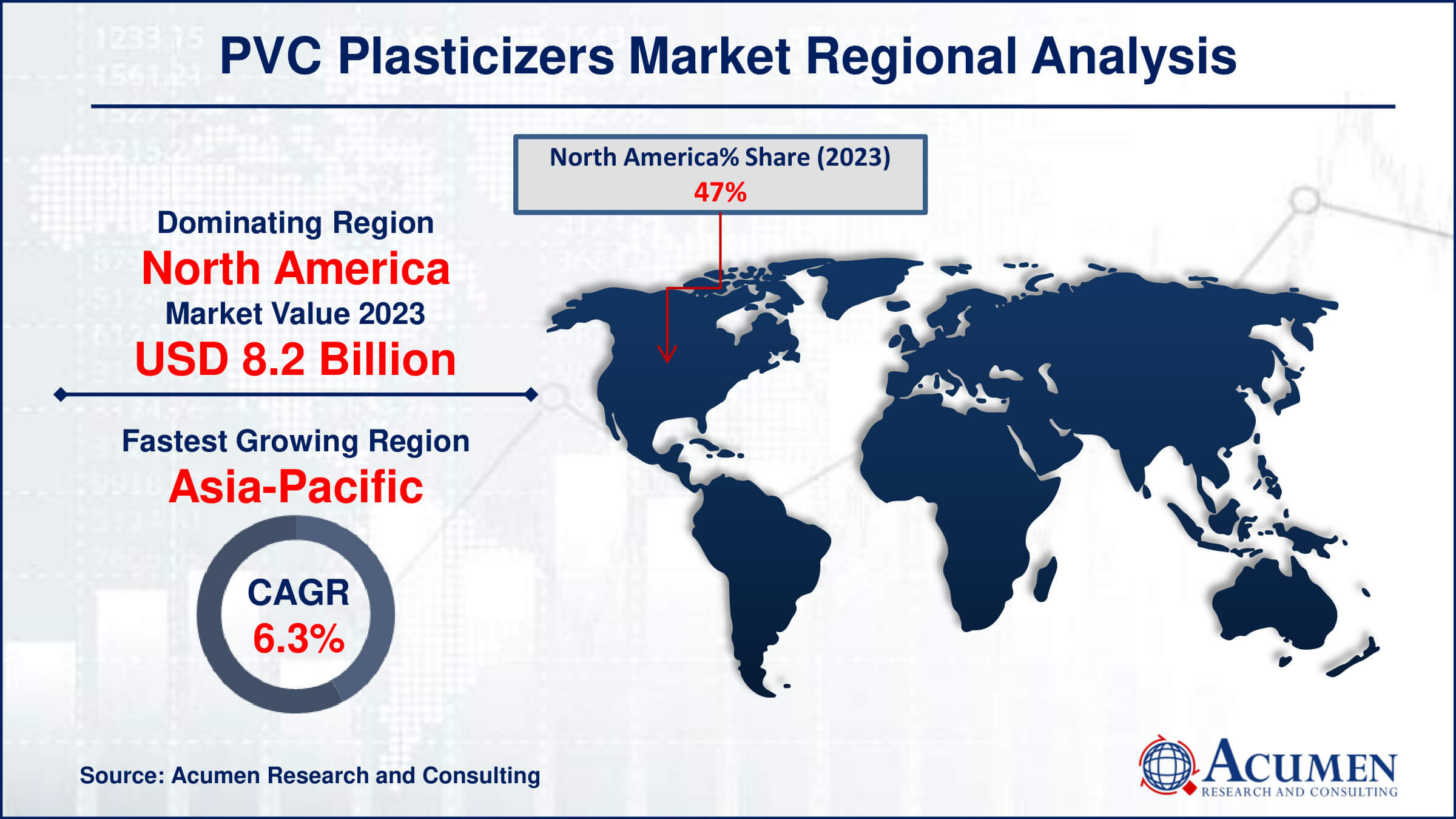

- North America PVC plasticizers market value occupied around USD 8.2 billion in 2023

- Asia-Pacific PVC plasticizers market growth will record a CAGR of more than 6.3% from 2024 to 2032

- Based on types, the phthalates sub-segment expected to generated significant market share in 2023

- Based on application, the wire and cable sub-segment shows 26% market share in 2023

- Growing demand for phthalate-free plasticizers due to health and environmental concerns is the PVC plasticizers market trend that fuels the industry demand

PVC plasticizers are chemicals added to polymers to enhance their flexibility, softness, and resistance to brittleness. They also improve the material's malleability. Depending on the type of modifications they induce, plasticizers can be either internal or external. External plasticizers are further categorized into primary and secondary types. Primary plasticizers are primarily used to increase elongation and softness, while secondary plasticizers serve as mixing agents with other plasticizers. There are various types of plasticizers available in the market, with phthalates, terephthalates, epoxies, and aliphatic plasticizers being among the most widely used.

Global PVC Plasticizers Market Dynamics

Market Drivers

- Increasing demand for flexible PVC products in construction and automotive industries

- Growing use of plasticizers in cosmetics and healthcare applications

- Rising urbanization and infrastructure development activities globally

Market Restraints

- Environmental concerns and stringent regulations regarding plasticizer use

- Fluctuating raw material prices impacting production costs

- Health risks associated with certain types of phthalate plasticizers

Market Opportunities

- Development of bio-based and non-phthalate plasticizers

- Growing demand for flexible PVC applications

- Innovations in plasticizer formulations to enhance performance and reduce toxicity

PVC Plasticizers Market Report Coverage

| Market | PVC Plasticizers Market |

| PVC Plasticizers Market Size 2022 | USD 17.6 Billion |

| PVC Plasticizers Market Forecast 2032 | USD 28.5 Billion |

| PVC Plasticizers Market CAGR During 2023 - 2032 | 5.5% |

| PVC Plasticizers Market Analysis Period | 2020 - 2032 |

| PVC Plasticizers Market Base Year |

2022 |

| PVC Plasticizers Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Types, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF, Proviron Holding nv, Eastman Chemical India Pvt. Ltd., DuPont, Chromaflo Technologies Private Limited, DIC Corporation, Nan Ya Plastics Corporation, CCC Corporate, ExxonMobil, UPC Technology Corporation and Aekyung Petrochemical Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

PVC Plasticizers Market Insights

The increasing use of plasticizers in cosmetics and healthcare applications is significantly driving the growth of the PVC plasticizers market. For instance, according to U.S Food and Drug Administration, the main phthalates used in cosmetic products include dibutylphthalate (DBP), which is employed as a plasticizer in nail polishes to prevent cracking by making them less brittle; dimethylphthalate (DMP), which is used in hair sprays to prevent stiffness by forming a flexible film on the hair; and diethylphthalate (DEP), which serves as a solvent and fixative in fragrances. These plasticizers enhance the flexibility, durability, and longevity of PVC products, making them ideal for a wide range of applications. In the cosmetics industry, plasticizers are used to improve the texture and spreadability of products. In healthcare, they are crucial in the manufacture of medical devices such as tubing and blood bags. This rising demand for high-performance, versatile materials in these sectors are fueling the expansion of the PVC plasticizers market.

The PVC plasticizers market faces significant restraints due to growing environmental concerns and stringent regulations. Environmental agencies and governments worldwide are increasingly targeting plasticizers, particularly phthalates, due to their potential health risks and environmental impact. Regulations such as REACH in Europe and TSCA in the United States impose strict controls and restrictions on the use of harmful plasticizers. These measures compel manufacturers to seek alternative materials and invest in the development of eco-friendly plasticizers, thereby increasing production costs and reducing market growth. As a result, the industry is under pressure to innovate and comply with evolving regulatory standards to sustain market viability.

The development of bio-based and non-phthalate plasticizers represents a significant opportunity for the PVC plasticizers market. For instance, in December 2022, BASF, a German multinational company, partnered with StePac Ltd. of Israel to lead the way in developing advanced sustainable packaging designed specifically for the fresh produce sector. This collaboration aimed to tackle environmental issues by creating innovative and environmentally friendly packaging solutions for the agricultural industry. These alternatives address growing environmental and health concerns associated with traditional phthalate plasticizers. Bio-based plasticizers are derived from renewable resources, reducing dependency on fossil fuels and lowering the carbon footprint. Non-phthalate plasticizers offer safer options, mitigating risks of harmful effects linked to phthalates. As regulatory pressures and consumer preferences shift towards more sustainable and safer products, the demand for these innovative plasticizers is expected to rise, driving market growth.

PVC Plasticizers Market Segmentation

The worldwide market for PVC plasticizers is split based on type, application, and geography.

PVC Plasticizers Types

- Phthalates

- Diisononyl phthalate (DINP)

- Diisodecyl phthalate (DIDP)

- Dioctyl phthalate (DOP)

- Butyl benzyl phthalate (BBP)

- Others

- Non-Phthalates

- Adipates

- Trimellitates

- Epoxides

- Phosphates

- Bio-Based Plasticizers (e.g., epoxidized soybean oil)

- Others

The phthalates segment is expected to dominates PVC plasticizers market, due to their high efficiency, low cost, and versatility in various applications. Phthalates are widely used in producing flexible PVC for products such as cables, flooring, and medical devices. Their ability to impart desired physical properties like flexibility, durability, and resistance to environmental factors makes them a preferred choice. Despite growing health and environmental concerns, phthalates remain prevalent due to their established performance and cost-effectiveness. Efforts are ongoing to find safer alternatives, but phthalates continue to lead the market.

PVC Plasticizers Applications

- Flooring & Wall

- Film & Sheet Covering

- Wires & Cables

- Coated Fibers

- Consumer Goods

- Others

According to the PVC plasticizers industry analysis, wires & cables dominate market, due to the increasing demand for durable and flexible electrical components. PVC plasticizers enhance the flexibility, durability, and longevity of cables, making them ideal for various industrial and residential applications. The growth in construction, automotive, and telecommunication sectors further fuels this demand. Additionally, advancements in technology and the shift towards renewable energy sources require high-performance cables, driving the market's expansion. Consequently, manufacturers are focusing on developing innovative plasticizers to meet these evolving needs.

PVC Plasticizers Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

PVC Plasticizers Market Regional Analysis

For several reasons, North America dominates market, due to the significant presence of established automobile companies using PVC plasticizers for manufacturing automotive and aerospace components. Additionally, robust presence of key manufacturers and their innovations and development further bolster market growth. For instance, in April 2022, ExxonMobil introduced Exceed S, a type of Performance Polyethylene (PE) resin known for its combination of toughness, stiffness, and ease of processing. This new PE is designed to streamline film designs and formulations, enhancing packaging durability, conversion efficiency, and overall film performance compared to competitors.

Asia-Pacific region is fastest-growing region in market, driven by robust growth in construction, automotive, and packaging industries. Rapid urbanization, industrialization, and increasing disposable incomes in countries like China and India have significantly boosted demand for PVC products. Additionally, favorable government policies and investments in infrastructure development contribute to the market's expansion. The region's large manufacturing base and availability of raw materials also support its dominant position. Overall, Asia-Pacific's dynamic economic landscape and industrial activities underpin its leadership in the PVC plasticizers market.

Europe shows notable growth in market, PVC plasticizer phthalates are recommended by the European Pharmacopoeia for softening disposable medical items, blood bags, and tubing. Moreover, key payers advancements further maintain market’s its position in European market. For instance, in May 2023, TotalEnergies acquired Iber Resinas to bolster its plastic recycling operations in Europe. The acquisition aims to enhance the company's footprint in circular polymers, broaden its range of recycled products, and expand its access to raw materials via Iber Resinas's supplier network.

PVC Plasticizers Market Players

Some of the top PVC plasticizers companies offered in our report include BASF, Proviron Holding nv, Eastman Chemical India Pvt. Ltd., DuPont, Chromaflo Technologies Private Limited, DIC Corporation, Nan Ya Plastics Corporation, CCC Corporate, ExxonMobil, UPC Technology Corporation, and Aekyung Petrochemical Co., Ltd.

Frequently Asked Questions

How big is the PVC plasticizers market?

The PVC plasticizers market size was valued at USD 17.6 billion in 2023.

What is the CAGR of the global PVC plasticizers market from 2024 to 2032?

The CAGR of PVC plasticizers is 5.5% during the analysis period of 2024 to 2032.

Which are the key players in the PVC plasticizers market?

The key players operating in the global market are including include BASF, Proviron Holding nv, Eastman Chemical India Pvt. Ltd., DuPont, Chromaflo Technologies Private Limited, DIC Corporation, Nan Ya Plastics Corporation, CCC Corporate, ExxonMobil, UPC Technology Corporation and Aekyung Petrochemical Co., Ltd.

Which region dominated the global PVC plasticizers market share?

North America held the dominating position in PVC plasticizers industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of PVC plasticizers during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global PVC plasticizers industry?

The current trends and dynamics in the PVC plasticizers industry include increasing demand for flexible PVC products in construction and automotive industries, growing use of plasticizers in cosmetics and healthcare applications, and rising urbanization and infrastructure development activities globally

Which application held the maximum share in 2023?

The wire and cables to held the maximum share of the PVC plasticizers industry.