Portable Water Purifiers Market | Acumen Research and Consulting

Portable Water Purifiers Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

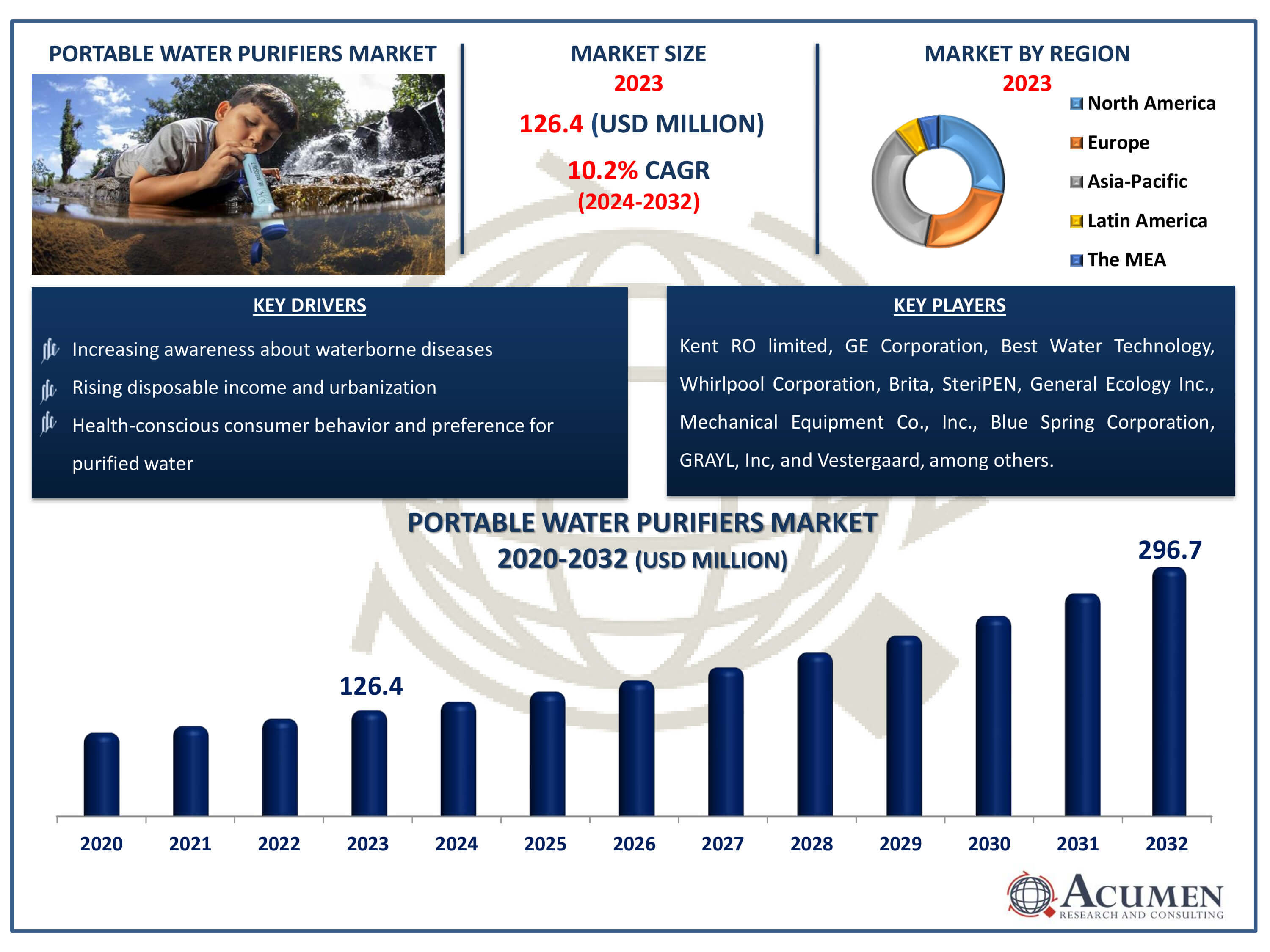

The Portable Water Purifiers Market Size accounted for USD 126.4 Million in 2022 and is estimated to achieve a market size of USD 296.7 Million by 2032 growing at a CAGR of 10.2% from 2024 to 2032.

Portable Water Purifiers Market Highlights

- Global portable water purifiers market revenue is poised to garner USD 296.7 million by 2032 with a CAGR of 10.2% from 2024 to 2032

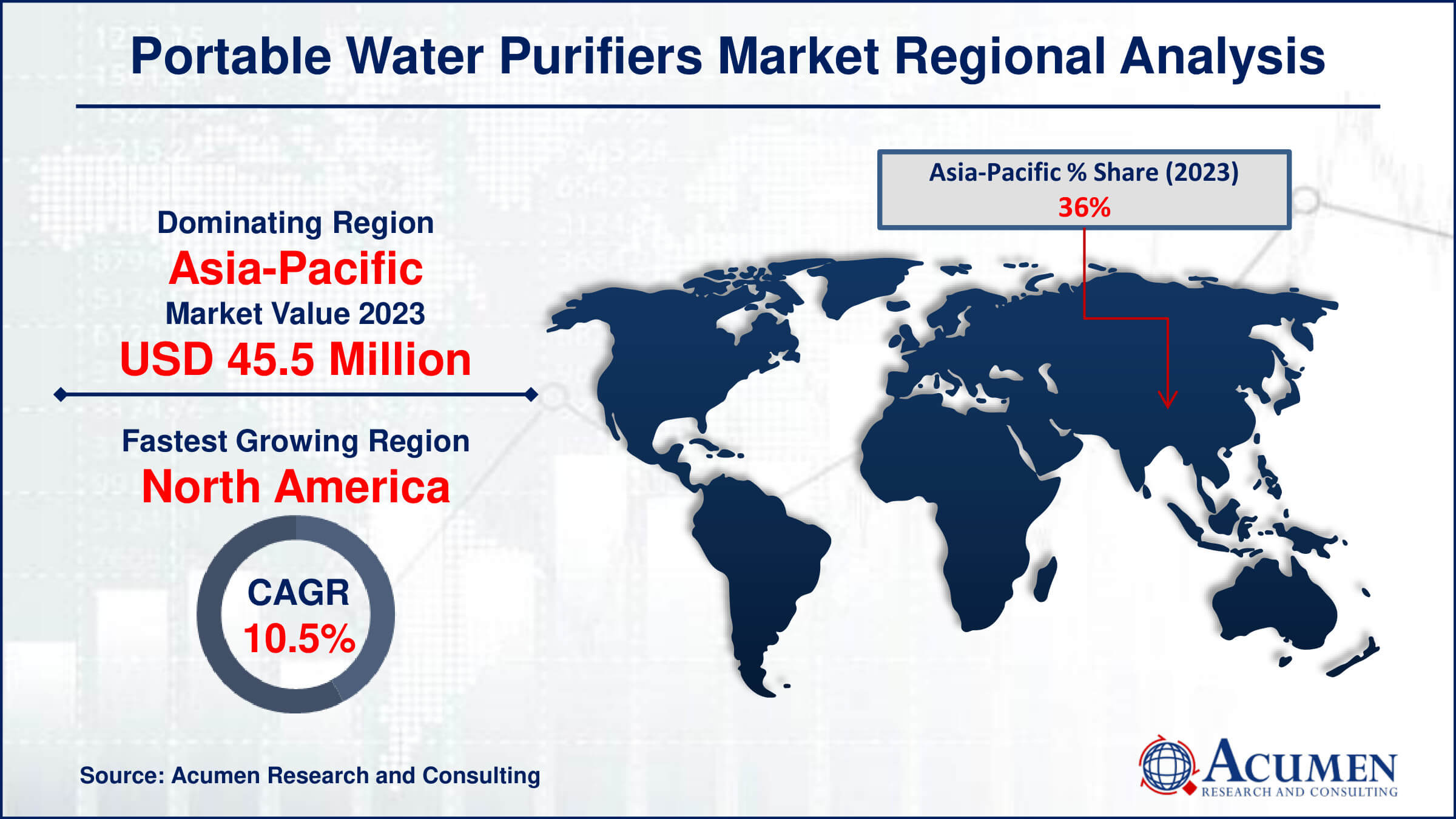

- Asia-Pacific portable water purifiers market value occupied around USD 45.5 million in 2022

- North America portable water purifiers market growth will record a CAGR of more than 10.5% from 2024 to 2032

- Among technology, the RO purifier generator sub-segment generated more than USD 64.5 million revenue in 2022

- Based on end-use, the residential sub-segment generated noteworthy portable water purifiers market share in 2022

- Integration of smart technology for real-time water quality monitoring is a popular portable water purifiers market trend that fuels the industry demand

Portable water purifiers are small, lightweight machines that remove pollutants from water, making it safe to drink. They are necessary for outdoor activities such as hiking, camping, and emergency circumstances where clean water is not readily accessible. These purifiers destroy bacteria, viruses, protozoa, and other contaminants by a variety of techniques, including filtration, ultraviolet (UV) radiation, and chemical treatments. Filtration usually uses physical barriers such as ceramic or charcoal filters, whereas UV purifiers utilise light to kill microorganisms. Chemical treatments frequently employ iodine or chlorine. Portable water purifiers are practical and simple to operate, providing access to safe drinking water in distant or disaster-prone places.

Global Portable Water Purifiers Market Dynamics

Market Drivers

- Increasing awareness about waterborne diseases

- Rising disposable income and urbanization

- Growing need for safe drinking water in disaster-prone areas

- Health-conscious consumer behavior and preference for purified water

Market Restraints

- High initial cost of advanced purifiers

- Limited availability in remote regions

- Competition from bottled water

Market Opportunities

- Development of more efficient and affordable purifiers

- Increasing government initiatives for clean water access

- Growing popularity of portable purifiers among travelers

Portable Water Purifiers Market Report Coverage

| Market | Portable Water Purifiers Market |

| Portable Water Purifiers Market Size 2022 | USD 126.4 Billion |

| Portable Water Purifiers Market Forecast 2032 |

USD 296.7 Billion |

| Portable Water Purifiers Market CAGR During 2024 - 2032 | 10.2% |

| Portable Water Purifiers Market Analysis Period | 2020 - 2032 |

| Portable Water Purifiers Market Base Year |

2022 |

| Portable Water Purifiers Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Technology, By Distributional Channel, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Kent RO limited, GE Corporation, Best Water Technology, Whirlpool Corporation, Brita, SteriPEN, General Ecology Inc., Mechanical Equipment Co., Inc., Blue Spring Corporation, GRAYL, Inc, Vestergaard, Portable Aqua, Aquasana, Inc., and Panasonic. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Portable Water Purifiers Market Insights

The noticeable increase in the percentage of consumers opting for outdoor activities such as hiking, trekking, etc., along with a rise in awareness related to waterborne diseases due to the consumption of outdoor water, is resulting in higher demand for portable water filters. This is a major factor expected to drive the growth of the global portable water filters market. Consumer interest in outdoor activities is increasing. The rise in health awareness and focus on living healthier lifestyles is driving the growth of the active and outdoor recreation sectors. Running, hiking, cycling, boating, fishing, camping, and walking are some of the major activities gaining traction among consumers worldwide. In 2016, 144.4 million Americans, or 48.8% of the US population, participated in an outdoor activity at least once. Outdoor participation grew from 48.4% of the US population in 2015 to 48.8% in 2016. Consumers' spending on healthier lifestyles is increasing, coupled with the growing importance of outdoor recreation, leading to increased demand for products and accessories in this sector.

Major players, along with advanced technology, are focusing on introducing innovative filters that help consumers remove undesirable chemicals, biological contaminants, suspended solids, and gases from water. Their approach to product launches to attract new customers is expected to impact the growth of the portable water filters market. In 2018, GRAYL, a manufacturer of sports accessories, launched the GRAYL GEOPRESS, a next-generation purifier that quickly cleans even the sketchiest water for travelers, adventurers, and survivalists. This product launch helped the company enhance its product portfolio and increase its revenue share.

The increase in the number of inpatients in hospitals due to infections caused by waterborne diseases is leading to a growing inclination towards the adoption of portable filters, which is expected to augment the growth of the portable water filters market. People are traveling to rural areas as part of their life experiences, and travelers are becoming more conscious about the water they consume. The availability of fresh and pure water is difficult to ensure, increasing the importance of portable filters. According to the U.S. Department of Health & Human Services, about 7.2 million Americans get sick every year from diseases spread through water. Factors such as the availability of packaged drinking water and increasing government initiatives to provide clean water are expected to hamper the growth of the global portable water filters market.

Additionally, the lack of awareness among consumers and the preference for other alternatives are factors expected to challenge the growth of the target market. However, technological advancements by major players and the introduction of innovative solutions with high marketing strategies for product awareness are expected to create new opportunities for players operating in the portable water filters market over the forecast period. Furthermore, increasing partnerships and agreements to strengthen the distribution channel are expected to support the revenue transaction of the target market.

Portable Water Purifiers Market Segmentation

The worldwide market for portable water purifiers is split based on technology, distributional channel end-use, and geography.

Portable Water Purifier Technologies

- Gravity Purifier

- UV Purifier

- RO Purifier

According to portable water purifiers industry analysis, the reverse osmosis (RO) purifier category dominates market due to its improved filtering capabilities and extensive customer confidence. RO purifiers employ a semi-permeable membrane to remove contaminants including bacteria, viruses, heavy metals, and dissolved salts, resulting in high-quality, safe drinking water. This method is very useful in places with heavily polluted water sources. RO purifiers are popular because they can handle a broad variety of impurities, making them adaptable and dependable. Furthermore, advances in portable RO technology have made these devices more small and efficient, appealing to users looking for reliable purifying solutions for outdoor sports and travel. The RO segment's dominance is driven by the high need for complete water treatment.

Portable Water Purifiers Distributional Channel

- Online

- Offline

Several major reasons are predicted to drive the online distribution channel to become the largest segment in the market and it is expected to grow throughout the water purifiers market industry forecast period. The ease of internet shopping allows customers to compare items, read reviews, and make informed selections from the comfort of their own homes. E-commerce sites frequently provide a broader selection of items than conventional stores, including the most recent models and innovations. Furthermore, internet shops typically provide discounts, promotions, and rapid shipping choices, increasing the attraction of buying portable water purifiers online. The increased internet usage and dependence on digital devices for shopping contribute to this segment's supremacy. The accessibility, variety, and cost-effectiveness of online shopping have contributed to its popularity among many customers.

Portable Water Purifiers End-Use

- Commercial

- Residential

In terms of portable water purifiers market analysis, the residential category is likely to be the largest in the industry, owing to growing concerns about water quality and safety in households globally. With rising awareness of waterborne illnesses and toxins in tap water, more people are turning to portable purifiers to guarantee they have access to safe drinking water at home. Residential units are often designed to be small, user-friendly, and cost-effective, meeting the demands of individual homes. Furthermore, advances in purifying technology have made domestic water purifiers more efficient and inexpensive, resulting in increased adoption. Furthermore, the increase in urbanization, along with rising living standards, is driving demand for residential water purifiers as vital equipment for health-conscious customers looking for dependable water purifying solutions in their homes.

Portable Water Purifiers Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Portable Water Purifiers Market Regional Analysis

The market in Asia-Pacific is the largest region and it is expected to maintain same over the portable water purifiers market forecast period in the target market due to increasing consumer awareness related to portable filters. Furthermore, players are focusing on tapping into the untapped market in developing countries, which is expected to augment the regional market growth for portable water filters. A variety of reasons drive the Asia-Pacific portable water purifier market. Rapid urbanization, industrialization, and population increase have put a pressure on water supplies and raised worries about water quality in several nations. As a result, there is an increasing need for portable purifiers, particularly in highly populated cities and places prone to waterborne infections.

Portable Water Purifiers Market Players

Some of the top portable water purifiers companies offered in our report includes Kent RO limited, GE Corporation, Best Water Technology, Whirlpool Corporation, Brita, SteriPEN, General Ecology Inc., Mechanical Equipment Co., Inc., Blue Spring Corporation, GRAYL, Inc, Vestergaard, Portable Aqua, Aquasana, Inc., and Panasonic.

Frequently Asked Questions

How big is the portable water purifiers market?

The portable water purifiers market size was valued at USD 126.4 million in 2022.

What is the CAGR of the global portable water purifiers market from 2024 to 2032?

The CAGR of portable water purifiers is 10.2% during the analysis period of 2024 to 2032.

Which are the key players in the portable water purifiers market?

The key players operating in the global market are including Kent RO limited, GE Corporation, Best Water Technology, Whirlpool Corporation, Brita, SteriPEN, General Ecology Inc., Mechanical Equipment Co., Inc., Blue Spring Corporation, GRAYL, Inc, Vestergaard, Portable Aqua, Aquasana, Inc., and Panasonic.

Which region dominated the global portable water purifiers market share?

Asia-Pacific held the dominating position in portable water purifiers industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of portable water purifiers during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global portable water purifiers industry?

The current trends and dynamics in the portable water purifiers industry include increasing awareness about waterborne diseases, rising disposable income and urbanization, growing need for safe drinking water in disaster-prone areas, and health-conscious consumer behavior and preference for purified water.

Which distributional channel held the maximum share in 2022?

The online distributional channel expected to hold the maximum share of the portable water purifiers industry.