Production Chemicals Market Size (By Type: Demulsifiers, Corrosion Inhibitors, Scale Inhibitors, Asphaltene Inhibitors, Biocides, Scavengers, Surfactants, and Others; By Oilfield Type: Onshore, and Offshore) � Global Industry Analysis, Market Size, Opportunities and Forecast 2022� 2030

Published :

Report ID:

Pages :

Format :

Production Chemicals Market Size (By Type: Demulsifiers, Corrosion Inhibitors, Scale Inhibitors, Asphaltene Inhibitors, Biocides, Scavengers, Surfactants, and Others; By Oilfield Type: Onshore, and Offshore) � Global Industry Analysis, Market Size, Opportunities and Forecast 2022� 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

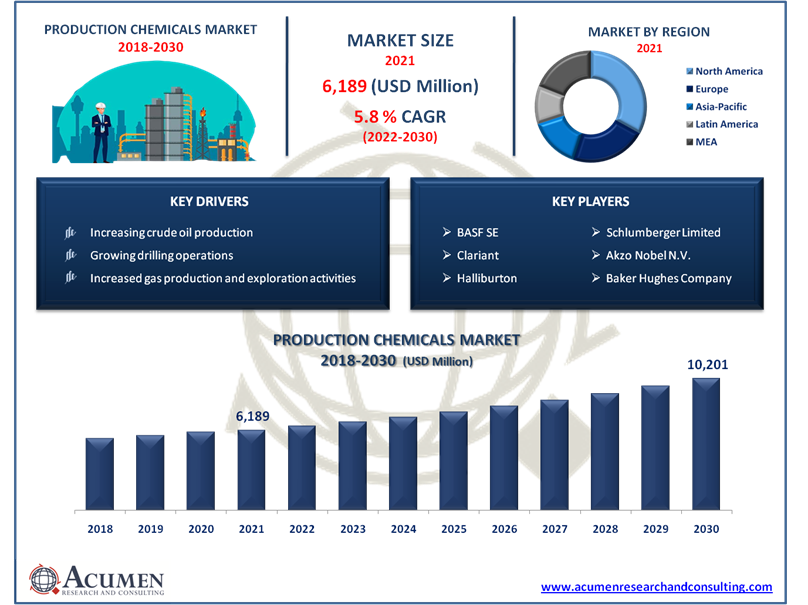

Request Sample Report

The global production chemicals market accounted for US$ 6,189 Mn in 2021 and is expected to reach US$ 10,201 Mn by 2030 with a considerable CAGR of 5.8% during the forecast timeframe of 2022 to 2030.

Modern manufacturing technology and environmental constraints have necessitated the usage of chemical solutions over the years. As oilfields age, so does the need for chemicals to maintain consistent output. Production Chemicals for the Oil and Gas Sector covers a wide range of chemicals used in the upstream oil and gas industry, both topside and downhole. Chemicals of various types are used to assist in the production of oil and gas, from well drilling to the separation plant, so that the crude oil is in an acceptable state for transportation to the refinery's tank farm via pipeline or tanker. With stringent regulations limiting the quality of water thrown into the sea, the usage of appropriate chemicals is becoming a growing concern for production chemists.

Production chemicals include corrosion inhibitors, demulsifiers, asphaltene inhibitors, surfactants, scale inhibitors, biocides, scavengers, and other chemicals. These chemicals are utilized in production to achieve optimal performance and boost oil recovery efficiency. Production chemicals are used to facilitate the extraction of hydrocarbons from wells.

Drivers

- Rising used for improving the recovery of hydrocarbons from the well

- Increasing crude oil production

- Growing drilling operations

- Increased production and exploration of oil and gas

- The use of environmentally friendly production chemicals is increasing

Restraints

- Raw material prices fluctuate

- Transition to sustainable power

Opportunity

- The transportation industry is increasing its demand for petroleum-based fuel

Report Coverage:

| Market | Production Chemicals Market |

| Market Size 2021 | US$ 6,189 Mn |

| Market Forecast 2028 | US$ 10,201 Mn |

| CAGR | 5.8% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Oilfield Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Universal Oil Field Chemical Pvt. Ltd., Clariant, Huntsman International LLC, Halliburton, Schlumberger Limited, Akzo Nobel N.V., Chemcon Speciality Chemicals Ltd., Baker Hughes Company, Croda International Plc, Dow Chemicals, and Solvay. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Production Chemicals Market Dynamics

Production chemicals are used in oilfield operations to improve production maintenance and transport, as well as reserve recovery. Increased oil output, oil recovery from technically complex hydrocarbon ecoregions, and the need for enhanced extraction are all boosting market interest. Furthermore, the continued advancement of shale oil and gas drilling and production, as well as the introduction of environmentally friendly production chemicals, will increase demand for production chemicals throughout the forecast period. Increased exploration & development activities, as well as the expansion of ultra-deep water drilling programs, are expected to drive increasing demand for production chemicals over the projection period.

The global market's fluctuating crude oil prices may act as a restraint on the overall expansion of the production chemicals industry. Also, rising environmental concerns and accompanying government laws aimed at preserving crude oil and other natural resources around the world may impede the continued expansion of the production chemicals market during the projection period.

Market Segmentation

Market By Type

- Demulsifiers

- Scale Inhibitors

- Corrosion Inhibitors

- Asphaltene Inhibitors

- Scavengers

- Biocides

- Surfactants

- Others

Based on the type, the demulsifiers segment accounted for the major share of the global market in 2021. Demulsifiers, also known as emulsion breakers, are specialty chemicals that are used to separate emulsions such as water in oil. Demulsifiers are commonly employed in the refining of oil products, which has a high concentration of saline water. Demulsifiers are chemical substances that include polyols, epoxy resins, polyamines, epoxides, phenol-formaldehyde, and polyamines. Expanding crude oil output around the world is expected to be a primary driver for the demulsifier industry in the coming years, as is rapid industrialization paired with an increasing variety of energy plants to meet the world's ever-increasing population's energy needs.

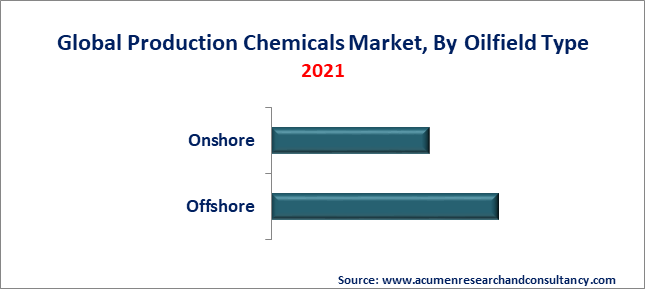

Market By Oilfield Type

- Onshore

- Offshore

Based on the type of oilfield, the offshore segment is expected to dominate the market in the approaching years. Offshore oil and gas extraction, which involves extracting petroleum from beneath the sea, is a critical component of the world's energy supply. It necessitates the use of increasingly advanced technologies, as well as a greater knowledge of the environmental effects. Offshore production currently accounts for around 20% of world oil reserves and 30% of worldwide gas reserves. Biocides are industrial chemicals that are often used in offshore operations. They are utilized to safeguard naturally occurring gum in aqueous mud’s.

Production Chemicals Market Regional Overview

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America has led the global production chemicals market in recent years, owing to the region's well-established and experienced industry business, as well as the number of active wells in diverse reservoirs. Because of their expanding use in the workover & finishing as well as production sectors, production chemicals are in high demand in the region. The United States is estimated to account for a significant portion of the North American production chemicals market, owing largely to the shale gas boom, technological advancements, and increased oil exports. Additionally, the presence of well-established chemical and oil production plants, substantial manufacturing businesses, and increased R&D investment is expected to boost the North American market, notably in the United States.

Competitive Landscape

Some of the prominent players in global production chemicals market are BASF SE, Universal Oil Field Chemical Pvt. Ltd., Clariant, Huntsman International LLC, Halliburton, Schlumberger Limited, Akzo Nobel N.V., Chemcon Speciality Chemicals Ltd., Baker Hughes Company, Croda International Plc, Dow Chemicals, and Solvay.

Frequently Asked Questions

How much was the estimated value of the global production chemicals market in 2021?

The estimated value of global production chemicals market in 2021 was accounted to be US$6,189 Mn.

What will be the projected CAGR for global production chemicals market during forecast period of 2022 to 2030?

The projected CAGR of production chemicals during the analysis period of 2022 to 2030 is 5.8%.

Which are the prominent competitors operating in the market?

The prominent players of the global production chemicals market involve BASF SE, Universal Oil Field Chemical Pvt. Ltd., Clariant, Huntsman International LLC, Halliburton, Schlumberger Limited, Akzo Nobel N.V., Chemcon Speciality Chemicals Ltd., Baker Hughes Company, Croda International Plc, Dow Chemicals, and Solvay.

Which region held the dominating position in the global production chemicals market?

North America held the dominating share for production chemicals during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for production chemicals market during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global production chemicals market?

Increasing crude oil production, growing drilling operations, and rising use for improving the recovery of hydrocarbons from the well are the prominent factors that fuel the growth of global production chemicals market.

By segment type, which sub-segment held the maximum share?

Based on type, demulsifiers segment held the maximum share for production chemicals market in 2021.