Plastic Surgery Instruments Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Plastic Surgery Instruments Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

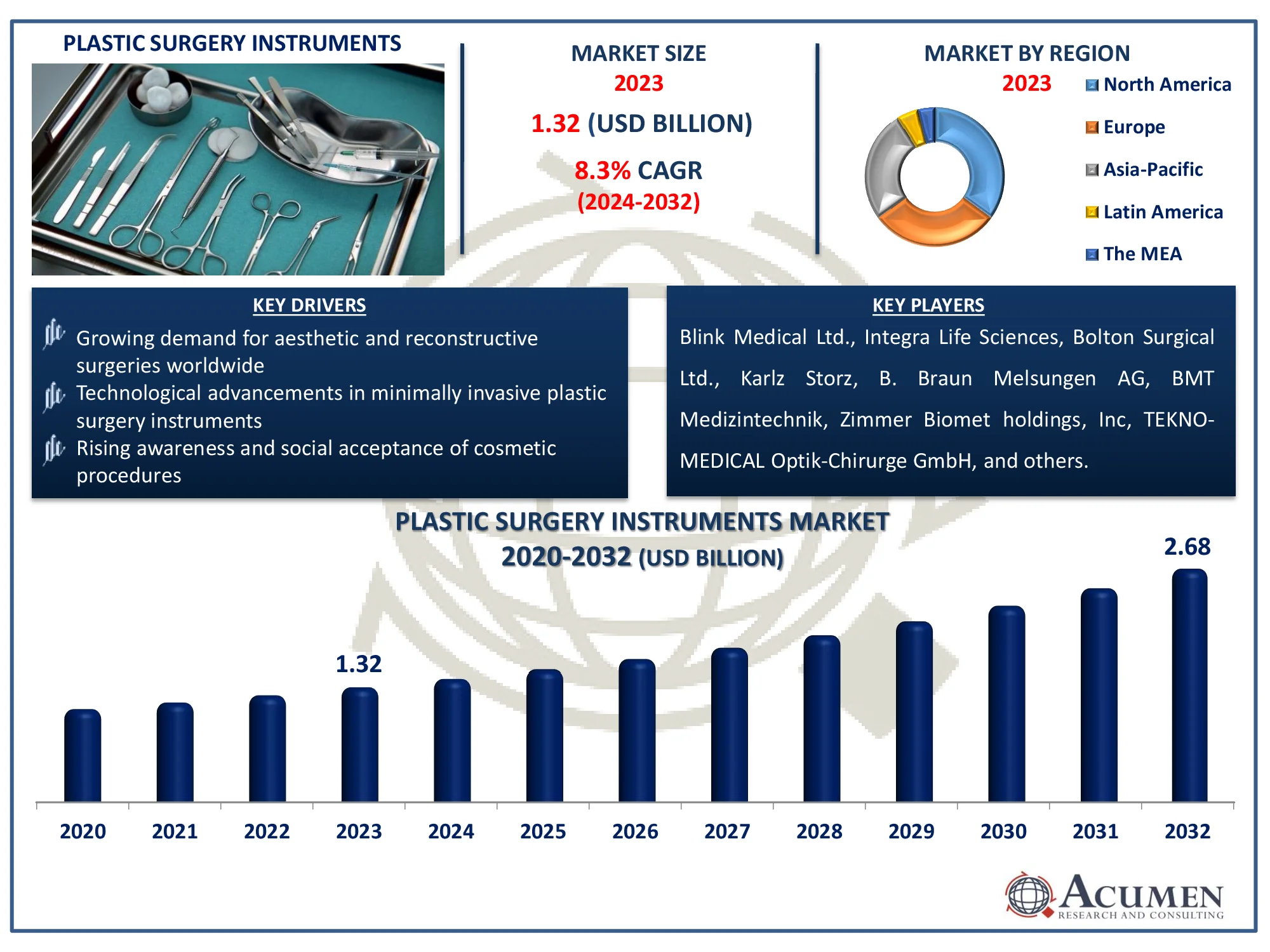

The Global Plastic Surgery Instruments Market Size accounted for USD 1.32 Billion in 2023 and is estimated to achieve a market size of USD 2.68 Billion by 2032 growing at a CAGR of 8.3% from 2024 to 2032.

Plastic Surgery Instruments Market Highlights

- The global plastic surgery instruments market revenue is projected to reach USD 2.68 billion by 2032, with a CAGR of 8.3% from 2024 to 2032

- As per International Society of Aesthetic Plastic Surgery (ISAPS) data, 34.9 million surgical and nonsurgical aesthetic procedures were performed by plastic surgeons in 2023

- According to the American Society of Plastic Surgeons statistics, there were 1,575,244 number of cosmetic procedures performed in 2023

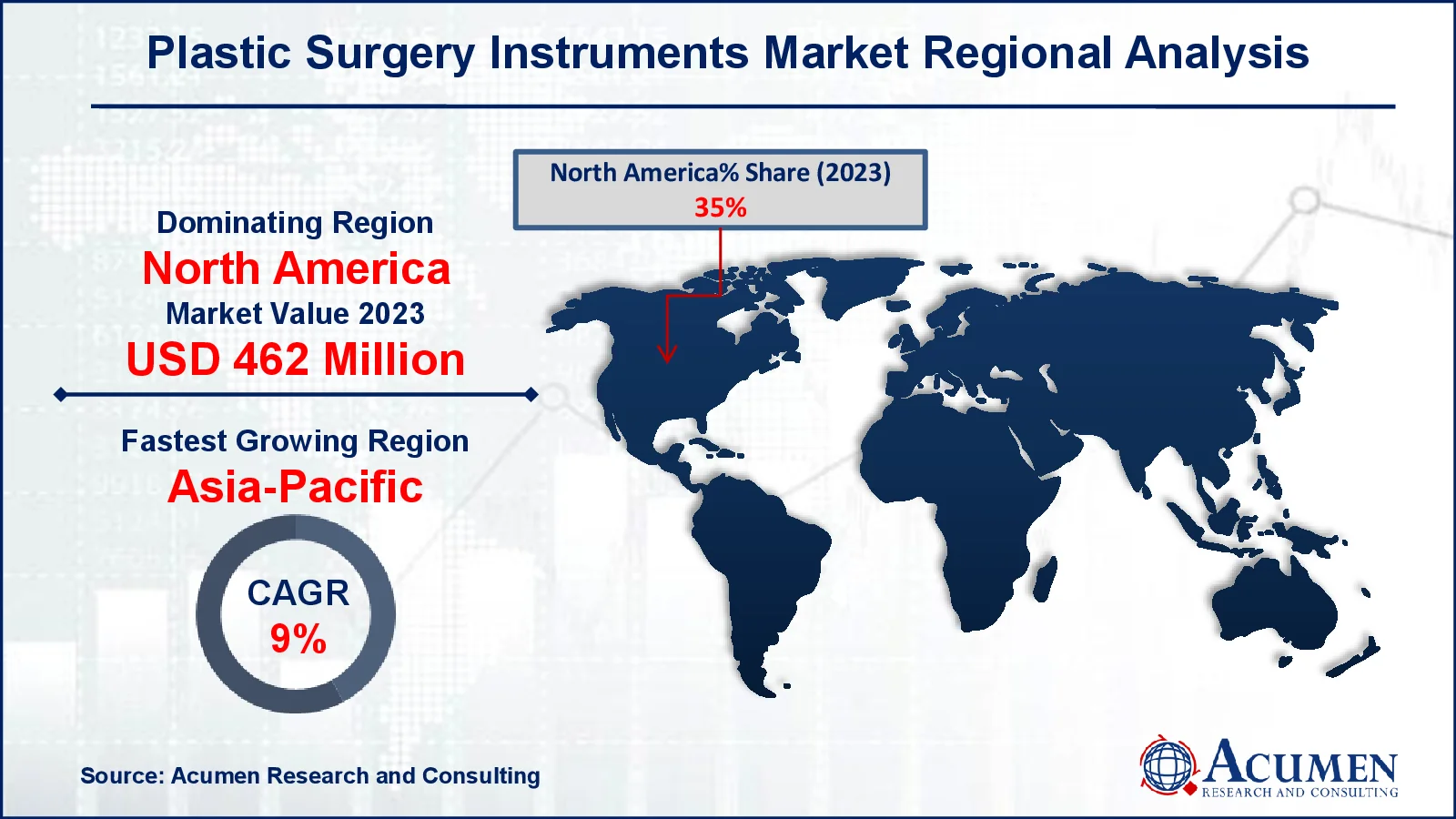

- In 2023, North America’s plastic surgery instruments market was valued at approximately USD 462 million

- The Asia-Pacific plastic surgery instruments market is anticipated to grow at a CAGR exceeding 9% from 2024 to 2032

- Among type, the handheld surgical instruments segment held a 72% market share in 2023

- Face and head procedures 44% growth within the plastic surgery instruments market by procedure type in 2023

- Rising integration of robotic-assisted technology in plastic surgery procedures is the plastic surgery instruments market trend that fuels the industry demand

Plastic surgery is the restoration, replacement, modification, and rehabilitation of bodily parts such as the head, skin, musculoskeletal system, breast, and others. There are two types of plastic surgery: cosmetic and reconstructive. Cosmetic procedures include face and head surgery, breast surgery, and body and limb surgery. Breast reconstruction, congenital deformity therapy, tissue extension, and other procedures are examples of reconstructive surgery. Plastic operations require a variety of equipment, including scissors, dissectors, chisels, awls, forceps, needle carriers, clamps, graspers, and electrosurgical tools.

Global Plastic Surgery Instruments Market Dynamics

Market Drivers

- Growing demand for aesthetic and reconstructive surgeries worldwide

- Technological advancements in minimally invasive plastic surgery instruments

- Rising awareness and social acceptance of cosmetic procedures

Market Restraints

- High cost of plastic surgery procedures and instruments

- Stringent regulatory requirements for medical instruments

- Limited reimbursement policies for cosmetic surgeries

Market Opportunities

- Increasing demand for non-invasive and minimally invasive procedures

- Expanding healthcare infrastructure in emerging markets

- Rising preference for personalized and patient-specific surgical tools

Plastic Surgery Instruments Market Report Coverage

| Market | Plastic Surgery Instruments Market |

| Plastic Surgery Instruments Market Size 2022 |

USD 1.32 Billion |

| Plastic Surgery Instruments Market Forecast 2032 | USD 2.68 Billion |

| Plastic Surgery Instruments Market CAGR During 2023 - 2032 | 8.3% |

| Plastic Surgery Instruments Market Analysis Period | 2020 - 2032 |

| Plastic Surgery Instruments Market Base Year |

2022 |

| Plastic Surgery Instruments Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Procedure, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Sklar Surgical Instruments, Blink Medical Ltd., Bolton Surgical Ltd., BMT Medizintechnik GmbH, Karlz Storz, B. Braun Melsungen AG, Zimmer Biomet holdings, Inc, Integra Life Sciences, TEKNO-MEDICAL Optik-Chirurge GmbH, and Anthony Product. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Plastic Surgery Instruments Market Insights

Plastic operations are conducted to restore tissue function and improve physical look in areas such as the skin, hands, musculoskeletal system, and torso. The development of minimally invasive procedures, or less invasive surgeries, has resulted in a rise in the number of surgeries conducted annually. According to the Mayo Clinic, minimally invasive surgery originated in the 1980s as a safe technique to address the surgical demands of a large number of individuals. Many surgeons have come to prefer it to open, or traditional, surgery over the previous two decades. This growing trend toward minimally invasive surgeries promotes the growth of the plastic surgery devices market.

The growing incidence of accidents worldwide leads to an increase in the need for plastic surgery, which promotes market growth. For example, the Ministry of Road Transport and Highways' (MORTH) Annual Report 2023-24 publishes accident numbers for the calendar year 2022. During the year, 461,312 accidents injured 443,366 individuals and died 168,491. These characteristics are predicted to have a beneficial impact on revenue generation. Females are driving up the global demand for cosmetic treatments, accounting for more than 86% of all cosmetic clients. Cosmetic surgery aims to improve the physique, whereas plastic surgery repairs damaged tissue caused by burns or injuries. Breast augmentation (silicone implants), liposuction, eyelid surgery, abdominoplasty, and breast lift are the most common procedures for women.

Another factor is the rise in the number of cosmetic operations that use minimally invasive new technology, such as lasers to extract the skin's external layer. Good lines, wrinkles, crow's feet, and forehead scrubbing can all be improved with laser surgery. In addition, eyelift surgery is one of the most popular procedures requested by both genders.

Furthermore, the number of males undergoing plastic surgery has increased significantly. However, plastic surgery is always dangerous. Obesity, diabetes, and cardiovascular and pulmonary disorders are all risk factors for heart attacks and blood clots in the lungs and foot. These problems following surgery may impede growth during the projected period.

Plastic Surgery Instruments Market Segmentation

The worldwide market for plastic surgery instruments is split based on types, procedure, and geography.

Plastic Surgery Instrument Market By Type

- Handheld Surgical Instruments

- Elevators

- Graspers

- Forceps

- Retractors

- Sutures and Staplers

- Auxiliary Instruments

- Cutter Instruments

- Cannulas

- Chisels and Gouges

- Dissectors

- Electrosurgical Instruments

- Monopolar Instrument

- Bipolar Instruments

According to the plastic surgery instruments industry analysis, the proportion of handheld surgical devices was highest in 2023. The sector is expected to grow at 72% share. Handheld surgical tools include forceps, retractors, graspers, supplemental tools, cutter tools, lifts, chisels, cannulas, and sutures. Electrosurgical devices are classified as either monopolistic or bipolar. Forceps held the largest share of the portable surgical tools market throughout the forecast period. The market is being pushed by a better understanding of various surgical treatments, a growth in the number of plastic surgeries, and technological advancements. Furthermore, monopolar tools dominated the segment, accounting for more than half of all electrosurgical tools in 2023. Increased plastic surgery, an expanding number of plastic doctors, and enhanced technology are all factors that drive advancement.

Plastic Surgery Instrument Market By Procedure

- Face and Head Procedures

- Ear Surgery

- Brow Lift

- Face and Bone Contouring

- Face and Neck Lift Surgery

- Eyelid Surgery

- Rhinoplasty

- Breast Procedures

- Gynecomastia

- Breast Lift

- Breast Augmentation

- Breast Reduction

- Body and Extremities Procedures

- Buttock Augmentation

- Thigh Lift

- Upper and Lower Body Lift

- Arm lift

- Labiaplasty

- Reconstruction Surgeries

- Liposuction

- Abdominoplasty

According to the plastic surgery instruments market forecast, face and head operations dominate market due to increased demand for aesthetic enhancements and reconstructive surgeries in these areas. Common operations, including as facelifts, rhinoplasty, and eyelid surgery, necessitate the use of specialist devices that are accurate enough to handle fragile, complicated tissue. This trend is being driven by rising awareness and demand for facial aesthetic treatments, which makes this category an important driver to market growth.

Breast treatments showcasing notable growth in the market due to high incidence of breast cancer cases necessitating reconstructive surgery. For instance, according to American Cancer Society, in 2024, an estimated 310,720 new cases of invasive breast cancer would be identified in women, with roughly 42,250 dying from the disease. While rare, this year, 2,790 males will be diagnosed with breast cancer, with 530 dying from the disease. This growth increases the demand for specialized surgical instruments developed for precision in these procedures.

Plastic Surgery Instruments Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Plastic Surgery Instruments Market Regional Analysis

For several reasons, in 2023, North America led the industry, and this is expected to continue during the projected period. Favorable reimbursement systems, the involvement of key stakeholders, increasing the number of public initiatives, and providing access to modern technology and training for physicians are all major factors contributing to this progress. For instance, in July 2024, Dr. Devgan Scientific Beauty announced the release of surgical tools meant to eliminate structural bias in instrument sizing, with a focus on surgeons with smaller hands and women.

Asia Pacific is predicted to grow at the fastest rate during the projection period, as investment in the region increases. Japan, China, India, Australia, and South Korea are the five largest contributors in Asia-Pacific. Additional variables are anticipated in the development of government projects to incorporate enhanced reimbursement measures and raise awareness of reconstructive or plastic surgery. For instance, Amrita Hospital in Kochi celebrates Plastic Surgery Week with a range of informative events and activities to raise awareness and highlight achievements in the field. On Monday, July 15, 2024, a Sushrutha Vandhana was held at the Maharishi Sushrutha Statue to begin the celebration. This monument to the ancient sage honored the pioneering spirit of plastic and reconstructive surgery.

Plastic Surgery Instruments Market Players

Some of the top plastic surgery instruments companies offered in our report include Sklar Surgical Instruments, Blink Medical Ltd., Bolton Surgical Ltd., BMT Medizintechnik GmbH, Karlz Storz, B. Braun Melsungen AG, Zimmer Biomet holdings, Inc, Integra Life Sciences, TEKNO-MEDICAL Optik-Chirurge GmbH, and Anthony Product.

Frequently Asked Questions

How big is the plastic surgery instruments market?

The plastic surgery instruments market size was valued at USD 1.32 billion in 2023.

What is the CAGR of the global plastic surgery instruments market from 2024 to 2032?

The CAGR of plastic surgery instruments is 8.3% during the analysis period of 2024 to 2032.

Which are the key players in the plastic surgery instruments market?

The key players operating in the global market are including Sklar Surgical Instruments, Blink Medical Ltd., Bolton Surgical Ltd., BMT Medizintechnik GmbH, Karlz Storz, B. Braun Melsungen AG, Zimmer Biomet holdings, Inc, Integra Life Sciences, TEKNO-MEDICAL Optik-Chirurge GmbH, Anthony Product, and others.

Which region dominated the global plastic surgery instruments market share?

North America held the dominating position in plastic surgery instruments industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of plastic surgery instruments during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global plastic surgery instruments industry?

The current trends and dynamics in the plastic surgery instruments industry include growing demand for aesthetic and reconstructive surgeries worldwide, technological advancements in minimally invasive plastic surgery instruments, and rising awareness and social acceptance of cosmetic procedures

Which type held the maximum share in 2023?

The handheld surgical instruments expected to hold the maximum share of the plastic surgery instruments industry.?