Phosphate Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Phosphate Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

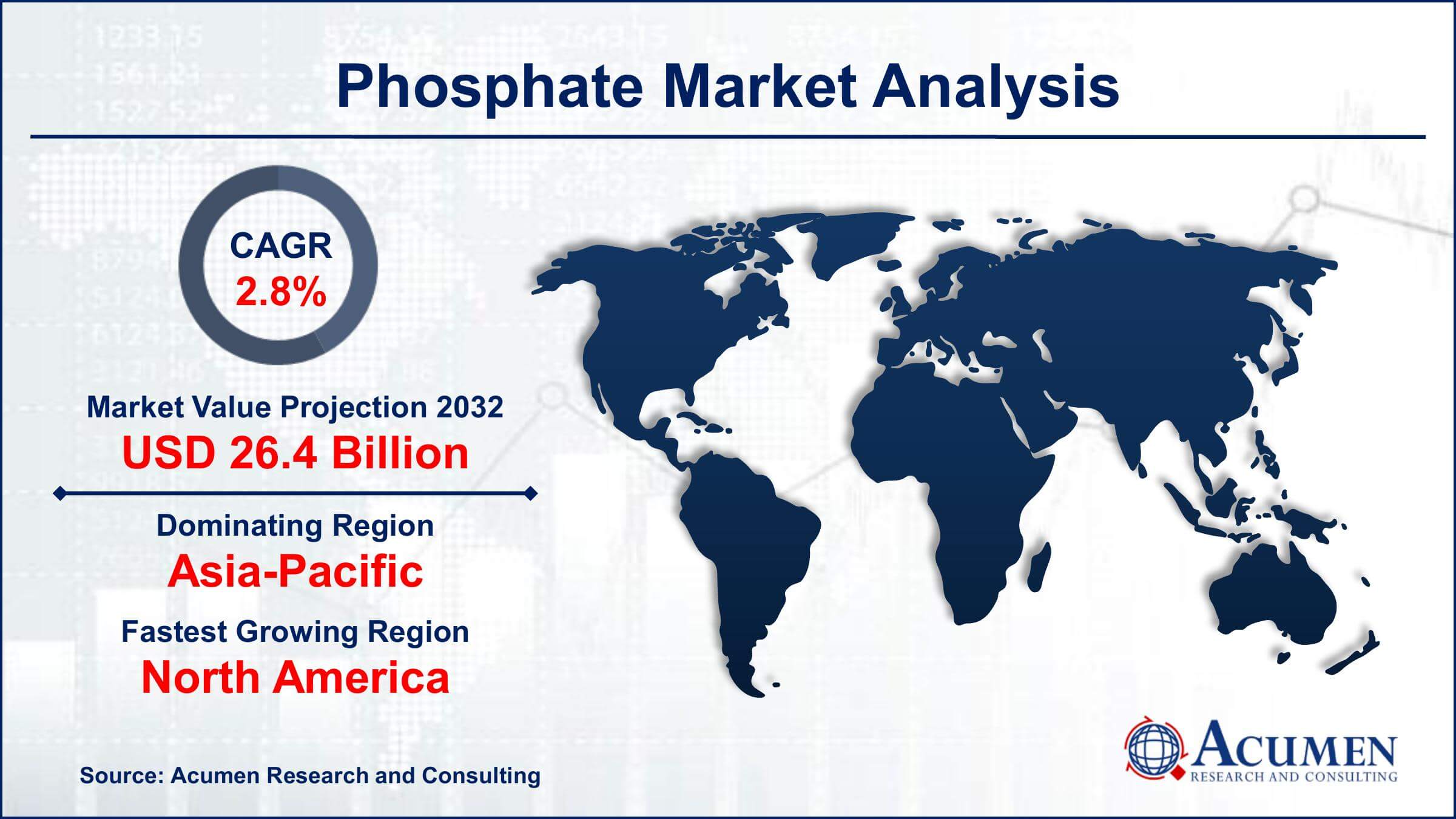

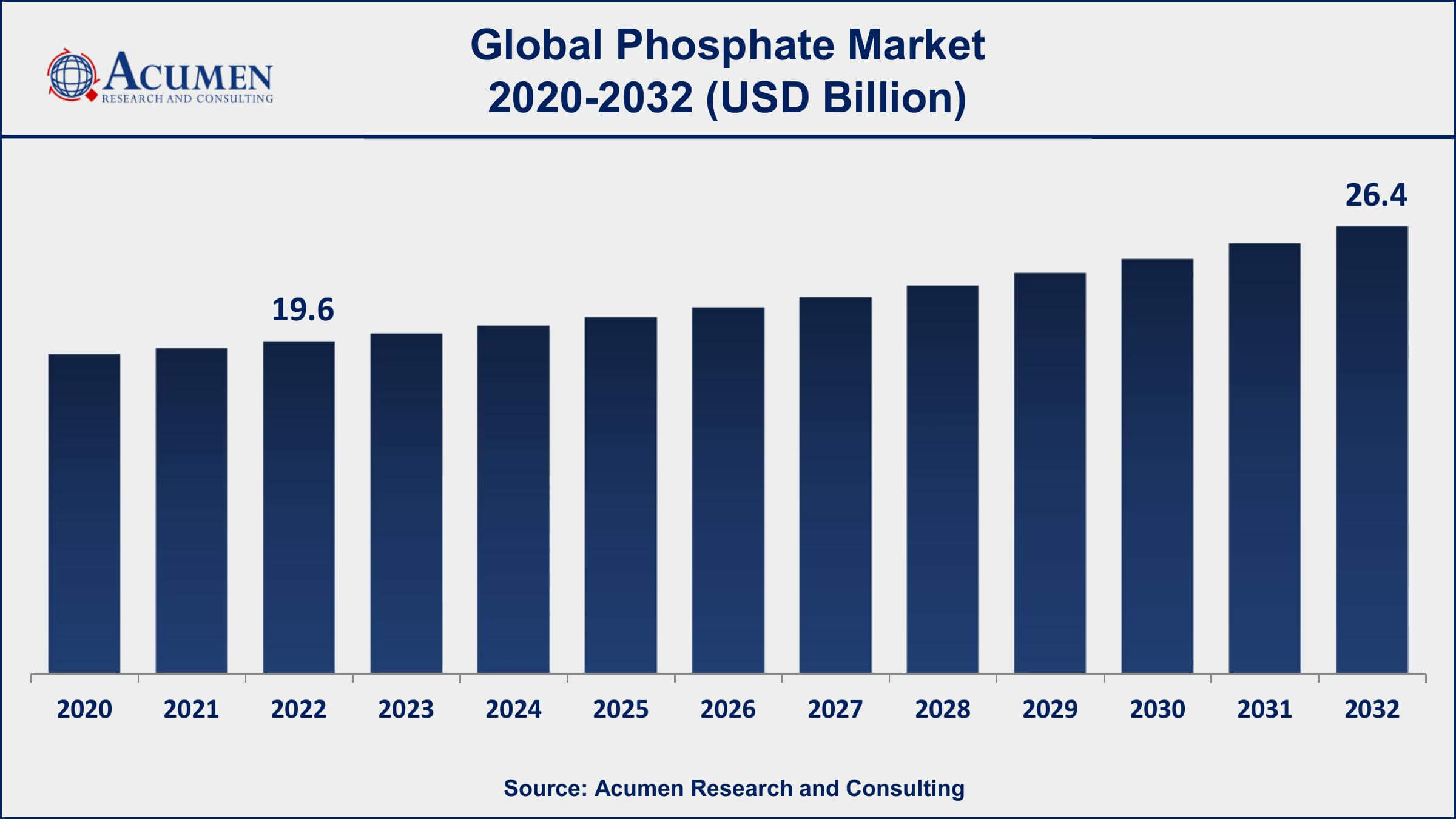

The Global Phosphate Market Size accounted for USD 19.6 Billion in 2022 and is projected to achieve a market size of USD 26.4 Billion by 2032 growing at a CAGR of 2.8% from 2023 to 2032.

Phosphate Market Report Key Highlights

- Global phosphate market revenue is expected to increase by USD 26.4 Billion by 2032, with a 2.8% CAGR from 2023 to 2032

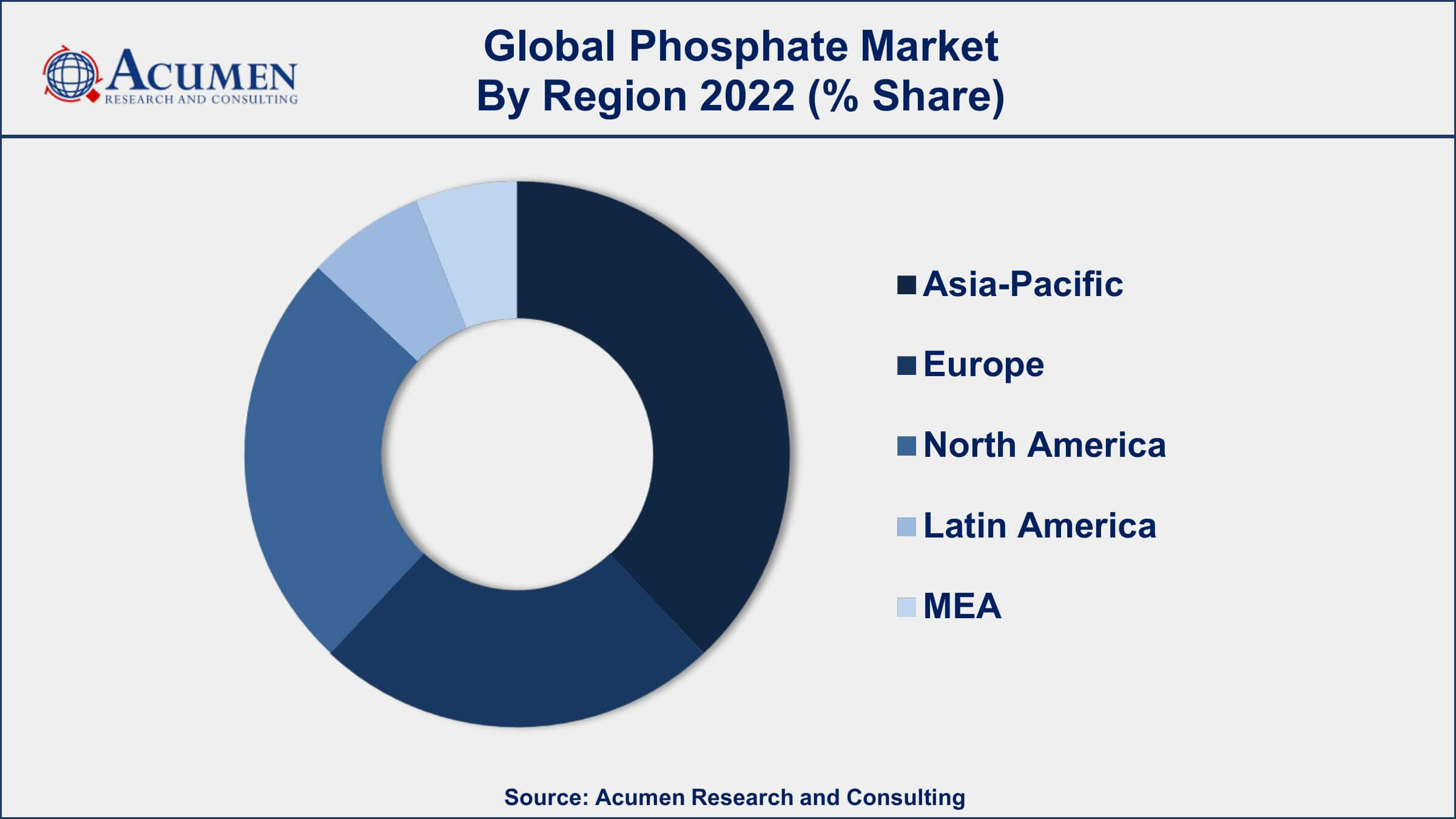

- Asia-Pacific region led with more than 41% of phosphate market share in 2022

- China is the largest producer of phosphate rock, accounting for about 37% of the world's total production in 2020

- According to the United States Geological Survey (USGS), global production of phosphate rock in 2020 was about 260 million metric tons.

- The main use of phosphate rock is in the production of fertilizers, with approximately 90% of phosphate rock being used for this purpose

- Expanding application in animal feed industry, drives the phosphate market size

Phosphate is a chemical compound that contains the element phosphorus, which is essential for life as it plays a crucial role in numerous biological processes such as energy transfer, DNA synthesis, and cell signaling. Phosphates are commonly used as fertilizers in agriculture to improve crop yield and quality, and they are also used in a wide range of industrial applications, such as the production of detergents, animal feed, and food additives.

In terms of market growth, the global phosphate market value is expected to continue to grow in the coming years due to the increasing demand for food, particularly in developing countries, and the growing use of phosphates in various industrial applications. The demand for phosphate-based fertilizers is expected to be the major driving force behind the growth of the market, particularly in regions such as Asia Pacific and Latin America, where there is a significant need to improve agricultural productivity.

Global Phosphate Market Trends

Market Drivers

- Growing demand for fertilizers in agriculture sector

- Increasing use of phosphates in food and beverage industry

- Rising demand for phosphate-based chemicals in various industries

- Expanding application of phosphates in animal feed industry

Market Restraints

- Volatility in phosphate rock prices

- Environmental concerns related to phosphate mining and processing

Market Opportunities

- Emergence of new applications for phosphates in various industries

- Increasing investments in phosphate mining and processing projects

Phosphate Market Report Coverage

| Market | Phosphate Market |

| Phosphate Market Size 2022 | USD 19.6 Billion |

| Phosphate Market Forecast 2032 | USD 26.4 Billion |

| Phosphate Market CAGR During 2023 - 2032 | 2.8% |

| Phosphate Market Analysis Period | 2020 - 2032 |

| Phosphate Market Base Year | 2022 |

| Phosphate Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Resource, By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Jordan Phosphate Mines Company, Mosaic Company, Saudi Arabian Mining Company, Innophos Holdings Inc., ChemischeFabrikBudenheim, Nutrien Ltd., Israel Chemical Ltd. (ICL), Yuntianhua Group Co., Ltd., Incitec Pivot Limited, and Yara International ASA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The increased food requirement in many Asian countries has resulted in an increased need for fertilizer production. This increment, in turn, has resulted in increasing demand for phosphate, assisting the development of the global phosphates market. The Asia-Pacific region has emerged as a strong contender in the overall growth of the industry, together with the Middle East and Latin America. Phosphate has an extensive range of applications and the demand for phosphate has been comparatively stable. Unlike other participants in the fertilizer market, companies manufacturing phosphate profit from this stability. The main end users of phosphate include the food industry, industrial use, detergents, and animal feed. There is significant depletion in the arable land per person and deterioration in the soil quality. Phosphates play a vital role in meeting the need for yielding maximum production from the available arable land. In Asia-Pacific, a little more than one-tenth of a hectare per person of land is accessible for agriculture.

The global phosphate market is segmented by type into ammonium phosphate, phosphoric acid, calcium phosphate, sodium tripolyphosphate, potassium phosphate, and others. The market for calcium phosphate is probable to grow at the highest rate during the forecast period. The higher growth rate for calcium phosphate over other types is owing to the increasing demand from foods & beverages, pharmaceuticals, healthcare & nutraceuticals, rubber, plastics, and other applications. It offers benefits such as clarity, softness, flexibility, waterproof properties, barrier, resistance to stress and crack, ultraviolet radiations, and mechanical and optical properties. Besides, the growing consumption of packaged food is influencing the demand for calcium phosphate.

Phosphate Market Segmentation

The global phosphate market segmentation is based on resource, type, application, and geography.

Phosphate Market By Resource

- Sedimentary Marine Deposit

- Biogenic

- Weathered Rock

- Others

According to the phosphate industry analysis, the sedimentary marine deposit segment is predicted to lead the market. These deposits are formed from the accumulation of organic matter and animal remains in marine sediments over millions of years. The sedimentary marine deposit resource segment is considered to be one of the most abundant and accessible sources of phosphate, with major reserves located in regions such as Morocco, Western Sahara, and South Africa. The increasing demand for phosphate fertilizers and the growing use of phosphates in various industrial applications are expected to drive the growth of the sedimentary marine deposit resource segment in the phosphate market. Moreover, technological advancements in mining and extraction techniques, such as in-situ mining and selective mining, are expected to enhance the efficiency and cost-effectiveness of phosphate mining from sedimentary marine deposits.

Phosphate Market By Type

- Calcium Phosphate

- Ammonium Phosphate

- Phosphoric Acid

- Sodium Tripolyphosphate

- Potassium Phosphate

- Others

In terms of type, the ammonium phosphate segment is widely employed in the industry. Ammonium phosphate is a type of phosphate fertilizer that is commonly used in agriculture due to its high nitrogen and phosphorus content. It is produced by combining phosphoric acid with ammonia and can be used in a variety of crops such as corn, wheat, and soybeans. The ammonium phosphate segment is one of the key segments of the global phosphate market, and it is expected to grow in the coming years. The growing demand for food, the increasing population, and the need to improve crop yields are some of the key factors driving the growth of the ammonium phosphate segment in the phosphate market. Additionally, the use of ammonium phosphate as a cost-effective and efficient source of nutrients in agriculture is expected to drive its demand.

Phosphate Market By Application

- Foods & Beverages

- Fertilizers

- Water Treatment Chemicals

- Detergents

- Metal Finishing

- Others

According to the phosphate market forecast, the fertilizers segment is predicted to grow significantly in the coming years. The fertilizer application is one of the most significant segments of the global market, accounting for a significant portion of the demand for phosphate. Phosphates are widely used as fertilizers in agriculture to enhance crop yields and improve crop quality. They are essential nutrients for plant growth, and their use helps to replenish the soil's nutrients that are depleted by farming activities. The demand for phosphate fertilizers in the agricultural sector is driven by the growing global population, which has led to an increase in demand for food. Additionally, the need to improve crop yields and quality to meet the growing demand for food is expected to drive the demand for phosphate fertilizers in the coming years.

Phosphate Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

The Asia-Pacific region is currently dominating the global phosphate market, and it is expected to continue to do so in the coming years. The key factors driving the dominance of the Asia-Pacific region in the phosphate market include its large population, growing economy, and increasing demand for food and agricultural products. Additionally, the region is home to some of the world's fastest-growing economies, such as China and India, which are major consumers of phosphate fertilizers and industrial phosphates. The increasing demand for food in the Asia-Pacific region, driven by its large population, is a major driver of the market. Phosphate fertilizers are used extensively in agriculture in the region to improve crop yields and ensure food security. Furthermore, the rising demand for animal feed due to the growing demand for meat and dairy products is driving the market growth in the region.

Phosphate Market Player

Some of the top phosphate market companies offered in the professional report include Jordan Phosphate Mines Company, Mosaic Company, Saudi Arabian Mining Company, Innophos Holdings Inc., Chemische Fabrik Budenheim, Nutrien Ltd., Israel Chemical Ltd. (ICL), Yuntianhua Group Co., Ltd., Incitec Pivot Limited, and Yara International ASA.

Frequently Asked Questions

What was the market size of the global phosphate in 2022?

The market size of phosphate was USD 19.6 Billion in 2022.

What is the CAGR of the global phosphate market during forecast period of 2023 to 2032?

The CAGR of phosphate market is 2.8% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global phosphate market are Jordan Phosphate Mines Company, Mosaic Company, Saudi Arabian Mining Company, Innophos Holdings Inc., ChemischeFabrikBudenheim, Nutrien Ltd., Israel Chemical Ltd. (ICL), Yuntianhua Group Co., Ltd., Incitec Pivot Limited, and Yara International ASA.

Which region held the dominating position in the global phosphate market?

Asia-Pacific held the dominating position in phosphate market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

North America region exhibited fastest growing CAGR for phosphate market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global phosphate market?

The current trends and dynamics in the phosphate industry include the growing demand for fertilizers in agriculture sector, and increasing use of phosphates in food and beverage industry.

Which type held the maximum share in 2022?

The ammonium phosphate type held the maximum share of the phosphate market.