Pre-engineered Buildings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Pre-engineered Buildings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

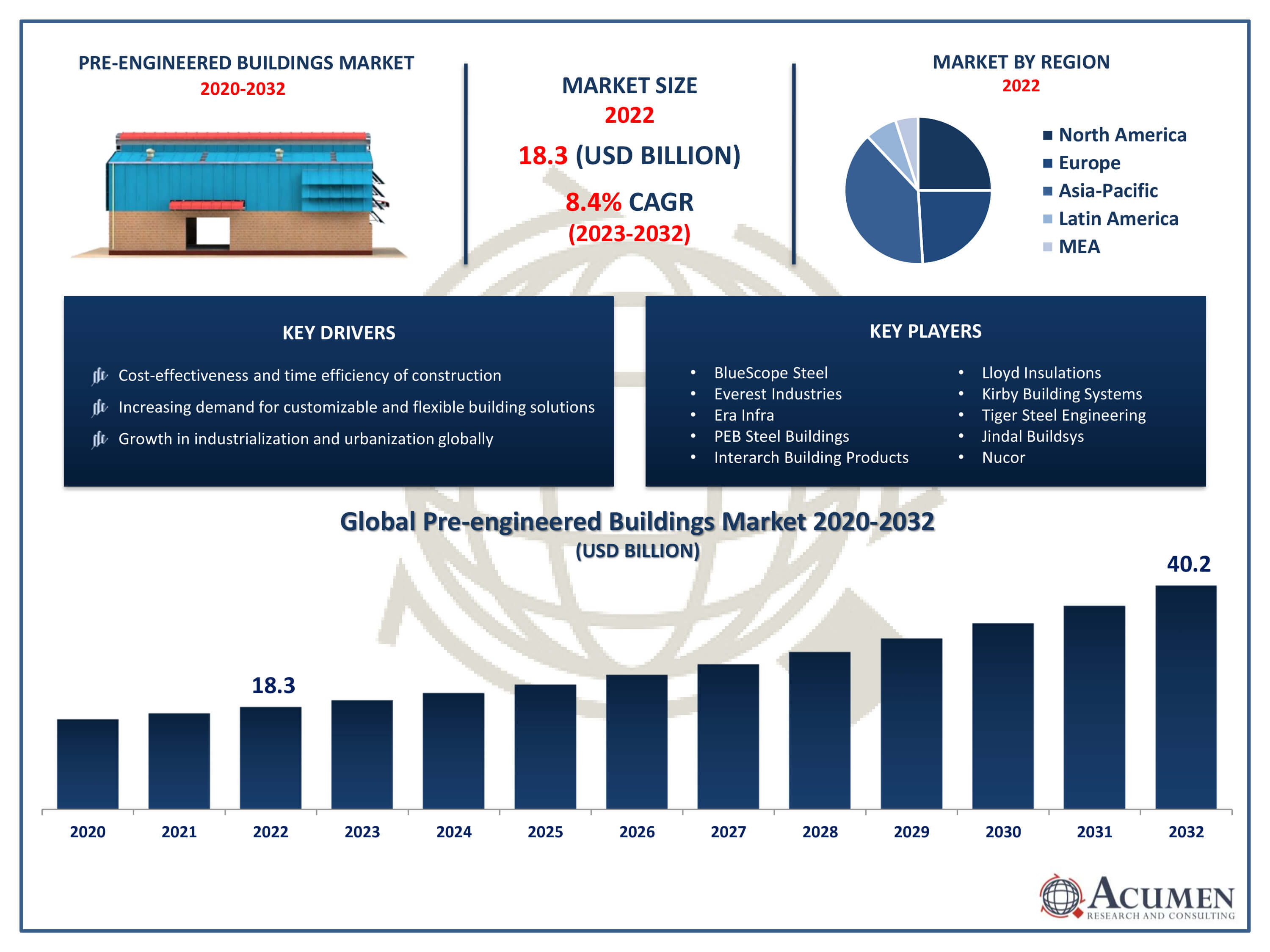

The Pre-engineered Buildings Market Size accounted for USD 18.3 Billion in 2022 and is projected to achieve a market size of USD 40.2 Billion by 2032 growing at a CAGR of 8.4% from 2023 to 2032.

Pre-engineered Buildings Market Highlights

- Global pre-engineered buildings market revenue is expected to increase by USD 40.2 billion by 2032, with a 8.4% CAGR from 2023 to 2032

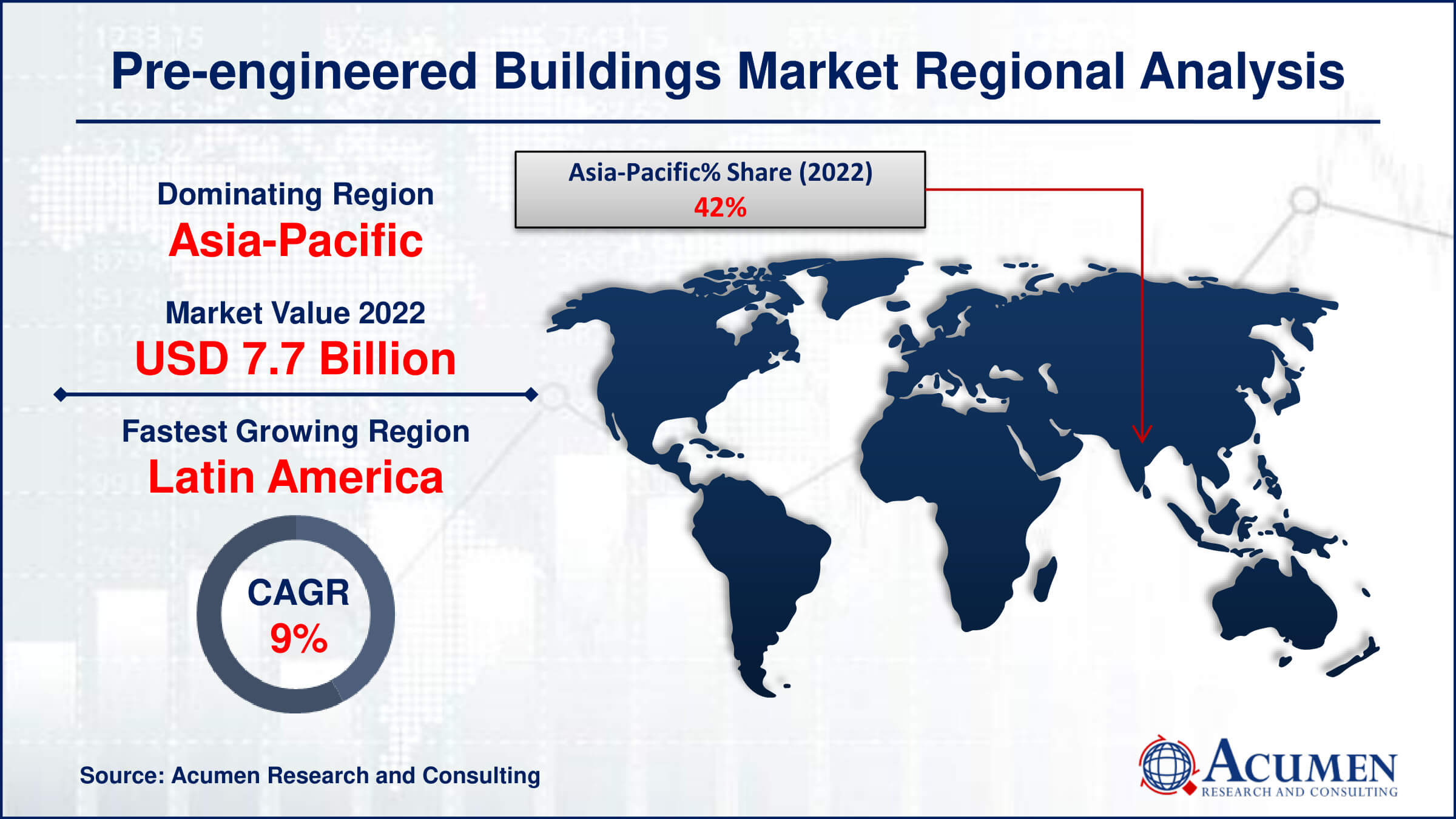

- Asia-Pacific region led with more than 42% of pre-engineered buildings market share in 2022

- Latin America pre-engineered buildings market growth will record a CAGR of more than 8.9% from 2023 to 2032

- By structure, the single-story segment captured more than 61% of revenue share in 2022.

- By application, the industrial segment had the largest market share of 45% in 2022

- Increasing demand for customizable and flexible building solutions, drives the pre-engineered buildings market value

Pre-engineered buildings (PEBs) are structures that are designed and fabricated off-site using a combination of raw materials and standardized components. These components are then transported to the construction site for assembly. PEBs are characterized by their cost-effectiveness, speed of construction, and flexibility in design. They are commonly used for a variety of applications such as warehouses, industrial facilities, commercial buildings, and even residential structures.

Pre-engineered buildings (PEBs) are structures that are designed and fabricated off-site using a combination of raw materials and standardized components. These components are then transported to the construction site for assembly. PEBs are characterized by their cost-effectiveness, speed of construction, and flexibility in design. They are commonly used for a variety of applications such as warehouses, industrial facilities, commercial buildings, and even residential structures.

The market for pre-engineered buildings has seen notable growth in recent years, driven by several key factors, including the rising demand for cost-effective and time-efficient construction solutions. PEBs enable faster construction timelines compared to traditional methods, significantly reducing labor and overall project costs. Their flexible design options allow for customization to meet specific project requirements. The surge in industrialization and urbanization globally has further fueled the market expansion, as industries seek quick and efficient infrastructure solutions. For instance, at a symposium on 27 December, Minister of Industry and Information Technology Jin Zhuanglong stated that China will actively promote new industrialization as part of its efforts to advance Chinese modernization. Additionally, as sustainability and environmental concerns gain importance, PEBs offer benefits in energy efficiency and material optimization, enhancing their appeal. Consequently, the pre-engineered buildings market is expected to maintain its growth trajectory as the construction industry adapts to the demands of a rapidly changing world.

Global Pre-engineered Buildings Market Trends

Market Drivers

- Cost-effectiveness and time efficiency of construction

- Increasing demand for customizable and flexible building solutions

- Growth in industrialization and urbanization globally

- Energy efficiency and sustainability advantages

Market Restraints

- Perceived limitations in architectural creativity compared to traditional construction

- Potential resistance from established construction practices

Market Opportunities

- Growing emphasis on sustainable and green building practices

- Technological advancements in PEB design and manufacturing

Pre-engineered Buildings Market Report Coverage

| Market | Pre-engineered Buildings Market |

| Pre-engineered Buildings Market Size 2022 | USD 18.3 Billion |

| Pre-engineered Buildings Market Forecast 2032 | USD 40.2 Billion |

| Pre-engineered Buildings Market CAGR During 2023 - 2032 | 8.4% |

| Pre-engineered Buildings Market Analysis Period | 2020 - 2032 |

| Pre-engineered Buildings Market Base Year |

2022 |

| Pre-engineered Buildings Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material Type, By Structure, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BlueScope Steel, Everest Industries, Era Infra, PEB Steel Buildings, Interarch Building Products, Lloyd Insulations, Kirby Building Systems, Tiger Steel Engineering, Jindal Buildsys, Nucor, and Zamil Steel. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Pre-engineered buildings (PEBs) are structures designed and fabricated off-site using standardized components and materials. Manufactured in a factory, these components are then transported to the construction site for assembly. A defining feature of PEBs is the prefabrication of structural elements, such as columns, beams, and roof trusses, which are engineered to fit together seamlessly. This construction method enables efficient and rapid assembly, leading to cost savings and shorter project timelines compared to traditional construction. PEBs are versatile and adaptable, making them suitable for various sectors. Common applications include warehouses, industrial facilities, commercial complexes, and residential buildings. In industrial settings, PEBs are especially valued for providing large clear-span spaces, which are crucial for accommodating machinery and storage.

The pre-engineered buildings (PEB) market has seen substantial growth in recent years, fueled by several factors highlighting its benefits in the construction sector. For instance, in February 2023, Everest Industries made public that its board had given the green light to a capital expenditure amounting to Rs 125 crore. This investment is intended for establishing a manufacturing facility dedicated to the steel buildings division (ESBS) in South India. The demand for PEBs has increased due to their intrinsic cost-effectiveness and time efficiency. The off-site fabrication of standardized components greatly reduces construction time, resulting in lower labor costs and quicker project completion. This efficiency matches the industry's broader trend toward faster turnaround times, making PEBs an appealing option for various uses, including warehouses, factories, and commercial buildings.

Moreover, the flexibility and customization options offered by pre-engineered buildings contribute to their widespread adoption. As businesses and industries seek tailored solutions for their specific needs, PEBs provide a versatile platform that allows for efficient design modifications. The market growth is further fueled by the global trends of industrialization and urbanization, with PEBs emerging as a preferred choice for meeting the escalating demand for infrastructure. Additionally, the focus on sustainability and energy efficiency has positioned PEBs as environmentally conscious alternatives, contributing to their expanding market share.

Pre-engineered Buildings Market Segmentation

The global pre-engineered buildings market segmentation is based on material type, structure, application, and geography.

Pre-engineered Buildings Market By Material Type

- Aluminum

- Steel

- Others

According to the pre-engineered buildings industry analysis, the steel segment accounted for the largest market share in 2022. dominance can be attributed to steel's inherent strength, durability, and versatility, making it the preferred material for pre-engineered buildings (PEBs) by key manufacturers. For instance, Nucor agreed to acquire Summit Utility Structures LLC, Sovereign Steel Manufacturing LLC to serve the customers of North America. High-quality steel components ensure structural integrity, enabling larger clear spans and taller buildings without compromising stability. This is particularly advantageous for constructing warehouses, industrial facilities, and commercial structures, where open and unobstructed spaces are essential. The growth in the steel segment of the PEB market is also due to the material's cost-effectiveness and manufacturing efficiency. Steel components can be precisely fabricated off-site, reducing construction time and labor costs. This aligns with the industry's increasing demand for faster project delivery without sacrificing quality.

Pre-engineered Buildings Market By Structure

- Single-story

- Multi-story

In terms of structures, the single-story segment is expected to witness significant growth in the coming years. Single-story pre-engineered buildings (pebs) are especially favored in industrial and commercial settings, such as warehouses, manufacturing facilities, and retail spaces. Their straightforward design and construction enable quick assembly and cost savings compared to multi-story buildings. This efficiency meets the demand for rapid project completion, making single-story PEBs a preferred choice for clients seeking timely and economical solutions. The growth in this segment is also driven by the flexibility and adaptability these structures offer. Businesses often require open and spacious floor plans, and single-story PEBs provide large, uninterrupted spaces without internal support columns, making them ideal for various industrial and commercial applications.

Pre-engineered Buildings Market By Application

- Commercial

- Residential

- Industrial

According to the pre-engineered buildings market forecast, the industrial segment is expected to witness significant growth in the coming years. The rising demand for pre-engineered buildings in the industrial sector, driven by the need for cost-effective and efficient construction solutions to support expanding manufacturing operations. For instance, in May 2023, EPAK Prefab, a leading supplier of pre-engineered construction solutions, achieved the successful completion of industrial facilities covering an impressive 3.2 million square feet. These facilities, valued at around $24 million, were tailored to meet the needs of major automobile companies operating in India. Pre-engineered buildings (PEBs) have become the preferred choice for constructing industrial facilities such as warehouses, manufacturing plants, and distribution centers due to their rapid construction time and cost savings. Industries with dynamic and evolving needs find them particularly appealing. The industrial sector benefits from PEBs' ability to offer large, column-free interior spaces, enhancing functionality for storage, production, and logistics. Additionally, the growth of the industrial segment is closely linked to the adaptability and customization options that PEBs provide. Industries often need tailored solutions to accommodate specialized equipment, production processes, and storage requirements. PEBs offer the flexibility to design and modify structures to meet these specific needs, ensuring efficient and streamlined operations.

Pre-engineered Buildings Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Asia-Pacific has become a leading player in the pre-engineered buildings (PEB) market, propelled by economic growth, urbanization, and increased infrastructure development. For instance, in March 2023, Kirby Building Systems India celebrated the grand opening of its latest manufacturing facility in Halol, Gujarat, marking the inauguration of the third Kirby Building Systems plant in India and the seventh worldwide. Rising industrialization in countries such as China and India has boosted demand for industrial and commercial spaces, with PEBs preferred for their quick construction and cost-effectiveness. The region's strong manufacturing sector and booming e-commerce industry have significantly contributed to the PEB market's growth, as businesses seek efficient and scalable infrastructure solutions. Additionally, rapid urbanization has increased the need for residential and commercial spaces, further driving PEB demand. Government investments in infrastructure projects, such as airports, educational institutions, and healthcare facilities, and initiatives have also promoted PEB adoption due to their construction speed and versatility. For instance, in November 2023, the Indian Green Building Council introduced the 'Nest' initiative, with the goal of cultivating sustainable and eco-friendly construction methods within the residential housing sector. This initiative underscores a dedication to advancing green and energy-efficient building solutions, highlighting the significance of sustainable practices in creating a more environmentally conscious and robust housing landscape in India. The presence of robust key players and their advancements led to maintain the regions position in industry. For instance, in July 2022, APL Apollo, an Indian manufacturer of structural steel pipes, introduced next-generation steel building solutions designed to enhance pre-engineered buildings. These innovations promise to deliver cost-effectiveness, faster construction speeds, and superior quality. With ongoing economic growth and development, Asia-Pacific is expected to maintain its dominance in the PEB market, driven by sustained demand across multiple industries and construction sectors.

Latin America is experiencing the fastest growth in the pre-engineered buildings market due to rapid industrialization, urbanization, and infrastructural development. For instance, Brazil has initiated a fresh industrial policy outlining developmental objectives and implementing measures proposed to progress until 2033. The region's economic expansion and increasing investments in construction projects are driving demand for cost-effective, efficient building solutions. Additionally, favorable government policies and advancements in construction technologies are further propelling market growth.

Pre-engineered Buildings Market Player

Some of the top pre-engineered buildings market companies offered in the professional report include BlueScope Steel, Everest Industries, Era Infra, PEB Steel Buildings, Interarch Building Products, Lloyd Insulations, Kirby Building Systems, Tiger Steel Engineering, Jindal Buildsys, Nucor, and Zamil Steel.

Frequently Asked Questions

How big is the pre-engineered buildings market?

The pre-engineered buildings market size was USD 18.3 Billion in 2022.

What is the CAGR of the global pre-engineered buildings market from 2023 to 2032?

The CAGR of pre-engineered buildings is 8.4% during the analysis period of 2023 to 2032.

Which are the key players in the pre-engineered buildings market?

The key players operating in the global market are including BlueScope Steel, Everest Industries, Era Infra, PEB Steel Buildings, Interarch Building Products, Lloyd Insulations, Kirby Building Systems, Tiger Steel Engineering, Jindal Buildsys, Nucor, and Zamil Steel.

Which region dominated the global pre-engineered buildings market share?

Asia-Pacific held the dominating position in pre-engineered buildings industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Latin America region exhibited fastest growing CAGR for market of pre-engineered buildings during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global pre-engineered buildings industry?

The current trends and dynamics in the pre-engineered buildings industry include cost-effectiveness and time efficiency of construction, increasing demand for customizable and flexible building solutions, and growth in industrialization and urbanization globally.

Which structure held the maximum share in 2022?

The single-story structure held the maximum share of the pre-engineered buildings industry.