Pharmaceutical Manufacturing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Pharmaceutical Manufacturing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

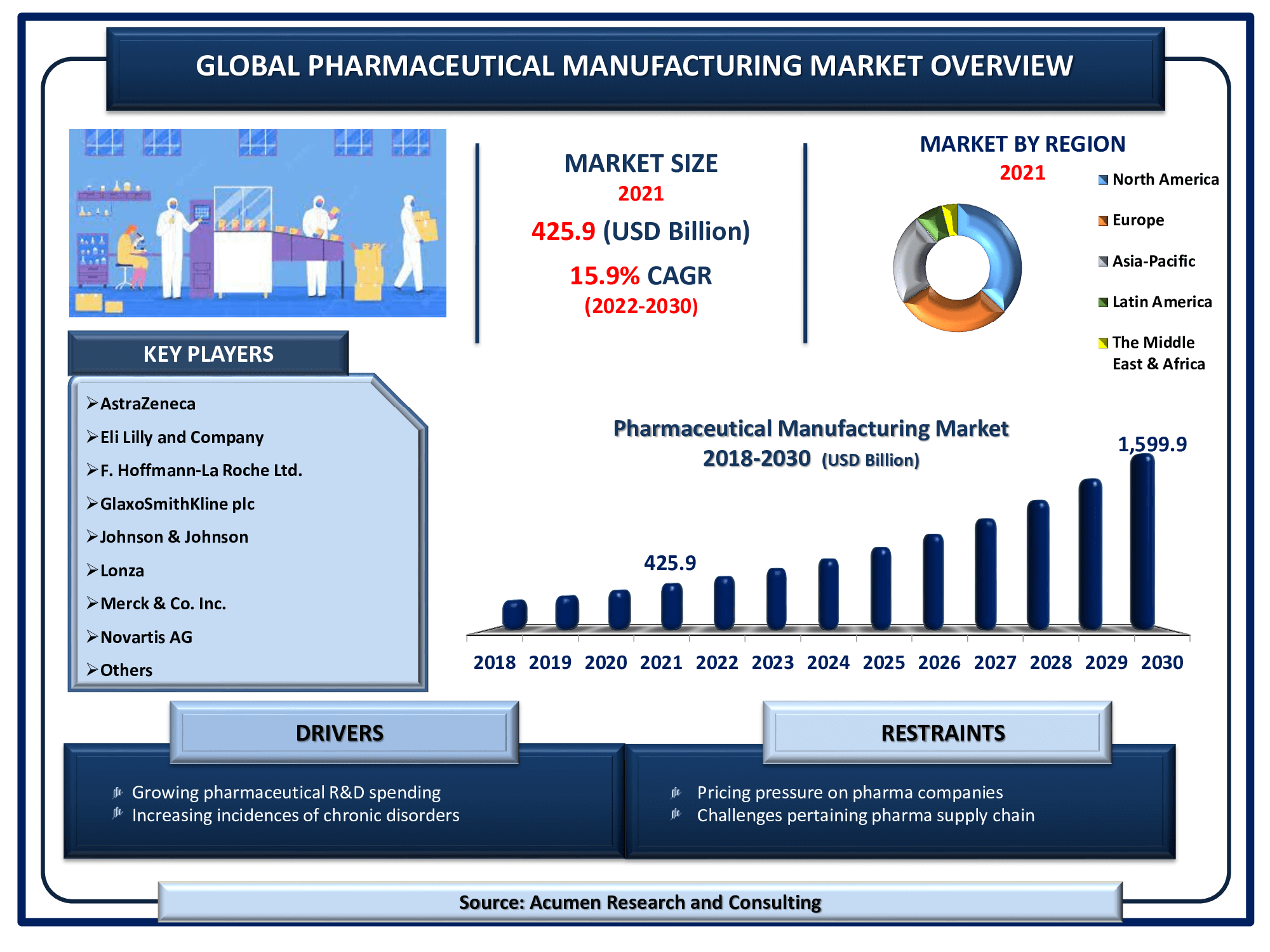

The Global Pharmaceutical Manufacturing Market Size accounted for USD 425.9 Billion in 2021 and is estimated to achieve a market size of USD 1,599.9 Billion by 2030 growing at a CAGR of 15.9% from 2022 to 2030. Increasing prevalence of chronic disorders is primarily fueling the pharmaceutical manufacturing market growth. Additionally, rising number of clinical trials is a prominent pharmaceutical manufacturing market trend that is strengthening the industry growth. Furthermore, growing emphasis on outsourcing drug manufacturing is expected to open up new growth prospects for the industry in the coming years.

Pharmaceutical Manufacturing Market Report Key Highlights

- Global pharmaceutical manufacturing market revenue is poised to garner USD 1,599.9 Billion by 2030 with a CAGR of 15.9% from 2022 to 2030

- Growing elderly population fuels the pharmaceutical manufacturing market growth

- According to the World Bank Statistics 2019, there were 703 million people aged 65 years or over in the world

- North America is the leading region with over 37% shares in 2021

- Asia-Pacific is likely to attain a significant CAGR from 2022 to 2030

- Based on route of administration segment, oral attained more than 55% of the total market share in 2021

Pharmaceutical manufacturing comprises the physical process of manufacturing pharmaceutical drugs. The process includes blending, compression, filtration, heating, encapsulation, shearing, tableting, granulation, coating, and drying. Pharmaceutical manufacturing is said to be a conservative business with low readiness and appetite for changes, assuming risks or embarking on new technological strategies and approaches. Pharmaceutical manufacturing has evolved with the increased focus on science and engineering principles.

Global Pharmaceutical Manufacturing Market Dynamics

Market Drivers

- Growing pharmaceutical R&D spending

- Increasing incidences of chronic disorders

- Growing focus on outsourcing manufacturing activities

- Advancements in pharmaceutical manufacturing technologies

Market Restraints

- Pricing pressure on pharma companies

- Challenges pertaining pharma supply chain

Market Opportunities

- Growing number of clinical trials

- Increasing investments and growing government support

Pharmaceutical Manufacturing Market Report Coverage

| Market | Pharmaceutical Manufacturing Market |

| Pharmaceutical Manufacturing Market Size 2021 | USD 425.9 Billion |

| Pharmaceutical Manufacturing Market Forecast 2030 | USD 1,599.9 Billion |

| Pharmaceutical Manufacturing Market CAGR During 2022 - 2030 | 15.9% |

| Pharmaceutical Manufacturing Market Analysis Period | 2018 - 2030 |

| Pharmaceutical Manufacturing Market Base Year | 2021 |

| Pharmaceutical Manufacturing Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Formulation, By Route of Administration, By Prescription, By Drug Development, By Distribution Channel, And By Geography |

| Pharmaceutical Manufacturing Market Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AstraZeneca, Eli Lilly and Company, F. Hoffmann-La Roche Ltd., GlaxoSmithKline plc, Johnson & Johnson, Lonza, Merck & Co. Inc., Novartis AG, Pfizer, Inc., Sanofi SA, and others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Pharmaceutical Manufacturing Market Insights

The increasing spending in the pharmaceutical R&D sector along with the advancements in pharmaceutical manufacturing technologies is driving the market growth. For instance, the FDA’s Center for Drug Evaluation and Research (CDER) has approved 46 new molecular entities (NMEs) in 2017 and the entity number got doubled in 2016. The rising focus on the healthcare needs of emerging nations across the globe is bolstering the market value. The growing geriatric population and incidence rate of chronic disorders due to changing lifestyle is further propelling the market value. Furthermore, the increasing number of clinical trials along with the increasing investment and funding programs across the pharmaceutical manufacturing industry is projected to create potential opportunities over the forecast period from 2022 to 2030.

On the other side, patent expiration of most profitable drugs and pricing pressures on pharmaceutical companies is estimated to hinder the growth to an extent over the forecast period from 2022 to 2030.

Pharmaceutical Manufacturing Market Segmentation

The worldwide pharmaceutical manufacturing market is split based on formulation, route of administration, prescription, drug development, distribution channel, and geography.

Pharmaceutical Manufacturing Market By Formulation

- Tablets

- Capsules

- Injectable

- Sprays Suspensions

- Powders

- Other Formulations

According to our pharmaceutical manufacturing industry analysis, the tablet formulation occupied the majority of the share in 2021. The widespread availability of tablets in different shapes, sizes, and colors is a prominent reason for this segmental growth. In addition, the arrival of 3D-printed tablets along with the growing trend of personalized medicines are boosting the market share.

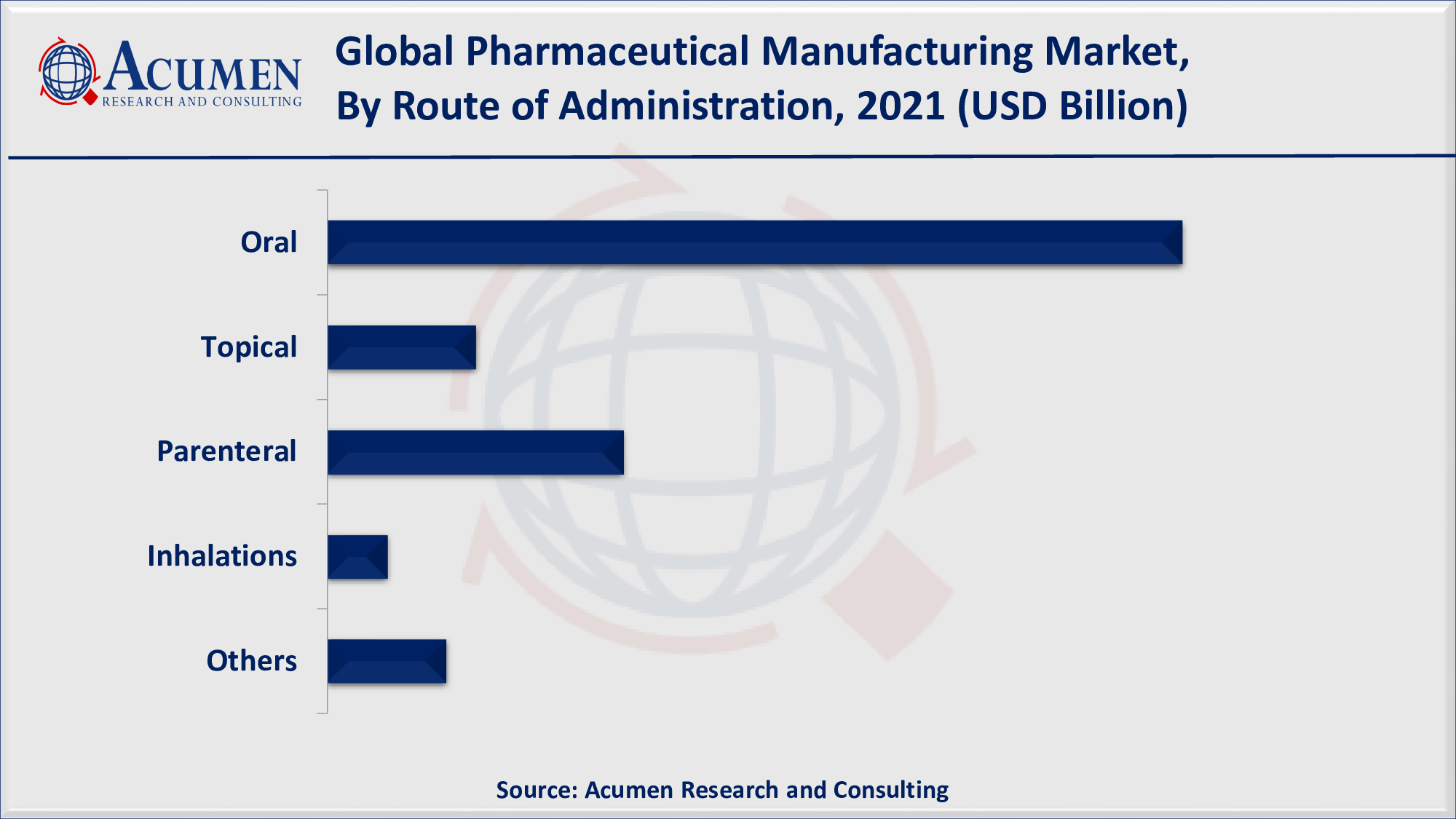

Pharmaceutical Manufacturing Market By Route of Administration

- Oral

- Topical

- Parenteral

- Inhalations

- Others

In 2021 the oral segment by route of administration is leading the market with maximum revenue share. The benefits associated with the oral dosage of drugs like affordability, ease of manufacturing, and patient-friendly among others is contributing to the segmental market value. The advancement in the drug delivery technology for oral administration of drugs like sustained release dosage formulations and targeted drug delivery is further bolstering the segmental market value.

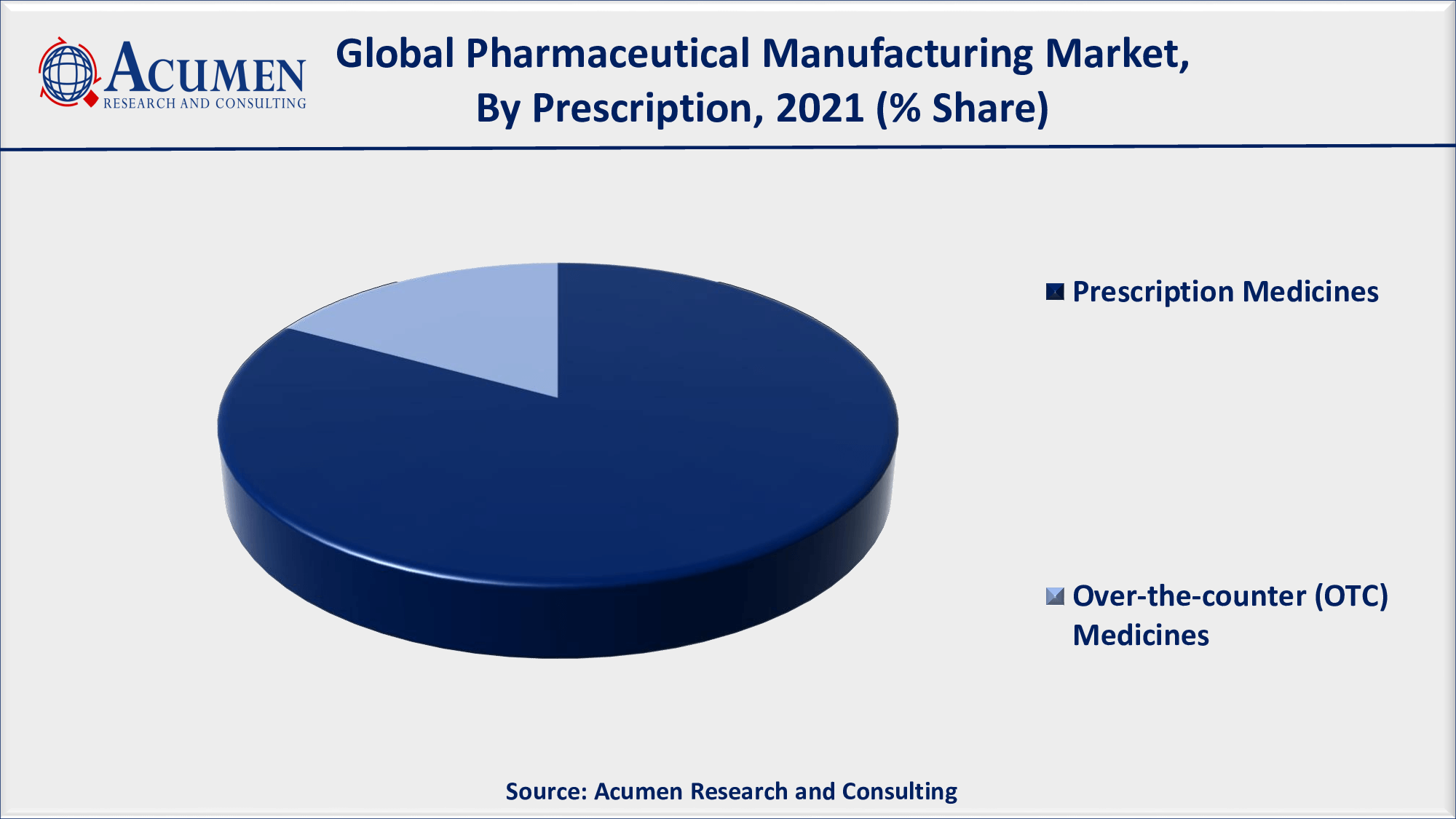

Pharmaceutical Manufacturing Market By Prescription

- Prescription Medicines

- Over-the-counter (OTC) Medicines

According to our pharmaceutical manufacturing market forecast, prescription medicines acquired more than 80% of the pharmaceutical manufacturing market share in 2021. This massive share of prescription drugs is because of the rising prescription drug expenditures throughout the world. A gradual shift of consumers towards over-the-counter (OTC) medicines is anticipated to witness a noteworthy growth rate in the coming years.

Pharmaceutical Manufacturing Market By Drug Development

- Outsource

- In-house

In 2021, the outsource drug development accumulated the principal market share. Several advantages associated with outsourcing operations are projected to propel the market forward at a rapid rate in the coming years. The in-house drug development also gathered a significant share in 2021. The use of in-house infrastructure and knowledge by large pharmaceutical corporations for drug development is the primary reason for multi-dose systems' significant market dominance.

Pharmaceutical Manufacturing Market By Distribution Channel

- Online

- Offline

Based on the distribution channel, the offline segment will account for more than 70% of the overall market. As medical costs and healthcare coverage have risen, more people have moved their preferences toward self-medication for minor health conditions. However, the advent of COVID-19 and rising consumer preference toward e-commerce will boost the online distribution channel segment in the coming years.

Pharmaceutical Manufacturing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa (ME&A)

North America accounted for the maximum revenue share in the pharmaceutical manufacturing market

In 2021, North America is leading the pharmaceutical manufacturing market with maximum revenue share (%), and the region along with its major economies projected to continue with its dominance over the estimated period from 2022 to 2030. The presence of major players and the well-established healthcare sector in the region is supporting its dominance. Additionally, the presence of a high-income population which is spending on their health is another factor giving momentum to the market value.

Asia Pacific is estimated to experience fastest growth over the forecast timeframe from 2020 to 2027

The rapidly developing pharmaceutical sector of the developing economies of the region is primarily supporting market growth. The COVID-19 pandemic has also given traction to the regional market value, as the developing economies including India and China have invested their time and money in the development of vaccination in large quantities which is another consideration for the regional market growth. The increasing number of regional players along with the rising focus of major global players on the developing markets of the region is additionally proliferating the regional pharmaceutical manufacturing market value.

Pharmaceutical Manufacturing Market Players

Some of the top pharmaceutical manufacturing companies offered in the professional report include AstraZeneca, Eli Lilly and Company, F. Hoffmann-La Roche Ltd., GlaxoSmithKline plc, Johnson & Johnson, Lonza, Merck & Co. Inc., Novartis AG, Pfizer, Inc., and Sanofi SA.

Frequently Asked Questions

What is the size of global pharmaceutical manufacturing market in 2021?

The market size of pharmaceutical manufacturing market in 2021 was accounted to be USD 425.9 Billion.

What is the CAGR of global pharmaceutical manufacturing market during forecast period of 2022 to 2030?

The projected CAGR of pharmaceutical manufacturing market during the analysis period of 2022 to 2030 is 15.9%.

Which are the key players operating in the market?

The prominent players of the global pharmaceutical manufacturing market are AstraZeneca, Eli Lilly and Company, F. Hoffmann-La Roche Ltd., GlaxoSmithKline plc, Johnson & Johnson, Lonza, Merck & Co. Inc., Novartis AG, Pfizer, Inc., and Sanofi SA.

Which region held the dominating position in the global pharmaceutical manufacturing market?

North America held the dominating pharmaceutical manufacturing during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for pharmaceutical manufacturing during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global pharmaceutical manufacturing market?

Growing pharmaceutical R&D spending, increasing incidences of chronic disorders, and growing focus on outsourcing manufacturing activities drives the growth of global pharmaceutical manufacturing market.

Which Formulation held the maximum share in 2021?

Based on formulation, tablets segment is expected to hold the maximum share pharmaceutical manufacturing market.