Pipeline Safety Market | Acumen Research and Consulting

Pipeline Safety Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

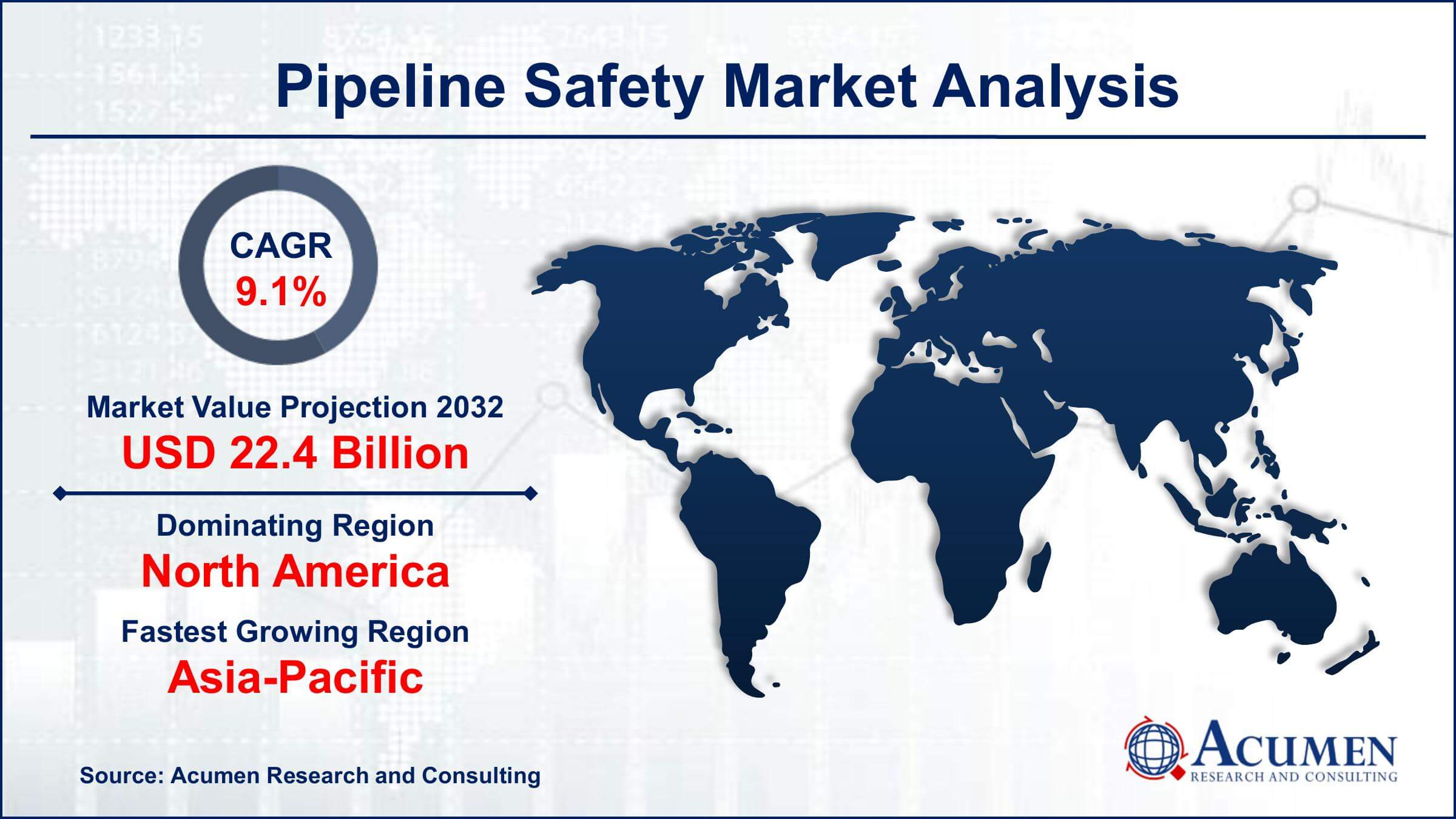

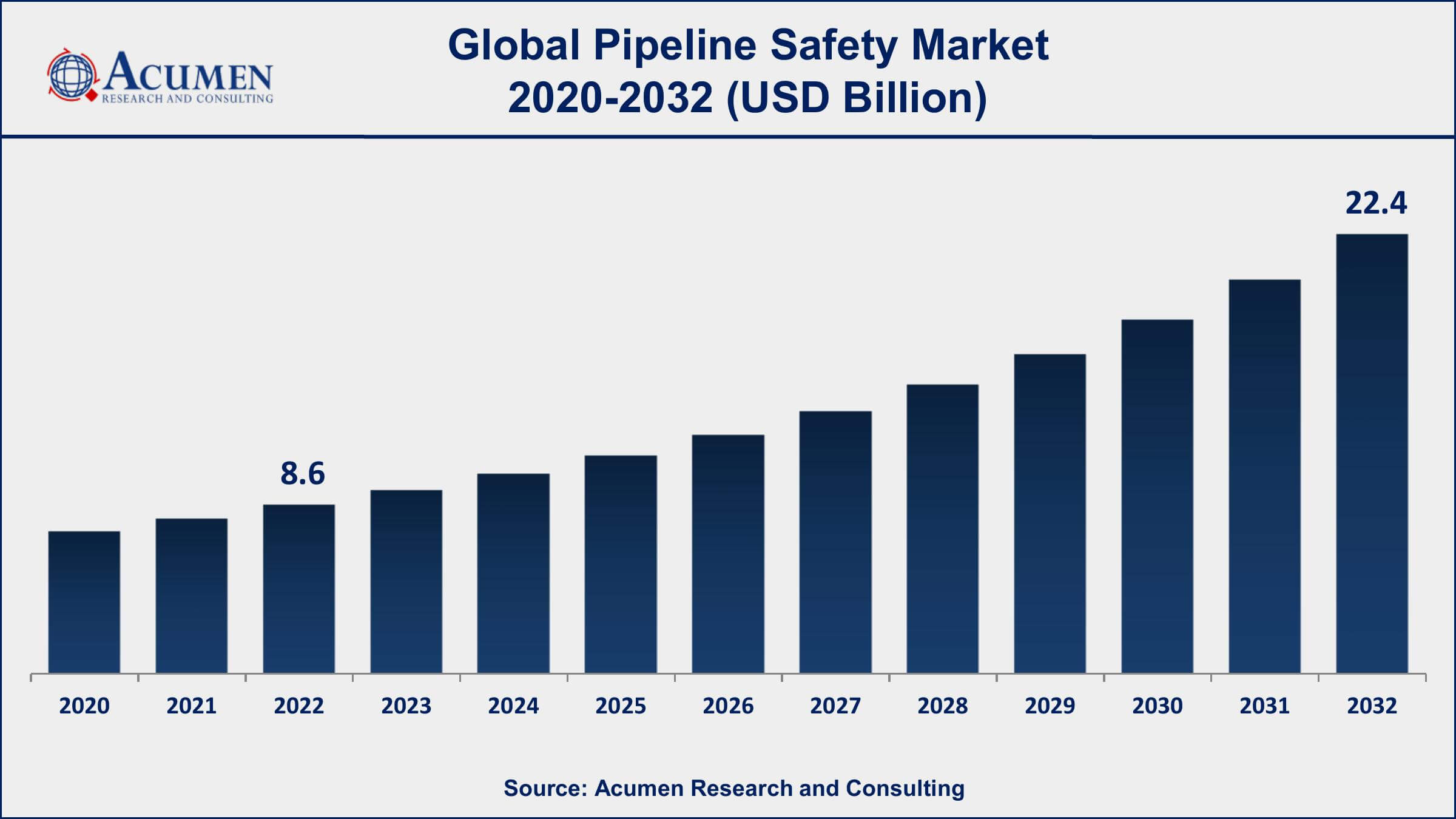

The Global Pipeline Safety Market Size accounted for USD 8.6 Billion in 2022 and is projected to achieve a market size of USD 22.4 Billion by 2032 growing at a CAGR of 9.1% from 2023 to 2032.

Pipeline Safety Market Report Key Highlights

- Global Pipeline Safety market revenue is expected to increase by USD 22.4 Billion by 2032, with a 9.1% CAGR from 2023 to 2032

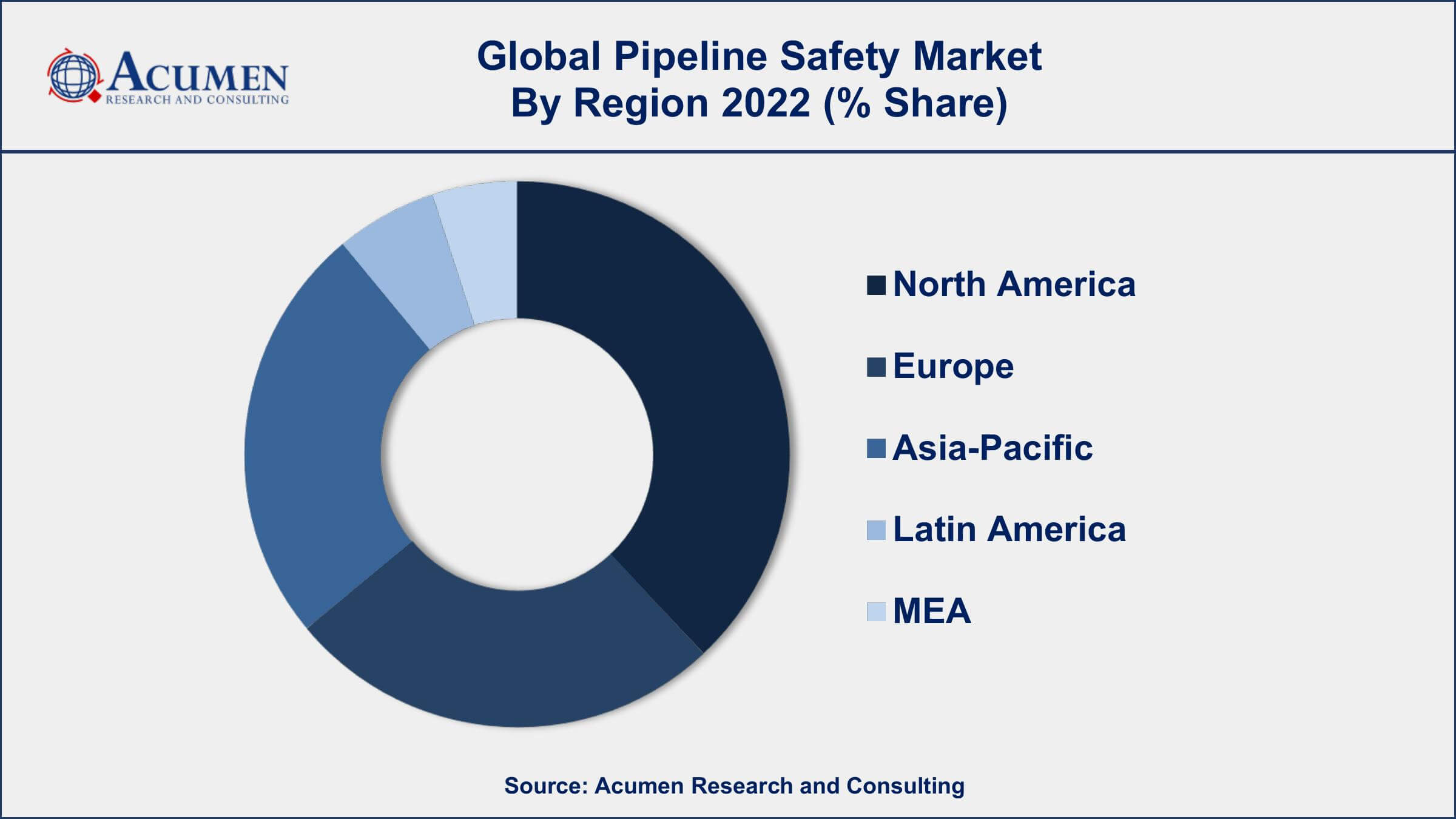

- North America region led with more than 38% of Pipeline Safety market share in 2022

- According to the Pipeline and Hazardous Materials Safety Administration (PHMSA), there are approximately 2.8 million miles of pipelines in the United States that transport oil, gas, and other hazardous liquids

- According to PHMSA data, there were 729 pipeline incidents in 2001, compared to 282 in 2020

- Corrosion is another major cause of pipeline incidents, accounting for 14% of incidents in 2019

- In 2020, the Keystone XL pipeline project was canceled due to concerns about environmental impact and safety risks

- Growing demand for biopharmaceuticals and biosimilars, drives the Pipeline Safety market size

Pipeline safety refers to the measures taken to ensure the safety of oil and gas pipelines, including regular maintenance and monitoring, risk assessments, and emergency response plans. The pipeline safety market has been growing steadily in recent years, driven by increasing demand for oil and gas transportation infrastructure, as well as greater regulatory scrutiny and public concern around pipeline safety.

The pipeline safety market has been experiencing significant growth in recent years due to the increasing demand for energy and the need to transport oil and gas across long distances. Factors contributing to the growth of the pipeline safety market include government regulations, increasing investments in pipeline infrastructure, and the adoption of advanced technologies for pipeline monitoring and control. The need for pipeline safety is especially important in regions with high seismic activity or extreme weather conditions, as well as areas with high population density.

Global Pipeline Safety Market Trends

Market Drivers

- Increase in oil and gas production and transportation through pipelines

- Stringent safety regulations by regulatory agencies

- Growing demand for energy in emerging economies

- Advancements in technology and automation in pipeline safety solutions

- Increasing incidents of pipeline accidents and spills lead to greater emphasis on safety measures

Market Restraints

- High cost of implementing safety solutions and services

- Limited technological expertise in certain regions

Market Opportunities

- Increasing investments in pipeline safety by government and private organizations

- Expansion of pipeline networks in emerging economies

- Growing demand for real-time pipeline monitoring and automation solutions

Pipeline Safety Market Report Coverage

| Market | Pipeline Safety Market |

| Pipeline Safety Market Size 2022 | USD 8.6 Billion |

| Pipeline Safety Market Forecast 2032 | USD 22.4 Billion |

| Pipeline Safety Market CAGR During 2023 - 2032 | 9.1% |

| Pipeline Safety Market Analysis Period | 2020 - 2032 |

| Pipeline Safety Market Base Year | 2022 |

| Pipeline Safety Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Honeywell International Inc., Siemens AG, ABB Group, Schneider Electric SE, General Electric Company, Emerson Electric Co., Rockwell Automation, Inc., Yokogawa Electric Corporation, KROHNE Group, and Endress+Hauser Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Pipeline safety is the set of technological solutions implemented by companies in order to secure pipeline infrastructure from terrorist attacks, external damage, natural disasters, and cyberattacks. The market for oil & gas pipeline safety is majorly influenced by the repair & development of the aging pipeline infrastructure. Rising threats from criminal and terrorist activities are the key growth factor for the pipeline safety market. The risks from terrorist attacks vary across sectors that include refining, exploration and production, pipeline transportation, product distribution and marketing, and marine transportation. Since oil & gas exploration and development sites are easy targets for terrorists, the need for protecting such sites is continually increasing. This growing need to protect oil and gas pipeline infrastructure is expected to bolster the market growth during the forecast period.

Rising spending by oil & gas companies for ensuring and upgrading safety standards of existing pipeline infrastructure and network protection along with the upgradation of oil refineries, pipelines, and drilling sites are some of the factors expected to drive the pipeline market. The major drivers include the need for sustainable use of resources, expansion, and up-gradation of refineries, and increased spending by oil & gas companies for network and infrastructure protection. Furthermore, rising security regulations, increasing oil & gas demand in developing countries, and mandatory standards provide significant opportunities for pipeline security service providers, vendors, consulting companies, and solutions providers.

Rising incidents of oil & gas attacks are one of the key reasons to adopt and deploy pipeline safety solutions, worldwide. Transportation of oil & gas through pipelines is the safest mode of transporting fuel. However, cyberattacks on oil & gas pipelines are very common. For instance, in 2008, an intended cyberattack where hackers shut down all the alarms and cut off communications took place in a Turkey pipeline blast. Thus, pipeline safety solutions are progressively more adopted and implemented in existing infrastructures as well as a large number of ongoing pipeline projects across the world to combat such cyber attacks on critical infrastructure, especially in the Asia-Pacific region.

Pipeline Safety Market Segmentation

The global pipeline safety market segmentation is based on component, application, and geography.

Pipeline Safety Market By Component

- Service

- Professional services

- Pipeline integrity management

- Solution

- Perimeter intrusion detection

- Secure communication

- Pipeline monitoring system

- SCADA for pipelines

- Industrial control system security

According to a pipeline safety industry analysis, the solution segment accounted for the largest market share in 2022. The solution segment includes a variety of products and services that help to ensure the safe and efficient operation of pipelines. These solutions include leak detection systems, pipeline integrity management systems, control systems, and emergency shutdown systems, among others. Leak detection systems are one of the most important solutions in the pipeline safety market, as they help to detect leaks in pipelines and prevent major accidents. These systems use a variety of technologies, such as acoustic, infrared, and mass balance, to detect leaks and alert operators in real time. Pipeline integrity management systems, on the other hand, help to ensure the overall structural integrity of pipelines and prevent damage caused by corrosion, cracking, or other factors.

Pipeline Safety Market By Application

- Natural gas

- Refined products

- Crude oil

- Others

According to the pipeline safety market forecast, the natural gas segment is expected to grow significantly in the coming years. Natural gas is an important source of energy and is transported through pipelines over long distances to reach consumers. The safety of these pipelines is critical to ensure the safe and efficient delivery of natural gas. The growth of the natural gas segment in the market is driven by several factors. First, natural gas is becoming an increasingly important source of energy as countries look to transition away from fossil fuels. Second, the increase in shale gas production in North America has led to a significant expansion of natural gas pipelines in the region. Third, the rise of liquefied natural gas (LNG) exports has led to an increase in natural gas pipeline construction and safety measures.

Pipeline Safety Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Geographically, North America is currently dominating the pipeline safety market. One of the main reasons is the high number of pipelines in the region, particularly in the United States, which has one of the largest pipeline networks in the world. The vast network of pipelines in North America requires significant investment in safety measures to ensure the safe transportation of oil and gas across long distances. Another reason why North America is dominating the pipeline safety market is the stringent safety regulations in place. Regulatory agencies such as the Pipeline and Hazardous Materials Safety Administration (PHMSA) in the United States have implemented strict safety standards for pipeline construction, operation, and maintenance. These regulations have driven demand for safety-related products and services in the region.

Additionally, the increase in shale gas production in North America has led to a significant expansion of natural gas pipelines in the region, which has further driven the demand for pipeline safety solutions. Companies in the pipeline safety market are investing heavily in new technologies to meet the growing demand for real-time pipeline monitoring, automation, and control solutions.

Pipeline Safety Market Player

Some of the top pipeline safety market companies offered in the professional report includes Honeywell International Inc., Siemens AG, ABB Group, Schneider Electric SE, General Electric Company, Emerson Electric Co., Rockwell Automation, Inc., Yokogawa Electric Corporation, KROHNE Group, and Endress+Hauser Group.

Frequently Asked Questions

What was the market size of the global pipeline safety in 2022?

The market size of pipeline safety was USD 8.6 Billion in 2022.

What is the CAGR of the global pipeline safety market during forecast period of 2023 to 2032?

The CAGR of pipeline safety market is 9.1% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global pipeline safety market are Honeywell International Inc., Siemens AG, ABB Group, Schneider Electric SE, General Electric Company, Emerson Electric Co., Rockwell Automation, Inc., Yokogawa Electric Corporation, KROHNE Group, and Endress+Hauser Group.

Which region held the dominating position in the global pipeline safety market?

North America held the dominating position in pipeline safety market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for pipeline safety market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global pipeline safety market?

The current trends and dynamics in the pipeline safety industry include the increase in oil and gas production and transportation through pipelines, and stringent safety regulations.

Which component held the maximum share in 2022?

The solution component held the maximum share of the pipeline safety market.