Polycaprolactone Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Polycaprolactone Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

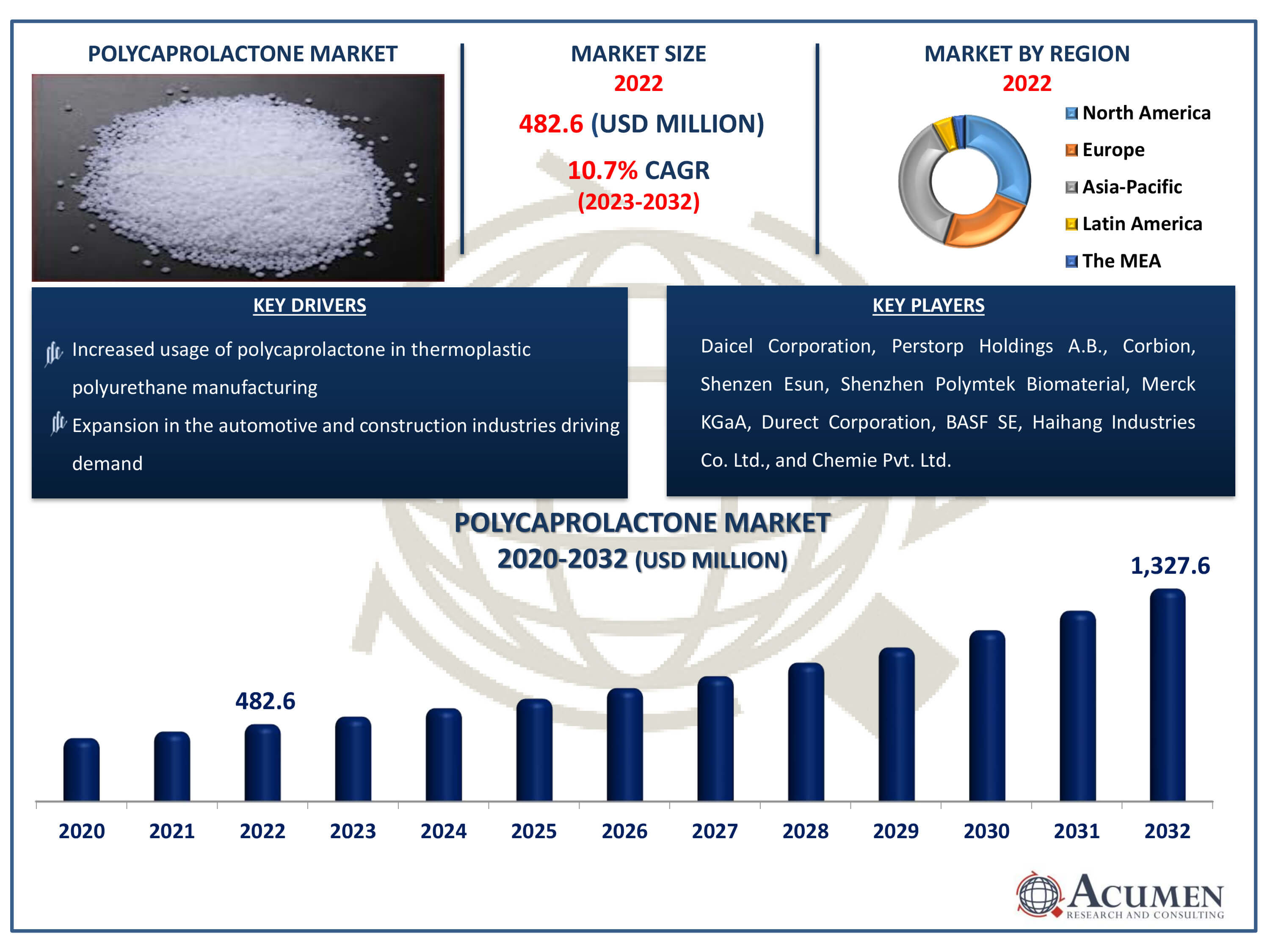

The Polycaprolactone Market Size accounted for USD 482.6 Million in 2022 and is estimated to achieve a market size of USD 1,327.6 Million by 2032 growing at a CAGR of 10.7% from 2023 to 2032.

Polycaprolactone Market Highlights

- Global polycaprolactone market revenue is poised to garner USD 1,327.6 million by 2032 with a CAGR of 10.7% from 2023 to 2032

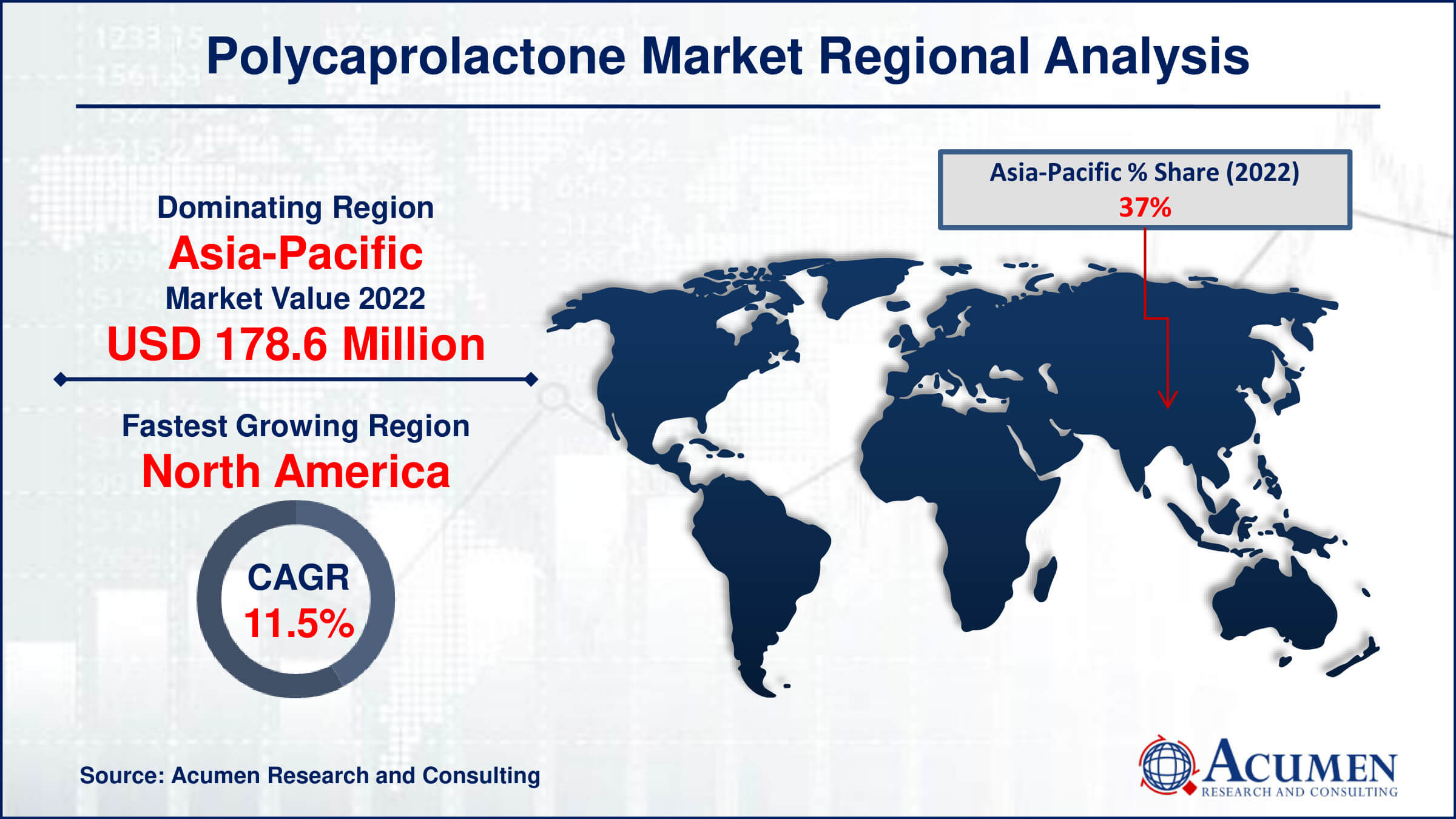

- Asia-Pacific polycaprolactone market value occupied around USD 178.6 million in 2022

- North America polycaprolactone market growth will record a CAGR of more than 11.5% from 2023 to 2032

- Among Form, the pellets sub-segment generated more than USD 183.4 million revenue in 2022

- Based on application, the coating & thermoplastic polyurethane sub-segment generated around 46% share in 2022

- The expanding use of polycaprolactone in designing and prototyping systems is a popular polycaprolactone market trend that fuels the industry demand

Polycaprolactone known as PCL refers to a semi-cristalline and fossil-based biodegradable polyester; the molecular formula is theoretically expressed as c6h10o2. The molecular weight of PCL and crystallinity is assumed to be inversely proportional to each other, meaning that the crystallinity reduces as the molecular weight increases. PCL is used to produce organic polyurethane, which is more environmentally friendly. This makes it capable of melting easily, with low viscosity and biodegradability, for example, non-toxicity.

Global Polycaprolactone Market Dynamics

Market Drivers

- Growing demand for environmentally friendly polymers

- Increased usage of polycaprolactone in thermoplastic polyurethane manufacturing

- Rising adoption in healthcare applications, especially for surgical instruments

- Expansion in the automotive and construction industries driving demand

Market Restraints

- Potential challenges in meeting demand for polycaprolactone polyols in specific applications

- Limited acceptance in certain industries hindering widespread use

- Challenges related to the demand for polycaprolactone polyols in related applications

Market Opportunities

- Emerging applications like osteobotics creating new growth avenues

- Growing emphasis on biodegradable materials in various industries

- Increasing disposable income and rising vehicle sales fueling demand

Polycaprolactone Market Report Coverage

| Market | Polycaprolactone (PCL) Market |

| Polycaprolactone (PCL) Market Size 2022 | USD 482.6 Million |

| Polycaprolactone (PCL) Market Forecast 2032 | USD 1,327.6 Million |

| Polycaprolactone (PCL) Market CAGR During 2023 - 2032 | 10.7% |

| Polycaprolactone (PCL) Market Analysis Period | 2020 - 2032 |

| Polycaprolactone (PCL) Market Base Year |

2022 |

| Polycaprolactone (PCL) Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Form, By Method, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Daicel Corporation, Perstorp Holdings A.B., Corbion, Shenzen Esun, Shenzhen Polymtek Biomaterial, Merck KGaA, Durect Corporation, BASF SE, Haihang Industries Co. Ltd., and Chemie Pvt. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Polycaprolactone Market Insights

The global polycaprolactone industry is witnessing significant growth, driven by its role in manufacturing thermoplastic polyurethane a biodegradable polymer. The increasing demand for polycaprolactone in polyurethane applications, particularly in healthcare, is accelerating industry development. While the global market faced no significant threats in 2019, challenges may arise in the demand for polycaprolactone polyols, particularly in related applications. However, emerging concepts like osteobotics are expected to provide attractive growth prospects for this sector in the next five years, marking a notable recent development in the polycaprolactone industry.

The market for polycaprolactone (PCL) is propelled by the rising need for biodegradable and ecologically friendly polymers. Its demand is fueled by its use as biodegradable polyester in the production of thermoplastic polyurethane. PCL's environmentally friendly qualities attract industries seeking sustainable options, and its use as a supplement in healthcare and other applications supports market expansion.

Despite the industry's robust growth, difficulties in meeting the demand for PCL polyols in specific applications pose a noteworthy barrier. Overcoming this obstacle and ensuring steady growth requires addressing issues such as improving compatibility or meeting particular application needs.

With the advent of cutting-edge applications like osteobotics, the polycaprolactone market presents an interesting prospect. Robotics in orthopedic surgery, or osteobotics, offers a fresh way to utilize PCL. Suitable for bone-related medical technologies due to its biodegradable and adaptable properties, PCL's potential in cutting-edge technology positions the market for substantial growth. The use of PCL in innovative applications, such as osteobotics, is expected to offer new avenues for growth and profitable prospects for the polycaprolactone market as medical technology progresses.

Polycaprolactone Market Segmentation

The worldwide market for polycaprolactone is split based on form, method, application, and geography.

Polycaprolactone PCL Market By Forms

- Nanosphere

- Pellets

- Microsphere

Accordning to the polycaprolactone industry analysis, the pellets sector leads the market with the biggest share. This dominance is ascribed to PCL pellets' numerous uses and simplicity of application. Pellets are the main form of PCL and are widely used in the packaging, automotive, and healthcare industries due to their simplicity. The pellet form makes industrial processing simple and allows for smooth integration into various production processes. They are a favoured option due to their consistency and versatility, which greatly increases market demand. The significance of the Pellets category highlights the critical role this form plays in propelling Polycaprolactone's growth and maintaining its market leadership across a range of industrial applications.

Polycaprolactone PCL Market By Methods

- Polycondesation of Carboxylic Acid

- Ring Opening Polymerization

The market for polycaprolactone (PCL) is dominated by the polycondensation of carboxylic acid technique. Its efficiency and broad use in PCL manufacture are credited with its dominance. Carboxylic acid monomers react during the polycondensation process to generate the PCL polymer. This approach is favoured for PCL manufacture on an industrial scale due to its affordability, scalability, and ease of use. Because of its adaptability, PCL with a range of molecular weights can be produced to satisfy a variety of industry needs. The market-leading polycondensation of carboxylic acid technique, which provides a dependable and effective means of generating polycaprolactone for a variety of applications in many industries, is highlighted by its widespread use.

Polycaprolactone PCL Market By Applications

- Healthcare

- Coating & Thermoplastic polyurethane

- Other

In terms of polycaprolactone market analysis, the coating & thermoplastic polyurethane category is the largest. The demand for PCL in thermoplastic polyurethane formulations and its many uses are the main factors contributing to its dominance. Because it is flexible and biodegradable, PCL is a recommended option for these applications because it provides long-lasting, eco-friendly solutions. PCL is prized in the coatings industry for its capacity to improve film-forming qualities and offer a sustainable substitute. The segment's expansion is further aided by PCL's application in thermoplastic polyurethane formulations, which are renowned for their durability and flexibility. The significance of the Coating & Thermoplastic Polyurethane segment underscores the critical function of PCL in catering to the varied requirements of different sectors and propelling the broader market growth.

Polycaprolactone PCL Market By Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Polycaprolactone Market Regional Analysis

Asia-Pacific held a significant market share and is projected to continue dominating the market throughout the forecast period. This is attributed to the extensive use of thermoplastic polyurethane, particularly in key end-user industries such as construction, automotive, and packaging. The rapid urbanization and industrialization in the region drive the development of the construction industry. Moreover, the increasing disposable income contributes to heightened vehicle sales, further boosting the demand for thermoplastic polyurethane and, consequently, propelling polycaprolactone production.

Additionally, the North American market is expected to grow at a substantial compound annual growth rate (CAGR) during the polycaprolactone industry forecast period. This growth is driven by the rising demand for surgical instruments and biodegradable materials. Polycaprolactone is anticipated to find increased application in designing and prototyping systems, as well as serving as feedstock in various industries in the polycaprolactone market forecast years.

Furthermore, the automotive and construction sectors are likely to witness a surge in demand for polyurethane and thermoplastic polyurethane, further contributing to the overall growth of these markets.

Polycaprolactone Market Players

Some of the top polycaprolactone companies offered in our report include Daicel Corporation, Perstorp Holdings A.B., Corbion, Shenzen Esun, Shenzhen Polymtek Biomaterial, Merck KGaA, Durect Corporation, BASF SE, Haihang Industries Co. Ltd., and Chemie Pvt. Ltd.

Frequently Asked Questions

How big is the polycaprolactone market?

The polycaprolactone market size was valued at USD 482.6 million in 2022.

What is the CAGR of the global polycaprolactone market from 2023 to 2032?

The CAGR of polycaprolactone is 10.7% during the analysis period of 2023 to 2032.

Which are the key players in the polycaprolactone market?

The key players operating in the global market are including Daicel Corporation, Perstorp Holdings A.B., Corbion, Shenzen Esun, Shenzhen Polymtek Biomaterial, Merck KGaA, Durect Corporation, BASF SE, Haihang Industries Co. Ltd., and Chemie Pvt. Ltd.

Which region dominated the global polycaprolactone market share?

Asia-Pacific held the dominating position in polycaprolactone industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of polycaprolactone during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global polycaprolactone industry?

The current trends and dynamics in the polycaprolactone industry include growing demand for environmentally friendly polymers, increased usage of polycaprolactone in thermoplastic polyurethane manufacturing, rising adoption in healthcare applications, especially for surgical instruments, and expansion in the automotive and construction industries driving demand.

Which application held the maximum share in 2022?

The coating & thermoplastic polyurethane application held the maximum share of the polycaprolactone industry.?