Polyurethane Hot Melt Adhesives Market | Acumen Research and Consulting

Polyurethane Hot Melt Adhesives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

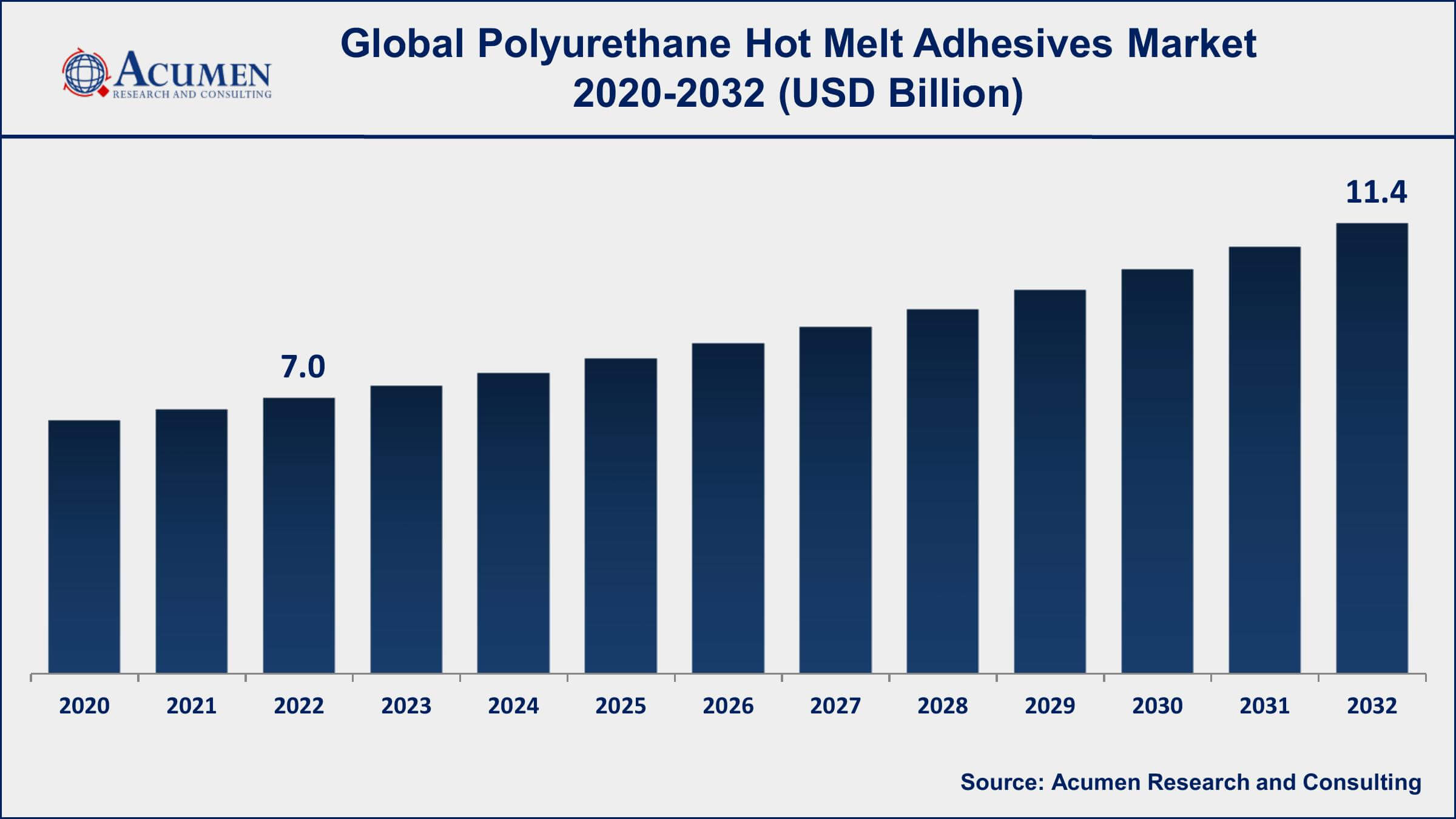

The Global Polyurethane Hot Melt Adhesives Market Size accounted for USD 7.0 Billion in 2022 and is projected to achieve a market size of USD 11.4 Billion by 2032 growing at a CAGR of 5.1% from 2023 to 2032.

Polyurethane Hot Melt Adhesives Market Key Highlights

- Global polyurethane hot melt adhesives market revenue is expected to increase by USD 11.4 Billion by 2032, with a 5.1% CAGR from 2023 to 2032

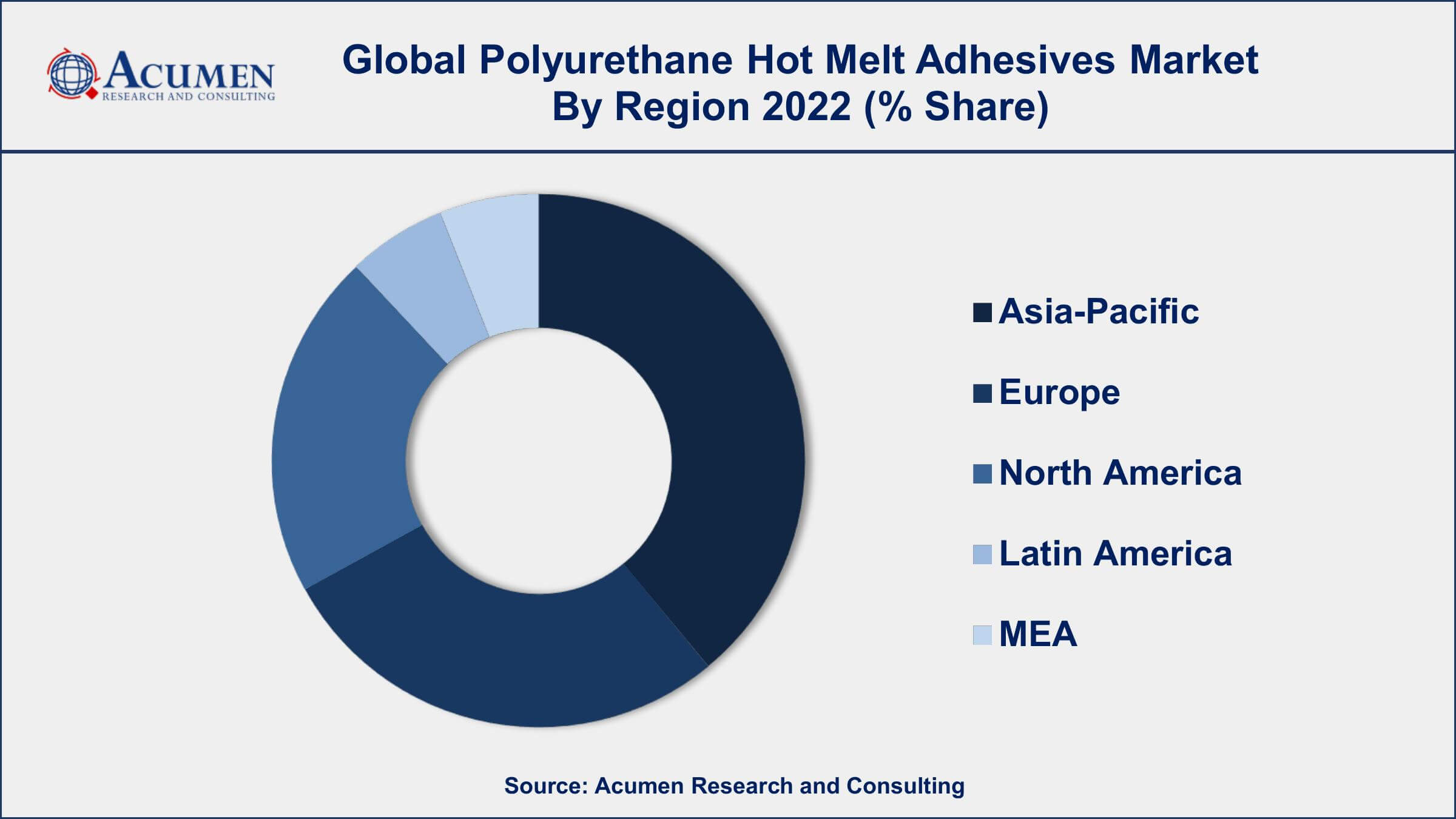

- Asia-Pacific region led with more than 38% of polyurethane hot melt adhesives market share in 2022

- Europe modular data centre market growth will record a CAGR of more than 6.2% from 2023 to 2032

- The reactive segment is the market's largest contributor by type and is predicted to increase at a CAGR of 5.9% during the forecast period

- The automotive industry is a major user of polyurethane hot melt adhesives, with applications including bonding of trim components, headliners, and door panels

- Increasing adoption of renewable energy and energy storage solutions, drives the polyurethane hot melt adhesives market value

Polyurethane hot melt adhesives are thermoplastic adhesives that are used for bonding various materials such as plastic, metal, wood, and paper. These adhesives offer several advantages over traditional solvent-based adhesives, including faster curing times, better adhesion, and improved water resistance. Polyurethane hot melt adhesives are widely used in industries such as automotive, construction, packaging, and textiles.

The global polyurethane hot melt adhesives market has been experiencing significant growth in recent years, driven by factors such as increasing demand from end-use industries, rising environmental concerns, and technological advancements. The demand for polyurethane hot melt adhesives is expected to continue growing due to the increasing adoption of lightweight materials in the automotive and construction industries. Additionally, the shift towards sustainable adhesives and increasing R&D activities in the industry are expected to create new growth opportunities for the market in the coming years.

Global Polyurethane Hot Melt Adhesives Market Trends

Market Drivers

- Growing adoption of lightweight materials in the automotive and construction industries

- Increased emphasis on energy-efficient buildings

- Growing demand for adhesives in the medical industry

- Strong growth in the packaging industry

- Growing demand for sustainable adhesives

Market Restraints

- Volatility in raw material prices

- Stringent environmental regulations

Market Opportunities

- Rising demand for bio-based and renewable adhesives

- Growing trend of automation in manufacturing processes

Polyurethane Hot Melt Adhesives Market Report Coverage

| Market | Polyurethane Hot Melt Adhesives Market |

| Polyurethane Hot Melt Adhesives Market Size 2022 | USD 7.0 Billion |

| Polyurethane Hot Melt Adhesives Market Forecast 2032 | USD 11.4 Billion |

| Polyurethane Hot Melt Adhesives Market CAGR During 2023 - 2032 | 5.1% |

| Polyurethane Hot Melt Adhesives Market Analysis Period | 2020 - 2032 |

| Polyurethane Hot Melt Adhesives Market Base Year | 2022 |

| Polyurethane Hot Melt Adhesives Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Henkel AG & Co. KGaA, H.B. Fuller Company, Arkema S.A., Ashland Global Holdings Inc., 3M Company, Sika AG, Huntsman Corporation, Jowat SE, Avery Dennison Corporation, Dow Chemical Company, Bostik SA, and Beardow & Adams (Adhesives) Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The global polyurethane hot melt adhesives market looks encouraging with several opportunities in disposable personal care products, packaging, bookbinding, automotive, and several other sectors. Polyurethane hot melt adhesives generally refer to solvent-free mixes, with no volatile natural compounds (VOCs) when contrasted with adhesives based on solvents. These adhesives are favored over different other adhesives for their exceptional properties, for example, dampness protection, high-temperature protection, brilliant adaptability, and their capacity to bond with an extensive variety of materials such as plastics, metals, and wood. These factors make them reasonable for a lion's share in commercial and modern applications. The significant development drivers for this market are developing interest for hot melt adhesives in end-use applications such as personal care products, automotive, and packaging industries because of quick preparation and environment-friendly characteristics. Improvement of bio-based products for helping consumers in diminishing their reliance on oil-based materials, especially in the packaging industry is a major trend pertaining to the market.

The remarkable growth of the global packaging industry has played a prominent role in the development of the global hot melt adhesives market. Additionally, speedy growth in the consumption of non-woven disposable products along with the increase in the consumption of hot melt adhesives, especially in the automotive sector, is likely to bring impetus to the overall demand over the forecast period. Moreover, growth in demand for healthcare products is further projected to bring new growth avenues in the foreseeable years. Thus, rising demand for packaged food products coupled with changing lifestyles is projected to lead to a robust growth of the global polyurethane hot melt adhesives market. Furthermore, sturdy application scope in disposables, packaging, footwear, and the automotive industry is further anticipated to drive the overall market size.

Polyurethane Hot Melt Adhesives Market Segmentation

The global polyurethane hot melt adhesives market segmentation is based on type, application, and geography.

Polyurethane Hot Melt Adhesives Market By Type

- Non-reactive

- Reactive

In terms of types, the reactive segment has seen significant growth in the polyurethane hot melt adhesives market in recent years. Reactive hot melt adhesives (RHMAs) are a type of polyurethane hot melt adhesive that is formulated with moisture-reactive chemical groups. When exposed to moisture, these chemical groups react and crosslink, resulting in a stronger bond. One of the main drivers of the growth of the reactive segment is the increasing demand for eco-friendly and sustainable adhesives. Reactive hot melt adhesives are considered to be more environmentally friendly than solvent-based adhesives, as they do not contain harmful volatile organic compounds (VOCs) and do not require any solvents for application. Additionally, the use of RHMAs is becoming more prevalent in the automotive and construction industries due to their superior bonding properties and resistance to extreme temperatures and weather conditions. The growing demand for lightweight materials in these industries is also driving the demand for RHMAs, as they offer excellent bonding performance for a wide range of substrates.

Polyurethane Hot Melt Adhesives Market By Application

- Automotive

- Paper, Board, and Packaging

- Footwear

- Healthcare

- Electrical and Electronics

- Furniture (Woodworking)

- Bookbinding

- Textiles

- Others

According to the polyurethane hot melt adhesives market forecast, the automotive segment is expected to witness significant growth in the coming years. Polyurethane hot melt adhesives are widely used in the automotive industry for bonding various components, such as interior trim, exterior trim, and structural parts. One of the main drivers of the growth of the automotive segment in the polyurethane hot melt adhesives market is the increasing demand for lightweight materials. The use of lightweight materials, such as aluminum and composites, is becoming more prevalent in the automotive industry due to the need for fuel-efficient vehicles. Polyurethane hot melt adhesives offer excellent bonding performance for these materials, enabling the production of lighter and more fuel-efficient vehicles. Additionally, the shift towards electric vehicles is also expected to drive the demand for polyurethane hot melt adhesives in the automotive industry.

Polyurethane Hot Melt Adhesives Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Polyurethane Hot Melt Adhesives Market Regional Analysis

Asia-Pacific is dominating the polyurethane hot melt adhesives market due to several factors, including the presence of several end-use industries, such as automotive, construction, packaging, and textiles, and the increasing demand for lightweight materials in these industries. The growing population and rapid industrialization in the region are also driving the demand for polyurethane hot melt adhesives. China is the largest market for polyurethane hot melt adhesives in Asia-Pacific, accounting for the largest share of the market. The country has a strong manufacturing industry, and the demand for polyurethane hot melt adhesives is driven by the automotive and construction industries. The increasing adoption of electric vehicles in China is also expected to create new opportunities for the polyurethane hot melt adhesives market growth.

Moreover, India is also a significant market for polyurethane hot melt adhesives, driven by the growing demand from end-use industries and the increasing adoption of lightweight materials. The Indian government's initiatives to promote domestic manufacturing and the growing trend of automation in the manufacturing sector are also expected to drive the country growth.

Polyurethane Hot Melt Adhesives Market Player

Some of the top polyurethane hot melt adhesives market companies offered in the professional report include Henkel AG & Co. KGaA, H.B. Fuller Company, Arkema S.A., Ashland Global Holdings Inc., 3M Company, Sika AG, Huntsman Corporation, Jowat SE, Avery Dennison Corporation, Dow Chemical Company, Bostik SA, and Beardow & Adams (Adhesives) Ltd.

Frequently Asked Questions

What was the market size of the global polyurethane hot melt adhesives in 2022?

The market size of polyurethane hot melt adhesives was USD 7.0 Billion in 2022.

What is the CAGR of the global polyurethane hot melt adhesives market from 2023 to 2032?

The CAGR of polyurethane hot melt adhesives is 5.1% during the analysis period of 2023 to 2032.

Which are the key players in the polyurethane hot melt adhesives market?

The key players operating in the global market are including Henkel AG & Co. KGaA, H.B. Fuller Company, Arkema S.A., Ashland Global Holdings Inc., 3M Company, Sika AG, Huntsman Corporation, Jowat SE, Avery Dennison Corporation, Dow Chemical Company, Bostik SA, and Beardow & Adams (Adhesives) Ltd.

Which region dominated the global polyurethane hot melt adhesives market share?

Asia-Pacific held the dominating position in polyurethane hot melt adhesives industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of polyurethane hot melt adhesives during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global polyurethane hot melt adhesives industry?

The current trends and dynamics in the polyurethane hot melt adhesives industry include growing adoption of lightweight materials in the automotive and construction industries.

Which application held the maximum share in 2022?

The electrical and electronics application held the maximum share of the polyurethane hot melt adhesives industry.