Pure Cashmere Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Pure Cashmere Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Pure Cashmere Market Size accounted for USD 1.9 Billion in 2023 and is estimated to achieve a market size of USD 3.4 Billion by 2032 growing at a CAGR of 6.5% from 2024 to 2032.

Pure Cashmere Market Highlights

- Global pure cashmere market revenue is poised to garner USD 3.4 billion by 2032 with a CAGR of 6.5% from 2024 to 2032

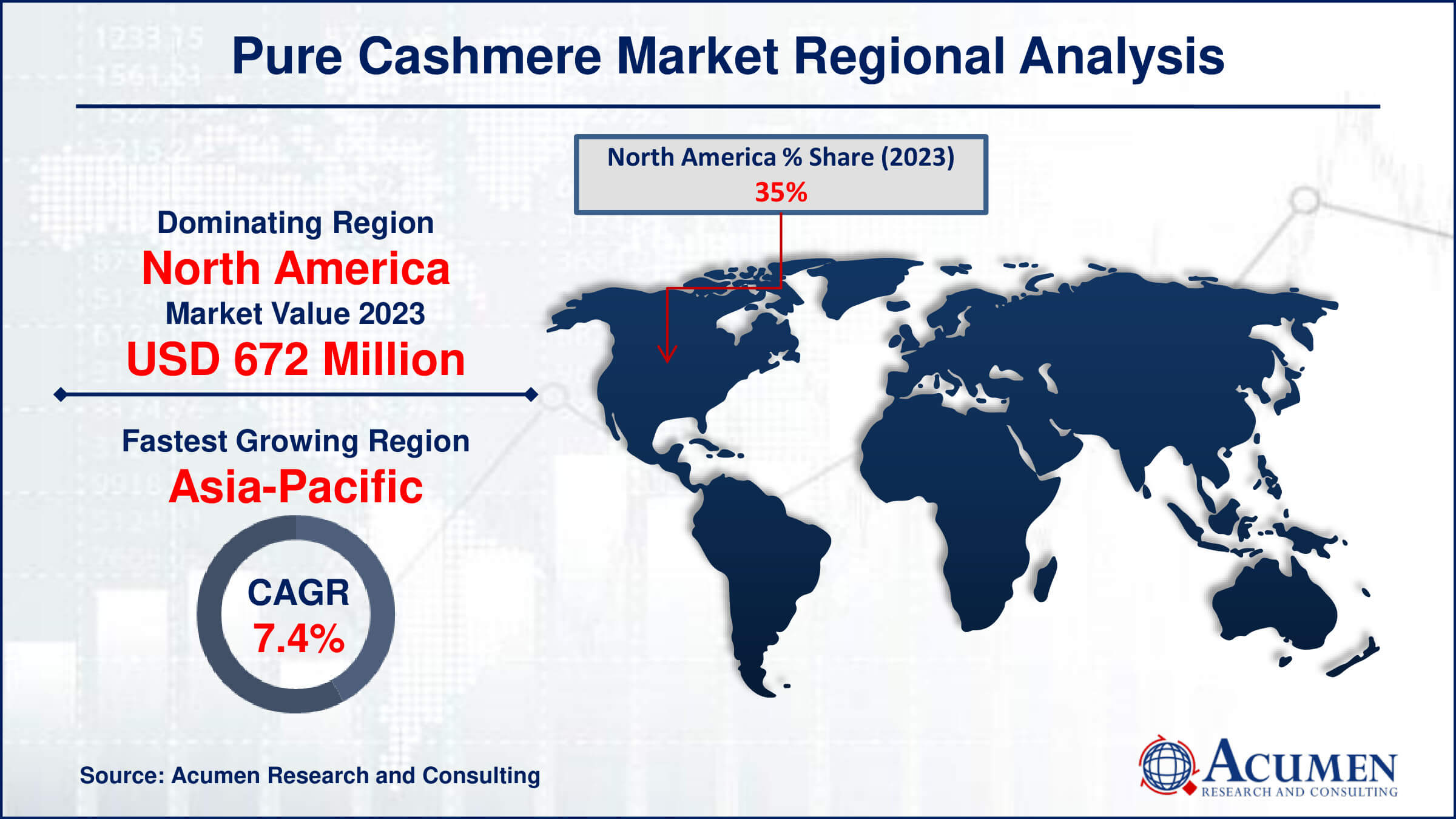

- North America pure cashmere market value occupied around USD 672 million in 2023

- Asia-Pacific pure cashmere market growth will record a CAGR of more than 7.4% from 2024 to 2032

- Among type, the white cashmere generator sub-segment generated notable revenue in 2023

- Based on distribution channel, the online retail sub-segment generated significant market share in 2023

- Collaborations with fashion designers and influencers to enhance brand visibility is a popular pure cashmere market trend that fuels the industry demand

Cashmere is known for its remarkable softness, which comes from fine threads that give it a luscious, almost velvety feel. Unlike typical wool, it is itch-free and provides outstanding warmth without the need for many layers. Cashmere is derived from goats accustomed to severe, cold conditions, specifically the capra hircus goat. These goats have a dual fleece for insulation: a soft, fleecy undercoat and a coarse outer layer known as guard hair. The quality of cashmere varies greatly depending on the environment surrounding the animals, with the most desired fibers coming from places where the yarn has long, silky, straight strands. This inherent diversity contributes to cashmere's reputation for superior comfort and insulation, making it a sought-after material in high-end fashion and cold-weather clothing worldwide.

Global Pure Cashmere Market Dynamics

Market Drivers

- Increasing consumer preference for luxury and sustainable textiles

- Growth in disposable income among middle-income households globally

- Rising demand for premium quality apparel and accessories

- Expansion of online retail channels, enhancing accessibility to global markets

Market Restraints

- High production costs associated with pure cashmere processing

- Vulnerability to fluctuations in raw material prices

- Limited availability of skilled labor for traditional handcrafting techniques

Market Opportunities

- Innovation in sustainable sourcing and production methods

- Penetration into emerging markets with growing affluent populations

- Customization and personalization trends in luxury fashion

Pure Cashmere Market Report Coverage

| Market | Pure Cashmere Market |

| Pure Cashmere Market Size 2022 | USD 1.9 Billion |

| Pure Cashmere Market Forecast 2032 | USD 3.4 Billion |

| Pure Cashmere Market CAGR During 2023 - 2032 | 6.5% |

| Pure Cashmere Market Analysis Period | 2020 - 2032 |

| Pure Cashmere Market Base Year |

2022 |

| Pure Cashmere Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | GOYO, Gobi, Sor Cashmere, Ningxia St.Edenweiss, Kingdeer, Cashmere Holding, Erdos, Tianshan Wool, Viction Cashmere, and Dongrong. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Pure Cashmere Market Insights

The global pure cashmere market is expanding rapidly, driven by a number of compelling causes. One of the key reasons is the distinct blend of lightweight and warmth that pure cashmere provides, making it ideal for both cold and moderate regions. This outstanding thermal regulation is attributable to the wool's high moisture content, which allows cashmere clothes to easily adjust to changing temperatures and provide comfort in a variety of settings. Another key element driving the market is the growing popularity of cashmere clothing, which is noted for its timeless style and durability. Consumers are increasingly appreciating the timeless elegance of cashmere clothes, which can be worn throughout seasons and trends. This endurance guarantees that cashmere goods retain their charm and functionality over time, providing long-term value to purchasers looking for wardrobe investment pieces.

Additionally, the sumptuous softness and comfort of pure cashmere are major factors driving demand. Cashmere's unmatched feel against the skin makes it a top choice for high-end clothing and accessories, boosting its popularity among discerning consumers who value comfort and quality. As lives become increasingly focused on well-being and comfort, cashmere's innate softness becomes an even more appealing selling factor. Moreover, the growing global middle class with increased disposable incomes is considerably driving market expansion. As more people have the money to spend on luxury items, the demand for high-quality cashmere grows. Furthermore, the proliferation of internet shopping channels has made cashmere more accessible to a wider audience, accelerating market growth.

Despite its numerous benefits, the pure cashmere market confronts substantial constraints that limit its expansion. One important difficulty is the expensive expense of genuine cashmere items. The labor-intensive manufacturing method and scarcity of raw materials contribute to high prices, making pure cashmere less accessible to a wider consumer base. Furthermore, the scarcity of pure cashmere due to the unique and seasonal nature of cashmere goat farming limits supply. This scarcity causes swings in raw material prices, which drives up costs even more. These elements, together, make pure cashmere items a luxury that only a small market can buy, limiting overall market penetration and growth potential. As a result, the high cost and scarcity of pure cashmere continue to be major commercial challenges.

Pure Cashmere Market Segmentation

The worldwide market for pure cashmere is split based on type, application, distribution channel, and geography.

Pure Cashmere Types

- White Cashmere

- Cyan Cashmere

- Purple Cashmere

- Others

According to pure cashmere industry analysis, the white cashmere sector is predicted to be the biggest. White cashmere is highly regarded because to its versatility and great quality. It is easily dyed into a variety of hues, making it a popular choice among producers and designers looking to create a diverse range of high-end cashmere products. White cashmere is highly sought after in premium fashion because to its incomparable softness, fineness, and warmth. Furthermore, its natural tint is frequently associated with purity and superior quality, increasing its appeal. White cashmere is the most sought-after segment because to its dyeability and high quality raw fiber, ensuring its supremacy in the pure cashmere industry.

Pure Cashmere Applications

- Cashmere Clothing

- Cashmere Accessory

- Cashmere Home Textiles

- Others

The cashmere clothing sector is projected to be the largest and it is expected to grow in the pure cashmere industry forecast period. This domination is due to the increasing demand for luxury, soft, and warm items such as sweaters, coats, and scarves, which are popular among consumers looking for high-quality and comfortable apparel. Cashmere clothing has exceptional insulation and a lightweight feel, making it suitable for both winter and transitional seasons. This segment is being propelled by the increased consumer choice for high-quality, long-lasting, and fashionable clothes. Furthermore, the growing middle class and rising disposable incomes in emerging nations are driving demand for luxury clothes, establishing the cashmere clothing segment as the largest and most profitable in the industry.

Pure Cashmere Distribution Channels

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retail

- Others

The online retail category is anticipated to be the most significant in the pure cashmere market. Consumer preference for this channel is driven by the convenience of online shopping, as well as a diverse product range and competitive pricing. E-commerce platforms enable customers to compare different brands and designs, read reviews, and access worldwide marketplaces from the comfort of their own homes. The digital shift has been driven by increased internet prevalence and smartphone usage, which has made online purchasing more convenient. Furthermore, several luxury cashmere firms have expanded their online presence, providing exclusive collections and personalized purchasing experiences. The efficiency of home delivery services, as well as the capacity to reach a larger client base, contributes to online retail's supremacy in the pure cashmere sector.

Pure Cashmere Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Pure Cashmere Market Regional Analysis

The global pure cashmere market exhibits various characteristics across geographies, with North America emerging as the largest during the pure cashmere market forecast period. This is due to changing lifestyles and increased demand for luxury cashmere products. Strong economic conditions and financial growth in North America boost consumer spending power, resulting in market expansion. Furthermore, the existence of various high-end fashion labels and a well-established retail infrastructure drives up demand for pure cashmere in this region.

In terms of pure cashmere market analysis, the Asia-Pacific (APAC) area is predicted to be the fastest-growing market for pure cashmere. The growing demand for luxury products, particularly in nations with large production capacities such as China, is a primary driver. The development of the middle class and rising disposable incomes in APAC lead to increased demand for pure cashmere. Rapid urbanization and economic development in the region fuel market growth, positioning APAC as a crucial sector for future advancement in the pure cashmere market.

Pure Cashmere Market Players

Some of the top pure cashmere companies offered in our report include GOYO, Gobi, Sor Cashmere, Ningxia St.Edenweiss, Kingdeer, Cashmere Holding, Erdos, Tianshan Wool, Viction Cashmere, and Dongrong.

Frequently Asked Questions

How big is the pure cashmere market?

The pure cashmere market size was valued at USD 1.9 billion in 2023.

What is the CAGR of the global pure cashmere market from 2024 to 2032?

The CAGR of pure cashmere is 6.5% during the analysis period of 2024 to 2032.

Which are the key players in the pure cashmere market?

The key players operating in the global market are including GOYO, Gobi, Sor Cashmere, Ningxia St.Edenweiss, Kingdeer, Cashmere Holding, Erdos, Tianshan Wool, Viction Cashmere, and Dongrong.

Which region dominated the global pure cashmere market share?

North America held the dominating position in pure cashmere industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of pure cashmere during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global pure cashmere industry?

The current trends and dynamics in the pure cashmere industry include increasing consumer preference for luxury and sustainable textiles, growth in disposable income among middle-income households globally, rising demand for premium quality apparel and accessories, and expansion of online retail channels, enhancing accessibility to global markets.

Which application held the maximum share in 2023?

The cashmere clothing application held the noteworthy share of the pure cashmere industry.