PVA Embolization Particles Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

PVA Embolization Particles Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

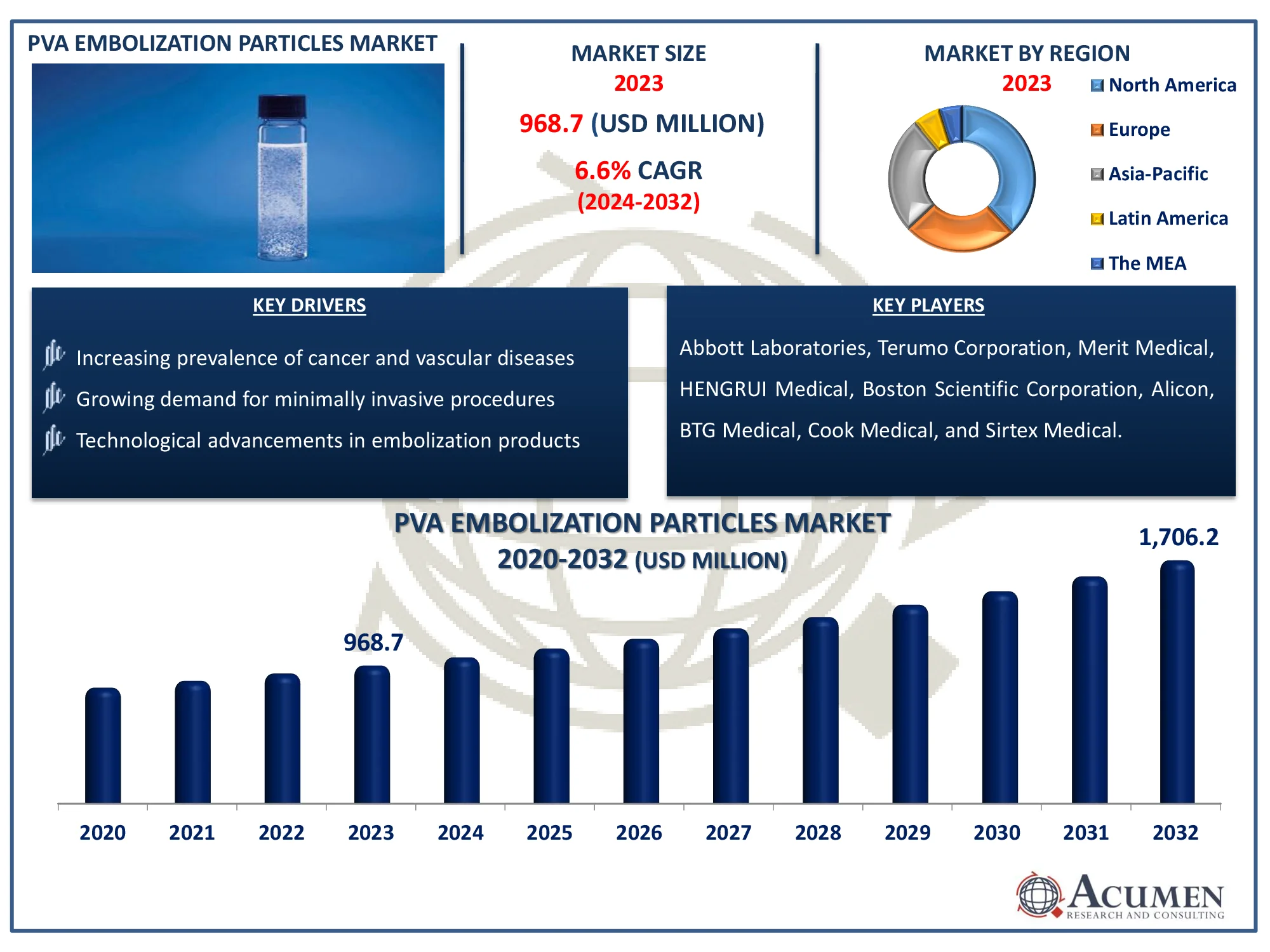

The Global PVA Embolization Particles Market Size accounted for USD 968.7 Million in 2023 and is estimated to achieve a market size of USD 1,706.2 Million by 2032 growing at a CAGR of 6.6% from 2024 to 2032.

PVA Embolization Particles Market Highlights

- Global PVA embolization particles market revenue is poised to garner USD 1,706.2 million by 2032 with a CAGR of 6.6% from 2024 to 2032

- National Institute of Health (NIH) states that number of new instances of liver cancer per year is expected to rise by 55.0% between 2020 and 2040, with an estimated 1.4 million persons diagnosed by 2040. In 2040, 1.3 million individuals are expected to die from liver cancer, up 56.4% from 2020.

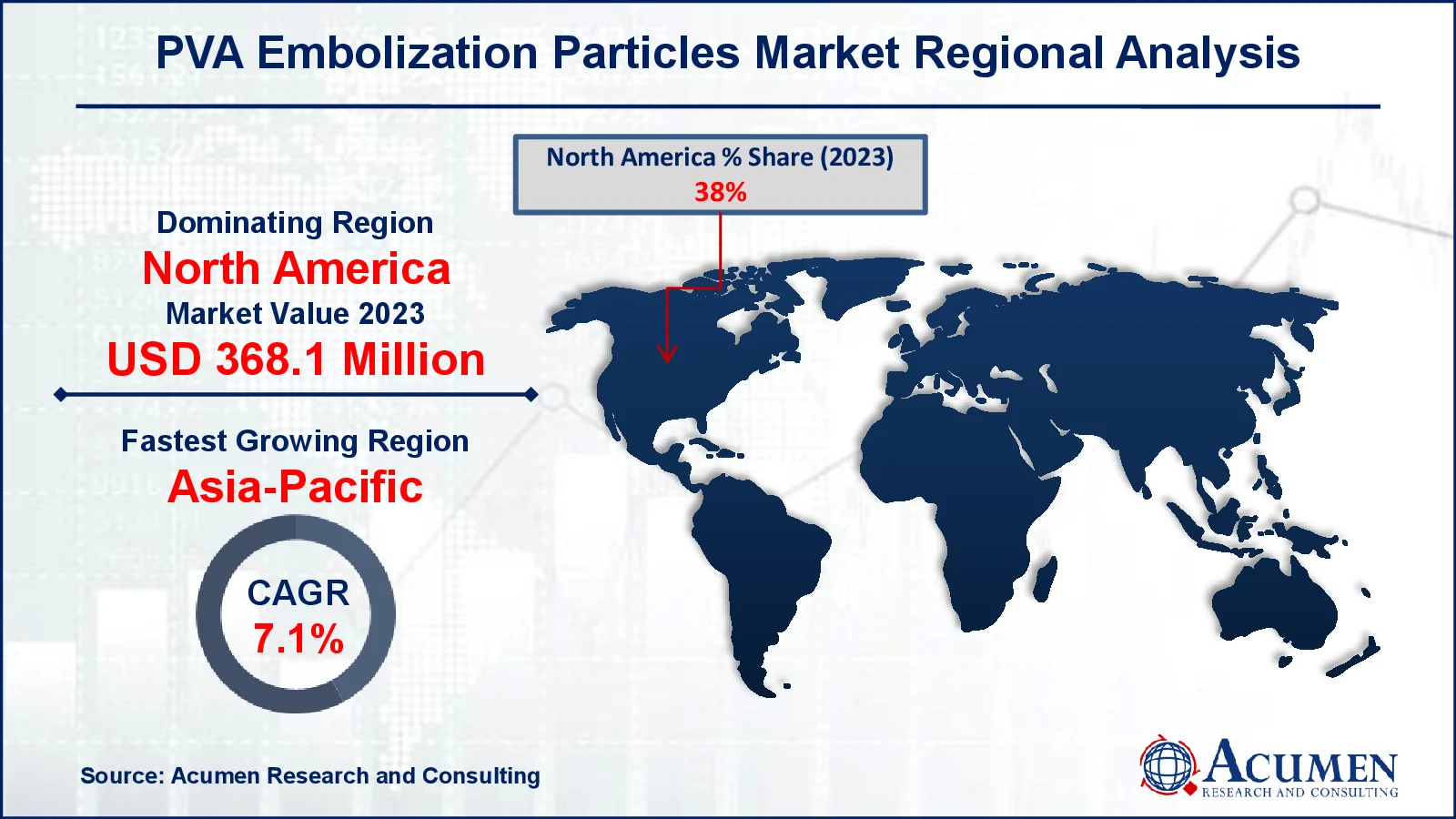

- North America PVA embolization particles market value occupied around USD 368.1 million in 2023

- Asia-Pacific PVA embolization particles market growth will record a CAGR of more than 7.1% from 2024 to 2032

- Among type, the conventional/irregular PVA sub-segment generated 61% of the market share in 2023

- Based on application, the trauma embolization sub-segment generated 28% market share in 2023

- Increasing demand for minimally invasive procedures is driving the adoption of PVA embolization particles in oncology and gynecology is the PVA

- embolization particles market trend that fuels the industry demand

PVA (polyvinyl alcohol) embolization particles are small, biocompatible spheres used to obstruct blood arteries during medical treatments. These particles are injected into the bloodstream to prevent blood flow to specific locations, which effectively treats problems such as tumors, uterine fibroids, and vascular abnormalities. By shutting off the blood supply, they aid in tumor shrinkage and the relief of symptoms associated with high blood flow. PVA particles are preferred because they are stable, non-toxic, and can conform to various vessel sizes. They are commonly employed in interventional radiology to provide focused, less invasive treatments.

Global PVA Embolization Particles Market Dynamics

Market Drivers

- Increasing prevalence of cancer and vascular diseases

- Growing demand for minimally invasive procedures

- Technological advancements in embolization products

Market Restraints

- High cost of embolization procedures and devices

- Risk of complications and side effects

- Limited availability of skilled interventional radiologists

Market Opportunities

- Expansion in emerging markets with rising healthcare investments

- Development of biodegradable and drug-eluting embolization particles

- Growing adoption in non-oncological applications, such as gynecology and urology

PVA Embolization Particles Market Report Coverage

|

Market |

PVA Embolization Particles Market |

|

PVA Embolization Particles Market Size 2023 |

USD 968.7 Million |

|

PVA Embolization Particles Market Forecast 2032 |

USD 1,706.2 Million |

|

PVA Embolization Particles Market CAGR During 2024 - 2032 |

6.6% |

|

PVA Embolization Particles Market Analysis Period |

2020 - 2032 |

|

PVA Embolization Particles Market Base Year |

2023 |

|

PVA Embolization Particles Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Particle Size, By Application, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Abbott Laboratories, Terumo Corporation, Merit Medical, HENGRUI Medical, Boston Scientific Corporation, Alicon, BTG Medical, Cook Medical, and Sirtex Medical. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

PVA Embolization Particles Market Insights

The increased frequency of cancer, particularly liver and kidney tumors is driving up demand for embolization operations. For example, the American Cancer Society estimates that 42,240 new cases of primary liver cancer and intrahepatic bile duct cancer will be detected in the United States in 2025, with 28,220 males and 14,020 women. Furthermore, around 30,090 people are expected to die from these cancers, including 19,250 men and 10,840 women. Since 1980, the incidence of liver cancer has more than tripled, while mortality rates have more than doubled. PVA embolization particles are extensively employed in chemoembolization to reduce blood flow to malignancies and improve therapy efficacy. As demand for focused embolization operations grows, so does the market for PVA embolization particles.

Furthermore, patients and healthcare providers are increasingly choosing minimally invasive therapies due to faster recovery periods, less problems, and shorter hospital stays. For example, in February 2023, Encision Inc. entered into a Proof of Concept Services Agreement with Vicarious Surgical Inc. The Vicarious surgical robot design aims to improve instrument precision, control, and visualization in robotically assisted minimally invasive surgery. This improvement in robotic-assisted minimally invasive surgery is likely to boost the market for PVA embolization particles by improving embolization precision and control.

The cost of PVA embolization particles and the necessary imaging equipment can be excessively expensive, especially in developing countries. This financial barrier limits patient access and inhibits acceptance among healthcare professionals. Additionally, reimbursement concerns in some countries limit market penetration.

The Indian healthcare sector is experiencing remarkable growth, with private equity and venture capital investments exceeding US$ 1 billion in the first five months of 2024, a 220% increase over the previous year. This increased financing is propelling breakthroughs in medical infrastructure and technology, particularly interventional radiology. As a result, the demand for minimally invasive procedures, such as those involving PVA embolization particles, is predicted to skyrocket. As a result, this increase in healthcare investment is expected to drive the PVA embolization particles market in India.

PVA Embolization Particles Market Segmentation

The worldwide market for PVA embolization particles is split based on type, particle size, application, end-user, and geography.

PVA Embolization Particles Market By Type

- Conventional/Irregular PVA

- Compressible and Spherical PVA

According to the PVA embolization particles industry analysis, conventional/irregular PVA particles continue to dominate the market. Conventional/irregular PVA particles are commonly utilized in situations where cost-effectiveness is a priority, although their application is becoming increasingly constrained as technology advances. However, they remain a more accessible choice in some therapeutic contexts. Compressible and spherical PVA particles dominate because to their superior controlled embolization capabilities, which provide better clinical outcomes in a variety of interventional treatments. These particles have a homogeneous distribution, allowing for precise occlusion, which is necessary in tumor embolization.

PVA Embolization Particles Market By Particle Size

- Large Size Particles

- Medium Size Particles

- Small Size Particles

According to the PVA embolization particles industry analysis, small PVA embolization particles are projected to expand due to their precision in targeting smaller blood arteries, which is critical in treating hypervascular malignancies and uterine fibroids. Their smaller diameter ensures deep penetration and effective occlusion, which improves therapeutic results. They are widely used in oncology and obstetrics because of their precision and low collateral harm. Medium-sized particles are employed in gastrointestinal bleeding and benign prostatic hyperplasia, whereas large particles are used in trauma care and high-flow vascular malformations.

PVA Embolization Particles Application

- Uterine Fibroid Embolization

- Prostatic Artery Embolization

- Liver Tumor Embolization

- Trauma Embolization

- Others

According to the PVA embolization particles industry analysis, trauma embolization is the most commonly used application due to its important function in controlling life-threatening hemorrhages. The quick and successful occlusion of bleeding arteries using PVA particles is critical in trauma care, hence it is the recommended method for emergency interventions. Its ability to offer fast hemostasis while reducing surgical risks contributes to its dominance in this segment. The remaining categories, such as uterine fibroid embolization, prostatic artery embolization, and liver tumor embolization, are steadily expanding due to increased procedural awareness and advances in interventional radiology. These uses are growing as minimally invasive treatments for chronic illnesses and cancer medicines become more prominent.

PVA Embolization Particles End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

According to the PVA embolization particles industry forecast, hospitals have superior infrastructure, specialized imaging technology, and competent interventional radiologists, making them suited for complex treatments such as TACE and UFE. Specialty clinics, which focus on specialties such as oncology and obstetrics, provide tailored embolization with reduced wait times, attracting patients seeking specialist care. Ambulatory surgical facilities offer affordable outpatient operations with faster recovery times. However, their market share is lower than that of hospitals due to restricted equipment and incapacity to handle complex cases.

PVA Embolization Particles Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

PVA Embolization Particles Market Regional Analysis

For several reasons, North America leads the PVA embolization particles market due to its advanced healthcare infrastructure, widespread use of minimally invasive procedures, and the presence of major medical device manufacturers. According to the Centers for Medicare and Medicaid Services, U.S. health-care spending would increase by 7.5% in 2023, hitting $4.9 trillion, or $14,570 per capita. Health spending made for 17.6 percent of the nation's GDP. The increase in US healthcare spending is likely to drive the PVA embolization particles market by increasing demand for improved minimally invasive procedures. Furthermore, advantageous reimbursement regulations and substantial research in interventional radiology contribute to its market dominance.

The PVA embolization particles market in Asia-Pacific is expanding rapidly due to increased healthcare investments, increased awareness of minimally invasive procedures, and a growing patient population suffering from cancer and vascular diseases. For example, the incidence of cancer in India is on the rise. According to the Global Cancer Observatory, cancer incidences in India will climb to 2.08 million by 2040, representing a 57.5 percent increase from 2020. Furthermore, the region is experiencing an increase in medical tourism, which is driving up demand for advanced embolization procedures.

PVA Embolization Particles Market Players

Some of the top PVA embolization particles companies offered in our report include Abbott Laboratories, Terumo Corporation, Merit Medical, HENGRUI Medical, Boston Scientific Corporation,, Alicon, BTG Medical, Cook Medical, and Sirtex Medical

Frequently Asked Questions

How big is the PVA Embolization Particles market?

The PVA embolization particles market size was valued at USD 968.7 Million in 2023.

What is the CAGR of the global PVA Embolization Particles market from 2024 to 2032?

The CAGR of PVA embolization particles is 6.6% during the analysis period of 2024 to 2032.

Which are the key players in the PVA Embolization Particles market?

The key players operating in the global market are including Abbott Laboratories, Terumo Corporation, Merit Medical, HENGRUI Medical, Boston Scientific Corporation, Alicon, BTG Medical, Cook Medical, and Sirtex Medical.

Which region dominated the global PVA Embolization Particles market share?

North America held the dominating position in PVA embolization particles industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of PVA embolization particles during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global PVA Embolization Particles industry?

The current trends and dynamics in the PVA embolization particles industry include increasing prevalence of cancer and vascular diseases, growing demand for minimally invasive procedures, and technological advancements in embolization products.

Which type held the maximum share in 2023?

The conventional/irregular PVA held the maximum share of the PVA embolization particles industry.