Polyalkylene Glycol Base Oil Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Polyalkylene Glycol Base Oil Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

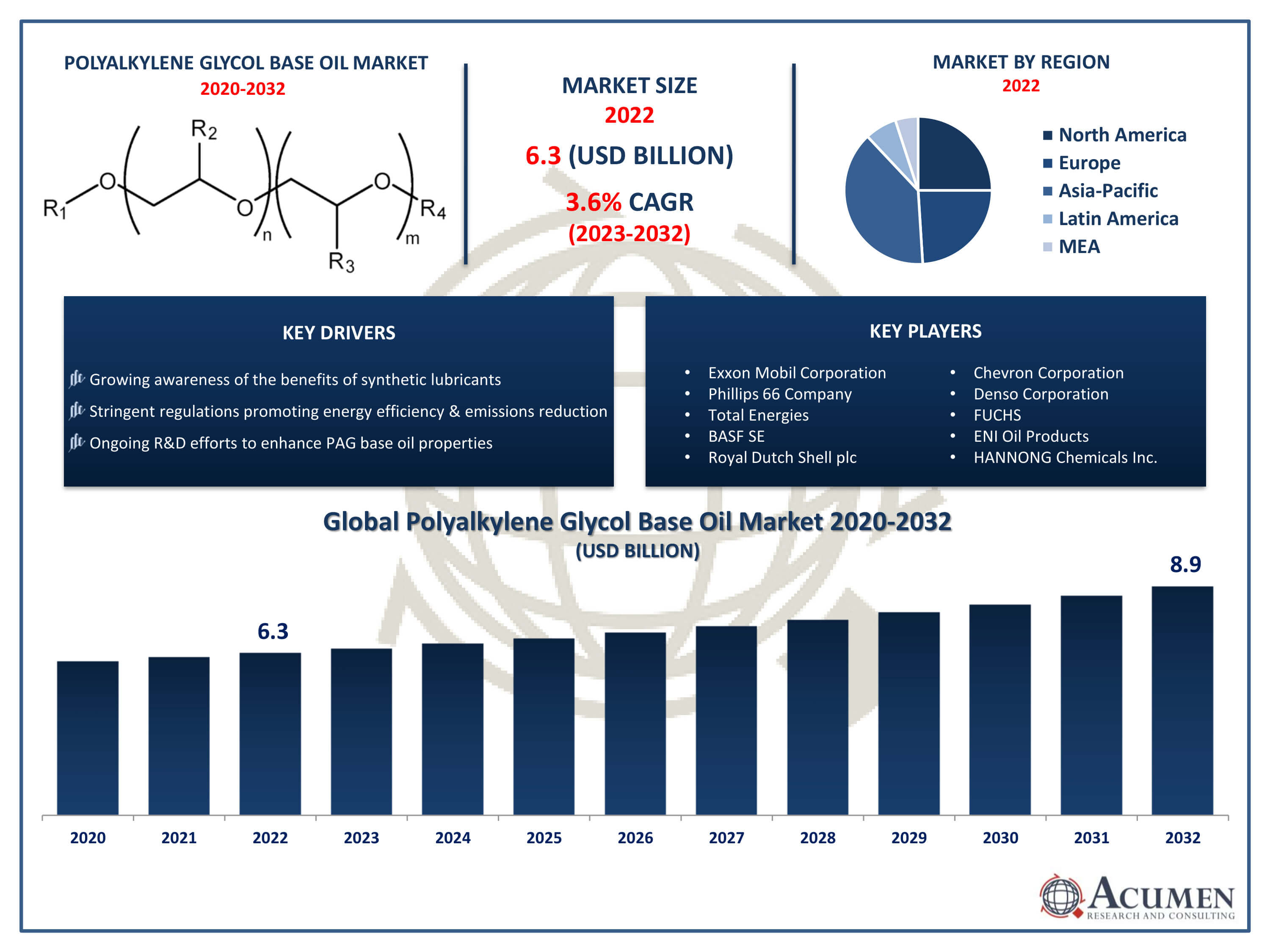

The Polyalkylene Glycol (PAG) Base Oil Market Size accounted for USD 6.3 Billion in 2022 and is projected to achieve a market size of USD 8.9 Billion by 2032 growing at a CAGR of 3.6% from 2023 to 2032.

Polyalkylene Glycol Base Oil Market Highlights

- Global polyalkylene glycol base oil market revenue is expected to increase by USD 8.9 Billion by 2032, with a 3.6% CAGR from 2023 to 2032

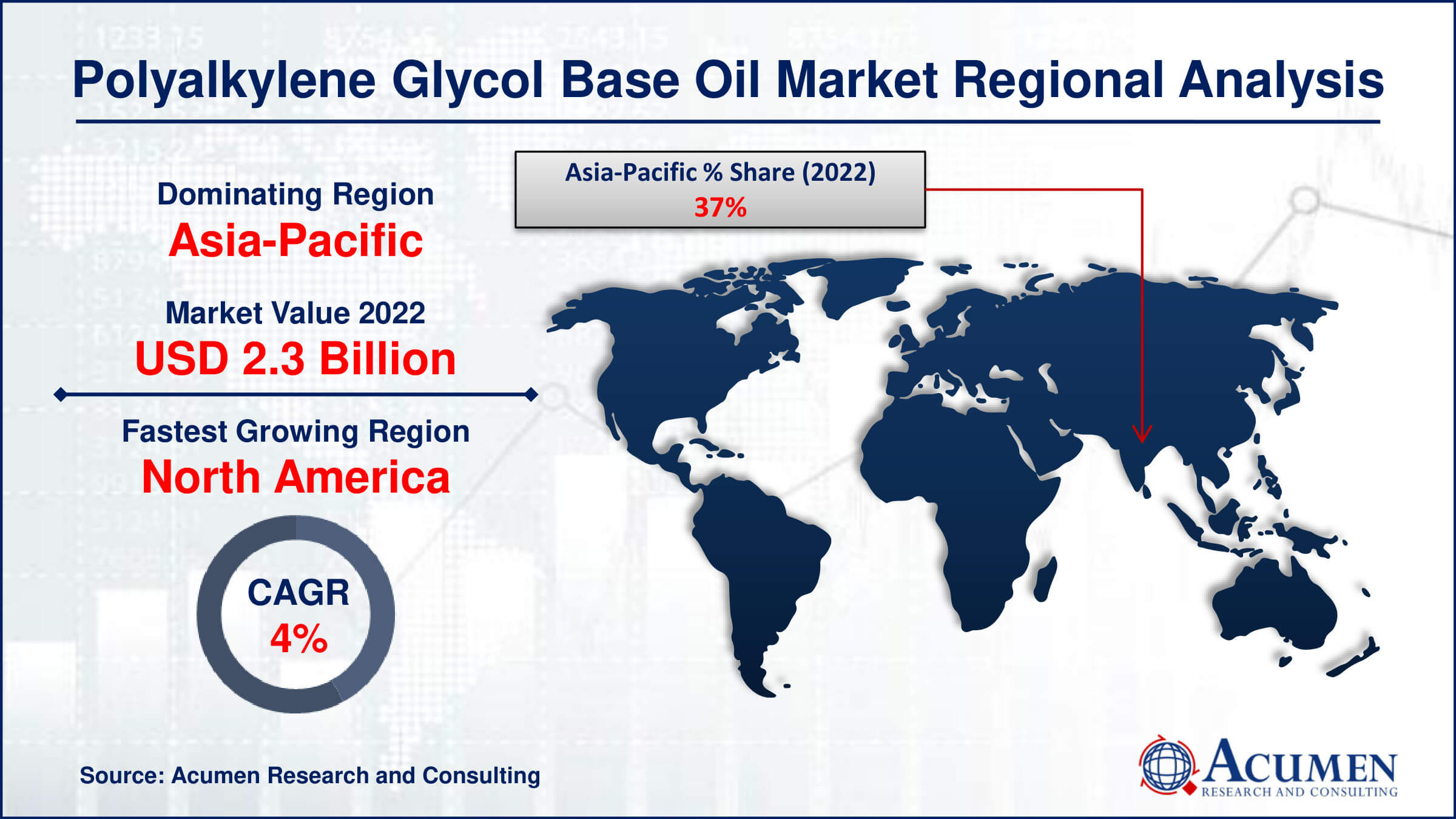

- Asia-Pacific region led with more than 37% of polyalkylene glycol base oil market share in 2022

- North America polyalkylene glycol base oil market growth will record a CAGR of more than 4.1% from 2023 to 2032

- By product, the conventional (water insoluble) segment captured more than 60% of revenue share in 2022.

- By application, the compressor oil segment is projected to expand at the fastest CAGR over the projected period

- Increasing demand for high-performance lubricants in industrial applications, drives the polyalkylene glycol base oil market value

Polyalkylene glycol (PAG) base oil is a type of synthetic lubricant base oil widely used in various industries including automotive, industrial, and aerospace. It is derived from the polymerization of alkylene oxides, typically ethylene oxide and/or propylene oxide. PAG base oils offer several advantages over conventional mineral oils, such as superior thermal and oxidative stability, high viscosity index, excellent lubricity, and low volatility. These properties make PAG base oils highly desirable for applications where extreme operating conditions, such as high temperatures and heavy loads, are encountered.

In recent years, the market for polyalkylene glycol base oil has witnessed significant growth driven by increasing demand for high-performance lubricants across diverse end-user industries. The automotive sector, in particular, has been a major contributor to the growth of PAG base oil market, owing to stringent regulations for fuel efficiency and emissions reduction. Additionally, the expanding industrial manufacturing sector, coupled with growing awareness regarding the benefits of synthetic lubricants, has further fueled the demand for PAG base oils. Moreover, ongoing advancements in technology and continuous research and development efforts aimed at enhancing the properties and performance of PAG base oils are expected to sustain the growth momentum of the market in the coming years.

Global Polyalkylene Glycol Base Oil Market Trends

Market Drivers

- Increasing demand for high-performance lubricants in industrial applications

- Stringent regulations promoting energy efficiency and emissions reduction

- Ongoing research and development efforts to enhance PAG base oil properties

- Growing awareness of the benefits of synthetic lubricants

- Expansion of end-user industries such as automotive, aerospace, and marine

Market Restraints

- High initial investment costs for transitioning to synthetic lubricants

- Limited availability of raw materials for PAG base oil production

Market Opportunities

- Increasing focus on sustainable and environmentally friendly lubricant solutions

- Technological advancements leading to improved PAG base oil formulations

Polyalkylene Glycol Base Oil Market Report Coverage

| Market | Polyalkylene Glycol Base Oil Market |

| Polyalkylene Glycol Base Oil Market Size 2022 | USD 6.3 Billion |

| Polyalkylene Glycol Base Oil Market Forecast 2032 |

USD 8.9 Billion |

| Polyalkylene Glycol Base Oil Market CAGR During 2023 - 2032 | 3.6% |

| Polyalkylene Glycol Base Oil Market Analysis Period | 2020 - 2032 |

| Polyalkylene Glycol Base Oil Market Base Year |

2022 |

| Polyalkylene Glycol Base Oil Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Exxon Mobil Corporation, Phillips 66 Company, Total Energies, BASF SE, Royal Dutch Shell plc, Chevron Corporation, Denso Corporation, FUCHS, ENI Oil Products, HANNONG Chemicals Inc., Croda International Plc, and Petronas Lubricants International. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Polyalkylene glycol (PAG) base oil is a type of synthetic lubricant base oil renowned for its exceptional thermal and oxidative stability, high viscosity index, and low volatility. It is synthesized through the polymerization of alkylene oxides, such as ethylene oxide or propylene oxide, resulting in a versatile lubricant that exhibits superior performance under extreme operating conditions. PAG base oils are characterized by their ability to maintain viscosity stability over a wide range of temperatures, making them ideal for applications where conventional mineral oils or other synthetic lubricants may fail. The applications of polyalkylene glycol base oils span various industries, including automotive, industrial machinery, aerospace, marine, and power generation. In automotive applications, PAG base oils are used in engine oils, transmission fluids, and gear oils, where they provide enhanced wear protection, improved fuel efficiency, and extended drain intervals.

The polyalkylene glycol (PAG) base oil market has witnessed significant growth in recent years and is expected to continue expanding at a robust pace. One of the primary drivers of this growth is the increasing demand for high-performance lubricants across various industries such as automotive, industrial machinery, aerospace, and marine. PAG base oils offer superior thermal and oxidative stability, as well as a high viscosity index, making them ideal for applications involving extreme operating conditions. Additionally, stringent regulations aimed at reducing emissions and improving energy efficiency have further fueled the adoption of PAG base oils, as they help enhance equipment reliability and longevity while meeting environmental standards. Moreover, ongoing research and development efforts in the lubricants sector are leading to continuous improvements in PAG base oil formulations, driving market growth. Manufacturers are investing in developing advanced PAG base oils with enhanced properties such as improved viscosity-temperature performance, better wear protection, and increased compatibility with various materials and seals.

Polyalkylene Glycol Base Oil Market Segmentation

The global polyalkylene glycol (PAG) base oil market segmentation is based on product, application, end-use, and geography.

Polyalkylene Glycol Base Oil Market By Product

- Water-soluble

- Conventional (Water Insoluble)

According to the polyalkylene glycol base oil industry analysis, the conventional (water insoluble) segment accounted for the largest market share in 2022. One significant factor is the increasing demand from industries where extreme operating conditions are common, such as heavy-duty machinery, metalworking, and automotive applications. Conventional PAG base oils offer excellent thermal and oxidative stability, as well as superior lubricity and anti-wear properties, making them well-suited for demanding industrial environments where traditional mineral oils may not suffice. Furthermore, the growth of the conventional PAG base oil segment can be attributed to ongoing advancements in formulation technologies. Manufacturers are continually innovating to enhance the performance characteristics of conventional PAG base oils, such as improving their viscosity-temperature behavior, extending drain intervals, and enhancing compatibility with various materials and seals. These advancements are driving increased adoption across a wide range of industrial applications, further fueling market growth.

Polyalkylene Glycol Base Oil Market By Application

- Hydraulic Oil

- Compressor Oil

- Gear Oil

- Greases

- Metal Working Fluids

- Others

In terms of applications, the compressor oil segment is expected to witness significant growth in the coming years. Compressors are critical components in various industries, including manufacturing, petrochemicals, and refrigeration, where they play a vital role in maintaining efficient operations. PAG-based compressor oils offer exceptional thermal stability, oxidative resistance, and anti-wear properties, making them ideal lubricants for high-pressure and high-temperature compressor systems. As industries increasingly adopt advanced compressor technologies to improve productivity and energy efficiency, the demand for high-performance compressor oils like those based on PAG is on the rise. Moreover, stringent regulations aimed at reducing greenhouse gas emissions and improving energy efficiency are driving the adoption of PAG-based compressor oils. These lubricants contribute to energy savings by reducing friction and wear within compressor systems, leading to lower operating temperatures and decreased energy consumption. Additionally, PAG compressor oils are known for their compatibility with various compressor materials and seals, helping to extend equipment life and reduce maintenance costs.

Polyalkylene Glycol Base Oil Market By End-Use

- Aerospace

- Automotive

- Marine

- HVAC & Refrigeration

- Tooling & Industrial Equipment

- Others

According to the polyalkylene glycol base oil market forecast, the automotive segment is expected to witness significant growth in the coming years. PAG-based lubricants offer superior performance characteristics compared to conventional mineral oils, making them increasingly attractive for automotive applications. These lubricants provide excellent thermal stability, oxidative resistance, and wear protection, which are essential for modern automotive engines operating under high temperatures and extreme conditions. As automakers strive to meet stringent emissions regulations and improve fuel efficiency, the demand for high-performance lubricants like PAG-based oils is on the rise. Moreover, the growing trend towards electric and hybrid vehicles is further propelling the demand for PAG-based lubricants in the automotive sector. Electric vehicles (EVs) require specialized lubricants to optimize the performance of components such as electric motors, transmissions, and power electronics. PAG-based oils are well-suited for these applications due to their compatibility with electric motor materials, excellent thermal conductivity, and low friction properties.

Polyalkylene Glycol Base Oil Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Polyalkylene Glycol Base Oil Market Regional Analysis

The Asia-Pacific region has emerged as a dominating force in the polyalkylene glycol (PAG) base oil market due to several key factors. One significant factor is the rapid industrialization and urbanization observed across countries in this region, driving demand for high-performance lubricants across various industries. Industries such as automotive manufacturing, metalworking, chemical processing, and construction are experiencing substantial growth in the Asia-Pacific region, creating a significant demand for PAG base oils to lubricate machinery and equipment operating under extreme conditions. Moreover, the growing automotive industry in countries like China, India, Japan, and South Korea has contributed significantly to the expansion of the PAG base oil market, as automakers increasingly adopt advanced lubricants to improve vehicle performance and reliability. Furthermore, the Asia-Pacific region is home to several major PAG base oil manufacturers and suppliers, further consolidating its dominance in the global market. Countries like China and India have emerged as key production hubs for synthetic lubricants, including PAG base oils, due to their abundant availability of raw materials, skilled labor force, and supportive government policies. This strong manufacturing base allows companies in the Asia-Pacific region to meet the growing demand for PAG base oils both domestically and internationally, positioning them as leading players in the global market. Additionally, the region's strategic location and well-established trade networks enable efficient distribution of PAG base oils to various end-user industries worldwide, further strengthening its dominance in the market.

Polyalkylene Glycol Base Oil Market Player

Some of the top polyalkylene glycol base oil market companies offered in the professional report include Exxon Mobil Corporation, Phillips 66 Company, Total Energies, BASF SE, Royal Dutch Shell plc, Chevron Corporation, Denso Corporation, FUCHS, ENI Oil Products, HANNONG Chemicals Inc., Croda International Plc, and Petronas Lubricants International.

Frequently Asked Questions

How big is the polyalkylene glycol base oil market?

The polyalkylene glycol base oil market size was USD 6.3 Billion in 2022.

What is the CAGR of the global polyalkylene glycol base oil market from 2023 to 2032?

The CAGR of polyalkylene glycol base oil is 3.6% during the analysis period of 2023 to 2032.

Which are the key players in the polyalkylene glycol base oil market?

The key players operating in the global market are including Exxon Mobil Corporation, Phillips 66 Company, Total Energies, BASF SE, Royal Dutch Shell plc, Chevron Corporation, Denso Corporation, FUCHS, ENI Oil Products, HANNONG Chemicals Inc., Croda International Plc, and Petronas Lubricants International.

Which region dominated the global polyalkylene glycol base oil market share?

Asia-Pacific held the dominating position in polyalkylene glycol base oil industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of polyalkylene glycol base oil during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global polyalkylene glycol base oil industry?

What are the current trends and dynamics in the global polyalkylene glycol base oil industry?

Which application held the maximum share in 2022?

The compressor oil application held the maximum share of the polyalkylene glycol base oil industry.