Plating on Plastics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Plating on Plastics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

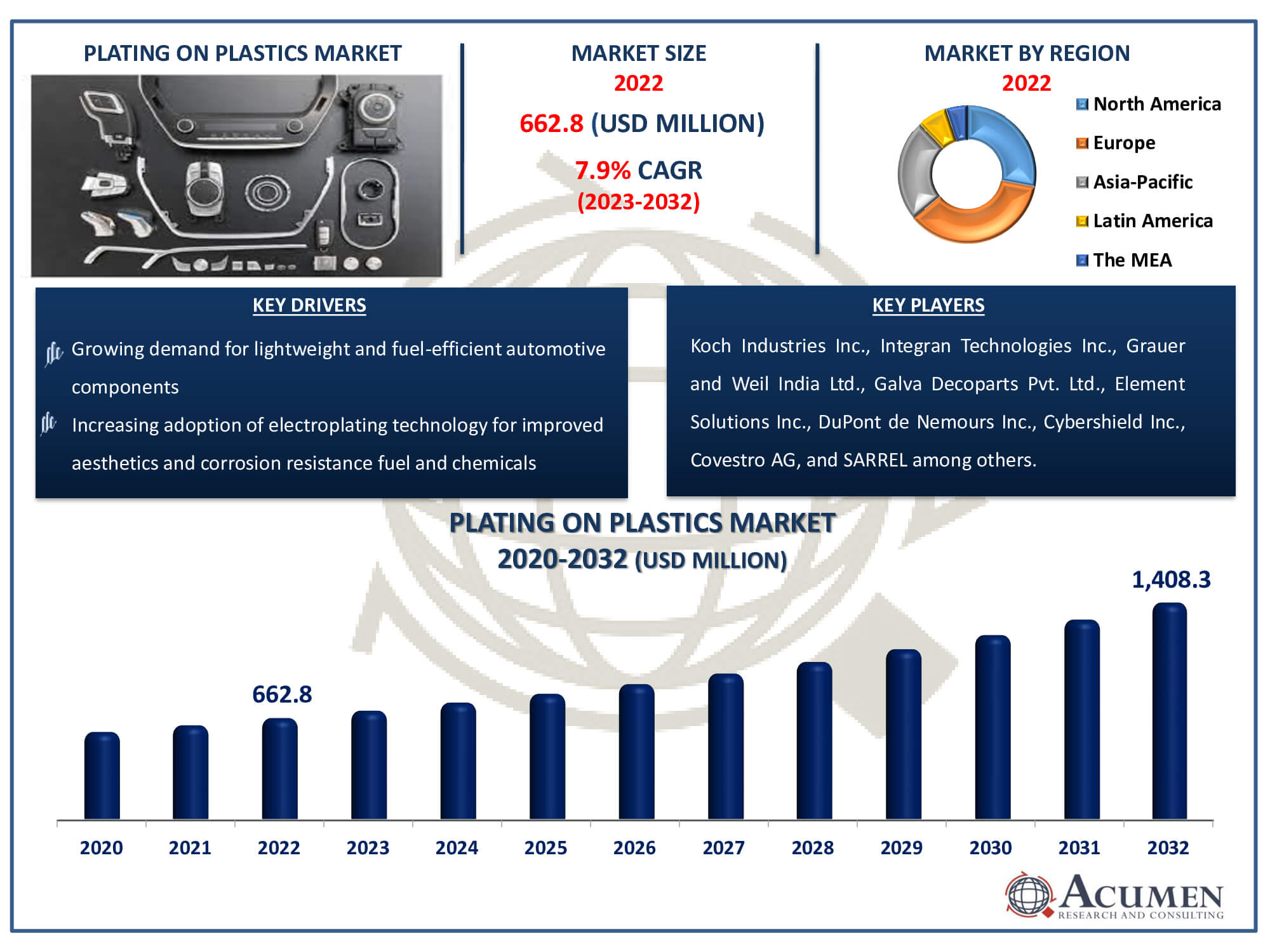

The Plating on Plastics Market Size accounted for USD 662.8 Million in 2022 and is estimated to achieve a market size of USD 1,408.3 Million by 2032 growing at a CAGR of 7.9% from 2023 to 2032.

Plating on Plastics Market Highlights

- Global plating on plastics market revenue is poised to garner USD 1,408.3 million by 2032 with a CAGR of 7.9% from 2023 to 2032

- Europe plating on plastics market value occupied around USD 238.6 Million in 2022

- Asia-Pacific plating on plastics market growth will record a CAGR of more than 8.5% from 2023 to 2032

- Among plating type, the chrome sub-segment generated noteworthy revenue in 2022

- Based on base material, the ABS sub-segment generated around 20% share in 2022

- Growth opportunities in emerging markets and the development of innovative applications is a popular plating on plastics market trend that fuels the industry demand

Plastic plating involves the use of electroplating technology to apply a metal coating to plastic surfaces. Metals like chrome, nickel, and copper are applied through this process to impart properties such as corrosion resistance, abrasion resistance, and increased hardness to the base material. Components made of plated plastic are widely utilized in the automotive industry, benefiting from their lightweight nature, durable surfaces, and attractive finishes. The market is expected to be driven by the growing demand for lightweight metal substitutes in the automotive and electronic industries. Additionally, increasing consumer awareness regarding environmental benefits, such as reduced CO2 emissions and enhanced efficiency in lightweight vehicles, is anticipated to further boost demand over the plating on plastics industry forecast period.

Global Plating on Plastics Market Dynamics

Market Drivers

- Growing demand for lightweight and fuel-efficient automotive components

- Increasing adoption of electroplating technology for improved aesthetics and corrosion resistance

- Rising environmental consciousness driving the demand for sustainable metal substitutes

- Expanding applications in electronics, appliances, and consumer goods industries

Market Restraints

- Environmental concerns related to the disposal and recycling of plated plastic components

- Stringent regulatory requirements and compliance standards impacting market entry

- Fluctuating metal prices influencing production costs

Market Opportunities

- Rise in electric vehicle production creating demand for lightweight plated plastic components

- Advancements in sustainable plating technologies offering eco-friendly solutions

- Focus on circular economy principles boosting demand for recyclable plating materials

Plating on Plastics Market Report Coverage

| Market | Plating on Plastics Market |

| Plating on Plastics Market Size 2022 | USD 662.8 Million |

| Plating on Plastics Market Forecast 2032 | USD 1,408.3 Million |

| Plating on Plastics Market CAGR During 2023 - 2032 | 7.9% |

| Plating on Plastics Market Analysis Period | 2020 - 2032 |

| Plating on Plastics Market Base Year |

2022 |

| Plating on Plastics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Plating Type, By Base Material, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled Construction & Building | Koch Industries Inc., Integran Technologies Inc., Grauer and Weil India Ltd., Galva Decoparts Pvt. Ltd., Element Solutions Inc., DuPont de Nemours Inc., Cybershield Inc., Covestro AG, SARREL, Plasman Plastics Inc., Phillips Plating Corp., MPC Plating Inc., and Leader Plating on Plastic Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Plating on Plastics Market Insights

In plumbing applications, particularly in toilets and kitchens, the demand for plastics is increasing to alleviate stress on water appliances. The demand for plastics is also on the rise for use in decorative chrome and nickel plating. However, the prohibition of chromium usage in some regions is likely to impede the growth of the plated plastics market in the coming years. Additionally, the market may face challenges in the near future due to the availability of alternatives, such as lightweight metals and composites in the automotive sector.

The industry has witnessed several technological advancements in electroplating that significantly enhance the overall quality of the finished product. To improve corrosion resistance capabilities, double-layer nickel systems have been developed, consisting of a semi-bright sub-layer with a bright nickel cover. Additionally, the introduction of the micro-discontinuous chromium system is a significant advancement, enhancing the resistance to corrosion of nickel and chromium deposits during the metallization process.

However, increasing stringency in regulatory regulations could have serious implications for overall market growth. The use of hexavalent Chromium in POPs was prohibited by the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH). Strict regulations set forth by EPA and OSHA are expected to further hinder overall growth in the years ahead.

Plating on Plastics Market Segmentation

The worldwide market for plating on plastics is split based on plating type, base material, application, and geography.

Plating on Plastics (PoP) Market by Plating Types

- Nickel

- Chrome

- Others

According to the plating on plastics industry analysis, the chrome segment expected to held the world's largest market share in the plating types for plastics in 2022. The demand for chrome plating is increasing due to its ease of cleaning and excellent surface finishing. The aesthetic appeal of chromium plating is expected to drive its demand over the plating on plastics market forecast period. Nickel represents the fast-expanding segment in the plastics market, projected to register the maximum CAGR in terms of revenues. The 'other' segment includes copper and precious metals such as gold, silver, and palladium. Gold and silver plating, despite providing superb decorative finishes and better surface qualities, face limitations in industrial use due to high costs. In chrome plating applications, ABS serves as the primary base material, holding noteworthy share of the plating market on plastics in 2022 in terms of revenues. With its cost efficiency, easy molding, high metal adhesion, and low thermal expansion factor, the ABS segment is expected to maintain an important market share over the forecast period, primarily driven by its use in the automotive industry.

Plating on Plastics (PoP) Market by Base Materials

- PEI

- PET

- PBT

- PC

- ABS

- ABS/PC

- Nylon

- Others

Among basic materials, acrylonitrile butadiene styrene (ABS) appears as the largest segment in the plating on plastics market. With maximum share of the market in terms of sales in 2022, ABS is the top option for applications involving chrome plating. Its dominance is attributed to its special qualities, which include low thermal expansion factor, good metal adhesion, ease of moulding, and cost effectiveness. Especially in the automobile sector, where its acrylonitrile-styrene matrix evenly dispersed in butadiene rubber effectively produces a smooth and consistent surface finish, ABS is used as the foundation material. Due to these attributes, the ABS segment is positioned to be a major player with a substantial market share and room to develop during the projection period.

Plating on Plastics (PoP) Market by Applications

- Automotive

- Electrical & Electronics

- Construction & Building

- Utilities

- Others

In the automotive segment, a significant market share is anticipated during the projected period, particularly in applications related to plating on plastic. Plating on plastic is predominantly utilized in the automotive industry, especially for passenger cars and commercial vehicles. The ABS/PC blend finds application in automotive components subjected to high temperatures, particularly in wheel coverings. The demand for plastics in the automobile segment is primarily driven by the pursuit of reduced weight and appealing design. Following the automotive sector, the construction and energy & electronics industry segments are expected to experience rapid expansion during the forecast period. The global market for plastics plating is poised to contribute to the growth of the worldwide electrical & electronics (E&E) industry in the near future, with applications in mobile phones, computers, laptops, and various other electronic devices. The electrical & electronics segment is anticipated to expand at a largest CAGR during the forecast period.

Plating on Plastics (PoP) Market by Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

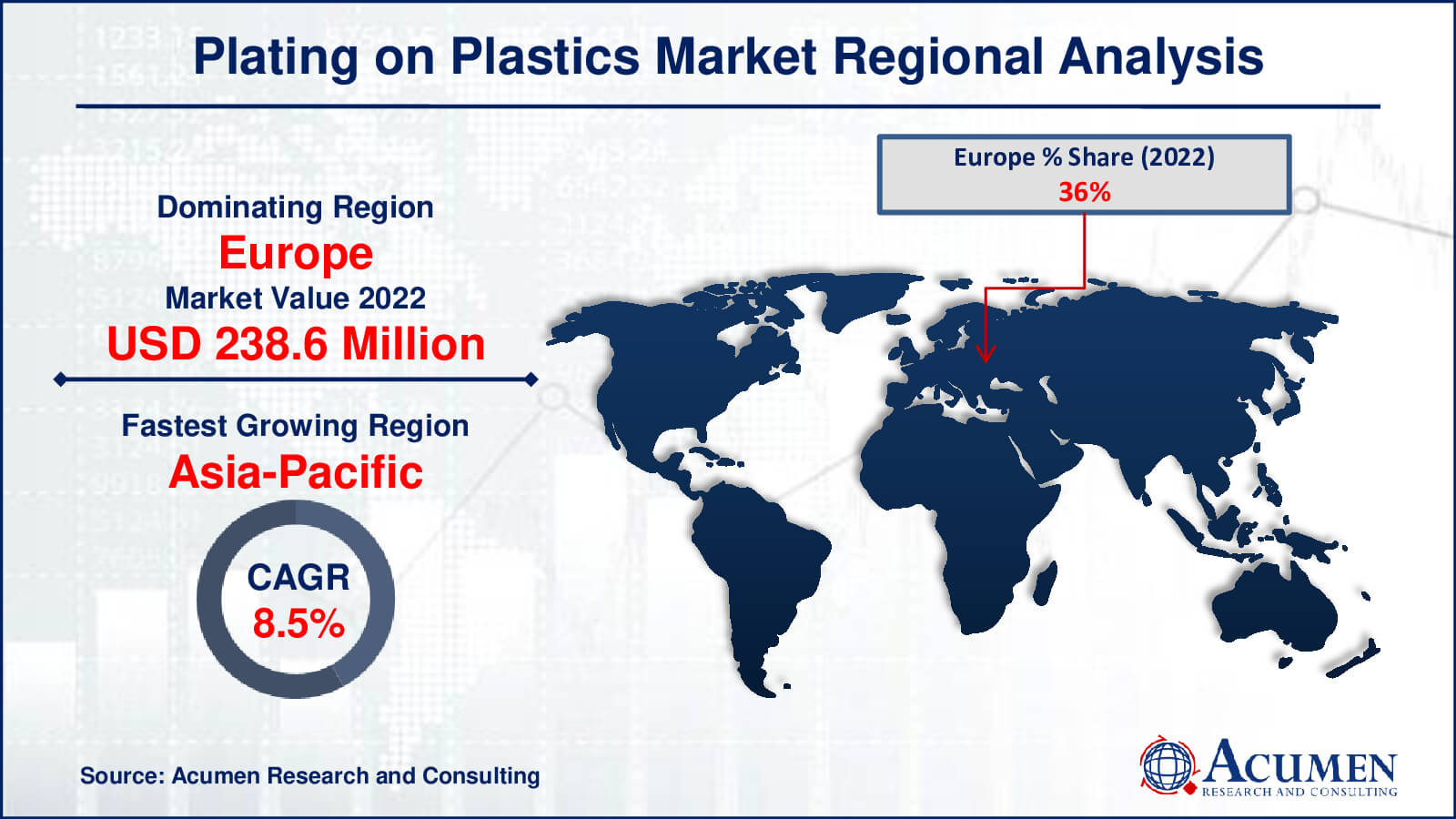

Plating on Plastics Market Regional Analysis

It is estimated that Europe will be a global market leader in terms of volume during the forecast period. The region is expected to benefit from an excellent car industry distribution network, driving market growth. The plastics marketplace in Europe is dominated by several global and regional players, including BMW and Ferrari.

In North America, the plating on plastics market is mature, and the region is anticipated to experience slow expansion during the forecast period. However, North America is expected to offer lucrative opportunities for the plastics plating market.

Asia-Pacific is a fast-growing plastics market, driven by the shift from automotive production to developing economies like China and India. The increase in plastics consumption in the building and infrastructure industries, for applications such as electric wire coverings and building decorative materials, propels the construction market segment in the region. Consequently, the plating on plastics market in Asia Pacific is expected to thrive during the forecast period.

In Latin America, demand for plastics is expected to increase modestly in the forecast period, with Brazil emerging as a new player in the automotive industry. Moreover, the growth in Latin American construction and infrastructure operations fuels the region's markets.

Plating on Plastics Market Players

Some of the top plating on plastics companies offered in our report includes Koch Industries Inc., Integran Technologies Inc., Grauer and Weil India Ltd., Galva Decoparts Pvt. Ltd., Element Solutions Inc., DuPont de Nemours Inc., Cybershield Inc., Covestro AG, SARREL, Plasman Plastics Inc., Phillips Plating Corp., MPC Plating Inc., and Leader Plating on Plastic Ltd.

Frequently Asked Questions

How big is the plating on plastics market?

The plating on plastics market size was valued at USD 662.8 million in 2022.

What is the CAGR of the global plating on plastics market from 2023 to 2032?

The CAGR of plating on plastics is 7.9% during the analysis period of 2023 to 2032.

Which are the key players in the plating on plastics market?

The key players operating in the global market are including Koch Industries Inc., Integran Technologies Inc., Grauer and Weil India Ltd., Galva Decoparts Pvt. Ltd., Element Solutions Inc., DuPont de Nemours Inc., Cybershield Inc., Covestro AG, SARREL, Plasman Plastics Inc., Phillips Plating Corp., MPC Plating Inc., and Leader Plating on Plastic Ltd.

Which region dominated the global plating on plastics market share?

Europe held the dominating position in plating on plastics industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of plating on plastics during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global plating on plastics industry?

The current trends and dynamics in the plating on plastics industry include growing demand for lightweight and fuel-efficient automotive components, increasing adoption of electroplating technology for improved aesthetics and corrosion resistance, rising environmental consciousness driving the demand for sustainable metal substitutes, and expanding applications in electronics, appliances, and consumer goods industries.

Which application held the maximum share in 2022?

The automotive application held the maximum share of the plating on plastics industry.