Pharmaceutical Cartridges Market | Acumen Research and Consulting

Pharmaceutical Cartridges Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

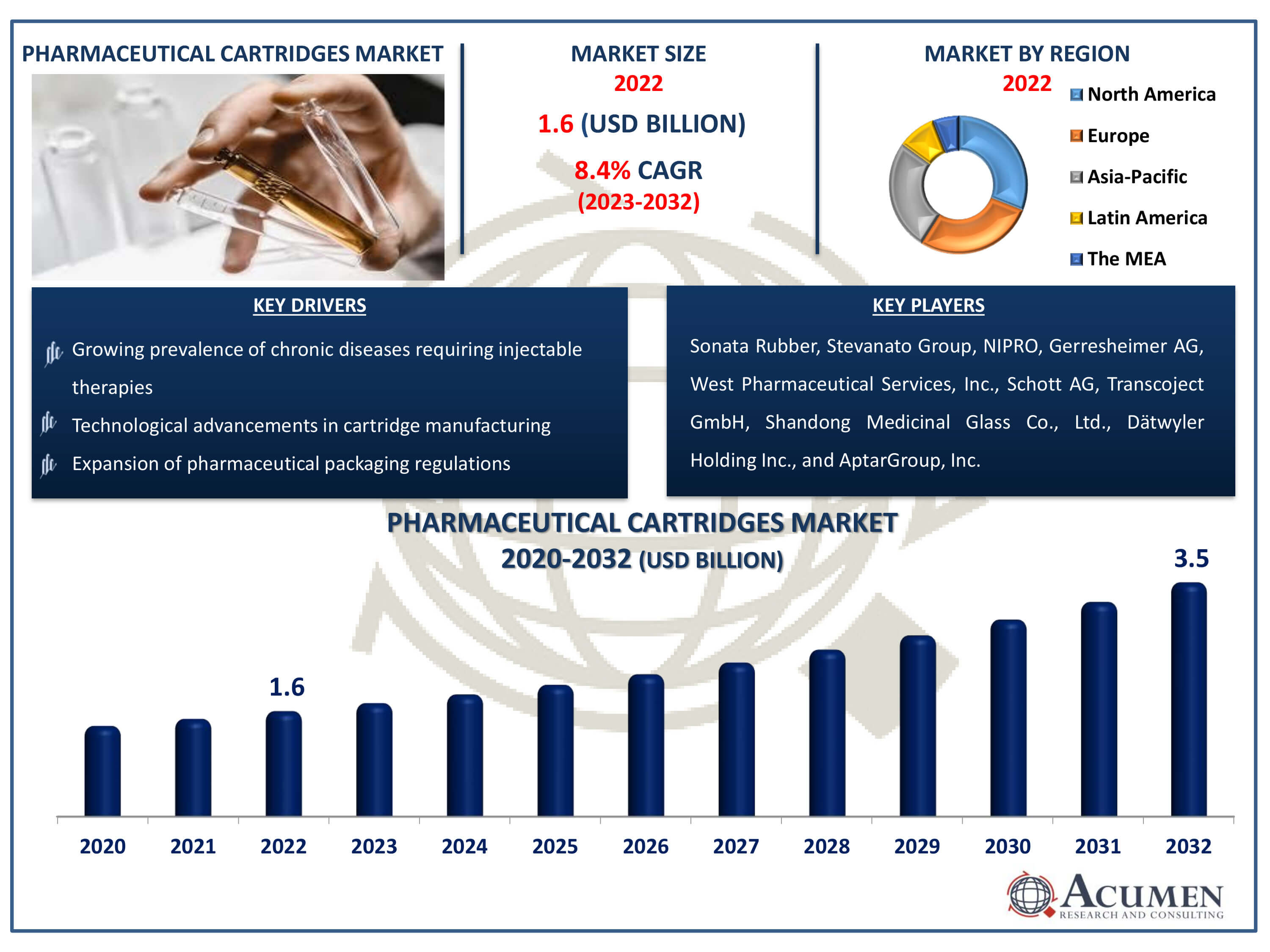

The Pharmaceutical Cartridges Market Size accounted for USD 1.6 Billion in 2022 and is estimated to achieve a market size of USD 3.5 Billion by 2032 growing at a CAGR of 8.4% from 2023 to 2032.

Pharmaceutical Cartridges Market Highlights

- Global pharmaceutical cartridges market revenue is poised to garner USD 3.5 billion by 2032 with a CAGR of 8.4% from 2023 to 2032

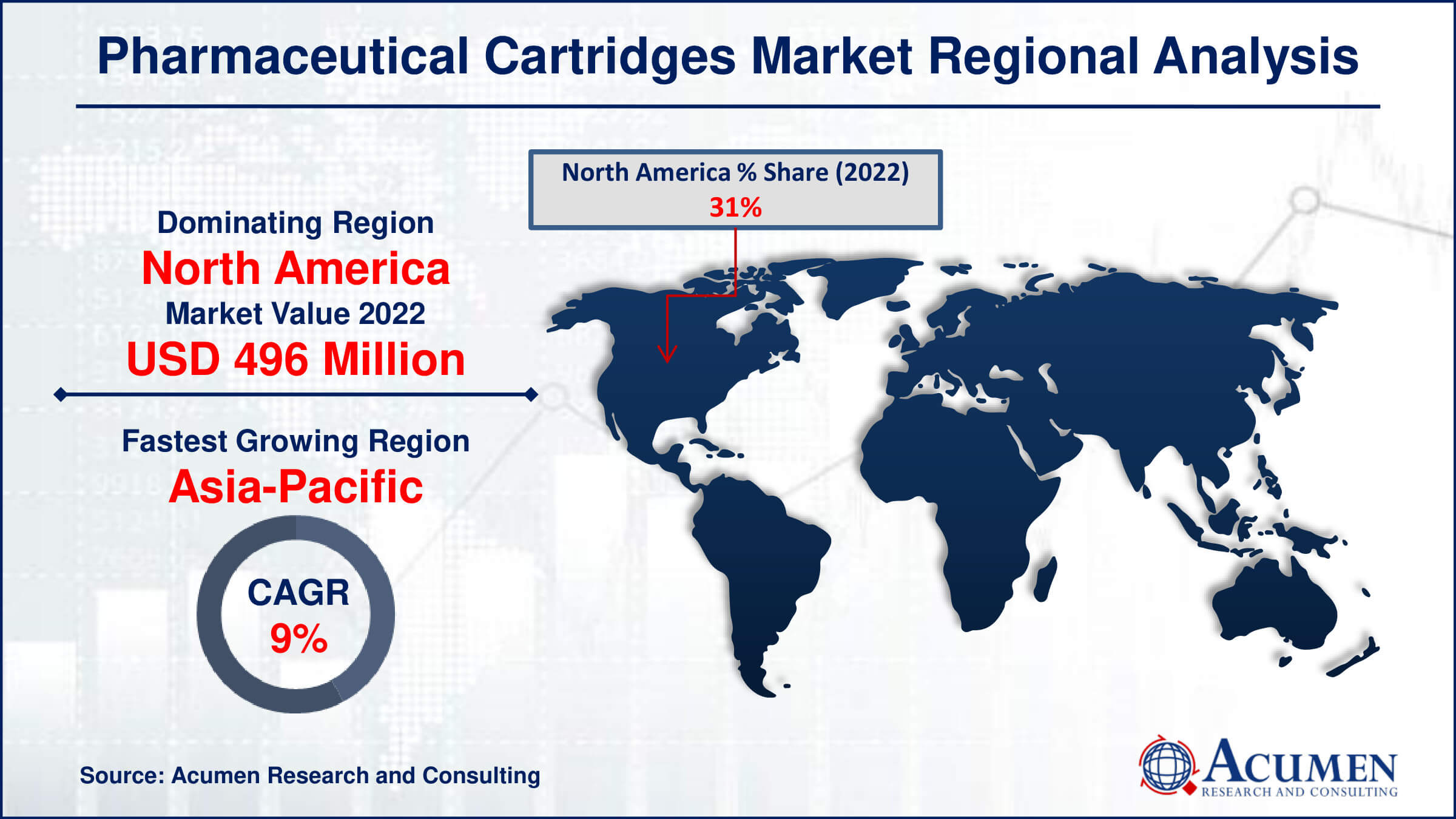

- North America pharmaceutical cartridges market value occupied around USD 496 Million in 2022

- Asia-Pacific pharmaceutical cartridges market growth will record a CAGR of more than 9% from 2023 to 2032

- Among material type, the glass sub-segment generated USD 992 million revenue in 2022

- Based on chamber type, the dual chamber sub-segment generated around 60% of pharmaceutical cartridges market share in 2022

- Increasing focus on sustainability and eco-friendly packaging solutions is a popular pharmaceutical cartridges market trend that fuels the industry demand

Pharmaceutical cartridges are specialized containers used to store and deliver pharmaceutical pharmaceuticals, notably injectable treatments. These cartridges are often built of high-quality materials like borosilicate glass or polymers, which are suitable for pharmaceutical formulas and maintain product integrity. Pharmaceutical cartridges exist in a variety of sizes and designs to allow varied dosages and administration methods, such as prefilled syringes and cartridge-based drug delivery devices. They serve an important role in the pharmaceutical business by offering a safe and dependable method of packing and delivering pharmaceuticals, assuring correct dosage, convenience of use, and patient safety. Furthermore, pharmaceutical cartridges are subjected to extensive quality control techniques to guarantee compliance with regulatory requirements and the purity and stability of the medication compositions contained inside.

Global Pharmaceutical Cartridges Market Dynamics

Market Drivers

- Increasing demand for biologics and injectable drugs

- Technological advancements in cartridge manufacturing

- Growing prevalence of chronic diseases requiring injectable therapies

- Expansion of pharmaceutical packaging regulations

Market Restraints

- High initial investment costs for manufacturing facilities

- Concerns regarding drug compatibility and leachables

- Stringent regulatory requirements for pharmaceutical packaging

Market Opportunities

- Rising adoption of prefilled syringes for self-administration

- Emerging markets presenting untapped growth potential

- Development of innovative drug delivery systems utilizing cartridges

Pharmaceutical Cartridges Market Report Coverage

| Market | Pharmaceutical Cartridges Market |

| Pharmaceutical Cartridges Market Size 2022 | USD 1.6 Billion |

| Pharmaceutical Cartridges Market Forecast 2032 |

USD 3.5 Billion |

| Pharmaceutical Cartridges Market CAGR During 2023 - 2032 | 8.4% |

| Pharmaceutical Cartridges Market Analysis Period | 2020 - 2032 |

| Pharmaceutical Cartridges Market Base Year |

2022 |

| Pharmaceutical Cartridges Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material Type, By Chamber Type, By Size, By Application, By End-user, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Transcoject GmbH, Stevanato Group, Shandong Medicinal Glass Co., Ltd., Gerresheimer AG, Dätwyler Holding Inc., West Pharmaceutical Services, Inc., AptarGroup, Inc., Sonata Rubber, Schott AG, and NIPRO. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Pharmaceutical Cartridges Market Insights

Rising mindfulness with respect to the advantages of utilizing pharmaceutical cartridges in the packaging business is moving the market request. These advantages incorporate on-time, precise, and safe medication conveyance, break-obstruction packaging, and low leftover volumes of medications. Expanding pervasiveness of incessant illnesses, for example, joint inflammation, diabetes, and oral conditions, and appeal for long haul stockpiling of medications are additionally foreseen to contribute toward market development.

For example, according to the National Diabetes Statistics Report distributed in 2017, American Indians were accounted for with the most astounding commonness of diabetes for the two females (15.3%) and guys (14.9%). Insulin treatment assumes an imperative job in the treatment of diabetes. In this way, developing instances of diabetes may expand the need for insulin treatment. Already, customary packaging, for example, rankle packs and containers, were utilized for insulin conveyance. Be that as it may, inferable from a few focal points, pharmaceutical cartridges are being favoured, which, thusly, is supporting business sector improvement.

Also, numerous initiatives taken by prominent organizations in the market are additionally expected to increase the pharmaceutical cartridges market request. For instance, the administrator and CEO of Merck, expressed in an article that the organization is intending to change over its injectable items to the new glass packaging arrangement, when it gets the endorsement. Moreover, in 2015, Schott AG began a focal point of brilliance at its U.S. creation office for growing chemically-strengthened glass cartridges.

Pharmaceutical Cartridges Market Segmentation

The worldwide market for pharmaceutical cartridges is split based on material type, chamber type, size, application, end-users, and geography.

Pharmaceutical Cartridge Material Types

- Glass

- Type 1

- Type 2

- Type 3

- Plastic

- Polypropylene (PP)

- Cyclic Olefin Copolymer (COC)

- Cyclic Olefin Polymer (COP)

- Polyethylene

- Rubber

According to pharmaceutical cartridges industry analysis, the glass sector leads market, accounting for the biggest share due to numerous major features. Glass cartridges are favoured for pharmaceutical packaging because of their inert qualities, which maintain the safety and integrity of medication formulations, particularly delicate biologics and vaccines. Glass has great chemical resistance, preventing medication interactions with container materials. Furthermore, glass cartridges are exceptionally clear, allowing for simple visual assessment of the contents and more precise dosage. Furthermore, glass is recyclable and ecologically friendly, which aligns with current sustainable packaging trends. These qualities contribute to glass cartridges' broad usage in the pharmaceutical business, making them the market's dominant material type.

Pharmaceutical Cartridge Chamber Types

- Large Volume

- Dual Chamber

The dual chamber segment dominates the pharmaceutical cartridges market due to its versatility and capacity to accept a wide range of medication compositions. Dual chamber cartridges provide the benefit of holding two distinct components or substances separately within the same cartridge, avoiding early mixing or degradation of delicate medications. This design is especially useful for complicated formulations like lyophilized or reconstitutable medications, allowing for easy mixing and administration at the point of use. The twin chamber arrangement improves product stability, shelf life, and precision dosage, resulting in widespread use in pharmaceutical packaging applications.

Pharmaceutical Cartridge Sizes

- 0.5 ml

- 1.8 ml

- 2ml to 2.5 ml

- 3 ml

- 5 ml

- More than 10 ml

The 3 ml sector accounts for the bulk of the market due to its widespread use in many applications and it is expected to grow over the pharmaceutical cartridges industry forecast period. This size is adaptable enough to package a variety of therapeutic compositions, including vaccines, biologics, and injectable drugs. Its small but adequate capacity makes it appropriate for both single-dose and multi-dose applications, catering to a wide range of patient demands and treatment regimens. Furthermore, the 3 ml size finds a compromise between volume needs and convenience of handling, making it the favored option of pharmaceutical producers and healthcare professionals, contributing to its market domination.

Pharmaceutical Cartridge Applications

- Pen Injectors

- Autoinjectors

- Wearable Injectors

- Dental Anesthesia

In terms of pharmaceutical cartridges market analysis, pen injectors have the biggest market share because to their broad acceptance and adaptability in a variety of healthcare settings. Pen injectors provide a practical and user-friendly method for self-administering injectable drugs, especially for chronic disorders like diabetes and autoimmune diseases. Their tiny and portable form, along with pre-filled cartridges, enables for simple and precise dosage by patients, minimising the need for healthcare professionals to administer. Furthermore, developments in pen injector technology, such as dosage customisation and digital connection, have increased their popularity and market domination.

Pharmaceutical Cartridge End-Users

- Pharmaceuticals

- Biotechnology

- Research Organizations

- Others

Pharmaceutical firms utilize cartridges extensively in medicine packaging and distribution, hence the pharmaceuticals category has the highest share of the pharmaceutical cartridges market. Pharmaceutical cartridges are used to store and administer injectable drugs such as vaccinations, insulin, and biologics. Pharmaceutical firms continue to rely extensively on cartridges to package their goods as the need for injectable medications to address chronic illnesses and medical problems grows. Furthermore, the pharmaceutical industry's rigorous quality standards and regulatory requirements encourage the use of pharmaceutical cartridges, strengthening the segment's market leadership.

Pharmaceutical Cartridges Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Pharmaceutical Cartridges Market Regional Analysis

North America is anticipated to observer the highest market share during the forthcoming years. Expanding predominance of unending illnesses, for example, joint inflammation, and corpulence, in North America are contributing towards the market development. For example, in 2017, according to the Centers for Disease Control and Prevention (CDC) around 30.3 Million individuals (9.4%) of all age in U.S. populace experienced diabetes and around 87.5% of grown-ups experienced heftiness in 2015.

Such examples are foreseen to increase the interest for medicine, particularly, insulin for the treatment of diabetes, in this way energizing business sector development. Pharmaceutical cartridges are broadly utilized for insulin conveyance attributable to their preferences, for example, long haul stockpiling and exact measurements. Besides, expanded focal point of organizations in U.S. on are producing glass cartridges because of their expanding selection in pharmaceutical bundling will positively affect the locale's development. The Asia-Pacific region is the fastest-growing in the industry and is expected to continue growing throughout the pharmaceutical cartridges market forecast period.

Pharmaceutical Cartridges Market Players

Some of the top pharmaceutical cartridges companies offered in our report includes Transcoject GmbH, Stevanato Group, Shandong Medicinal Glass Co., Ltd., Gerresheimer AG, Dätwyler Holding Inc., West Pharmaceutical Services, Inc., AptarGroup, Inc., Sonata Rubber, Schott AG, and NIPRO.

Frequently Asked Questions

How big is the pharmaceutical cartridges market?

The pharmaceutical cartridges market size was valued at USD 1.6 Billion in 2022.

What is the CAGR of the global pharmaceutical cartridges market from 2023 to 2032?

The CAGR of pharmaceutical cartridges is 8.4% during the analysis period of 2023 to 2032.

Which are the key players in the pharmaceutical cartridges market?

The key players operating in the global market are including Transcoject GmbH, Stevanato Group, Shandong Medicinal Glass Co., Ltd., Gerresheimer AG, Dätwyler Holding Inc., West Pharmaceutical Services, Inc., AptarGroup, Inc., Sonata Rubber, Schott AG, and NIPRO.

Which region dominated the global pharmaceutical cartridges market share?

North America held the dominating position in pharmaceutical cartridges industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of pharmaceutical cartridges during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global pharmaceutical cartridges industry?

The current trends and dynamics in the pharmaceutical cartridges industry include increasing demand for biologics and injectable drugs, technological advancements in cartridge manufacturing, growing prevalence of chronic diseases requiring injectable therapies, and expansion of pharmaceutical packaging regulations.

Which material type held the maximum share in 2022?

The glass held the maximum share of the pharmaceutical cartridges industry.