Polypropylene Compounds Market | Acumen Research and Consulting

Polypropylene Compounds Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

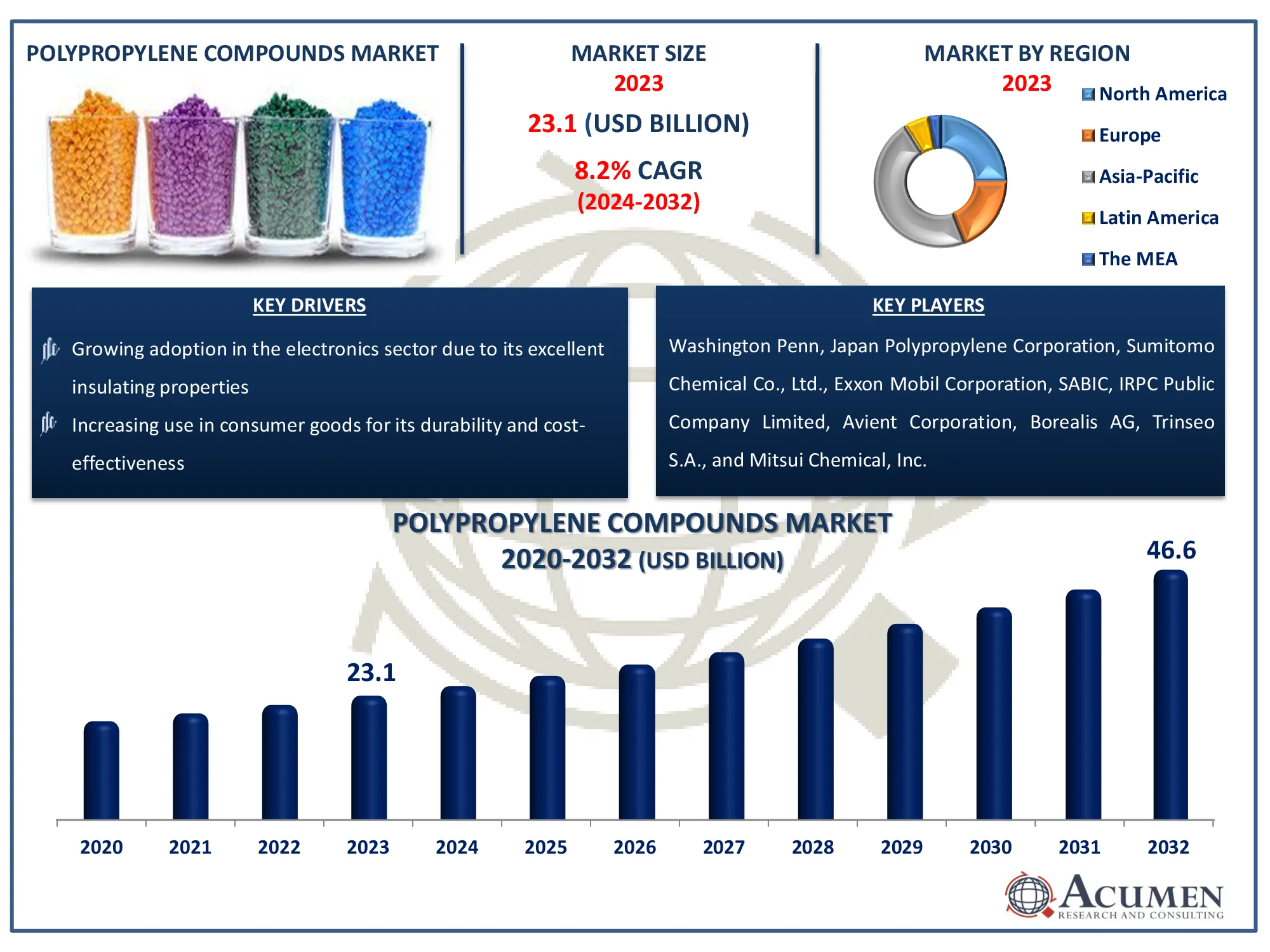

The Global Polypropylene Compounds Market Size accounted for USD 23.1 Billion in 2023 and is estimated to achieve a market size of USD 46.6 Billion by 2032 growing at a CAGR of 8.2% from 2024 to 2032

Polypropylene Compounds Market Highlights

- Global polypropylene compounds market revenue is poised to garner USD 46.6 billion by 2032 with a CAGR of 8.2% from 2024 to 2032

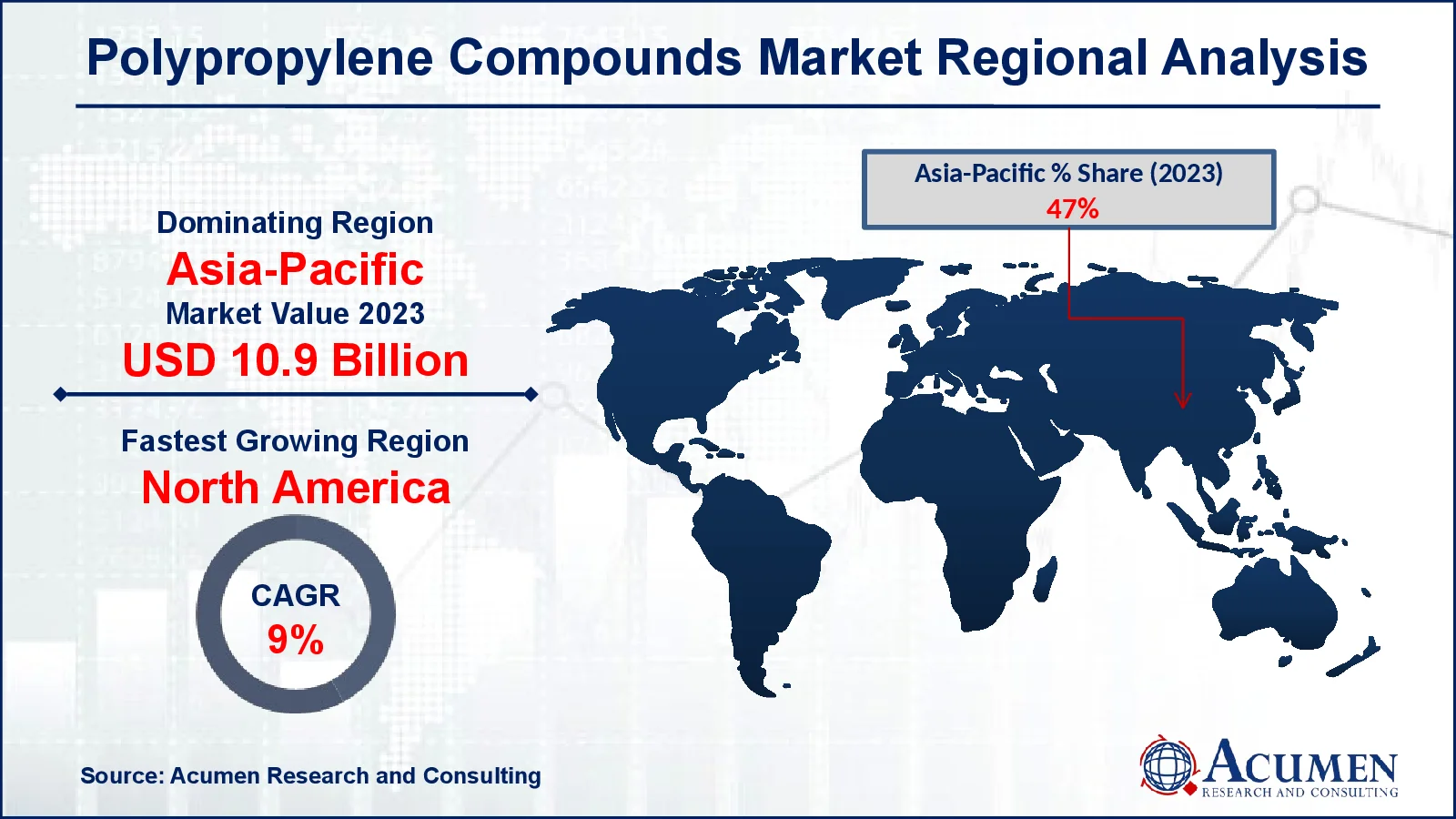

- Asia-Pacific polypropylene compounds market value occupied around USD 10.9 billion in 2023

- North America polypropylene compounds market growth will record a CAGR of more than 9% from 2024 to 2032

- Among application, the mineral filled PP sub-segment generated more than USD 10.4 billion revenue in 2023

- Based on end-user, the automotive sub-segment generated around 58% market share in 2023

- Emerging markets have a growing demand for sophisticated materials is a popular polypropylene compounds market trend that fuels the industry demand

Polypropylene compounds are synthetic materials created by combining polypropylene resin with a variety of additives, fillers, and reinforcements to improve their qualities for particular purposes. These compounds can be tailored to improve mechanical strength, impact resistance, thermal stability, and chemical resistance, making them suitable for usage in a variety of industries. Glass fibers, minerals, elastomers, and colorants are examples of commonly used additives. Polypropylene compounds are frequently utilized in automobile parts, consumer goods, packaging, and electronics because of their lightweight, durability, and low cost. They have several advantages, including ease of processing, recyclability, and a balance of rigidity and elasticity. Polypropylene compounds' customization capacity enables manufacturers to meet the individual performance needs of diverse products, contributing to their increasing demand in a variety of industrial sectors.

Global Polypropylene Compounds Market Dynamics

Market Drivers

- Rising demand for lightweight materials in automotive manufacturing

- Increasing use in consumer goods for its durability and cost-effectiveness

- The packaging sector is expanding and focusing on sustainable materials

- Growing adoption in the electronics sector due to its excellent insulating properties

Market Restraints

- Raw material prices fluctuate, affecting production costs

- Environmental issues about plastic waste and recyclability

- Alternative materials such as polyethylene and PVC provide a competitive threat

Market Opportunities

- Developed eco-friendly, bio-based polypropylene compounds

- Increasing usage in medical gadgets and healthcare items

- Expanding construction uses

Polypropylene Compounds Market Report Coverage

| Market | Polypropylene Compounds Market |

| Polypropylene Compounds Market Size 2022 |

USD 23.1 Billion |

| Polypropylene Compounds Market Forecast 2032 | USD 46.6 Billion |

| Polypropylene Compounds Market CAGR During 2023 - 2032 | 8.2% |

| Polypropylene Compounds Market Analysis Period | 2020 - 2032 |

| Polypropylene Compounds Market Base Year |

2022 |

| Polypropylene Compounds Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Washington Penn, Japan Polypropylene Corporation, Sumitomo Chemical Co., Ltd., Exxon Mobil Corporation, SABIC, IRPC Public Company Limited, Avient Corporation, Borealis AG, Trinseo S.A., and Mitsui Chemical, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Polypropylene Compounds Market Insights

The environmental impact and recyclability of plastic waste are significant impediments to the market for polypropylene compounds. While polypropylene is flexible and long-lasting, it does have disposal difficulties. The accumulation of polypropylene garbage in landfills, as well as the challenges of recycling this material, generate environmental concerns. These difficulties have fueled government pressure and customer expectations for more ecologically friendly methods, altering market dynamics. Manufacturers are under growing pressure to address environmental concerns by developing recycling technology and implementing sustainable industrial practices.

Because of the increased emphasis on lightweight materials, the automotive industry is a major consumer of PP compounds market. Automobile manufacturers are working to lower vehicle weight in order to improve fuel efficiency and emissions while adhering to strict environmental regulations. Polypropylene compounds are lightweight yet sturdy, making them excellent for usage in vehicle components such as dashboards, bumpers, and interior panels. They help make vehicles lighter while preserving safety and efficacy. As the automotive sector works to make cars greener and more efficient, demand for polypropylene compounds is likely to increase, resulting in quicker polypropylene (PP) compounds market growth.

The environmental impact of plastic waste and its recyclability are important barriers to the market for polypropylene compounds. Although polypropylene is flexible and long-lasting, it presents disposal issues. The accumulation of polypropylene waste in landfills, as well as the difficulties of recycling this material, raises environmental issues. These issues have fueled government demands and customer expectations for more environmentally responsible techniques, influencing industry trends. Manufacturers face increasing pressure to address environmental concerns by developing recycling technology and using sustainable production practices.

Polypropylene Compounds Market Segmentation

The worldwide market for polypropylene compounds is split based on product, application, end-user, and geography.

Polypropylene (PP) Compounds Market By Product

- Mineral Filled PP

- Talc filled

- Compounded TPO

- Glass Reinforced

- Compounded TPV

- Others

According to polypropylene compounds industry analysis, mineral-filled PP composite goods are predicted to develop from 2024 to 2032. Minerals are used in polypropylene composites to improve warmth bending and unbending qualities. The most frequent minerals found in polypropylene composites are talc, mica, silica, glass beads, and calcium. The increased temperature stability and mechanical toughness enable its widespread use in a few applications. For example, automotive, electrical, and electronic. TPO is an acronym for polypropylene, polyethylene, and EPDM elastic compounds. TPOs are handled using infusion molding and blow molding. They have unique characteristics, such as reduced thickness and great protection from influence and concoction. These features make them ideal for applications such as automotive parts, which require greater sturdiness and hardness than ordinary polymers.

Polypropylene (PP) Compounds Market By Application

- Fiber

- Film & sheet

- Raffia

- Others

The film and sheet segment accounts for the majority of the polypropylene compounds business. This is due mostly to the material's adaptability and desirable properties, such as durability, flexibility, and resistance to moisture and chemicals. Polypropylene films and sheets find use in a variety of industries, including packaging, agriculture, and construction. They are commonly used in flexible food packaging, agricultural films to protect crops, and construction sheets for a variety of uses. The demand for lightweight, strong, and cost-effective materials in various industries has driven the expansion of the film and sheet category, which is now the market leader.

Polypropylene (PP) Compounds Market By End-User

- Automotive

- Interior

- Exterior

- Under the Hood Components

- Building & Construction

- Electrical & Electronics

- Textiles

- Others

The automobile segment dominates the polypropylene compounds market. This supremacy is due to the material's lightweight nature and high strength-to-weight ratio, which contribute to increased fuel efficiency and lower emissions in cars. Polypropylene compounds are widely used in vehicle parts such as dashboards, bumpers, and interior panels because of their durability, low cost, and ability to tolerate a wide range of weather conditions. As automobile manufacturers focus more on decreasing vehicle weight to fulfill severe regulatory criteria and improve performance, the demand for polypropylene compounds in this sector grows. This tendency has made the automobile industry the main end-user in the polypropylene compounds market.

Polypropylene Compounds Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Polypropylene Compounds Market Regional Analysis

Asia-Pacific dominates the polypropylene compounds market because to its strong industrial base and high demand for polypropylene in industries such as automotive, construction, and packaging. Countries like China and India are important producers and users of polypropylene compounds, thanks to rising urbanization, growing automotive sectors, and expanding infrastructure projects. The region's enormous population and expanding industrial activity contribute greatly to its leading market position.

In contrast, North America is predicted to be the fastest-growing area in the polypropylene compounds market forecast period. This rise is being driven by technological advancements and rising demand for novel and high-performance materials. The United States and Canada are investing in new vehicle technology and sustainable materials, hence increasing the use of polypropylene compounds. Furthermore, North America's emphasis on decreasing vehicle weight and increasing energy efficiency is consistent with the benefits of polypropylene, boosting its adoption. As North America's industries change and accept new technology, the polypropylene compounds market is expected to rise rapidly.

Polypropylene Compounds Market Players

Some of the top polypropylene compounds companies offered in our report includes Washington Penn, Japan Polypropylene Corporation, Sumitomo Chemical Co., Ltd., Exxon Mobil Corporation, SABIC, IRPC Public Company Limited, Avient Corporation, Borealis AG, Trinseo S.A., and Mitsui Chemical, Inc.

Frequently Asked Questions

How big is the polypropylene compounds market?

The polypropylene compounds market size was valued at USD 23.1 billion in 2023.

What is the CAGR of the global polypropylene compounds market from 2024 to 2032?

The CAGR of polypropylene compounds is 8.2% during the analysis period of 2024 to 2032.

Which are the key players in the polypropylene compounds market?

The key players operating in the global market are including Washington Penn, Japan Polypropylene Corporation, Sumitomo Chemical Co., Ltd., Exxon Mobil Corporation, SABIC, IRPC Public Company Limited, Avient Corporation, Borealis AG, Trinseo S.A., and Mitsui Chemical, Inc.

Which region dominated the global polypropylene compounds market share?

Asia-Pacific held the dominating position in polypropylene compounds industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of polypropylene compounds during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Polypropylene Compounds industry?

The current trends and dynamics in the polypropylene compounds industry include rising demand for lightweight materials in automotive manufacturing, increasing use in consumer goods for its durability and cost-effectiveness, and growing adoption in the electronics sector due to its excellent insulating properties.

Which application held the notable share in 2023?

The film & sheet application held the notable share of the polypropylene compounds industry.