Preclinical CRO Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Preclinical CRO Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Preclinical CRO Market Size accounted for USD 5.2 Billion in 2022 and is estimated to achieve a market size of USD 10.7 Billion by 2032 growing at a CAGR of 7.6% from 2023 to 2032.

Preclinical CRO Market Highlights

- The global preclinical CRO market is set to achieve revenue of USD 10.7 billion by 2032

- The preclinical CRO market is experiencing a CAGR of 7.6% from 2023 to 2032

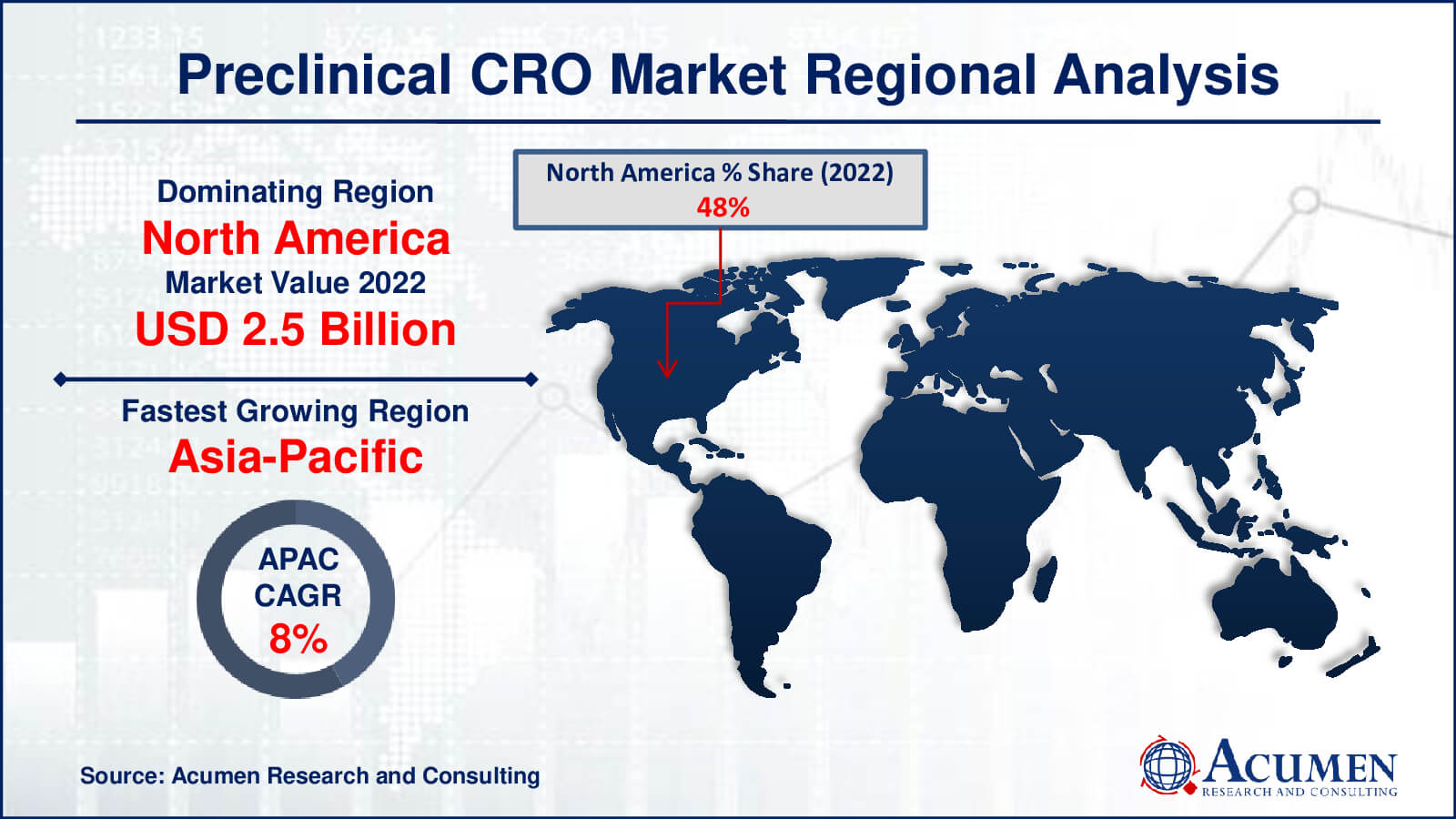

- In 2022, North America dominated the preclinical CRO market with USD 2.5 billion revenue

- The Asia-Pacific market is likely to witness CAGR of over 8% from 2023 to 2032

- Among service, the toxicology testing sub-segment generated revenue exceeding USD 1.4 billion in 2022

- In terms of model type, the patient derived organoid (PDO) model sub-segment accounted for approximately 80% of the market share in 2022

- Growth in orphan drug development is a notable preclinical CRO market trend

A substantial increase in activities related to drug discovery and the growing government expenditure on the healthcare sector are major factors expected to drive the growth of the global market. Developed and developing countries, such as the United States, China, Japan, India, and others, are investing significantly in the development of their healthcare sectors, with a heightened focus on the development of novel drugs, primarily due to the increasing number of patients suffering from chronic diseases. PhRMA member companies have invested nearly US$ 1 trillion in R&D since 2000, establishing the biopharmaceutical sector as the most R&D-intensive industry in the U.S. economy. The U.S. biopharmaceutical industry has been the world leader in the development of new medicines, and PhRMA member companies continue to be at the forefront.

The entire biopharmaceutical industry invested an estimated US$ 102 billion in research and development (R&D) in 2018. Approximately 7,000 rare diseases exist today, yet only 5% have an available treatment. Nearly 260 vaccines are in the biopharmaceutical pipeline to treat and prevent diseases, including dozens for COVID-19. The increasing collaborative approach among the public and government for the development of novel products is expected to have a significant impact on the growth of the preclinical CRO market.

Global Preclinical CRO Market Dynamics

Market Drivers

- Increasing outsourcing of drug development activities

- Growing emphasis on cost efficiency and time savings

- Rising R&D investments in pharmaceutical and biotechnology sectors

- Expansion of biologics and biosimilars

Market Restraints

- Regulatory challenges and compliance issues

- Quality control and data reliability concerns

- Intellectual property and confidentiality risks

Market Opportunities

- Advancements in technology, such as AI and automation

- Expansion of personalized medicine and precision therapeutics

- Emerging markets in Asia and Latin America

- Collaborative partnerships and strategic alliances in the industry

Preclinical CRO Market Report Coverage

| Market | Preclinical CRO Market |

| Preclinical CRO Market Size 2022 | USD 5.2 Billion |

| Preclinical CRO Market Forecast 2032 | USD 10.7 Billion |

| Preclinical CRO Market CAGR During 2023 - 2032 | 7.6% |

| Preclinical CRO Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Service, By Model Type, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Crown Bioscience, Charles River Laboratories International, Inc., Eurofins Scientific SE, Intertek Group plc (IGP), LabCorp, Medpace Holdings, Inc., PPD (Thermo Fisher Scientific, Inc.), PRA Health Sciences, Inc. (ICON plc), SGA SA, and WuXi AppTec, Inc. (WAI). |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Preclinical CRO Market Insights

The preclinical contract research organization (CRO) market is distinguished by a dynamic environment influenced by a number of critical variables. To begin, the pharmaceutical and biotechnology sectors are progressively outsourcing preclinical research and drug development operations to contract research organizations (CROs). The desire for cost-efficiency and time savings is driving this outsourcing trend. Companies are turning to CROs to utilize their specialized knowledge and infrastructure, expediting the drug development schedule, as drug research and development procedures become more complicated and costly. Furthermore, the rise of biologics and biosimilars has increased the demand for preclinical CRO services, as these novel drugs need specialized preclinical testing and knowledge.

Second, regulatory problems and quality control issues are stifling the preclinical CRO industry. To maintain data dependability and compliance with worldwide regulatory authorities, CROs must negotiate a complicated regulatory landscape while following tight rules. Concerns about intellectual property and secrecy might also stymie the industry's expansion, as sensitive information handled during preclinical research must be protected. Furthermore, the availability of trained staff, as well as economic uncertainty affecting funding, presents further hurdles. However, the industry is replete with potential, such as technological breakthroughs such as artificial intelligence and automation, which may improve efficiency and data accuracy. Collaborations and strategic alliances among CROs, pharmaceutical firms, and research institutes are also propelling innovation in the industry, while expanding markets in Asia and Latin America provide new development opportunities. Overall, the preclinical CRO market is expected to continue evolving, owing to a complex interplay of drivers, barriers, and opportunities in the pharmaceutical and biotechnology industries.

Drug Safety, Metabolism, Bioanalytical, Residue and Environmental Fate studies

Factors such as stringent government regulations related to preclinical research and the high costs associated with R&D are expected to hinder the growth of the global preclinical CRO market. Furthermore, the lack of developed infrastructure in developing countries, which limits R&D activities, is anticipated to pose a challenge to the market's growth. However, the substantial government investments in R&D activities and the focus of major players on increasing preclinical trials present new opportunities for companies operating in the global preclinical CRO market. Additionally, the trend toward strategic partnerships between regional and public players is expected to provide revenue support for the market's growth.

Preclinical CRO Market Segmentation

The worldwide market for preclinical CRO is segmented into service, model type, end-use, and geography.

Preclinical CRO Services

- Bioanalysis and DMPK studies

- In-vivo PK

- In vitro ADME

- Toxicology Testing

- GLP

- Non-GLP

- Compound Management

- Custom Synthesis

- Process R&D

- Others

- Chemistry

- Computation Chemistry

- Medicinal Chemistry

- Safety Pharmacology

- Others

According to the preclinical CROs industry analysis, toxiology testing is the largest service segment due to its critical role in ensuring the safety and efficacy of new pharmaceutical compounds. To analyze the possible risks and side effects of prospective medications, extensive toxicological studies are necessary during the drug development process, allowing pharmaceutical firms to make educated judgments about moving compounds down the pipeline. As regulatory bodies throughout the world impose more strict safety criteria, there is a rising demand for thorough toxicological research to fulfill these demands. Furthermore, the rising complexity of medication candidates, particularly biologics and biosimilars, has increased the need for comprehensive toxicological studies, making toxicology testing services vital for drug development. As a result, toxicology testing has emerged as a critical pillar of preclinical research, holding a sizable market share.

Preclinical CRO Model Types

- Patient Derived Organoid (PDO) Model

- Patient Derived Xenograft Model

The patient-derived organoid (PDO) model has proven itself as a leading type in preclinical research owing to its unique ability to closely resemble the intricate microenvironments and cellular characteristics of human organs, providing a highly relevant and personalized platform for drug testing and disease research. PDO models are created directly from patients' tissues, allowing the development of in vitro systems that maintain the genetic and histological characteristics of the patient's own tumor or organ of interest. Because of their great realism, PDO models are essential for studying individual patient reactions to different therapies and establishing precision medicine techniques. Furthermore, PDO models are becoming more popular since they are very easy to culture and provide a flexible tool for researching a wide range of illnesses, including cancer, propelling their significance in preclinical research.

Preclinical CRO End-Uses

- Biopharmaceutical Companies

- Government and Academic Institutes

- Medical Device Companies

According to the preclinical CRO market forecast, biopharmaceutical firms have emerged as the main participants in the preclinical contract research organization (CRO) market due to a number of important variables To begin with, these businesses are at the cutting edge of medication discovery, with a solid pipeline of new chemicals and biologics. To hasten the drug development process, they typically require the specialised knowledge and facilities provided by preclinical CROs. Furthermore, the biopharmaceutical industry's severe regulatory requirements entail extensive preclinical testing, driving demand for CRO services even higher. As the biopharmaceutical sector expands, with a greater emphasis on precision medicine and the development of novel medicines, biopharmaceutical firms rely significantly on CROs for their preclinical research needs, cementing their market dominance.

Preclinical CRO Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Preclinical CRO Market Regional Analysis

The North American market is expected to account for a major share of revenue in the global preclinical CRO market, primarily due to high government spending. Additionally, the increasing number of clinical trials conducted in the country to develop novel solutions is anticipated to support market growth. It's worth noting that only 12% of new molecular entities that enter clinical trials eventually receive approval from the U.S. Food and Drug Administration (FDA).

Conversely, the market in the Asia-Pacific region is expected to experience faster growth in the target market, largely owing to the flourishing healthcare sector. Furthermore, the presence of a large number of players operating in countries such as China and India, along with the introduction of new drugs, is expected to contribute to the regional market's growth.

Preclinical CRO Market Players

Some of the top preclinical CRO companies offered in our report include Crown Bioscience, Charles River Laboratories International, Inc., Eurofins Scientific SE, Intertek Group plc (IGP), LabCorp, Medpace Holdings, Inc., PPD (Thermo Fisher Scientific, Inc.), PRA Health Sciences, Inc. (ICON plc), SGA SA, and WuXi AppTec, Inc. (WAI).

Frequently Asked Questions

How big is the preclinical CRO market?

The preclinical CRO market collected USD 5.2 billion in 2022.

What is the CAGR of the preclinical CRO market from 2023 to 2032?

The CAGR of preclinical CRO is 7.6% during the analysis period of 2023 to 2032.

Which are the key players in the preclinical CRO market?

The key players operating in the global market are Crown Bioscience, Charles River Laboratories International, Inc., Eurofins Scientific SE, Intertek Group plc (IGP), LabCorp, Medpace Holdings, Inc., PPD (Thermo Fisher Scientific, Inc.), PRA Health Sciences, Inc. (ICON plc), SGA SA, and WuXi AppTec, Inc. (WAI).

Which region dominated the global preclinical CRO market share?

North America held the dominating position in preclinical CRO industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of preclinical CRO during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global preclinical CRO Industry?

The current trends and dynamics in the preclinical CRO industry include increasing outsourcing of drug development activities, growing emphasis on cost efficiency and time savings, and rising R&D investments in pharmaceutical and biotechnology sectors.

Which service held the maximum share in 2022?

The toxicology testing service held the maximum share of the preclinical CRO industry.