Predictive Genetic Testing and Consumer Wellness Genomics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Predictive Genetic Testing and Consumer Wellness Genomics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

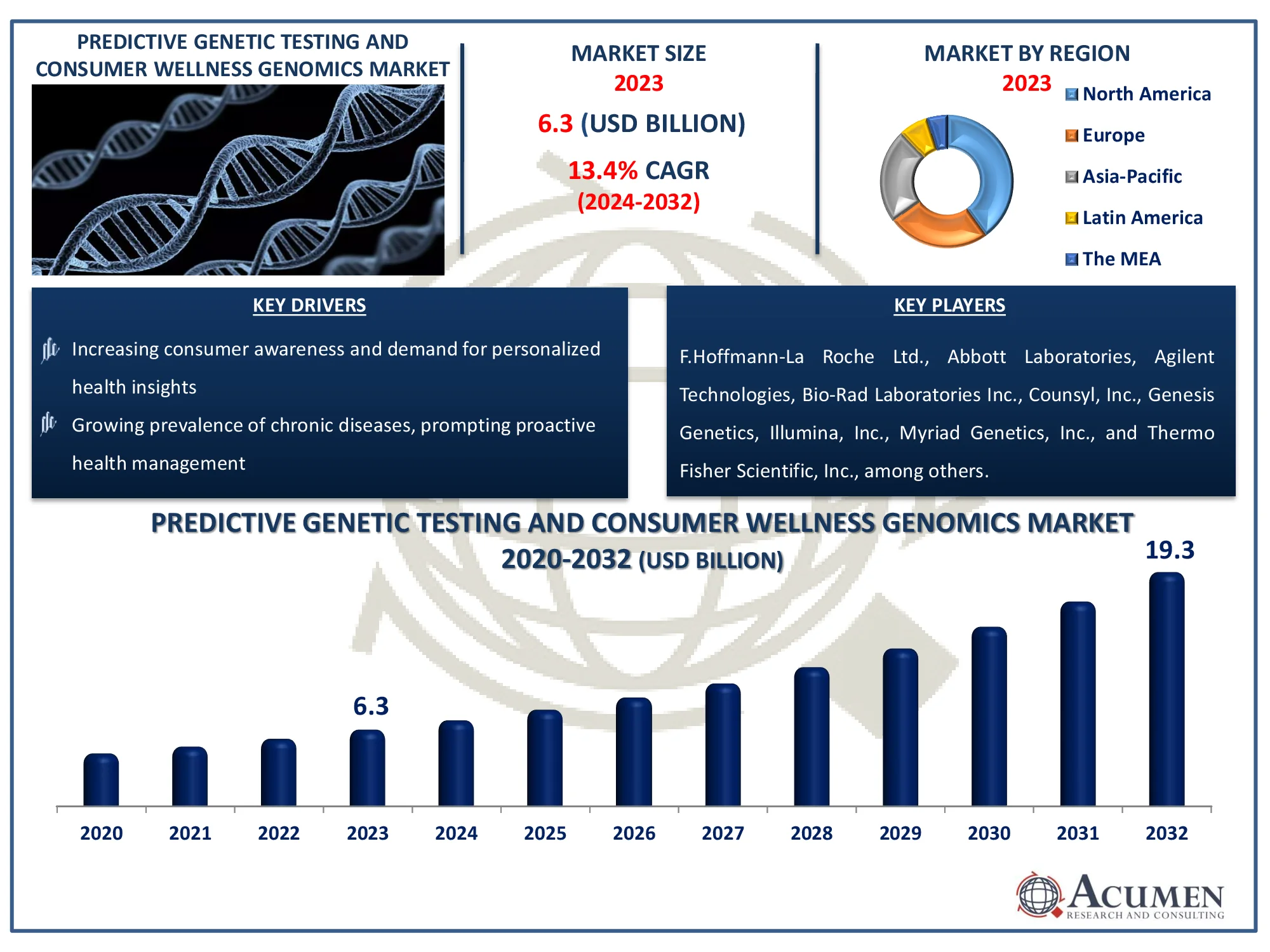

The Global Predictive Genetic Testing and Consumer Wellness Genomics Market Size accounted for USD 6.3 Billion in 2023 and is estimated to achieve a market size of USD 19.3 Billion by 2032 growing at a CAGR of 13.4% from 2024 to 2032.

Predictive Genetic Testing and Consumer Wellness Genomics Market Highlights

- Global predictive genetic testing and consumer wellness genomics market revenue is poised to garner USD 19.3 billion by 2032 with a CAGR of 13.4% from 2024 to 2032

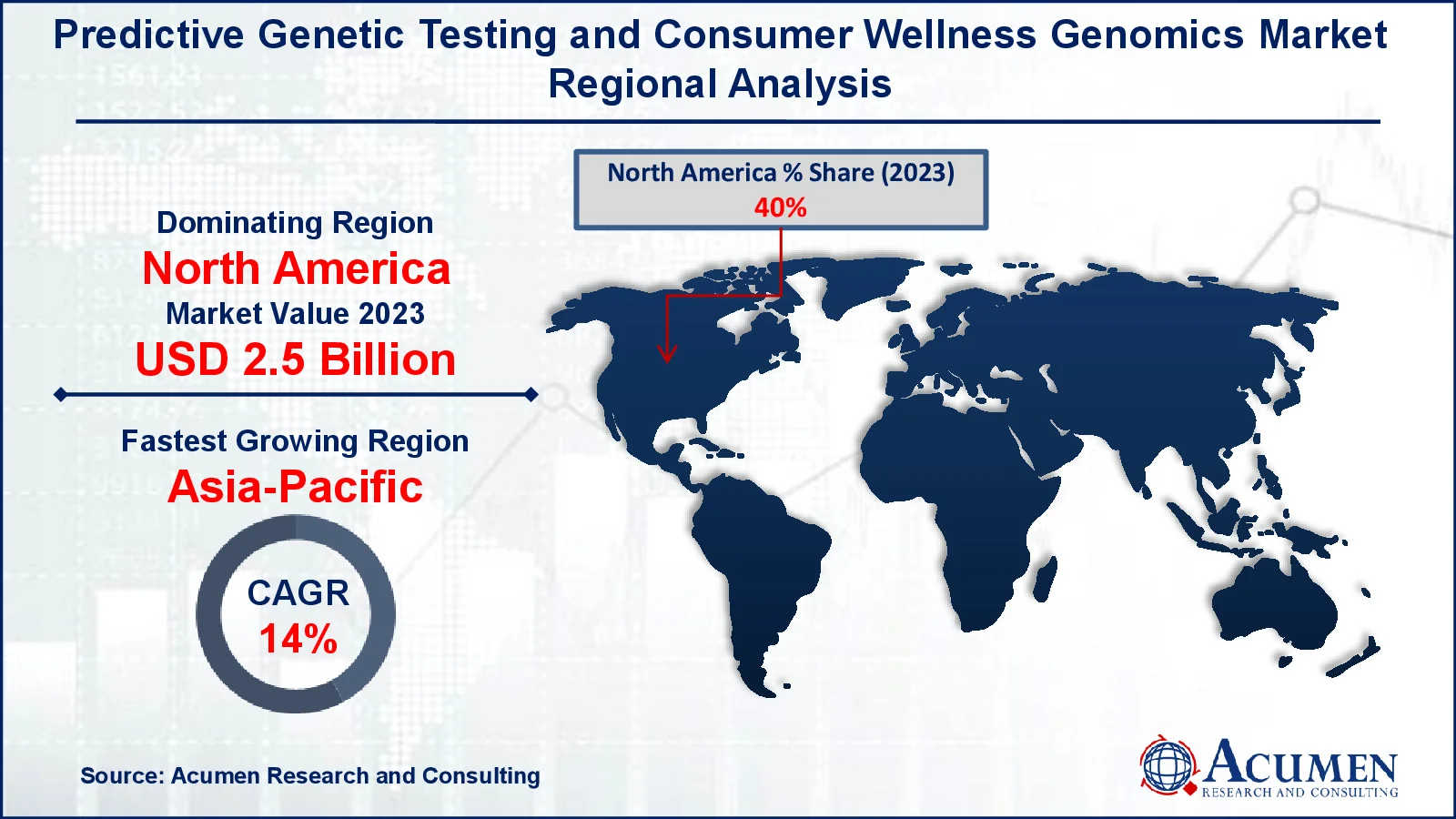

- North America predictive genetic testing and consumer wellness genomics market value occupied around USD 2.5 billion in 2023

- Asia-Pacific predictive genetic testing and consumer wellness genomics market growth will record a CAGR of more than 14% from 2024 to 2032

- Among test type, the predictive testing sub-segment generated more than USD 3.8 million revenue in 2023

- Based on setting type, the DTC sub-segment generated noteworthy predictive genetic testing and consumer wellness genomics market share in 2023

- Development of personalized nutrition and fitness plans based on genetic profiles is a popular predictive genetic testing and consumer wellness genomics market trend that fuels the industry demand

Genetic testing has become increasingly popular as a means of predicting potential health risks by providing data on an individual's chromosomes and genetic mutations, even before symptoms manifest. While genetic testing in public health methods, particularly in developed countries, is relatively new, it is rapidly gaining traction. It is increasingly utilized to inform dietary policies and treatment outcomes across a range of conditions. Common diseases such as Huntington's disease, cystic fibrosis, phenylketonuria, Down syndrome, breast cancer, and sickle-cell anemia are among those screened for. Generally, genetic testing involves identifying genetic characteristics that could predispose individuals to diseases later in life, even if they are currently healthy. Genetic susceptibility, predictive diagnosis, and demographic screening are among the most prevalent forms of predictive genetic testing. They can be particularly helpful for individuals with a family history of certain genetic disorders.

The application of whole-genome sequencing to categorize individuals into different risk groups for various diseases typically falls under consumer genomics. Wellness genomics are used to assist individuals in making informed health choices that promote their well-being and maintain optimal health. Typical data includes various genotypes and clinical information. Consumer genomics and wellness are integral components of health and wellness decisions in various populations, often in conjunction with preventive medicine.

Global Predictive Genetic Testing and Consumer Wellness Genomics Market Dynamics

Market Drivers

- Growing prevalence of chronic diseases, prompting proactive health management

- Rising adoption of direct-to-consumer genetic testing kits

- Supportive regulatory environment fostering market growth

- Increasing consumer awareness and demand for personalized health insights

Market Restraints

- Limited access to genetic counseling and interpretation services

- Ethical considerations surrounding genetic testing, especially in minors

- Challenges in accurately interpreting complex genetic data

Market Opportunities

- Collaboration with pharmaceutical companies for targeted drug development

- Utilization of genetic testing in employer-sponsored wellness programs for preventive healthcare

- Integration of genetic testing with telemedicine platforms for remote healthcare

Predictive Genetic Testing and Consumer Wellness Genomics Market Report Coverage

|

Market |

Predictive Genetic Testing and Consumer Wellness Genomics Market |

|

Predictive Genetic Testing and Consumer Wellness Genomics Market Size 2023 |

USD 6.3 Billion |

|

Predictive Genetic Testing and Consumer Wellness Genomics Market Forecast 2032 |

USD 19.3 Billion |

|

Predictive Genetic Testing and Consumer Wellness Genomics Market CAGR During 2024 - 2032 |

13.4% |

|

Predictive Genetic Testing and Consumer Wellness Genomics Market Analysis Period |

2020 - 2032 |

|

Predictive Genetic Testing and Consumer Wellness Genomics Market Base Year |

2023 |

|

Predictive Genetic Testing and Consumer Wellness Genomics Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Test Type, By Application, By Setting Type, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

F.Hoffmann-La Roche Ltd., Abbott Laboratories, Agilent Technologies, BGI, Bio-Rad Laboratories Inc., Counsyl, Inc., Genesis Genetics, Illumina, Inc., Myriad Genetics, Inc., Thermo Fisher Scientific, Inc., and ARUP Laboratories. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Predictive Genetic Testing and Consumer Wellness Genomics Market Insights

One of the main drivers of growth in the genetic prediction testing market is the expansion of predictive testing horizons, driven by increased collaboration between leading suppliers in the genomics sector. These new partnerships enable businesses to offer end-to-end solutions that are viable for consumers, thereby increasing acceptance rates among clients. Additionally, partnerships between government authorities and research organizations enhance prospects for entry into the predictive genetic testing field. Market advancements are further bolstered by efforts to improve the efficacy of genetic testing by federal legislative bodies. These efforts aim to standardize operations for producers and healthcare professionals, thereby increasing sales volume.

The next-generation sequencing (NGS) platform is primarily utilized for predictive genetic testing and direct-to-consumer testing. The growing automation of sequencing methodologies is expected to enhance predictive genetic tests based on the NGS principle, facilitating the implementation of efficient and rapid genomic sequencing processes. The adoption of niche and fragmented point-of-care solutions across the genomic value chain is driving the market, particularly with NGS protocols for delivery. Additionally, the increased outsourcing penetration has resulted in a variety of firms offering sample-to-insight services or 'sequence-as-a-service' solutions.

Predictive Genetic Testing and Consumer Wellness Genomics Market Segmentation

Predictive Genetic Testing and Consumer Wellness Genomics Market Segmentation

The worldwide market for predictive genetic testing and consumer wellness genomics is split based on test type, application setting type, and geography.

Predictive Genetic Testing and Consumer Wellness Genomics Test Types

- Predictive Testing

- Genetic Susceptibility Test

- Predictive Diagnostics

- Population Screening

- Consumer Genomics

- Wellness Genomics

- Nutria Genetics

- Skin & Metabolism Genetics

- Other

According to predictive genetic testing and consumer wellness genomics industry analysis, predictive tests are highly valued for anticipating the risk of illnesses such as neurodegenerative diseases and cancer in clinical procedures and translational research. they accounted for the largest share. The paradigm of "predict and prevent" is likely to increase public awareness of early screening programs. Continued R&D activity in genetic susceptibility testing has encouraged the introduction of cancer-sensitivity testing and appropriate prediction by identifying an ideal therapy program. The availability of multigene panels for identifying various gene variants or mutations has also accelerated the implementation of susceptibility tests to increase revenue generation. The profit growth of consumer genomics over the predictive genetic testing and consumer wellness genomics industry forecast period is expected due to the rapid marketing of direct genetic tests to consumers. Direct-to-consumer (DTC) tests allow users to gain insights into their ancestry, family history, and risk of illness.

Predictive Genetic Testing and Consumer Wellness Genomics Applications

- Breast & Ovarian Cancer

- Cardiovascular Screening

- Diabetic Screening & Monitoring

- Colon Cancer

- Parkinsonism / Alzheimer’s Disease

- Urologic screening/ Prostate Cancer Screening

- Orthopedic & Musculoskeletal

- Other cancer screening

- Other

In 2023, the revenue generated from predictive breast and ovarian cancer tests was shown to be the highest in the field of predictive genetic testing and the consumer genomics market. This segment is driven by the high incidence of breast and ovarian cancer worldwide, along with significant penetration of susceptibility gene tests. BRCA1 and BRCA2 mutations, identified as hereditary in approximately 5–10 percent of breast and ovarian cancer cases in the US, contribute to this trend. Similar growth trends are anticipated in the disease indicator segment, as products covering trials for various disease classifications become available. Predictive genetic tests and predispositional tests enable orthopedic surgeons and doctors to assess the risk of disease progression before its onset, thus significantly driving this segment

Predictive Genetic Testing and Consumer Wellness Genomics Setting Types

- Professional

- DTC

In terms of predictive genetic testing and consumer wellness genomics market analysis, DTC (direct-to-consumer) testing retained the largest share of income due to its wider immediate accessibility to customers at cost-effective prices and increasing awareness of DTC testing methods among patients. This led to an increase in the sales volume of DTC test kits. As new entrants adopt strategies such as launching gene-based services and providing post-genetic DTC counseling as an additional service, established players are competing with emerging rivals in this market. However, this has resulted in a decrease in the penetration of professional exams, as customers are more inclined towards DTC testing providers than doctors. The prescription rate for these products is expected to increase significantly with doctors becoming more oriented towards this market, thereby enhancing usage in professional settings.

Predictive Genetic Testing and Consumer Wellness Genomics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Predictive Genetic Testing and Consumer Wellness Genomics Market Regional Analysis

North America led the sector in terms of income because to the large number of participants in the United States. These companies hold several patents related to genomics and predictive testing. Many participants in this market are undertaking various development initiatives to maintain their market share and generate greater income in the region. For example, in July 2018, 23andMe Inc. collaborated with GlaxoSmithKline plc to identify novel targets for understanding progressive disease pathways and developing therapies for disease eradication.

Asia Pacific is expected to record the highest compound annual growth rate (CAGR), as both disposable income and healthcare expenditures are increasing among patients in countries in this region. In addition to demand growth, supplier potential in this region is anticipated to make significant strides over the predictive genetic testing and consumer wellness genomics market forecast period. In developing economies, prominent members utilize distribution partners to offer their services.

Predictive Genetic Testing and Consumer Wellness Genomics Market Players

Some of the top predictive genetic testing and consumer wellness genomics companies offered in our report includes F.Hoffmann-La Roche Ltd., Abbott Laboratories, Agilent Technologies, BGI, Bio-Rad Laboratories Inc., Counsyl, Inc., Genesis Genetics, Illumina, Inc., Myriad Genetics, Inc., Thermo Fisher Scientific, Inc., and ARUP Laboratories.

Frequently Asked Questions

How big is the predictive genetic testing and consumer wellness genomics market?

The predictive genetic testing and consumer wellness genomics market size was valued at USD 6.3 billion in 2023.

What is the CAGR of the global predictive genetic testing and consumer wellness genomics market from 2024 to 2032?

The CAGR of predictive genetic testing and consumer wellness genomics is 13.4% during the analysis period of 2024 to 2032.

Which are the key players in the predictive genetic testing and consumer wellness genomics market?

The key players operating in the global market are including F.Hoffmann-La Roche Ltd., Abbott Laboratories, Agilent Technologies, BGI, Bio-Rad Laboratories Inc., Counsyl, Inc., Genesis Genetics, Illumina, Inc., Myriad Genetics, Inc., Thermo Fisher Scientific, Inc., and ARUP Laboratories.

Which region dominated the global predictive genetic testing and consumer wellness genomics market share?

North America held the dominating position in predictive genetic testing and consumer wellness genomics industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of predictive genetic testing and consumer wellness genomics during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global predictive genetic testing and consumer wellness genomics industry?

The current trends and dynamics in the predictive genetic testing and consumer wellness genomics industry include growing prevalence of chronic diseases, prompting proactive health management, rising adoption of direct-to-consumer genetic testing kits, supportive regulatory environment fostering market growth, and increasing consumer awareness and demand for personalized health insights.

Which setting type held the maximum share in 2023?

The DTC setting type held the maximum share of the predictive genetic testing and consumer wellness genomics industry.