Project Portfolio Management Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Project Portfolio Management Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Project Portfolio Management Market Size accounted for USD 5,841 Million in 2021 and is estimated to achieve a market size of USD 16,770 Million by 2030 growing at a CAGR of 12.6% from 2022 to 2030. Factors including the growing desire to maximize the value of project expenditures increased complexity of organizational operations, and rapid demand for collaboration and monitoring systems are propelling the worldwide project portfolio management market growth. Furthermore, the growing usage of cloud-based solutions for remote project monitoring is an important aspect that is projected to considerably contribute to the project portfolio management market value over the next few years.

Project Portfolio Management Market Report Key Highlights

- Global project portfolio management market revenue intended to gain USD 16,770 million by 2030 with a CAGR of 12.6% from 2022 to 2030

- North America region led with more than 43% project portfolio management market share in 2021

- Asia-Pacific regional market is expected to grow at a CAGR of more than 13.5% during the forecast period

- Among end-use, IT and telecom sector engaged more than 35% of the total market share

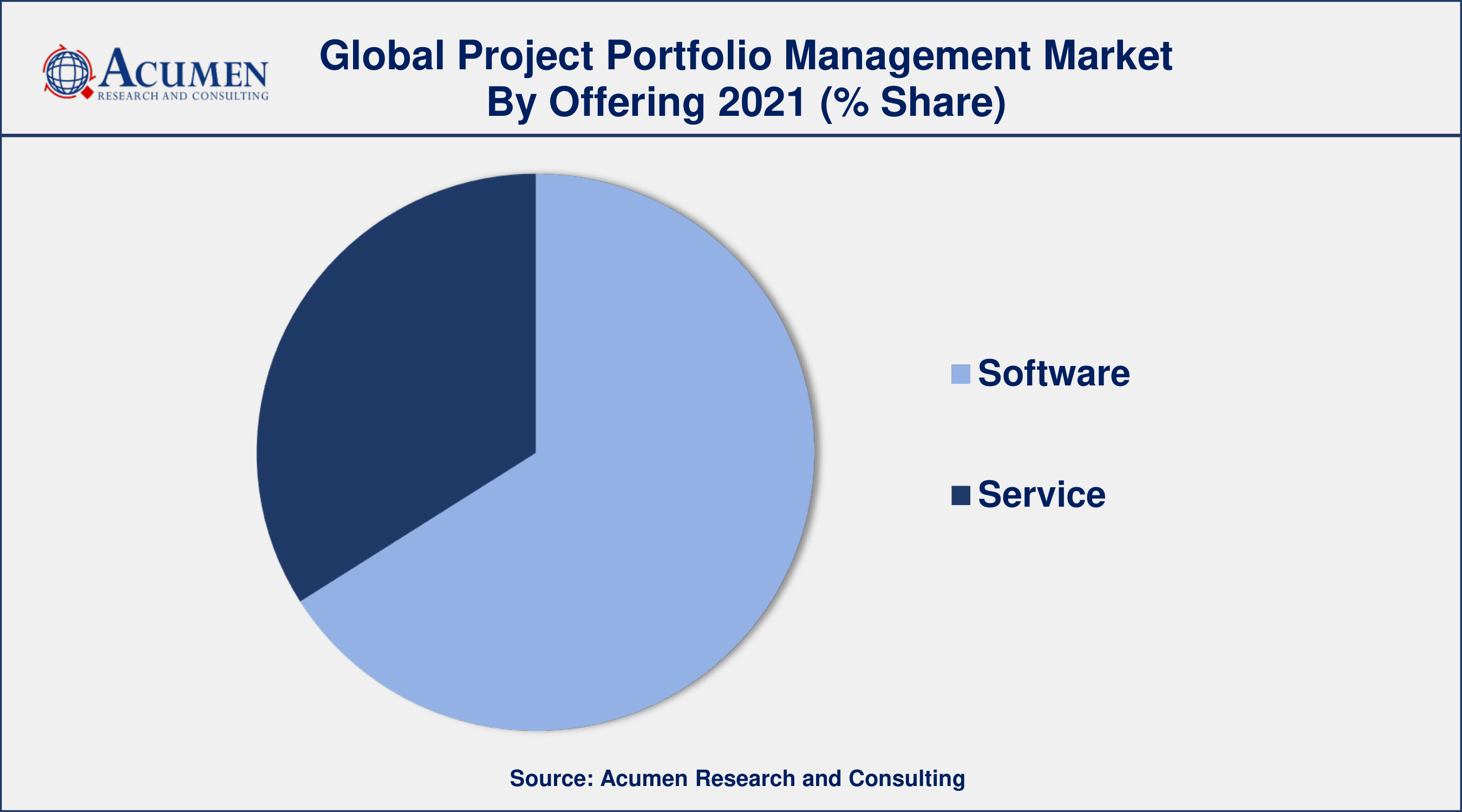

- By offering, software segment generated about 68% market share in 2021

- Rising demand for cloud-based PPM solutions, drives the project portfolio management market size

Project portfolio management (PPM) differs significantly from project and program management. Project and program management are concerned with project execution and delivery-doing projects correctly. In contrast, project portfolio management (PPM) focuses on completing the right projects at the right time by selecting and managing projects as a portfolio of investments. It necessitates entirely new techniques and perspectives.

Global Project Portfolio Management Market Analysis

Market Drivers

- Rising demand for cloud-based PPM solutions

- Rapid growth in BYOD trend among organizations

- Increase in the complexity of enterprise projects

- Growing demands for monitoring and collaboration tools

Market Restraints

- Concerns about data confidentiality

- Combining advanced PPM technologies with legacy systems

Market Opportunities

- Reducing project failure rates through the use of agile methodologies

- Getting a bird's-eye view of project management and resources planning

Project Portfolio Management Market Report Coverage

| Market | Project Portfolio Management Market |

| Project Portfolio Management Market Size 2021 | USD 5,841 Million |

| Project Portfolio Management Market Forecast 2030 | USD 16,770 Million |

| Project Portfolio Management Market CAGR During 2022 - 2030 | 12.6% |

| Project Portfolio Management Market Analysis Period | 2018 - 2030 |

| Project Portfolio Management Market Base Year | 2021 |

| Project Portfolio Management Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Offering, By Revenue, By Enterprise Size, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Oracle, Microsoft Corporation, Celoxis Technologies Pvt. Ltd., Planview, Changepoint Corporation, Broadcom Corporation, HP Development Company, SAP SE, Workfront, and ServiceNow. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Project Portfolio Management Market Dynamics

The global project portfolio management market is growing due to factors such as an increase in the need to maximize the value of project investments, an increase in the complexity of enterprise projects, and an increase in the demand for collaboration and monitoring tools. However, concerns about data privacy and security, as well as a steep learning curve for PPM software, are impeding the market growth. Furthermore, the adoption of cloud-based PPM integrated applications and the reduction of project failure rates by embracing agile methods are expected to provide lucrative opportunities for the growth of the PPM market.

Project Portfolio Management (PPM) Market Trends

Reducing Number Of Ultimate Project Failure Through Integration Of Agile Methods Fuel The Global Project Portfolio Management (PPM) Market Growth

One of the key factors enhancing the future scope of the PPM market is the easier adoption of agile methodologies for projects in project portfolio management solutions. Project portfolio management tools, such as Microsoft Project, have begun to add extra time for feedback loops for projects from the planning phase itself, making it easier for project managers to plan an agile project. Agile methods divide the project into small increments that can be tested after each phase, and any changes or improvements can be addressed in the next phase rather than restarting the entire project, saving the organization valuable time and money.

COVID-19 Impact On Project Portfolio Management (PPM) Market Value

To combat the rapidly spreading coronavirus, governments in many countries imposed stringent rules and regulations, including workforce policies that reduced the number of employees on-site in order to ensure that social distancing and self-isolation measures were implemented and the virus's spread was limited. These initiatives made it impossible for business organizations and project managers to track current projects or even assign new projects and resources using traditional project management methodologies. As a result, these organizations adopted project portfolio management solutions, which provided them with specialized tools for project planning and execution.

Project Portfolio Management Market Segmentation

The worldwide project portfolio management market segmentation is based on the offering, deployment, enterprise size, end-use, and geography.

Project Portfolio Management Market By Offering

- Software

- Service

According to the project portfolio management industry analysis, the software segment will hold the greatest market share in 2021. This expansion can be attributable to the greater engagement of these solutions by IT firms. This software is in high demand across all industries. Furthermore, the increased need for cloud-based solutions will continue to drive segment expansion in the coming years.

Aside from that, the service sector is expected to increase rapidly over the projection period. The increasing demand can be ascribed to the market participants' novel services such as process improvement, and process assessment, including reporting and analysis.

Project Portfolio Management Market By Deployment

- Cloud

- On-premise

Based on the deployment, the cloud segment is expected to have the highest revenue share in the global project portfolio management (PPM) market. To maximize profits, most vendors in the project portfolio management market offer cloud-based solutions. Cloud systems make better use of technology and allow for the sharing of infrastructure among multiple users and offices, providing greater scalability and lowering the ongoing cost of implementation and continuous development. These advantages are expected to drive cloud PPM solution adoption across verticals.

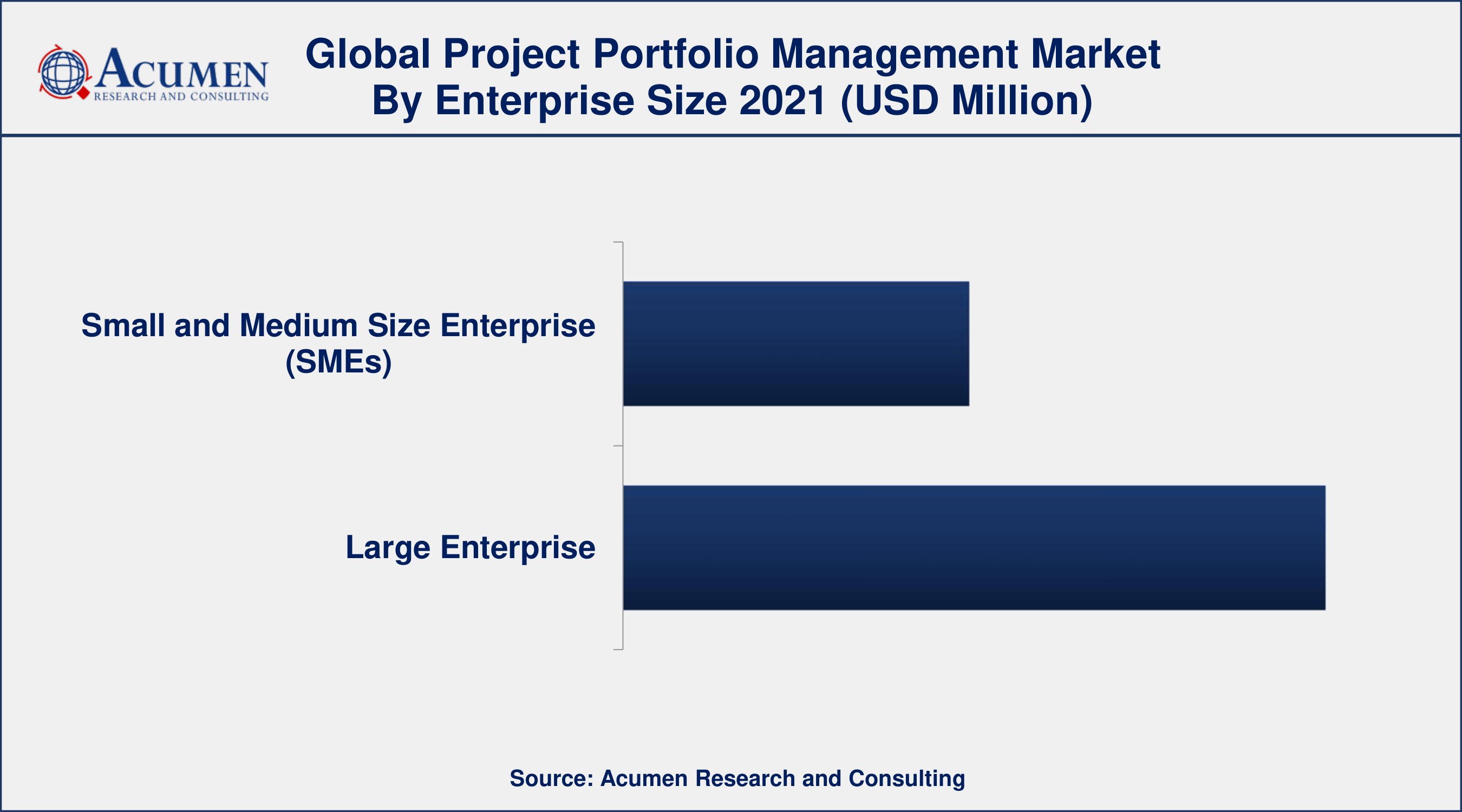

Project Portfolio Management Market By Enterprise Size

- Small and Medium Size Enterprise (SMEs)

- Large Enterprise

According to the project portfolio management market forecast, the small and medium enterprises (SMEs) sector would develop at the fastest rate over the projected period. The increase in overseas funding for SMEs is likely to propel the segment's expansion. Increasing SMEs in developing markets, as well as the rapid expansion of information technology-related services, are driving the segment growth. These solutions provide effective control and monitoring of corporate functions, assisting SMEs with business efficiency and judgment call.

Project Portfolio Management Market By End-Use

- IT and telecommunication

- Government

- BFSI

- Healthcare

- Engineering & Construction

- Others

In terms of end-user, the healthcare segment is expected to drive the global project portfolio management (PPM) market. The healthcare and life sciences industry is confronted with issues such as alarming demand due to pandemics such as COVID-19 and inconsistent data quality due to a variety of complex projects. Vendors provide this sector with a PPM solution to reduce equipment installation time, improve patient care and quality, reduce waiting time, reduce re-admission rates, and accelerate Electronic Medical Records (EMR) automation, thereby optimizing revenue cycles. By reducing communication gaps, the PPM solution increases visibility across the entire work department. For this reason, the vertical is showing a growing interest in implementing the PPM solution in order to meet market demands, provide uninterrupted patient care, and keep costs low.

Project Portfolio Management Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America Dominates; Asia-Pacific To Register Fastest Growing CAGR For The Project Portfolio Management (PPM) Market

The project portfolio management (PPM) market is expected to be dominated by North America. According to Project Management Institute, Inc. statistics, government entities waste US$97 Mn for every US$1 Bn invested in projects and programs. North America is the world's largest revenue contributor to the PPM market. The PPM market in the region is undergoing significant growth. The region's growing market share in the PPM market is supplemented by massive project spending (approximately USD 2 trillion) each year, accounting for one-fourth of all regions. Furthermore, the rise of technologies such as cloud computing and Bring Your Own Device (BYOD) has compelled end users to adopt far more sophisticated PPM solutions with evolving integration platforms.

The Administrative Office of the Courts' Information Services Division is looking to implement a project portfolio management (PPM) tool to appropriately track, report, monitor, measure, and govern their technology projects, program, and portfolios, according to a report released by the Judicial Council of California. The purpose of this Request for Information (RFI) is to gather information on qualified web-based applications, as well as suppliers of those applications, capable of providing a PPM tool to the Information Services Division (ISD).

On the other hand, Asia-Pacific is expected to have the fastest-growing CAGR in the project portfolio management (PPM) market in the coming years. Asia Pacific is expected to emerge as an opportunistic region for the project portfolio management (PPM) market, owing to its developing and rapidly expanding IT infrastructure. Technology acceptance and ongoing digitization are key factors that will most likely support PPM market growth in the Asia-Pacific region. Furthermore, the widespread adoption of cloud-based solutions is expected to drive SaaS PPM demand across the region. As a result, Asia-Pacific is expected to show significant growth for the market during the forecast period.

Project Portfolio Management Market Players

Some of the top project portfolio management companies offered in the professional report include Oracle, Microsoft Corporation, Celoxis Technologies Pvt. Ltd., Planview, Changepoint Corporation, Broadcom Corporation, HP Development Company, SAP SE, Workfront, and ServiceNow.

Frequently Asked Questions

What is the size of global project portfolio management market in 2021?

The estimated value of global project portfolio management market in 2021 was accounted to be USD 5,841 Million.

What is the CAGR of global project portfolio management market during forecast period of 2022 to 2030?

The projected CAGR Project portfolio management market during the analysis period of 2022 to 2030 is 12.6%.

Which are the key players operating in the market?

The prominent players of the global project portfolio management market are Oracle, Microsoft Corporation, Celoxis Technologies Pvt. Ltd., Planview, Changepoint Corporation, Broadcom Corporation, HP Development Company, SAP SE, Workfront, and ServiceNow.

Which region held the dominating position in the global project portfolio management market?

North America held the dominating project portfolio management during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for project portfolio management during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global project portfolio management market?

Strong demand for cloud-based PPM technologies, and rapidly increasing BYOD trend among organizations, drives the growth of global project portfolio management market.

By End-Use segment, which sub-segment held the maximum share?

Based on end-use, BFSI segment is expected to hold the maximum share project portfolio management market.