Polypropylene Homopolymer Market | Acumen Research and Consulting

Polypropylene Homopolymer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

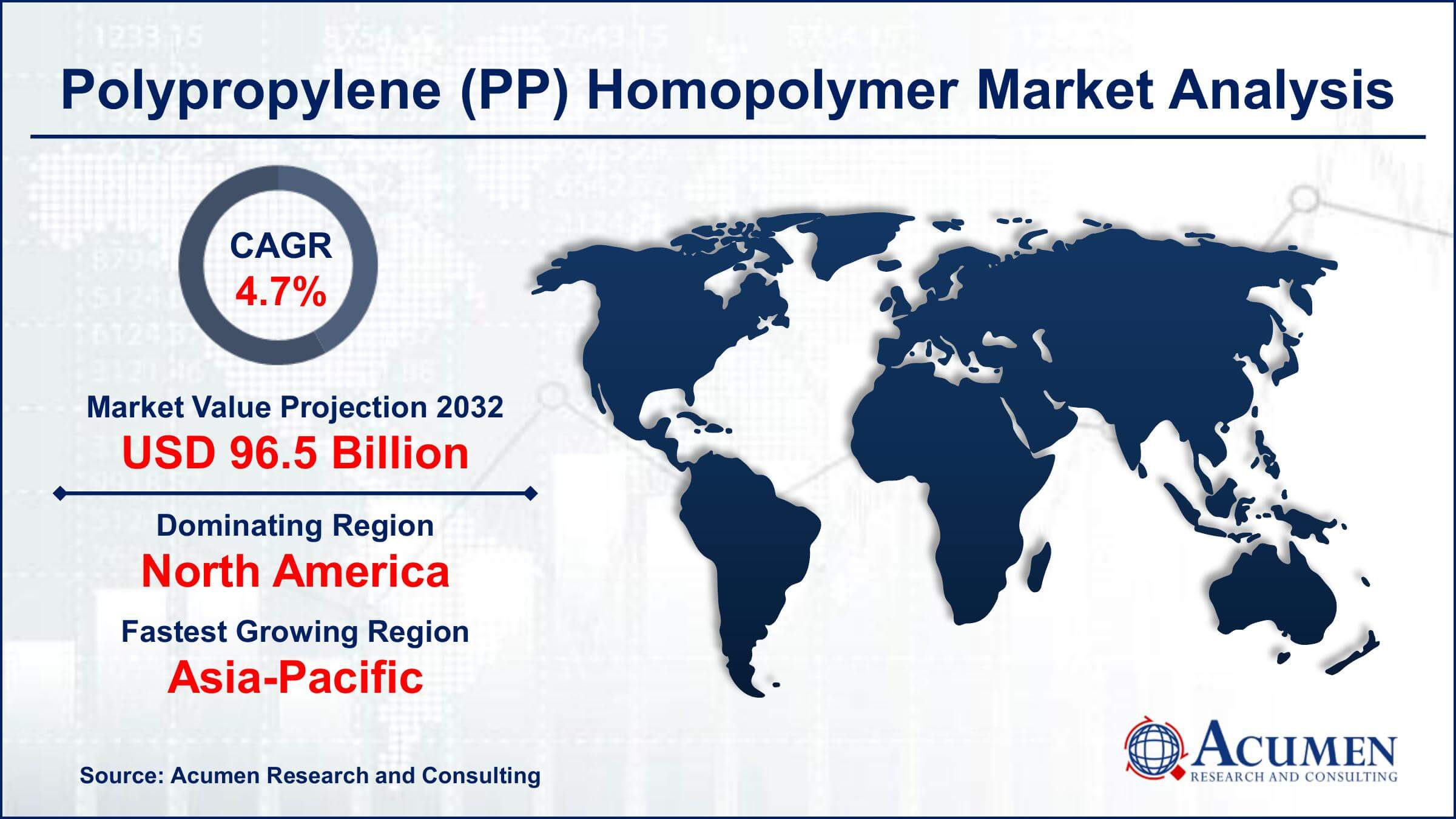

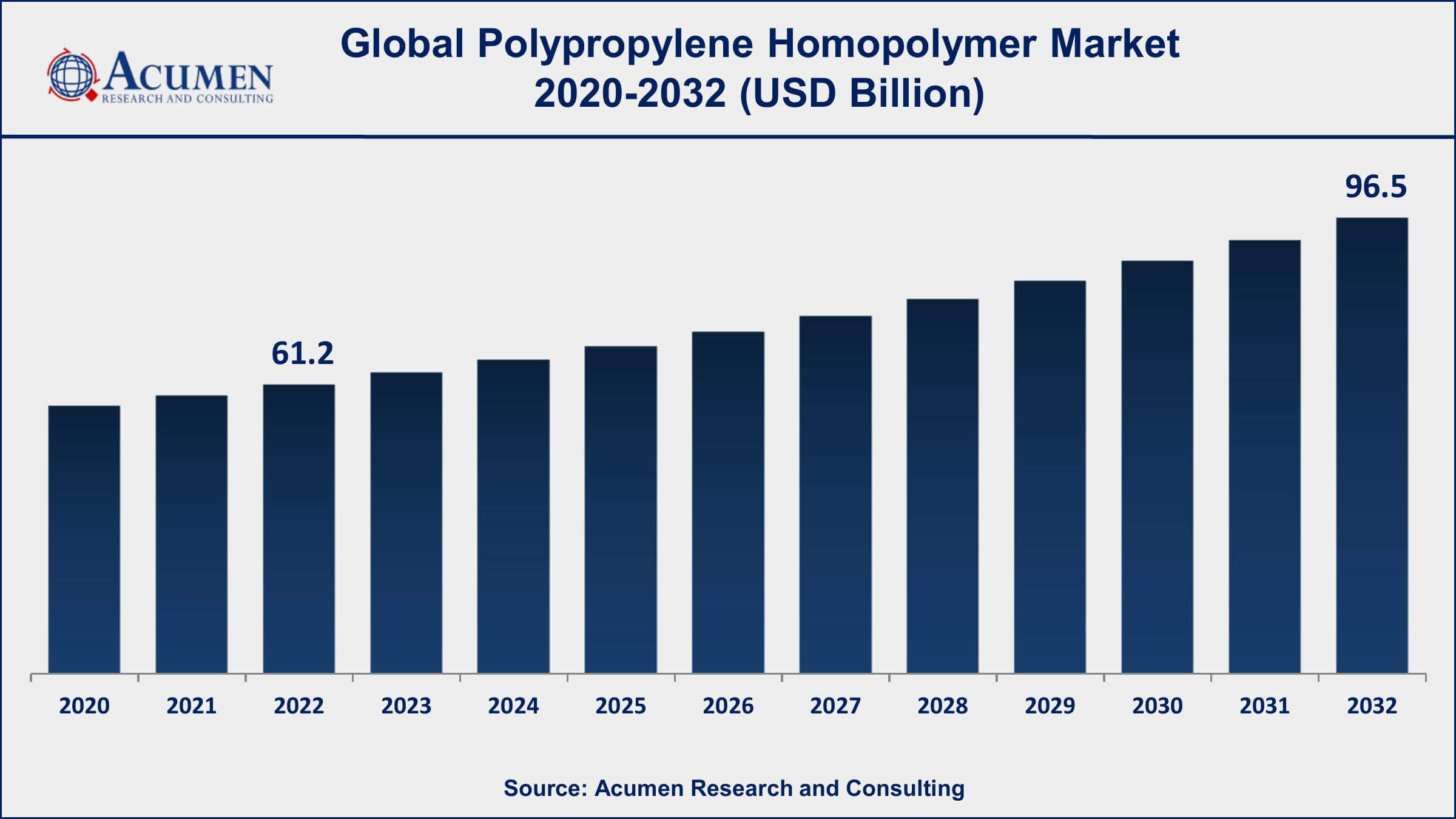

The Global Polypropylene (PP) Homopolymer Market Size accounted for USD 61.2 Billion in 2022 and is projected to achieve a market size of USD 96.5 Billion by 2032 growing at a CAGR of 4.7% from 2023 to 2032.

Polypropylene Homopolymer Market Key Highlights

- Global polypropylene homopolymer market revenue is expected to increase by USD 96.5 Billion by 2032, with a 4.7% CAGR from 2023 to 2032

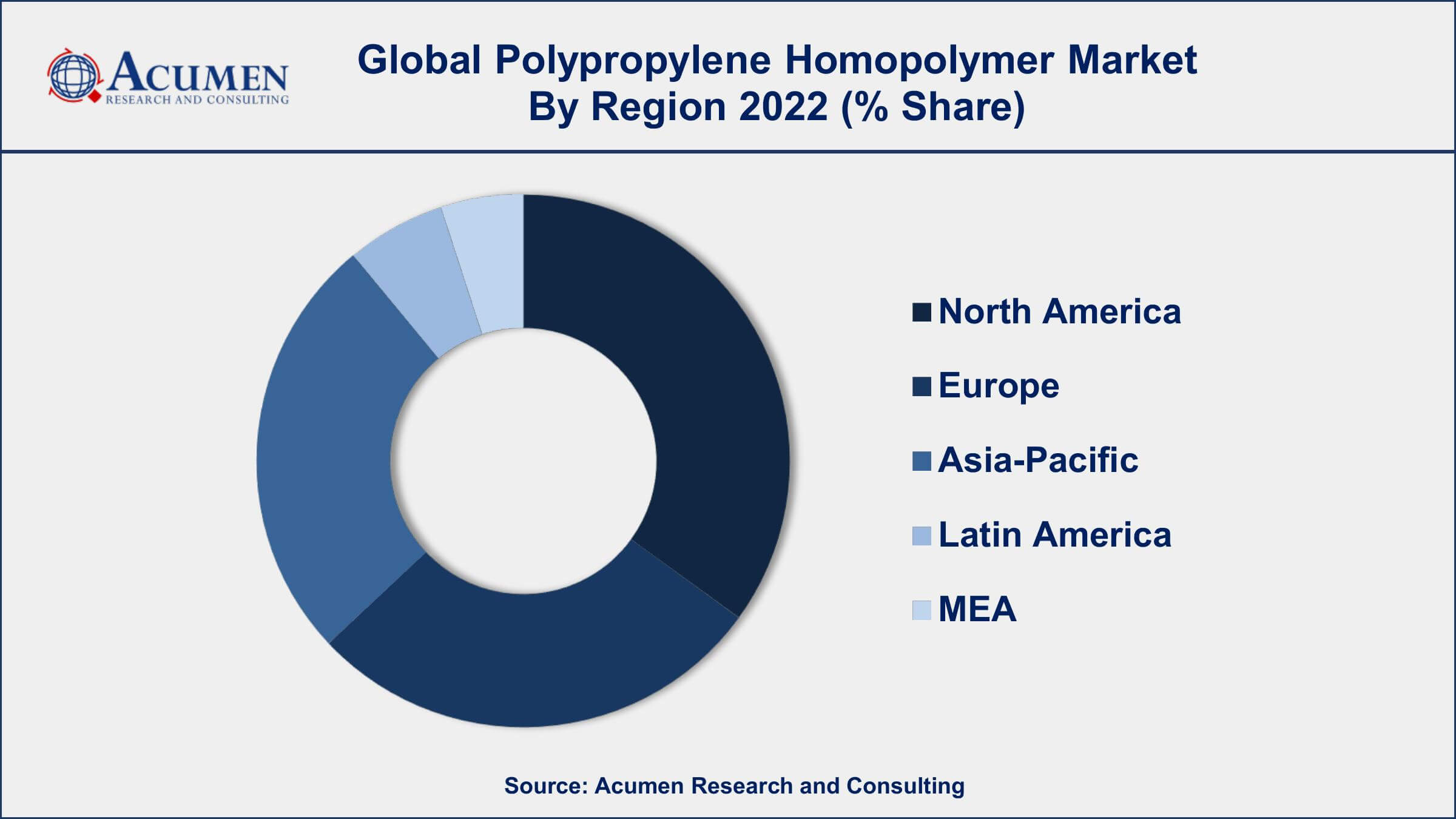

- North America region led with more than 33% of polypropylene homopolymer market share in 2022

- According to the NBS, China is the world's largest producer of PP, with the total production of PP homopolymer reaching 22.6 million metric tons in 2020

- According to a research study, the PP homopolymer market is projected to hold 7-9% of the market share in the overall polymer industry

- By end use, the packaging sub-segment gathered more than 35% share in 2022

- Increasing adoption of renewable energy and energy storage solutions, drives the polypropylene homopolymer market value

Polypropylene homopolymer is a type of thermoplastic polymer that is produced through the polymerization of propylene. It is a versatile material with a wide range of applications due to its high strength, durability, and resistance to heat and chemicals. Polypropylene homopolymer is commonly used in the manufacturing of various products, including packaging materials, automotive components, consumer goods, and medical devices.

The market for polypropylene homopolymers has been growing steadily over the past few years, driven by increasing demand from various end-use industries. The rise in consumer awareness regarding sustainable packaging solutions has led to an increase in demand for polypropylene homopolymer-based products, as it is a highly recyclable materials. The growing automotive industry and rising demand for lightweight and high-performance materials have also contributed to the polypropylene homopolymer market growth. The increasing adoption of polypropylene homopolymers in the medical industry due to their high chemical resistance and low toxicity is also expected to contribute to the growth of the market in the coming years.

Global Polypropylene Homopolymer Market Trends

Market Drivers

- Increasing demand for sustainable packaging solutions

- Growing automotive industry and demand for lightweight and high-performance materials

- Rising demand for consumer goods and appliances

- Increasing demand from the medical industry

- Growing construction industry

Market Restraints

- Fluctuations in raw material prices

- Stringent regulations related to the use of plastics

Market Opportunities

- Growing demand for 3D printing applications

- Development of bio-based polypropylene homopolymer

Polypropylene Homopolymer Market Report Coverage

| Market | Polypropylene Homopolymer Market |

| Polypropylene Homopolymer Market Size 2022 | USD 61.2 Billion |

| Polypropylene Homopolymer Market Forecast 2032 | USD 96.5 Billion |

| Polypropylene Homopolymer Market CAGR During 2023 - 2032 | 4.7% |

| Polypropylene Homopolymer Market Analysis Period | 2020 - 2032 |

| Polypropylene Homopolymer Market Base Year | 2022 |

| Polypropylene Homopolymer Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Processing Technology, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | LyondellBasell Industries N.V., Braskem S.A., SABIC, Total Petrochemicals & Refining USA, Inc., ExxonMobil Chemical, Sinopec Corporation, Reliance Industries Limited, Formosa Plastics Corporation, INEOS Group Holdings S.A., PetroChina Company Limited, Mitsui Chemicals, Inc., and Sumitomo Chemical Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Polypropylene Homopolymer Market Dynamics

Polypropylene (PP) homopolymer, also known as homo polypropylene, is broadly utilized in plastic processing for the manufacture of several products in automotive, household, electronics, packaging, electrical, medical, and personal care applications. PP homopolymer furnishes an excellent strength-to-weight ratio and offers robust resistance to chemical and weldability. On account of its huge application areas, polypropylene homopolymer is considered to be a huge volume commodity across several end-use industries.

Increasing demand for PP homopolymers, especially in the bundling and packaging industry, is a major aspect driving the growth of the global PP homopolymer market value. Several characteristic properties such as robust chemical resistance and high physical strength make polypropylene homopolymer an excellent choice for a wide range of packaging areas. Owing to the growth of e-commerce as well as the retail sector, the demand for high-tech packaging is surging, which in turn is projected to bolster the overall demand for PP homopolymers, globally. In addition to this, to comply with several government and environmental norms, various automobile manufacturers across the globe are focusing on reducing carbon emissions and thus, PP homopolymer is playing a major role in the automotive application. Utilization of PP homopolymer in the automotive sector results in lightweight vehicles, which further helps in improving fuel efficiency. However, automotive manufacturers are switching towards the use of aluminum and PP copolymer since aluminum and PP copolymer offer relatively better durability and toughness when compared to PP homopolymer which is a major factor anticipated to hinder the market growth.

Polypropylene Homopolymer Market Segmentation

The global polypropylene homopolymer market segmentation is based on processing technology, end use, and geography.

Polypropylene Homopolymer Market By Processing Technology

- Injection Molding

- Blow Molding

- Film

- Fiber

- Sheet Extrusion

- Others

In terms of processing technology, the injection molding segment has seen significant growth in the polypropylene homopolymer market in recent years. Injection molding is a process in which molten plastic material is injected into a mold, where it cools and solidifies to form a desired shape. Polypropylene homopolymer is widely used in injection molding applications due to its high stiffness, impact resistance, and ability to withstand high temperatures. The injection molding segment is expected to grow at a significant rate in the coming years, driven by increasing demand from various end-use industries such as packaging, automotive, and consumer goods. The rising demand for lightweight and high-performance materials in the automotive industry is expected to boost the demand for polypropylene homopolymers in injection molding applications. Moreover, the growing demand for sustainable packaging solutions is also expected to drive the growth of the injection molding segment of the PP homopolymer market.

Polypropylene Homopolymer Market By End Use

- Packaging

- Building and Construction

- Electrical & Electronics

- Automotive

- Textile

- Others

According to the polypropylene homopolymer market forecast, the packaging segment is expected to witness significant growth in the coming years. Polypropylene homopolymer is widely used in the manufacturing of various types of packaging materials, such as bottles, containers, caps and closures, and flexible packaging films. Polypropylene homopolymer-based packaging materials are preferred due to their high strength, durability, and ability to withstand high temperatures. The packaging segment is expected to grow at a significant rate in the coming years, driven by the increasing demand for sustainable packaging solutions. The rise in consumer awareness regarding the impact of plastic waste on the environment has led to a shift towards more eco-friendly packaging materials. Moreover, the growing demand for packaged food and beverages, pharmaceuticals, and personal care products is also expected to drive the growth of the packaging segment.

Polypropylene Homopolymer Market Regional Outlook

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Polypropylene Homopolymer Market Regional Analysis

North America is one of the major regions in the global polypropylene homopolymer market. The region is dominating the market due to the presence of a well-established industrial base and a highly developed infrastructure. The growing demand for polypropylene homopolymer-based products from various end-use industries, such as packaging, automotive, and consumer goods, is expected to drive the growth of the market in North America. Moreover, the increasing demand for sustainable packaging solutions is also expected to boost the demand for polypropylene homopolymers in the region. North America has witnessed a rise in consumer awareness regarding the impact of plastic waste on the environment, which has led to a shift towards more eco-friendly packaging solutions. Polypropylene homopolymer-based packaging materials are highly recyclable, making them an attractive option for environmentally conscious consumers.

Polypropylene Homopolymer Market Player

Some of the top polypropylene homopolymer market companies offered in the professional report include LyondellBasell Industries N.V., Braskem S.A., SABIC, Total Petrochemicals & Refining USA, Inc., ExxonMobil Chemical, Sinopec Corporation, Reliance Industries Limited, Formosa Plastics Corporation, INEOS Group Holdings S.A., PetroChina Company Limited, Mitsui Chemicals, Inc., and Sumitomo Chemical Co., Ltd.

Frequently Asked Questions

What was the market size of the global polypropylene homopolymer in 2022?

The market size of PP homopolymer was USD 61.2 Billion in 2022.

What is the CAGR of the global polypropylene homopolymer market from 2023 to 2032?

The CAGR of polypropylene homopolymer is 4.7% during the analysis period of 2023 to 2032.

Which are the key players in the polypropylene homopolymer market?

The key players operating in the global market are including LyondellBasell Industries N.V., Braskem S.A., SABIC, Total Petrochemicals & Refining USA, Inc., ExxonMobil Chemical, Sinopec Corporation, Reliance Industries Limited, Formosa Plastics Corporation, INEOS Group Holdings S.A., PetroChina Company Limited, Mitsui Chemicals, Inc., and Sumitomo Chemical Co., Ltd.

Which region dominated the global PP homopolymer market share?

North America held the dominating position in polypropylene homopolymer industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of polypropylene homopolymer during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global polypropylene homopolymer industry?

The current trends and dynamics in the polypropylene homopolymer industry include increasing demand for sustainable packaging solutions, and growing automotive industry.

Which processing technology held the maximum share in 2022?

The injection molding processing technology held the maximum share of the polypropylene homopolymer industry.