Plasmid DNA Manufacturing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Plasmid DNA Manufacturing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

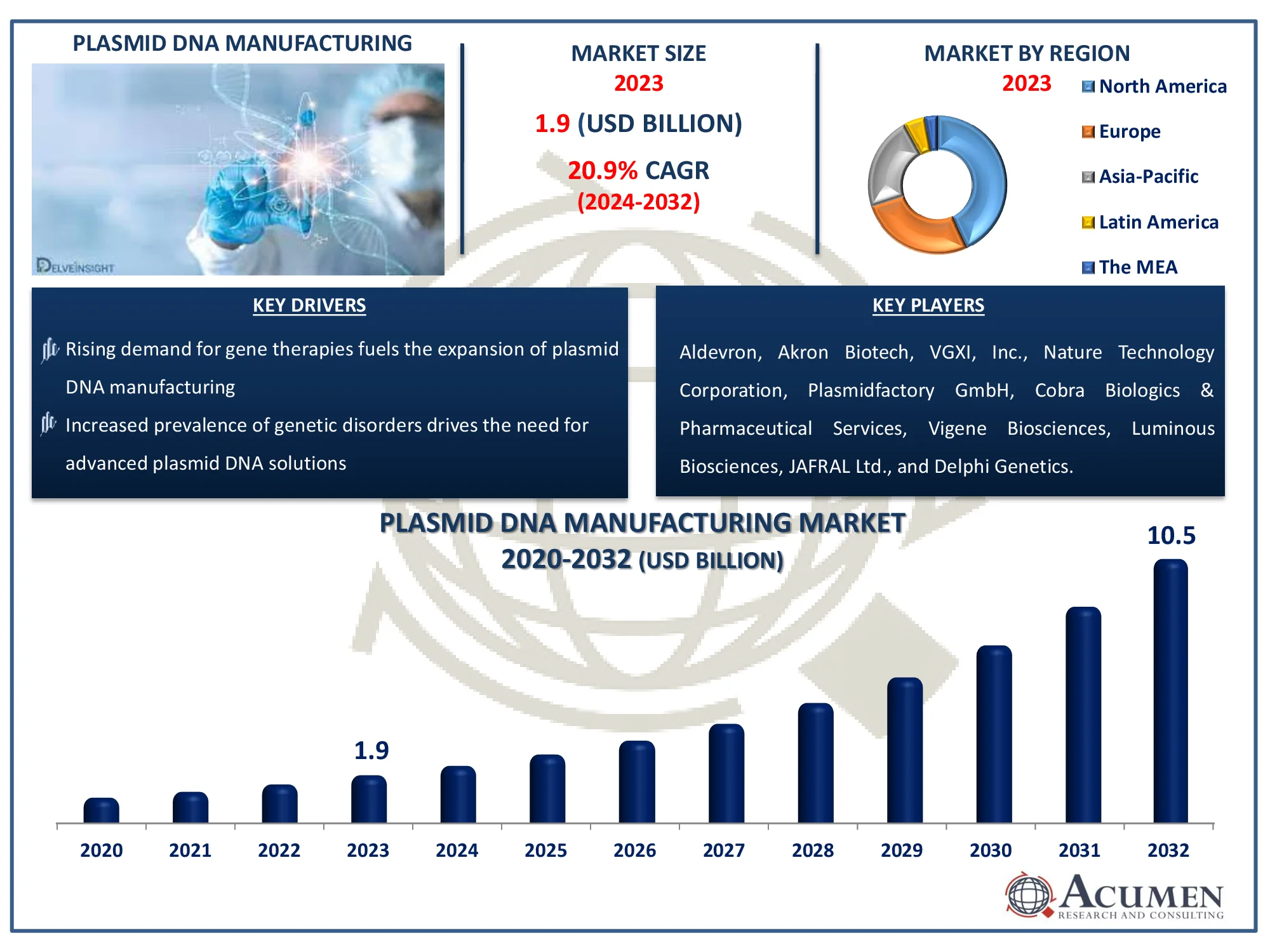

The Global Plasmid DNA Manufacturing Market Size accounted for USD 1.9 Billion in 2023 and is estimated to achieve a market size of USD 10.5 Billion by 2032 growing at a CAGR of 20.9% from 2024 to 2032.

Plasmid DNA Manufacturing Market Highlights

- Global plasmid DNA manufacturing market revenue is poised to garner USD 10.5 billion by 2032 with a CAGR of 20.9% from 2024 to 2032

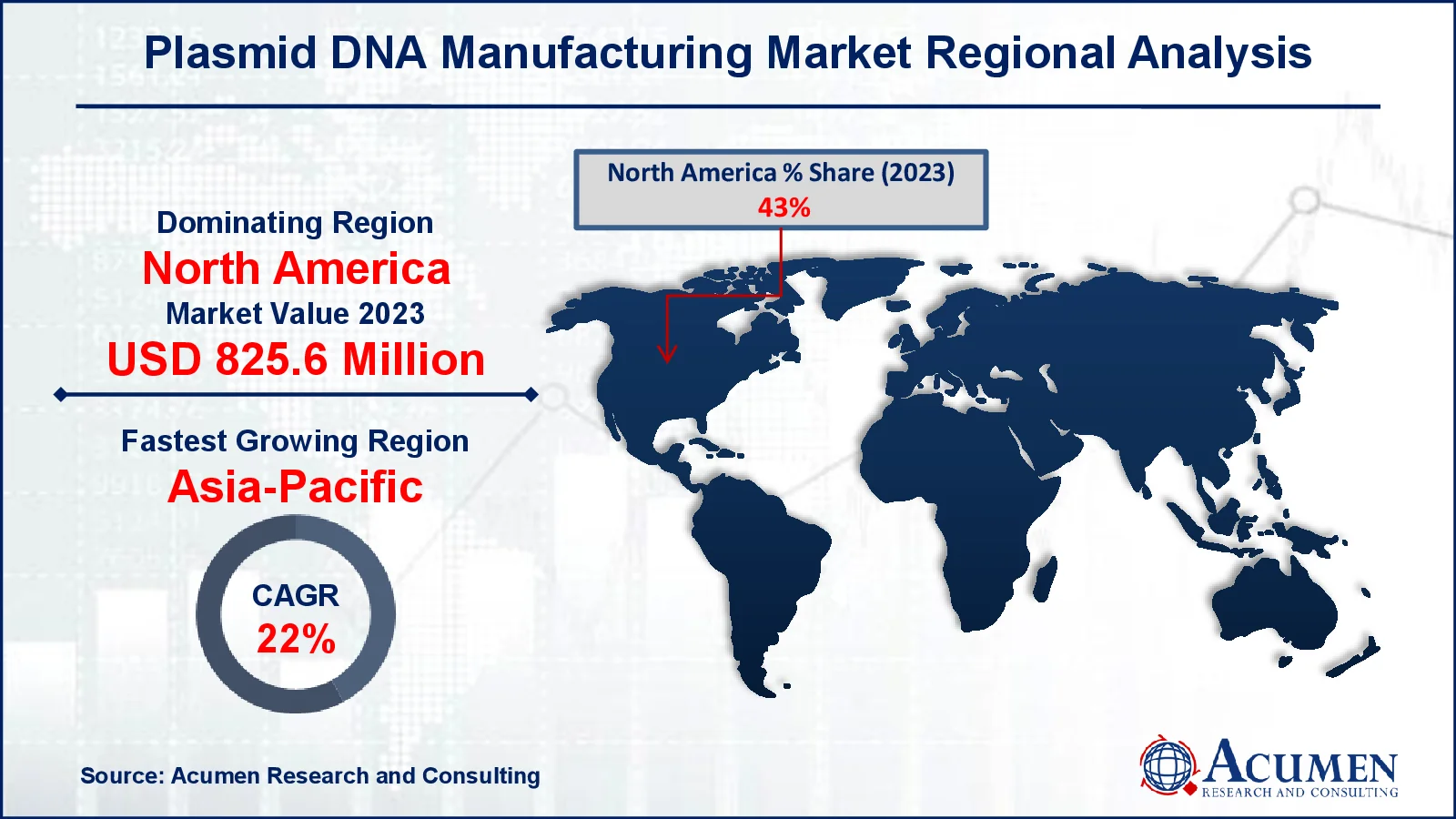

- North America plasmid DNA manufacturing market value occupied around USD 825.6 million in 2023

- Asia-Pacific plasmid DNA manufacturing market growth will record a CAGR of more than 22% from 2024 to 2032

- Among grade, the GMP grade sub-segment generated more than USD 1.6 billion revenue in 2023

- Based on development phase, the clinical therapeutics sub-segment generated around 54% plasmid DNA manufacturing market share in 2023

- Development of scalable production technologies is a popular plasmid DNA manufacturing market trend that fuels the industry demand

There are continuous development activities carried by major players in order to test plasmid DNA applicability. Usually plasmid DNA is prepared by cesium chloride density ultracentrifugation process and it has wide applications such as clones screening, sequencing, restriction digestion, cloning, and PCR. Plasmid DNA can be purified by various technique but most it is purified by using bacteria technique. These techniques include various methods such as alkaline lysis and ammonium acetate precipitation, and ion-exchange columns such as Qiagen columns, cesium chloride gradient separation, or PEG precipitation methods.

Global Plasmid DNA Manufacturing Market Dynamics

Market Drivers

- Rising demand for gene therapies fuels the expansion of plasmid DNA manufacturing

- Increased prevalence of genetic disorders drives the need for advanced plasmid DNA solutions

- Growing investments in biopharmaceutical R&D boost market innovation

- Advancements in synthetic biology enhance plasmid DNA production efficiency

Market Restraints

- High costs associated with plasmid DNA manufacturing limit market adoption

- Regulatory complexities pose challenges for product approval and commercialization

- Limited skilled workforce hinders large-scale production capabilities

Market Opportunities

- Emerging markets offer untapped potential for plasmid DNA-based treatments

- Expansion of personalized medicine creates demand for customized plasmid DNA solutions

- Increasing collaborations among biotech firms promote technological advancements

Plasmid DNA Manufacturing Market Report Coverage

| Market | Plasmid DNA Manufacturing Market |

| Plasmid DNA Manufacturing Market Size 2022 |

USD 8.6 Billion |

| Plasmid DNA Manufacturing Market Forecast 2032 | USD 10.5 Billion |

| Plasmid DNA Manufacturing Market CAGR During 2023 - 2032 | 20.9% |

| Plasmid DNA Manufacturing Market Analysis Period | 2020 - 2032 |

| Plasmid DNA Manufacturing Market Base Year |

2023 |

| Plasmid DNA Manufacturing Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Grade, By Disease, By Development Phase, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Aldevron, Akron Biotech, VGXI, Inc., Nature Technology Corporation, Plasmidfactory GmbH, Cobra Biologics & Pharmaceutical Services, Vigene Biosciences, Luminous Biosciences, JAFRAL Ltd., and Delphi Genetics. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Plasmid DNA Manufacturing Market Insights

Increased cancer prevalence is expected to boost the production of plasmid DNA. In applying gene therapy to diagnose and treat diseases in patients, plasmid DNA is used. Increased awareness about gene therapy promotes the growth of plasmid DNA manufacturing market for the production of plasmid DNA during upcoming period. This is mainly due to increase in gene therapy products, accepted to treat rare diseases worldwide and availability of approved gene therapy products.

Plasmid DNA (pDNA) is the base for DNA vaccines and gene therapies for many infectious, acquired, and genetic diseases, including HIV-AIDS, Ebola, Malaria, and various cancer types, enteric pathogens, and influenza. The advantages of DNA vaccines are high, not contaminating and focusing on immune response only to those anti-immunization-wishing antigens and long-term persistence of immunization protection compared to conventional vaccines. These are the factors leading to the growth of plasmid DNA manufacturing. Well-developed infrastructure in developed countries that is able to support the R&D activities, high investment by government and private players, coupled with introduction of new various protocols in order to support the manufacturing of various products are some other major factors expected to support the growth of the plasmid DNA manufacturing market.

Gene therapy has various complications such as risk of mutagenesis, safety & efficacy issues and strict regulatory framework which is resulting in limited adoption thus hampering the growth of the market. Lack of developed infrastructure in order to conduct the R&D activities, limitations pertaining to investment for adoption of advanced technology, and low awareness of the treatment are among other major factors expected to hamper the growth of the target market. Developing nations have poor access to such sophisticated treatments and the costs of these are sky high making it out of reach to most of the population.

Technological progress to address traditional vector production challenges provides lucrative opportunities to the manufacturers. Development of an adaptive electroporation system for intratumoral plasmid DNA delivery where pro-inflammatory cytokine interleukin 12 encoded plasmid DNA intratumoral electroporation promotes innate and adaptive immune responses related to antitumor effects. Fixed parameters for pre-clinical tumors consisting of cells implanted into the skin are optimized in clinical electroporation conditions.

These conditions can be limited to clinically important tumors, because implanted models cannot detect the heterogeneity found in genetically engineered mouse models or clinical tumors. Variables affecting the result of treatment include tumor size, vascularization degree, fibrosis and necrosis that can produce the transfers of suboptimal genes and the results of variable therapies. To address this, an electroporation generator controlled by feedback was developed that can measure the electrochemical properties of tissue in real time.

Plasmid DNA Manufacturing Market Segmentation

The worldwide market for plasmid DNA manufacturing is split based on grade, disease, development phase, application, and geography.

Plasmid DNA Manufacturing Market By Grade

- R&D Grade

- Viral Vector Development

- Lentivirus

- AAV

- Retrovirus

- Adenovirus

- Others

- Antibody Development

- mRNA Development

- DNA Vaccine Development

- Others

- Viral Vector Development

- GMP Grade

According to plasmid DNA manufacturing industry analysis, the GMP grade category dominates the market because of its importance in clinical and commercial biopharmaceutical applications. The GMP Grade category dominates the Plasmid DNA Manufacturing market because of its importance in clinical and commercial biopharmaceutical applications. This grade is required for sophisticated medicines such as CAR-T cell therapies and mRNA-based vaccinations, which explains its dominance. The growing global usage of gene-based medicines and vaccines drives up demand for GMP-grade plasmids. Furthermore, increased investments in R&D and clinical trials increase the demand for high-quality plasmids, establishing GMP-grade plasmid DNA as the market's preferred choice.

Plasmid DNA Manufacturing D Market By Disease

- Infectious Disease

- Cancer

- Genetic Disorder

The cancer segment is the largest segment in the market and it is expected to witness significant growth over the plasmid DNA manufacturing market forecast period, owing to high usage of vectors for development of cancer therapies is the primary growth stimulant for the segment. In addition, constant research endeavors taken up to target cancer and gain approvals in various classes of biopharmaceutical drugs are supplementing the growth of the segment.

Plasmid DNA Manufacturing Market By Development Phase

- Clinical Therapeutics

- Pre-Clinical Therapeutics

- Marketed Therapeutics

The clinical therapeutics is the leading segment in the plasmid DNA manufacturing market due to the increased number of clinical studies concentrating on gene therapies, DNA vaccines, and cell-based medicines. Plasmid DNA is a critical component of these sophisticated treatments, delivering genetic material to target cells. The growing prevalence of genetic defects and infectious diseases has boosted the demand for plasmid DNA in therapeutic applications. Furthermore, regulatory agencies around the world have streamlined permission processes to encourage clinical research, which is driving the segment's growth. As pharmaceutical and biotech companies invest heavily in developing novel therapies, the need for plasmid DNA in clinical-stage pharmaceuticals develops, cementing its position as the market's leading category.

Plasmid DNA Manufacturing Market By Application

- DNA Vaccines

- Cell & Gene Therapy

- Immunotherapy

- Others

The cell & gene therapy sector has emerged as the major application in the plasmid DNA manufacturing market, owing to the increasing use of sophisticated therapeutic solutions for genetic disorders and chronic diseases. Plasmid DNA is important in gene editing technologies like CRISPR-Cas9, as well as in the development of viral vectors for gene delivery. The expanding prevalence of genetic disorders, together with increased financing for cell and gene therapy research, is driving this segment's expansion. Furthermore, its applications in regenerative medicine and individualized treatment techniques reinforce its position in the growing market landscape.

Plasmid DNA Manufacturing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Plasmid DNA Manufacturing Market Regional Analysis

The North America plasmid DNA manufacturing market size was over 825.6 million USD in 2023 and is expected to witness the growth at a notable from 2024 to 2032. North America is expected to dominate in the global plasmid DNA manufacturing market. This can be attributed to the presence of several biopharmaceutical manufacturers in the U.S., coupled with a strong and effective regulatory structure for development of advanced therapies in the country. Besides this, recent approval of gene therapies by U.S. FDA is projected to augment the demand for plasmid DNA manufacturing market in the coming years.

The market in Europe is expected to contribute significant revenue share in the global market, owing to significant incentives offer through Orphan Medicinal Products Regulations (European Union) that has encouraged pharmaceutical and biotechnology companies to consider the development of rare disease medicines as a potentially profitable endeavor.

The market in Asia Pacific is expected to witness faster growth, owing to factors such as increasing government expenditure on healthcare sector in order to facilitate R&D activities. In addition, growing government initiatives and increased investments by private companies related to R&D activities are likely to fuel this regional market.

Plasmid DNA Manufacturing Market Players

Some of the top plasmid DNA manufacturing market companies offered in our report includes Aldevron, Akron Biotech, VGXI, Inc., Nature Technology Corporation, Plasmidfactory GmbH, Cobra Biologics & Pharmaceutical Services, Vigene Biosciences, Luminous Biosciences, JAFRAL Ltd., and Delphi Genetics.

Frequently Asked Questions

How big is the plasmid DNA manufacturing market?

The plasmid DNA manufacturing market size was valued at USD 1.9 Billion in 2023.

What is the CAGR of the global Plasmid DNA manufacturing market from 2024 to 2032?

The CAGR of plasmid DNA manufacturing is 20.9% during the analysis period of 2024 to 2032.

Which are the key players in the plasmid DNA manufacturing market?

The key players operating in the global market are including Aldevron, Akron Biotech, VGXI, Inc., Nature Technology Corporation, Plasmidfactory GmbH, Cobra Biologics & Pharmaceutical Services, Vigene Biosciences, Luminous Biosciences, JAFRAL Ltd., and Delphi Genetics.

Which region dominated the global plasmid DNA manufacturing market share?

North America held the dominating position in plasmid DNA manufacturing industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of plasmid DNA manufacturing during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global plasmid DNA manufacturing industry?

The current trends and dynamics in the plasmid DNA manufacturing industry include rising demand for gene therapies fuels the expansion of plasmid DNA manufacturing, and increased prevalence of genetic disorders drives the need for advanced plasmid DNA solutions.

Which Disease held the maximum share in 2023?

The cancer disease held the maximum share of the plasmid DNA manufacturing industry.