Power Tools Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Power Tools Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

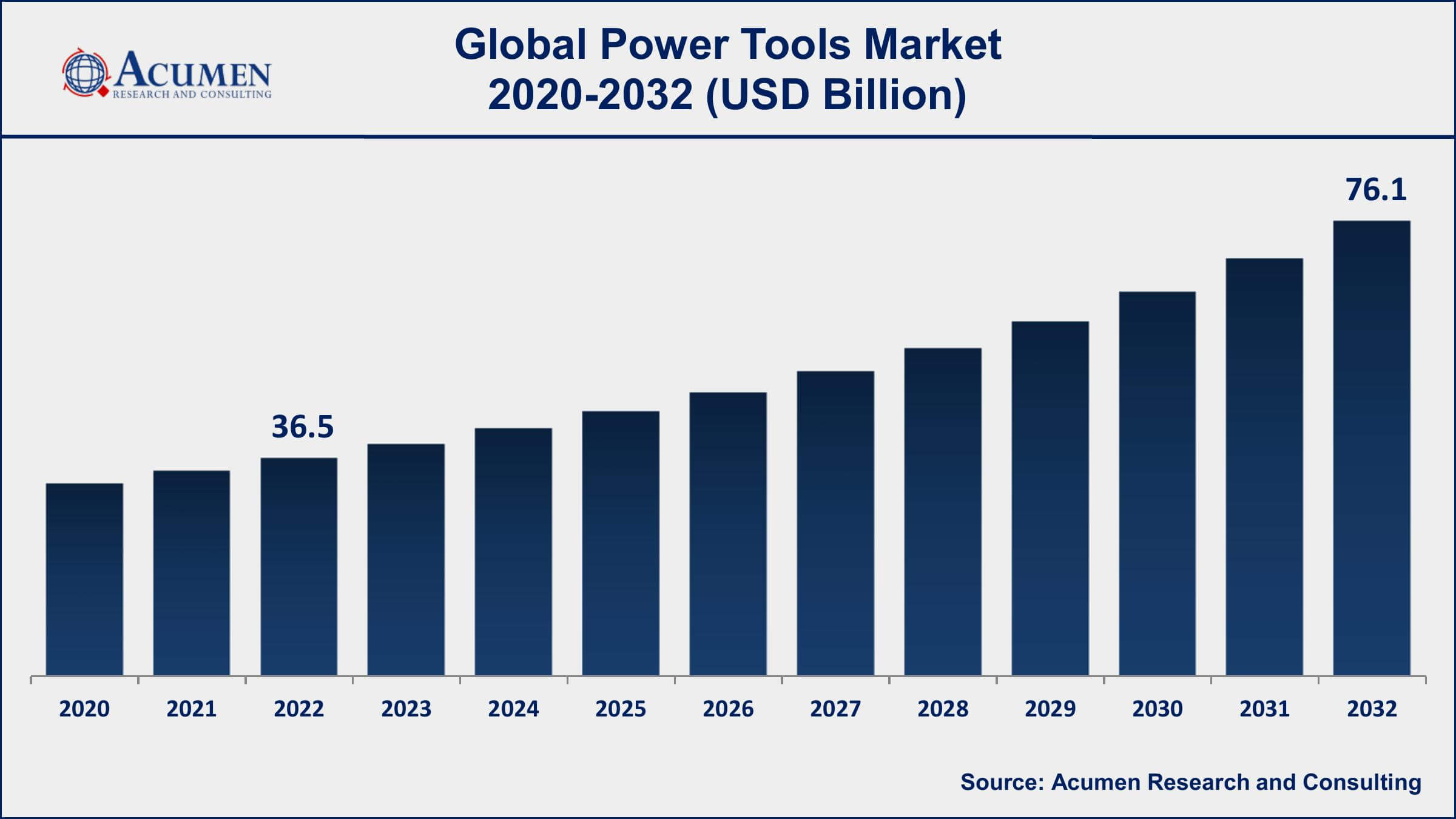

The Global Power Tools Market Size accounted for USD 36.5 Billion in 2022 and is projected to achieve a market size of USD 76.1 Billion by 2032 growing at a CAGR of 7% from 2023 to 2032.

Power Tools Market Highlights

- Global power tools market revenue is expected to increase by USD 76.1 Billion by 2032, with a 7% CAGR from 2023 to 2032

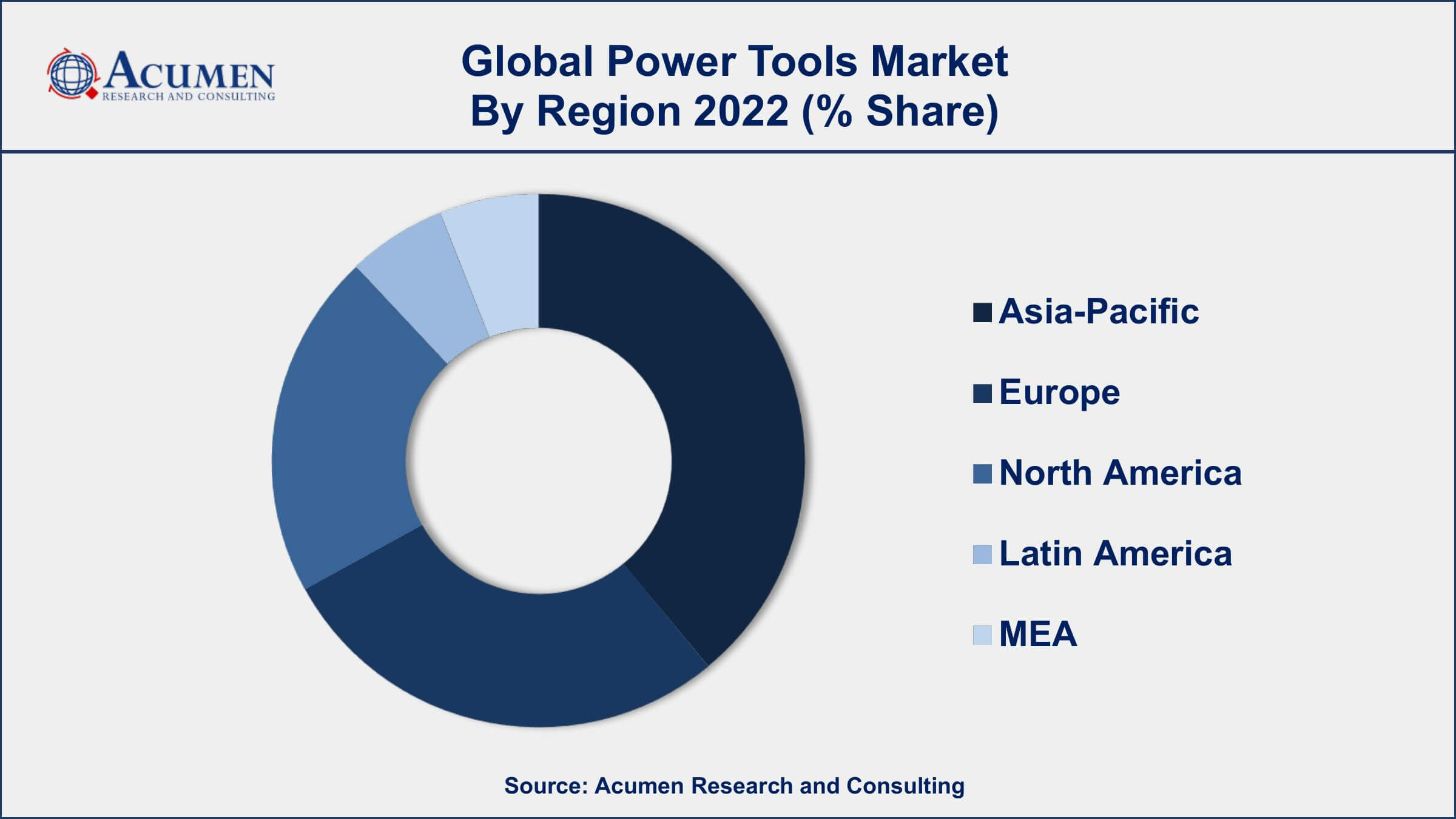

- Asia-Pacific region led with more than 35% of power tools market share in 2022

- North America power tools market growth will record a CAGR of around 7.8% from 2023 to 2032

- By product, the drill segment is the largest segment of the market, accounting for more than 32% of the market share

- By application, the residential segment is expected to grow at a CAGR of 8.2% during the forecast period of 2023 to 2032

- Growing demand for infrastructure development and construction projects, drives the power tools market value

Power tools are handheld or stationary machines that are powered by electricity or battery, and used for construction, manufacturing, woodworking, and other tasks. They are used to cut, shape, drill, polish, and perform other tasks that require a high level of precision and efficiency. Examples of power tools include drills, saws, sanders, grinders, and planers.

The market for power tools has been growing steadily over the past few years, driven by factors such as increasing industrialization, rising demand for infrastructure development, and growing DIY culture. The Asia Pacific region is expected to witness significant growth in the power tools industry, driven by factors such as rapid industrialization, increasing construction activities, and rising demand for electric vehicles. In addition, the growing popularity of online sales channels and the availability of advanced and high-quality power tools are also contributing to the growth of the market. Overall, the power tools industry is expected to continue its growth trajectory in the coming years, driven by technological advancements and increasing demand from various end-use industries.

Global Power Tools Market Trends

Market Drivers

- Increasing industrialization and manufacturing activities

- Growing demand for infrastructure development and construction projects

- Advancements in technology and the development of new and innovative power tools

- Rising popularity of DIY culture among consumers

Market Restraints

- High cost of power tools

- Availability of low-cost and counterfeit products in the market

Market Opportunities

- Rising demand for energy-efficient power tools

- Growing popularity of smart and connected power tools

Power Tools Market Report Coverage

| Market | Power Tools Market |

| Power Tools Market Size 2022 | USD 36.5 Billion |

| Power Tools Market Forecast 2032 | USD 76.1 Billion |

| Power Tools Market CAGR During 2023 - 2032 | 7% |

| Power Tools Market Analysis Period | 2020 - 2032 |

| Power Tools Market Base Year | 2022 |

| Power Tools Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Mode Of Operation, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Emerson Electric, Co., Atlas Copco AB, Hilti Corporation, Enerpac Tool Group, Ingersoll-Rand PLC, Stanley Black & Decker, Makita Corporation, Koki Holdings Co., Ltd., Robert Bosch, and Techtronic Industries. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Power tools are the tools that are used to produce products with increased comfort and convenience. The types of power tools include electric power tools, engine-driven power tools, and pneumatic power tools. Engine-driven power tools necessitate steam engines to work and are used by both individuals and professionals to cut wood and hedges. The power basis for pneumatic power tools is beaten air from air compressors, which helps the tool to function efficiently. The main trends that are likely to shape up the global power tools market are increased demand for lithium-ion batteries, particularly Ni-Cd, cordless power tools gaining popularity, global housing sector recovery, and domination of China-manufactured power tools.

Power Tools Market Segmentation

The global power tools market segmentation is based on product, mode of operation, application, and geography.

Power Tools Market By Product

- Drills

- Grinders

- Saws

- Sanders

- Wrenches

- Others

According to the power tools industry analysis, the drills segment accounted for the largest market share in 2022. Drills are used for a variety of tasks such as drilling holes, fastening screws, and mixing materials. The drills segment includes corded and cordless drills, hammer drills, rotary drills, and impact drills. The market for drills is being driven by a range of factors, including the growth of the construction and infrastructure development sectors, the increasing popularity of DIY culture, and advancements in technology. The drills segment is also being impacted by advancements in technology, such as the development of brushless motors, which offer improved performance, longer lifespan, and reduced maintenance costs. Manufacturers are also focusing on developing lightweight and ergonomic designs, which offer greater comfort and ease of use to users.

Power Tools Market By Mode Of Operation

- Electric

- Pneumatic

- Others

In terms of mode of operations, the electric segment is expected to witness significant growth in the coming years. These tools are used in various industries, including construction, woodworking, metalworking, and automotive. The electric segment includes tools such as drills, saws, sanders, grinders, and planers. The market for electric power tools is being driven by factors such as the growth of industrialization, rising demand for construction and infrastructure development, and advancements in technology. The electric power tools market is being driven by advancements in technology, such as the development of brushless motors, which offer higher efficiency and longer lifespan. Manufacturers are also focusing on developing lightweight and ergonomic designs, which offer greater comfort and ease of use to users. The availability of a wide range of electric power tools for different applications is also contributing to the growth of the market.

Power Tools Market By Application

- Industrial

- Residential

According to the power tools market forecast, the residential segment is expected to witness significant growth in the coming years. Power tools used in the residential segment include drills, saws, sanders, and many other handheld tools. The residential segment is also witnessing growth due to the increasing demand for home renovation and remodeling projects, which require power tools for tasks such as cutting, drilling, and sanding. The residential segment is also being impacted by advancements in technology, such as the development of smart and connected power tools, which offer greater control and customization to users. Manufacturers are also focusing on developing lightweight and ergonomic designs, which offer greater comfort and ease of use to homeowners and DIY enthusiasts. Overall, the residential segment is expected to continue its growth trajectory in the coming years, driven by increasing demand from homeowners and hobbyists, advancements in technology, and the growth of online sales channels.

Power Tools Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Power Tools Market Regional Analysis

Asia-Pacific is the dominant region in the power tools market, with countries such as China, Japan, and India being major contributors to the growth of the market. The market growth in Asia-Pacific is being driven by several factors, including the growth of the construction and infrastructure development sectors, increasing demand from the manufacturing industry, and the rising popularity of DIY culture. One of the key drivers of the Asia-Pacific market is the growth of the construction and infrastructure development sectors. Countries in the region are investing heavily in infrastructure development, including the construction of new buildings, roads, and other public facilities. This has led to increased demand for power tools such as drills, saws, and other handheld tools, which are used extensively in construction and renovation projects. Another factor driving the growth of the Asia-Pacific is the increasing demand from the manufacturing industry. With countries such as China and India emerging as major manufacturing hubs, there is a growing need for power tools in the manufacturing process. Power tools such as grinders, sanders, and drills are used in various stages of the manufacturing process, from cutting and drilling to polishing and finishing.

Power Tools Market Player

Some of the top power tools market companies offered in the professional report include Emerson Electric, Co., Atlas Copco AB, Hilti Corporation, Enerpac Tool Group, Ingersoll-Rand PLC, Stanley Black & Decker, Makita Corporation, Koki Holdings Co., Ltd., Robert Bosch, and Techtronic Industries.

Frequently Asked Questions

How big is the power tools market?

The power tools market size was USD 36.5 Billion in 2022.

What is the CAGR of the global power tools market from 2023 to 2032?

The CAGR of power tools is 7% during the analysis period of 2023 to 2032.

Which are the key players in the power tools market?

The key players operating in the global market are including Emerson Electric, Co., Atlas Copco AB, Hilti Corporation, Enerpac Tool Group, Ingersoll-Rand PLC, Stanley Black & Decker, Makita Corporation, Koki Holdings Co., Ltd., Robert Bosch, and Techtronic Industries.

Which region dominated the global power tools market share?

Asia-Pacific held the dominating position in power tools industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of power tools during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global power tools industry?

The current trends and dynamics in the power tools industry include increasing industrialization and manufacturing activities, growing demand for infrastructure development and construction projects, and advancements in technology and the development of new and innovative power tools.

Which mode of operation held the maximum share in 2022?

The electric mode of operation held the maximum share of the power tools industry.