Polyolefin Catalyst Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Polyolefin Catalyst Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

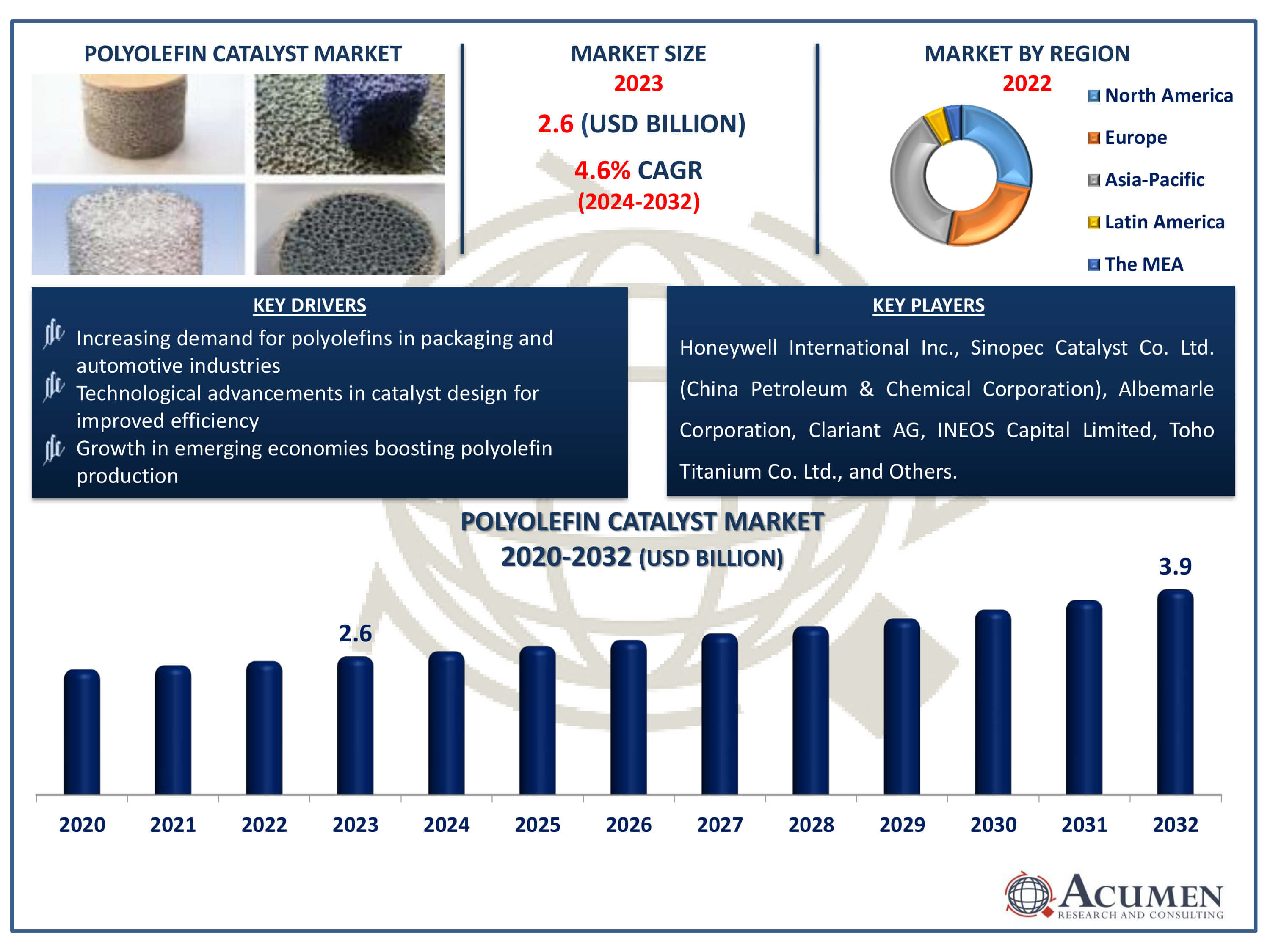

The Polyolefin Catalyst Market Size accounted for USD 2.6 Billion in 2023 and is estimated to achieve a market size of USD 3.9 Billion by 2032 growing at a CAGR of 4.6% from 2024 to 2032.

Polyolefin Catalyst Market Highlights

- Global polyolefin catalyst market revenue is poised to garner USD 3.9 billion by 2032 with a CAGR of 4.6% from 2024 to 2032

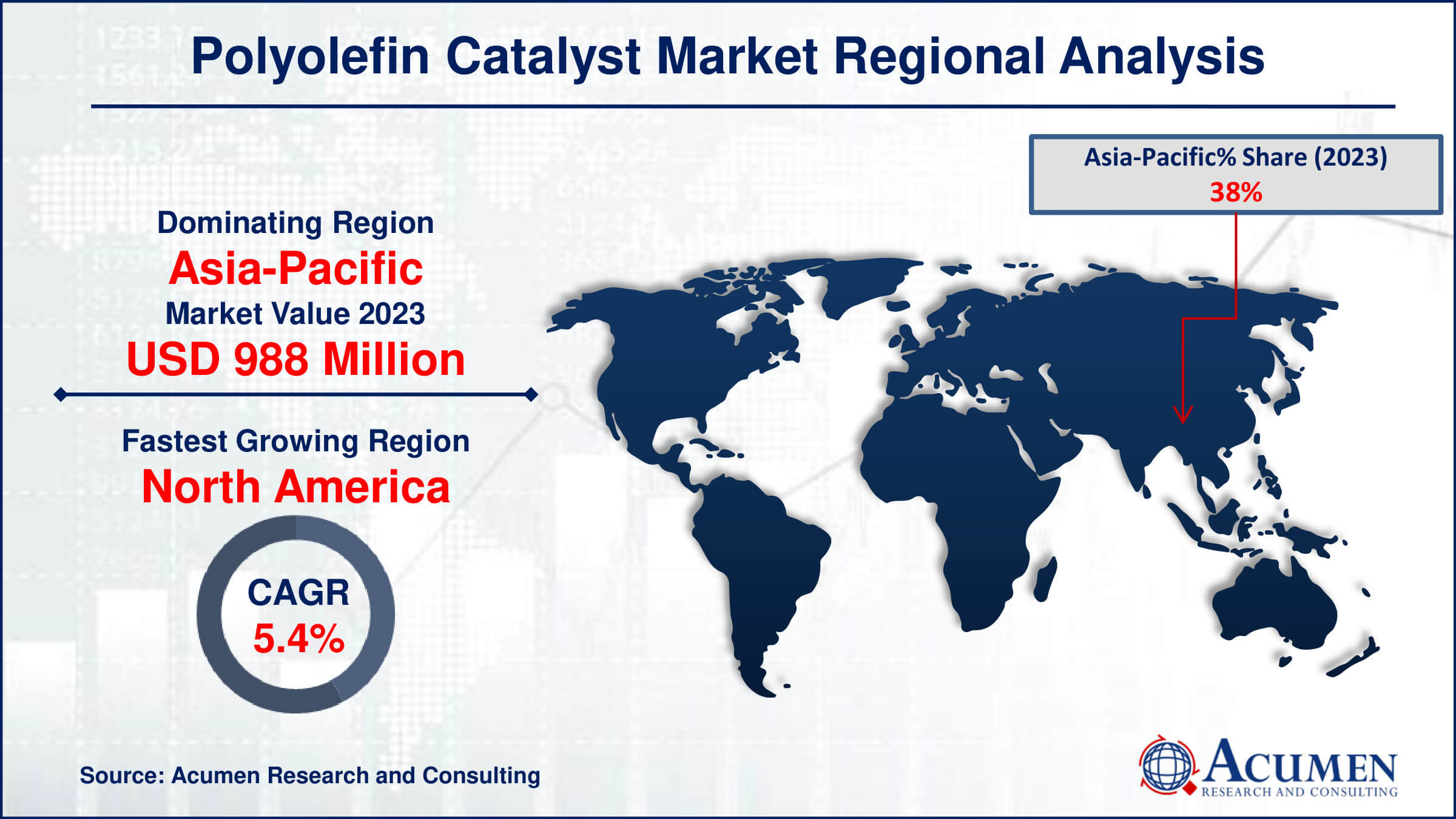

- Asia-Pacific polyolefin catalyst market value occupied around USD 988 million in 2023

- North America polyolefin catalyst market growth will record a CAGR of more than 5.4% from 2024 to 2032

- Among classification, the HDPE sub-segment generated 35% of the market share in 2023

- Based on catalyst, the ziegler natta sub-segment generated 60% of market share in 2023

- Increasing adoption of metallocene catalysts for precise control over polymer structure in polyolefin production is the polyolefin catalyst market trend that fuels the industry demand

A polyolefin catalyst is a key component in the production of polyolefin polymers like polyethylene and polypropylene, essential materials in industries ranging from packaging to automotive manufacturing. These catalysts, such as Ziegler-Natta and metallocene types, enable precise control over polymer structure and properties, influencing characteristics like strength, flexibility, and thermal stability. They play a crucial role in enhancing product performance and durability across various applications. Polyolefin catalysts also contribute to sustainability efforts by enabling the development of lightweight materials that reduce energy consumption and packaging waste. Moreover, they support advancements in recycling technologies by influencing the design and recyclability of plastic products. Overall, polyolefin catalysts are integral to modern industrial processes, driving innovation in materials science and promoting environmental responsibility through improved efficiency and recyclability.

Global Polyolefin Catalyst Market Dynamics

Market Drivers

- Increasing demand for polyolefins in packaging and automotive industries

- Technological advancements in catalyst design for improved efficiency

- Growth in emerging economies boosting polyolefin production

Market Restraints

- Volatility in raw material prices affecting production costs

- Environmental concerns and regulations on plastic usage

- High initial investment and R&D costs

Market Opportunities

- Development of sustainable and eco-friendly catalyst solutions

- Expansion of bio-based polyolefin production

- Rising applications in medical and healthcare sectors

Polyolefin Catalyst Market Report Coverage

| Market | Polyolefin Catalyst Market |

| Polyolefin Catalyst Market Size 2022 | USD 2.6 Billion |

| Polyolefin Catalyst Market Forecast 2032 | USD 3.9 Billion |

| Polyolefin Catalyst Market CAGR During 2023 - 2032 | 4.6% |

| Polyolefin Catalyst Market Analysis Period | 2020 - 2032 |

| Polyolefin Catalyst Market Base Year |

2022 |

| Polyolefin Catalyst Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Sinopec Catalyst Co. Ltd. (China Petroleum & Chemical Corporation), Albemarle Corporation, Clariant AG, INEOS Capital Limited, Toho Titanium Co. Ltd., Japan Polypropylene Corporation, Mitsubishi Chemical Corporation, Mitsui Chemicals Inc., Nova Chemicals Corporation, W. R. Grace and Company, Zeochem AG, AND LyondellBasell Industries N.V. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Polyolefin Catalyst Market Insights

The rising demand for polyolefins, particularly in the packaging and automotive industries, is significantly driving the growth of the polyolefin catalyst market. In packaging, polyolefins are prized for their durability, flexibility, and cost-effectiveness, leading to their widespread use in various applications such as films, containers, and bags. For instance, in 2023, Nova Chemicals Corporation and Pregis teamed up to create advanced sustainable packaging solutions tailored for food applications, including stand-up pouches (SUPs), fitmented pouches, and lay-flat bags. Similarly, the automotive industry leverages polyolefins for their lightweight and high-performance characteristics, which contribute to fuel efficiency and overall vehicle performance. As these industries expand and innovate, the need for advanced polyolefin catalysts to enhance polymer properties and production efficiency intensifies. Consequently, the polyolefin catalyst market is experiencing robust growth, fueled by technological advancements and increasing industry demands.

The polyolefin catalyst market faces significant challenges due to growing environmental concerns and stringent regulations on plastic usage. For instance, according to U.S. Department of Interior, Secretary's Order 3407 (SO 3407), issued on June 8, 2022, aims to minimize the procurement, sale, and distribution of single-use plastic items and packaging. As awareness of plastic pollution and its impact on ecosystems increases, governments and organizations worldwide are implementing stricter policies to reduce plastic production and consumption. This shift toward sustainable practices pressures industries to find eco-friendly alternatives, affecting the demand for traditional polyolefin products.

The increasing applications in the medical and healthcare sectors present a significant growth opportunity for the polyolefin catalyst market. Polyolefins, such as polyethylene and polypropylene, are essential materials in producing medical devices, packaging, and personal protective equipment due to their versatility, durability, and biocompatibility. The demand for these materials has surged with advancements in medical technology and the expansion of healthcare infrastructure. Additionally, the need for high-quality, sterilizable, and safe medical products drives the innovation and adoption of specialized polyolefin catalysts. Consequently, this sector's growth fuels the polyolefin catalyst market, enhancing its development and market potential.

Polyolefin Catalyst Market Segmentation

The worldwide market for polyolefin catalyst is split based on classification, type, application, and geography.

Polyolefin Catalyst Classifications

- Polypropylene

- LLDPE

- HDPE

According to the polyolefin catalyst industry analysis, high-density polyethylene (HDPE) holds a dominant position in the market due to its widespread applications and favorable properties. Catalysts tailored for HDPE production are crucial in enhancing polymer properties such as stiffness, strength, and environmental resistance. The market's growth is driven by increasing demand across sectors like packaging, automotive, and construction. Innovations in catalyst technology have enabled efficient and cost-effective production of HDPE, further bolstering its market presence. As environmental concerns rise, catalysts that support sustainable manufacturing practices are becoming increasingly pivotal in shaping the future of HDPE production.

Polyolefin Catalyst Types

- Ziegler Natta

- Single-site Catalyst

- Chromium

The ziegler natta segment is the largest catalyst category in the polyolefin catalyst market and it is expected to increase over the industry, due to its ability to precisely control polymerization processes, resulting in highly efficient production of polyethylene and polypropylene. Its versatility allows the creation of polymers with varied properties, enhancing material performance for diverse applications. The catalyst's cost-effectiveness and scalability make it a preferred choice for large-scale manufacturing. Additionally, ongoing advancements in ziegler-natta catalyst formulations continue to improve polymer quality and production efficiency. This dominance is supported by its long-established industrial use and extensive research backing.

Polyolefin Catalyst Applications

- Injection Molding

- Blow Molding

- Film

- Fiber

- Others

According to the polyolefin catalyst industry analysis, injection molding plays a dominant role in the market due to its efficiency and versatility in manufacturing plastic components. Polyolefin catalysts are crucial in this process as they enable the production of high-quality, consistent products with desirable mechanical properties. The catalysts facilitate precise control over the polymerization process, ensuring uniformity and reducing waste. Industries such as automotive, packaging, and consumer goods rely heavily on injection molding of polyolefins for cost-effective production of intricate parts and products. This method's widespread adoption underscores its pivotal role in driving innovation and growth within the polyolefin industry.

Polyolefin Catalyst Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Polyolefin Catalyst Market Regional Analysis

For several reasons, the Asia-Pacific region dominates the polyolefin catalyst market due to its significant manufacturing base, especially in countries like China and India, which are major producers of polyolefins. For instance, in July 2023, LyondellBasell Industries N.V. revealed that PetroChina Guangxi Petrochemical Company will adopt LyondellBasell's polyethylene technology, including its advanced high-pressure Lupotech process technology, at their plant in Qinzhou City, Guangxi, China. The region's growing industrialization and urbanization drive demand for polyolefins in various applications such as packaging, automotive, and construction. Additionally, investments in research and development and the availability of low-cost raw materials bolster market growth. The presence of major global players and favorable government policies also contribute to the region's leadership in the market. Overall, these factors collectively ensure Asia-Pacific's dominance in the polyolefin catalyst sector.

North America has emerged as the fastest-growing region in the polyolefin catalyst market due to robust industrialization and expanding manufacturing sectors. Increasing investments in research and development, coupled with technological advancements, have bolstered demand for efficient catalysts. For instance, in September 2023, ExxonMobil revealed the development of a novel polyolefin catalyst that offers greater sustainability compared to conventional catalysts. Moreover, favorable regulatory frameworks and initiatives promoting sustainability have further propelled market growth in the region.

Polyolefin Catalyst Market Players

Some of the top polyolefin catalyst companies offered in our report include BASF SE, Sinopec Catalyst Co. Ltd. (China Petroleum & Chemical Corporation), Albemarle Corporation, Clariant AG, INEOS Capital Limited, Toho Titanium Co. Ltd., Japan Polypropylene Corporation, Mitsubishi Chemical Corporation, Mitsui Chemicals Inc., Nova Chemicals Corporation, W. R. Grace and Company, Zeochem AG, AND LyondellBasell Industries N.V.

Frequently Asked Questions

How big is the polyolefin catalyst market?

The polyolefin catalyst market size was valued at USD 2.6 billion in 2023.

What is the CAGR of the global polyolefin catalyst market from 2024 to 2032?

The CAGR of polyolefin catalyst is 4.6% during the analysis period of 2024 to 2032.

Which are the key players in the polyolefin catalyst market?

The key players operating in the global market are including BASF SE, Sinopec Catalyst Co. Ltd. (China Petroleum & Chemical Corporation), Albemarle Corporation, Clariant AG, INEOS Capital Limited, Toho Titanium Co. Ltd., Japan Polypropylene Corporation, Mitsubishi Chemical Corporation, Mitsui Chemicals Inc., Nova Chemicals Corporation, W. R. Grace and Company, Zeochem AG, and LyondellBasell Industries N.V.

Which region dominated the global polyolefin catalyst market share?

Asia-Pacific held the dominating position in polyolefin catalyst industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of polyolefin catalyst during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global polyolefin catalyst industry?

The current trends and dynamics in the polyolefin catalyst industry include increasing demand for polyolefins in packaging and automotive industries, technological advancements in catalyst design for improved efficiency, and growth in emerging economies boosting polyolefin production.

Which classification held the maximum share in 2023?

The HDPE held the maximum share of the polyolefin catalyst industry.