Pharmacovigilance Outsourcing Market | Acumen Research and Consulting

Pharmacovigilance Outsourcing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

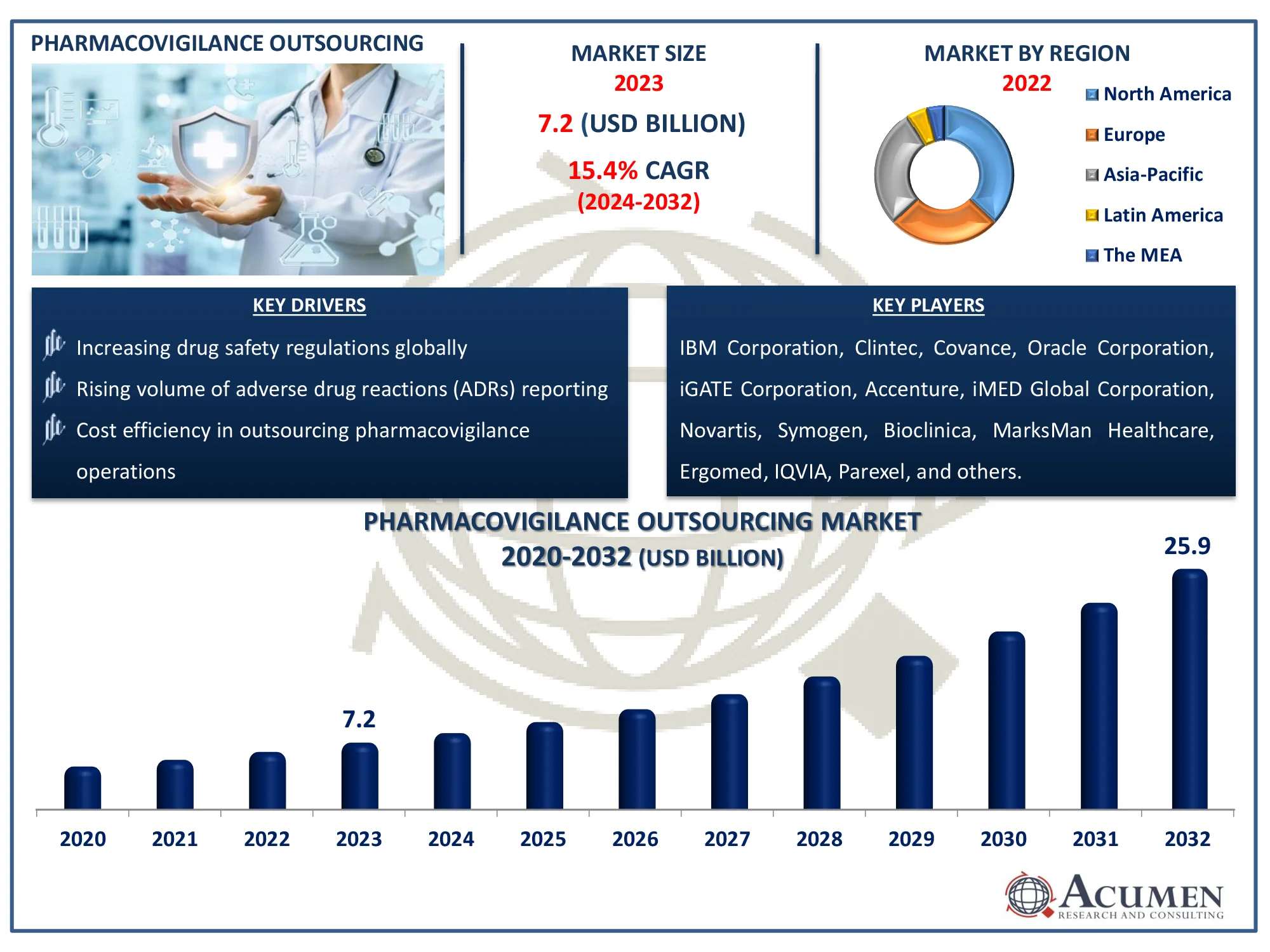

The Global Pharmacovigilance Outsourcing Market Size accounted for USD 7.2 Billion in 2023 and is estimated to achieve a market size of USD 25.9 Billion by 2032 growing at a CAGR of 15.4% from 2024 to 2032

Pharmacovigilance Outsourcing Market Highlights

- The global pharmacovigilance outsourcing market is expected to reach a revenue of USD 25.9 billion by 2032, growing at a CAGR of 15.4% between 2024 and 2032

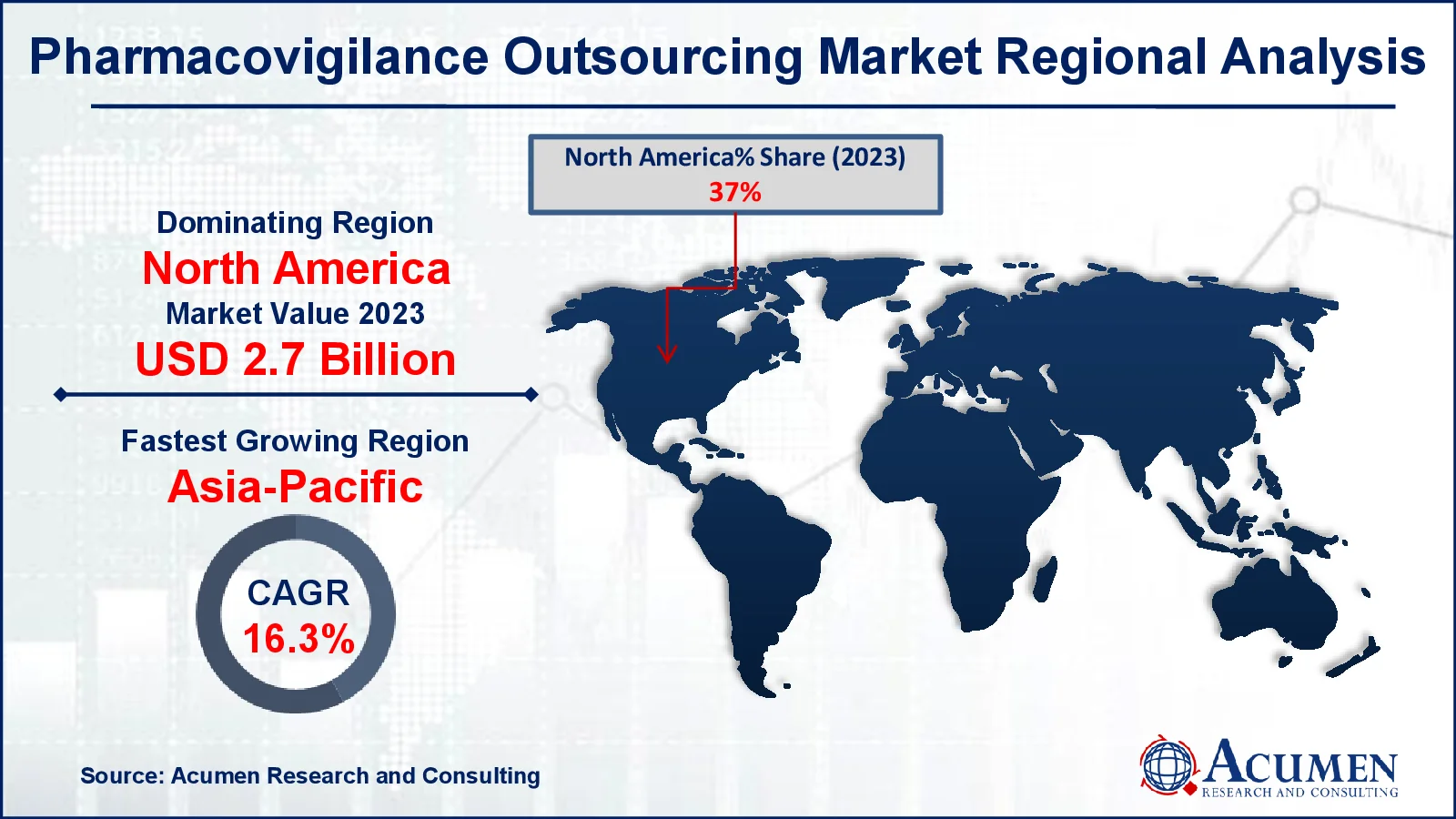

- In 2023, the North American pharmacovigilance outsourcing market was valued at approximately USD 2.7 billion

- The Asia-Pacific region is projected to experience a CAGR of over 16.3% in the pharmacovigilance outsourcing market from 2024 to 2032

- In 2023, contract research organizations (CROs) accounted for 65% of the market share in the service provider segment

- The pharmaceutical industry held a 44% share among end-users in 2023

- Adoption of AI and automation enhances outsourced pharmacovigilance processes is the pharmacovigilance outsourcing market trend that fuels the industry demand

According to the World Health Organization's (WHO) report on pharmaceutical consumption, medicines used to treat chronic diseases accounted for the majority of total drug utilization in non-hospital settings, resulting in a significant increase in the number of medicines available to consumers. Outsourcing for pharmacovigilance includes risk management, signal management, data management, and inspection support. The global pharmacovigilance outsourcing market is projected to grow at a CAGR of more than 15.4% during the forecast period. Furthermore, market participants are primarily focused on developing new innovative technologies to supplement the growth of pharmacovigilance outsourcing.

Global Pharmacovigilance Outsourcing Market Dynamics

Market Drivers

- Increasing drug safety regulations globally

- Rising volume of adverse drug reactions (ADRs) reporting

- Cost efficiency in outsourcing pharmacovigilance operations

Market Restraints

- Concerns over data security and confidentiality

- High dependency on third-party vendors

- Variability in regulatory requirements across regions

Market Opportunities

- Expansion of pharmacovigilance services in emerging markets

- Integration of AI and machine learning in safety data analysis

- Growing demand for personalized medicine and related safety monitoring

Pharmacovigilance Outsourcing Market Report Coverage

| Market | Pharmacovigilance Outsourcing Market |

| Pharmacovigilance Outsourcing Market Size 2022 |

USD 7.2 Billion |

| Pharmacovigilance Outsourcing Market Forecast 2032 | USD 25.9 Billion |

| Pharmacovigilance Outsourcing Market CAGR During 2023 - 2032 | 15.4% |

| Pharmacovigilance Outsourcing Market Analysis Period | 2020 - 2032 |

| Pharmacovigilance Outsourcing Market Base Year |

2023 |

| Pharmacovigilance Outsourcing Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Service, By Service Provider, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | IBM Corporation, Clintec, Covance, Oracle Corporation, Novartis, iGATE Corporation, Accenture, iMED Global Corporation, Bioclinica, MarksMan Healthcare, Symogen, Ergomed, IQVIA, Parexel, Medpace Holdings, and SIRO Clinpharm. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Pharmacovigilance Outsourcing Market Insights

The global pharmacovigilance outsourcing market is being driven by a growing emphasis on new drug development for chronic disease treatments, remote monitoring for clinical operations, quality assurance, regulatory affairs, statistical analysis, and clinical trials, an increasing preference among pharmaceutical companies for PV outsourcing facilities, and an increase in the number of adverse events and other safety concerns related to medical products. For instance, Charles River Laboratories will commence its Alternative Methods Advancement Project (AMAP) in April 2024, with the goal of developing alternatives to animal testing and setting a new standard for drug discovery and development. The company's initial investment was $200 million over the last four years, with a five-year target of investing an additional $300 million. This investment covers a range of technical developments, partnerships, and advocacy actions aimed at reducing the use of animal testing.

Growing safety concerns about medical products, as well as an increase in the number of unfavorable measures, are important drivers of the global pharmacovigilance (PV) outsourcing industry. The benefits provided by outsourcing facilities for in-house agreement operations are expected to drive the global pharmacovigilance outsourcing market over the forecast period. Increased usage of pharmacovigilance IT systems and services is expected to drive market growth over the forecast period.

Furthermore, several innovations in the medication development process are driving market expansion. A large number of pharmaceutical businesses are focused on outsourcing PV services in order to cut operational expenses and overall costs, consequently driving market growth. Nonetheless, issues connected with data security, such as mistreatment of patient data, may impede the growth of the worldwide pharmacovigilance outsourcing market.

Pharmacovigilance Outsourcing Market Segmentation

The worldwide market for pharmacovigilance outsourcing is split based on service, service provider, end-user, and geography.

Pharmacovigilance Outsourcing Services

- Pre-Marketing Services

- Clinical Pharmacovigilance Services

- Case Processing Services

- Safety Data Management Services

- Medical Review

- Post-Marketing Services

- Knowledge Process Outsourcing Services

- IT Solutions and Services

- Others

According to the pharmacovigilance outsourcing market forecast, pre-marketing services is expected to show notable growth in industry because they involve crucial tasks like collecting safety data and evaluating risks during clinical trials. These services are crucial for ensuring a drug is safe before it reaches the market, which is vital for obtaining regulatory approval. As more pharmaceutical companies rely on specialized providers to handle these tasks, the demand for pre-marketing pharmacovigilance services continues to grow.

Pharmacovigilance Outsourcing Service Providers

- Contract research organizations (CROs)

- Business process outsourcing (BPOs)

The contract research organizations (CROs) segment is the largest service provider category in the pharmacovigilance outsourcing market due to provide full drug safety services at a low cost to pharmaceutical corporations. CROs specialize in monitoring, reporting, and managing adverse drug reactions, making them a popular alternative for outsourcing. Their experience and global reach enable businesses to concentrate on core activities while maintaining regulatory compliance.

Pharmacovigilance Outsourcing End-Users

- Pharmaceutical Industry

- Research Organization

- Others

According to the pharmacovigilance outsourcing industry analysis, pharmaceutical industry plays a dominant role. This is because pharmaceutical companies need to ensure the safety and efficacy of their products through rigorous monitoring and reporting of adverse effects. By outsourcing pharmacovigilance activities, they can manage this complex process more efficiently, focus on core research and development, and ensure compliance with regulatory requirements globally.

Pharmacovigilance Outsourcing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Pharmacovigilance Outsourcing Market Regional Analysis

For several reasons, North America is predicted to be the highest revenue-generating area in the global pharmacovigilance outsourcing market. This expansion is linked to the presence of numerous major pharmaceutical and medical device businesses. In addition, a huge number of pharmaceutical businesses are largely focusing on outsourcing PV services in order to minimize operational expenses and lower total costs, consequently boosting the market expansion.

Asia-Pacific is also expected to increase significantly during the projected period due to China's extensive pharmacovigilance system, which comprises organizations and rules related to pharmacovigilance outsourcing. Advancements in medicine production in the region are a primary driver of regional market growth. Furthermore, strict and supportive policies aimed at improving the quality of pharmacovigilance services in India are projected to support regional market growth.

Pharmacovigilance Outsourcing Market Players

Some of the top pharmacovigilance outsourcing companies offered in our report include IBM Corporation, Clintec, Covance, Oracle Corporation, Novartis, iGATE Corporation, Accenture, iMED Global Corporation, Bioclinica, MarksMan Healthcare, Symogen, Ergomed, IQVIA, Parexel, Medpace Holdings, and SIRO Clinpharm.

Frequently Asked Questions

How big is the pharmacovigilance outsourcing market?

The pharmacovigilance outsourcing market size was valued at USD 7.2 Billion in 2023.

What is the CAGR of the global pharmacovigilance outsourcing market from 2024 to 2032?

The CAGR of pharmacovigilance outsourcing is 15.4% during the analysis period of 2024 to 2032.

Which are the key players in the Pharmacovigilance Outsourcing market?

The key players operating in the global market are including IBM Corporation, Clintec, Covance, Oracle Corporation, Novartis, iGATE Corporation, Accenture, iMED Global Corporation, Bioclinica, MarksMan Healthcare, Symogen, Ergomed, IQVIA, Parexel, Medpace Holdings, and SIRO Clinpharm.

Which region dominated the global pharmacovigilance outsourcing market share?

North America held the dominating position in pharmacovigilance outsourcing industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of pharmacovigilance outsourcing during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global pharmacovigilance outsourcing industry?

The current trends and dynamics in the pharmacovigilance outsourcing industry include increasing drug safety regulations globally, rising volume of adverse drug reactions (ADRs) reporting, and cost efficiency in outsourcing pharmacovigilance operations.

Which service provider held the maximum share in 2023?

The contract research organizations (CROs) held the maximum share of the pharmacovigilance outsourcing industry.