Phytase Market | Acumen Research and Consulting

Phytase Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

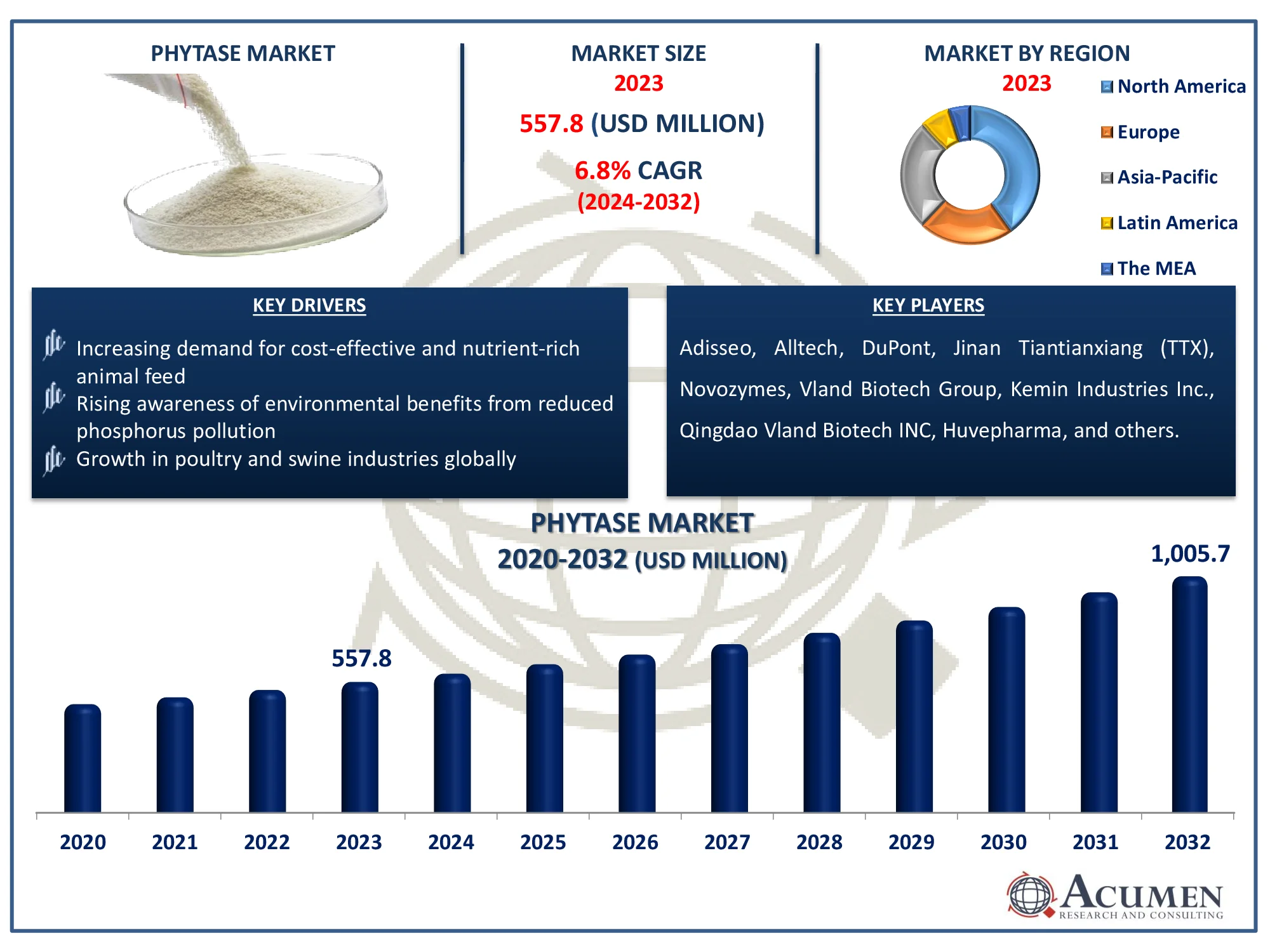

The Global Phytase Market Size accounted for USD 557.8 Million in 2023 and is estimated to achieve a market size of USD 1,005.7 Million by 2032 growing at a CAGR of 6.8% from 2024 to 2032.

Phytase Market Highlights

- The global phytase market is expected to reach USD 1,005.7 million by 2032, growing at a CAGR of 6.8% from 2024 to 2032

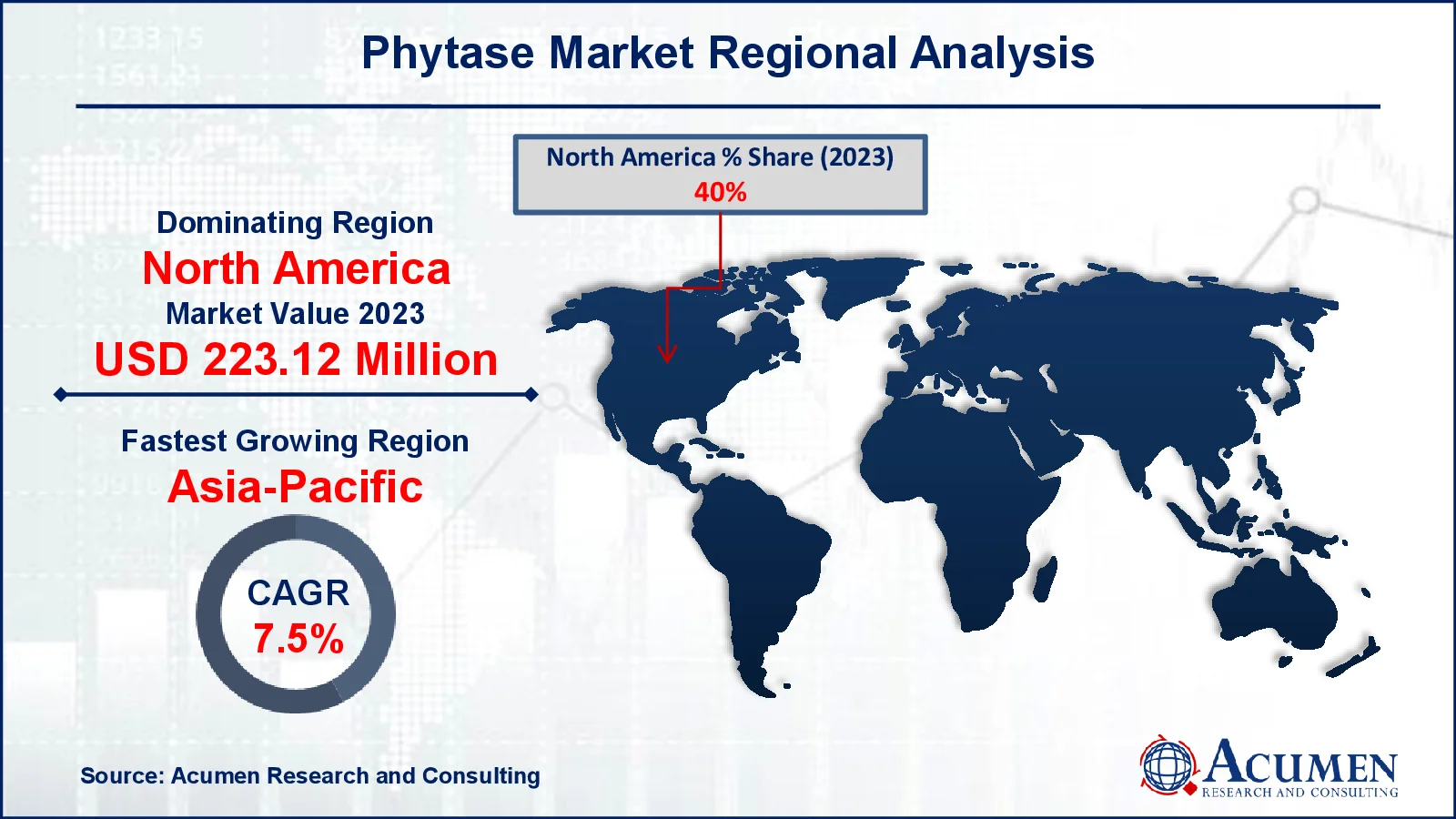

- In 2023, the North American phytase market was valued at approximately USD 223.12 million

- The Asia-Pacific phytase market is projected to grow at a CAGR of over 7.5% from 2024 to 2032

- The granular sub-segment accounted for 55% of the market share in 2023

- Advancements in phytase enzyme formulations and innovations in the biotechnology sector driving market growth is the phytase market trend that fuels the industry demand

Phytase, also known as myo-inositol hexakisphosphate phosphohydrolase, is a type of phosphatase enzyme that facilitates the breakdown of phytic acid. This enzyme enhances the availability and digestibility of essential nutrients such as calcium (Ca), zinc (Zn), sodium (Na), magnesium (Mg), and amino acids, particularly in broilers and pigs. Phytases are classified into two primary categories that are fungal phytases that are derived from species like aspergillus and peniophora and bacterial phytases which are sourced from escherichia coli.

Global Phytase Market Dynamics

Market Drivers

- Increasing demand for cost-effective and nutrient-rich animal feed

- Rising awareness of environmental benefits from reduced phosphorus pollution

- Growth in poultry and swine industries globally

Market Restraints

- High production and formulation costs of phytase enzymes

- Limited efficiency under extreme feed processing conditions

- Dependence on awareness and adoption in developing regions

Market Opportunities

- Expanding aquaculture sector requiring enhanced feed formulations

- Technological advancements in enzyme stability and efficacy

- Growing interest in plant-based diets boosting phytase demand in food products

Phytase Market Report Coverage

|

Market |

Phytase Market |

|

Phytase Market Size 2023 |

USD 557.8 Million |

|

Phytase Market Forecast 2032 |

USD 1,005.7 Million |

|

Phytase Market CAGR During 2024 - 2032 |

6.8% |

|

Phytase Market Analysis Period |

2020 - 2032 |

|

Phytase Market Base Year |

2023 |

|

Phytase Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Class, By Source, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Adisseo, Alltech, DuPont, Jinan Tiantianxiang (TTX), Novozymes, Vland Biotech Group, Kemin Industries Inc., Qingdao Vland Biotech INC, Huvepharma, Novus International, BASF SE, AB Enzymes (Associated British Foods PLC), and Willows Ingredients. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Phytase Market Insights

The growing global demand for animal protein, particularly in developing regions, has significantly increased the need for high-quality, cost-effective feed. According to the Food and Agriculture Organization, animal feeds have become a crucial part of the integrated food chain, with an increasing demand for cost-effective and nutrient-rich feed. Successful examples of nutrient enrichment include pro-vitamin A rice, high lysine maize, high oleic acid soybeans, and low-phytate maize, which enhance animal nutrition. Other potential improvements, like high methionine soybeans and high-oil maize, promise further advancements in feed quality and animal performance. This rising importance of animal feed drives demand for phytase as a means to enhance feed efficiency and lower overall production costs.

Phytase enzymes help in reducing the environmental impact of livestock farming by breaking down phytates in feed, which can otherwise lead to phosphorus pollution in animal waste. This reduction in excess phosphorus helps minimize environmental contamination, which is increasingly being regulated. According to the UN Environment Programme, phosphorus pollution is a major driver of biodiversity loss and the degradation of ecosystems critical to human survival. Eutrophication, caused by excessive phosphorus, is estimated to cost the US economy US$2.2 billion annually. The effects of phosphorus pollution have already surpassed safe limits, causing severe damage to the planet's ecosystems. Reducing phosphorus pollution is increasingly recognized as vital for environmental sustainability. As environmental concerns continue to rise, phytase’s role in sustainable agriculture and its eco-friendly benefits become more crucial.

Although phytase is a valuable enzyme for animal feed, the production and formulation costs can be high due to the complex processes involved in extracting and stabilizing the enzyme. These costs can limit its widespread adoption, particularly in price-sensitive markets. Smaller producers or those in developing countries may find the cost prohibitive despite the benefits phytase offers.

The rapidly growing aquaculture industry, driven by the increasing global demand for seafood, presents a major opportunity for phytase use. For instance, the 2024 edition of The State of World Fisheries and Aquaculture (SOFIA) reported that global fisheries and aquaculture production reached 223.2 million tonnes in 2022, reflecting a 4.4 percent growth compared to 2020. This production included 185.4 million tonnes of aquatic animals and 37.8 million tonnes of algae. Phytase supplementation in fish and shrimp feed enhances phosphorus availability, improving growth and feed conversion. As the aquaculture market continues to expand, phytase's role in efficient and sustainable feed formulations is expected to grow significantly.

Furthermore, in March 2022, Del Pacifico Seafoods, a prominent company specializing in wild-caught Mexican shrimp, introduced a new range of farmed shrimp and oysters at the Seafood Expo in North America. Driven by the rising demand for shrimp in the retail and food service sectors, the company is actively expanding its aquaculture operations. Rising seafood demand and aquaculture market continues to expand; phytase's role in efficient and sustainable feed formulations is expected to grow significantly

Phytase Market Segmentation

The worldwide market for phytase is split based on type, class, source, application, and geography.

Phytase Market By Type

- Granular

- Powder

- Liquid

- Thermostable

According to the phytase industry analysis, the granular type dominates industry due to its ease of handling, stable storage, and efficient mixing with animal feed. Granular phytase offers improved dispersion and better bioavailability compared to other forms, ensuring enhanced nutrient absorption in livestock. It is also preferred for large-scale feed production, where consistency and cost-effectiveness are key. This type’s high performance in various feed formulations makes it the leading choice in the phytase market.

Phytase Market By Class

- 3-Phytase

- 6-Phytase

- Others

According to the phytase industry analysis, 3-phytase growing significantly in market due to its higher efficiency in breaking down phytic acid in animal feed. It is widely preferred for its ability to work effectively in both acidic and neutral pH environments, which makes it suitable for various animal species. Additionally, 3-phytase has been extensively researched and developed, making it more commercially available. Its widespread use across poultry, swine, and aquaculture feeds contributes to its dominant position in the phytase market.

Phytase Market By Source

- Plants

- Microorganisms

According to the phytase industry analysis, plant-derived phytase is often favored for its natural occurrence in feed ingredients like grains, offering a cost-effective and sustainable option for livestock nutrition. On the other hand, microorganism-derived phytase, typically produced through fermentation, is prized for its high potency, consistent quality, and scalability, making it suitable for commercial applications. Both sources are essential in meeting the growing demand for efficient enzyme solutions in animal feed.

Phytase Market By Application

- Food

- Feed

- Pharmaceuticals

According to the phytase market forecast, phytase has diverse applications across the food, feed, and pharmaceutical industries. In food, it improves mineral bioavailability, especially in plant-based foods, enhancing nutritional quality. In feed, phytase boosts nutrient digestibility, reduces phosphorus supplementation, and promotes sustainable animal growth. For the pharmaceutical sector, phytase is used in treatments to enhance mineral absorption, aid digestion, and support bone health. Its versatile applications across these sectors drive its increasing demand in the market.

Phytase Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Phytase Market Regional Analysis

For several reasons, North America dominates the phytase market due to its advanced agricultural practices, large-scale animal farming, and strong focus on animal feed solutions. For instance, in April 2022, Symrise Pet Food revealed a USD 65.5 million investment in expanding its North American headquarters in Greenwood County. This expansion is aimed at meeting the growing demand for pet food and enhancing the company's range of powder palatant products. The region has a high demand for efficient animal feed additives like phytase, driven by the need to improve animal health and reduce feed costs. Additionally, North American companies are major producers of phytase enzymes, further solidifying the region's market leadership.

Asia-Pacific is growing rapidly in the phytase market due to the increasing demand for animal protein, particularly in countries like China and India. For instance, in May 2022, Cargill India revealed plans to invest USD 160 million over three years to grow its animal nutrition business and other operations. This strategic move aims to boost its ability to support the expanding livestock industry and solidify its market position in India, highlighting the company's dedication to the region's agricultural growth. The region's large poultry and swine industries are adopting phytase to enhance feed efficiency and reduce environmental impact. As awareness of phytase's benefits spreads and feed mills modernize, the market is expected to continue expanding at a significant pace in this region.

Phytase Market Players

Some of the top phytase companies offered in our report include Adisseo, Alltech, DuPont, Jinan Tiantianxiang (TTX), Novozymes, Vland Biotech Group, Kemin Industries Inc., Qingdao Vland Biotech INC, Huvepharma, Novus International, BASF SE, AB Enzymes (Associated British Foods PLC), and Willows Ingredients.

Frequently Asked Questions

How big is the phytase market?

The phytase market size was valued at USD 557.8 Million in 2023.

What is the CAGR of the global phytase market from 2024 to 2032?

The CAGR of phytase is 6.8% during the analysis period of 2024 to 2032.

Which are the key players in the Phytase market?

The key players operating in the global market are including Adisseo, Alltech, DuPont, Jinan Tiantianxiang (TTX), Novozymes, Vland Biotech Group, Kemin Industries Inc., Qingdao Vland Biotech INC, Huvepharma, Novus International, BASF SE, AB Enzymes (Associated British Foods PLC), and Willows Ingredients.

Which region dominated the global Phytase market share?

North America held the dominating position in phytase industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of phytase during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Phytase industry?

The current trends and dynamics in the phytase industry include increasing demand for cost-effective and nutrient-rich animal feed, rising awareness of environmental benefits from reduced phosphorus pollution, and growth in poultry and swine industries globally.

Which type held the maximum share in 2023?

The granular type held the maximum share of the phytase industry.