Pet Food Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Pet Food Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

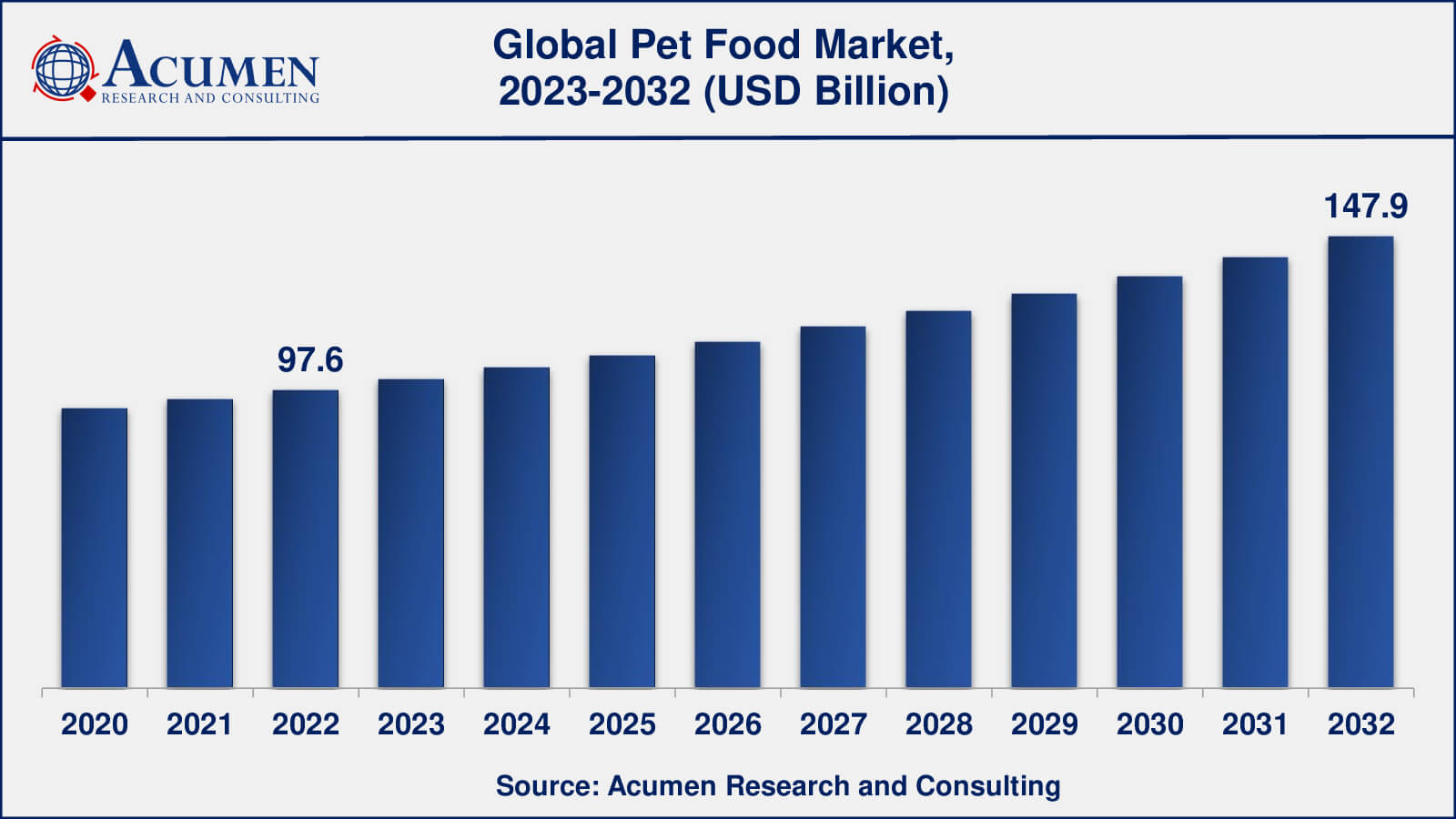

The Global Pet Food Market Size collected USD 97.6 Billion in 2022 and is set to achieve a market size of USD 147.9 Billion in 2032 growing at a CAGR of 4.3% from 2023 to 2032.

Pet Food Market Report Statistics

- Global pet food market revenue is estimated to reach USD 147.9 billion by 2032 with a CAGR of 4.3% from 2023 to 2032

- North America pet food market value occupied more than USD 46.8 billion in 2022

- Asia-Pacific pet food market growth will register a CAGR of around 4.5% from 2023 to 2032

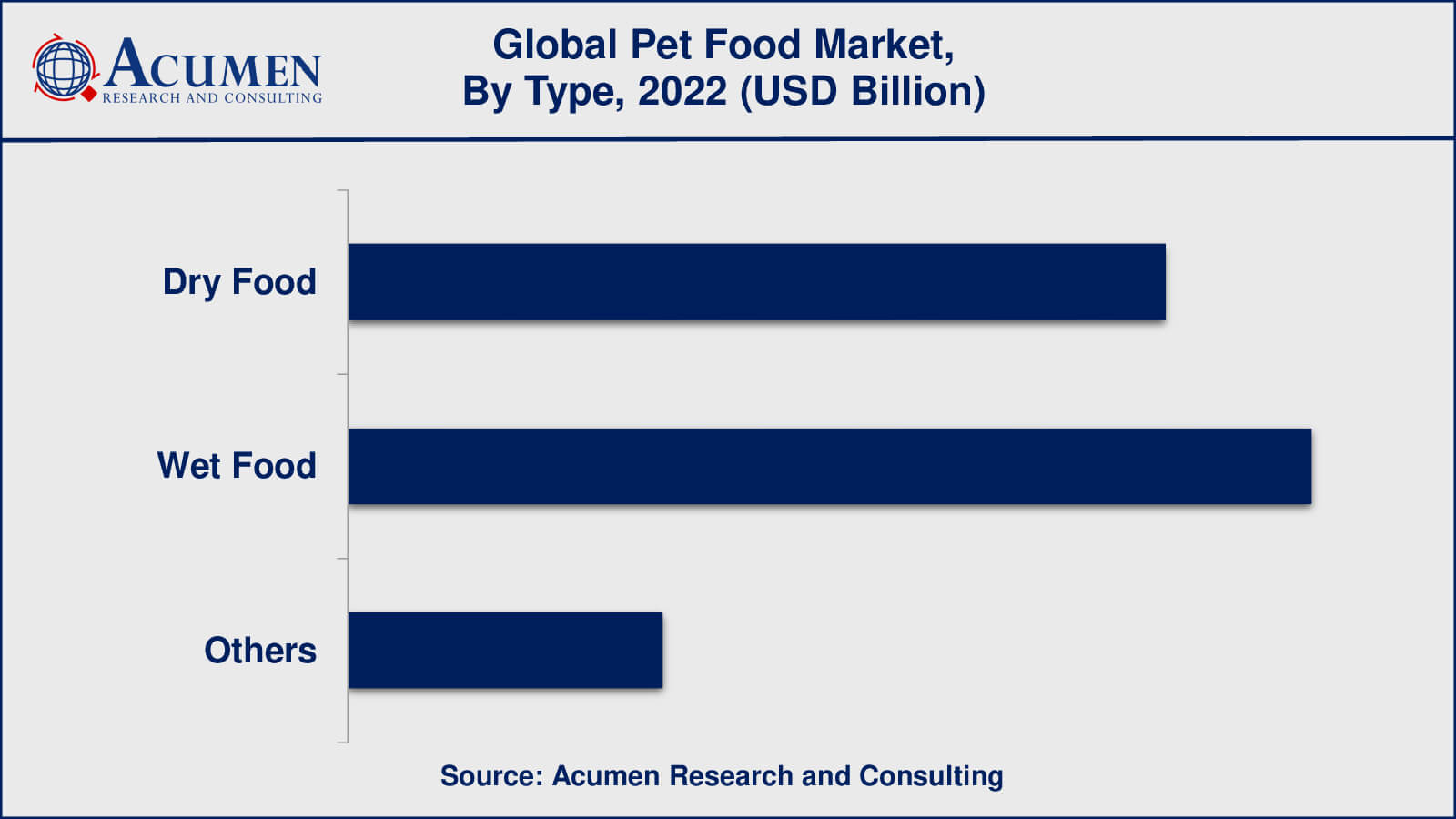

- Among type, the dry food sub-segment generated around 46% share in 2022

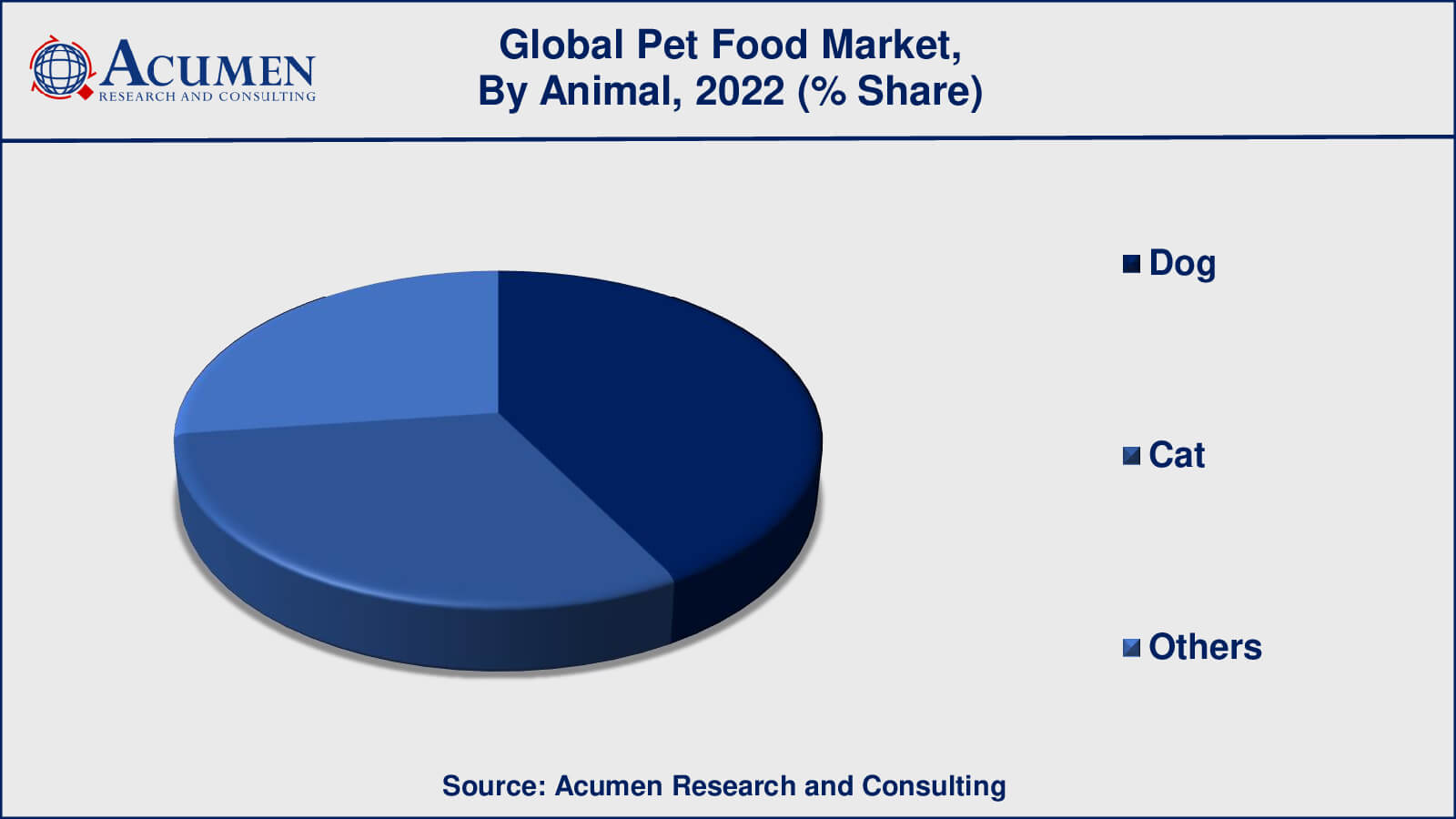

- Based on animal, the dogs sub-segment generated around US$ 41 billion revenue in 2022

- Increasing adoption of clean energy is a popular pet food market trend that fuels the industry demand

Pet food is either a plant or animal material intended to be consumed by pets. These food products are typically sold in supermarkets or pet stores and are usually animal species such as cat food or dog food. These products are generally the by-product of the human food industry. A rising trend has been observed in the perception of pet humanization in which pets are treated with more care and hygiene. These factors are resulting in demand for changes in the packaging of the products.

Global Pet Food Market Dynamics

Market Drivers

- Increasing pet ownership

- Growing awareness about pet health

- Innovation in pet food products

Market Restraints

- Competition from private label brands

- Sustainability concerns

Market Opportunities

- Increased demand for natural and organic pet food

- Growth of grain-free and limited-ingredient diets

- Rise of plant-based diets

Pet Food Market Report Coverage

| Market | Pet Food Market |

| Pet Food Market Size 2022 | USD 97.6 Billion |

| Pet Food Market Forecast 2032 | USD 147.9 Billion |

| Pet Food Market CAGR During 2023 - 2032 | 4.3% |

| Pet Food Market Analysis Period | 2020 - 2032 |

| Pet Food Market Base Year | 2022 |

| Pet Food Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Animal, By Source, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Blue Buffalo Pet Products, Inc., Diamond Pet Foods, Hill’s Pet Nutrition, Inc, Lupus Alimentos, Mars Incorporated, Nestlé Purina, The Hartz Mountain Corporation, The J.M. Smucker Company, Total Alimentos SA, and WellPet LLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Pet Food Market Growth Factors

The demand for pet food from developing countries and changing lifestyles in these nations are the key drivers for the increasing growth of the pet food market, globally. Furthermore, the growing awareness of consumers toward their pet’s health is another factor bolstering the market growth for pet food. Also, other factors responsible for the market growth include the rising trend of nuclear families thereby, pets are treated as family members by the consumers and thus, making consumers more concerned about their pet’s health, eating habits, and lifestyle.

The increasing need for healthy food to prevent over eating by pets is also driving the pet food market, globally. However, the rising rate of obesity in pets is a big concern for consumers, acting as a major restraint in the pet food market. Allergy to pets with specific food products is also hindering the market growth followed by regulatory issues. The continual rise in the number of pet owners along with the adoption of pets is also resulting in market growth. The need for variations in the taste of pet food and the requirement of proper nutrients gives a potential opportunity to the companies operating in the pet food market. Further, the rise in demand for home delivery services and online sales is propelling the demand for pet food.

Pet Food Market Segmentation

The worldwide market for pet food is categorized based on type, animal, source, distribution channel, and geography.

Pet Food Type Outlook

- Dry Food

- Wet Food

- Others (Organic products, Treats/snacks, Veterinary diets, and Liquid food)

According to the Pet Food industry analysis, the dry food type dominated the largest market share in 2022 and is expected to do so in the coming years. The convenience and long shelf life of dry food, also known as kibble, make it popular among pet owners. Dry food is also typically less expensive than wet food, making it a more cost-effective option for pet owners. Furthermore, dry food comes in a variety of flavors and formulations, including specialty diets for pets with specific health needs.

Wet food, on the other hand, is a popular choice among pet owners who prefer to feed their pets a diet similar to what they would eat in the wild. Wet food is also more hydrating than dry food, which may be beneficial for pets who suffer from urinary tract or kidney problems. Wet food, on the other hand, is more costly than dry food and has a shorter shelf life once opened.

Other products in the "others" category include treats, snacks, and supplements. While this segment is smaller than the dry and wet food segments, it remains a significant part of the pet food market, with strong growth potential due to rising demand for functional treats and supplements.

Pet Food Animal Outlook

- Dog

- Cat

- Others

According to the pet food market forecast, the dog sub-segment is expected to have the highest market share from 2023 to 2032. Dogs are the most popular pets worldwide, and they are frequently considered members of the family. As a result, dog owners are more willing to spend money on high-quality dog food. Dog food comes in a variety of formulations, including breed-specific diets, life-stage diets, and specialty diets for pets with special medical needs.

Cats are the second-largest segment of the pet food market and, like dogs, are frequently considered family members. The cat food market is also very diverse, with a wide variety of products available, such as dry food, wet food, and treats. Additionally, because cats are obligate carnivores, their diets frequently require more protein than dog diets.

Pets such as birds, fish, and small mammals are included in the "others" category. While this segment is relatively small than the dog and cat segments, it is still a large component of the pet food market, with strong growth potential due to these pets' growing popularity.

Pet Food Source Outlook

- Animal

- Plant

The majority of pet food ingredients are made from animal protein sources. This is because dogs and cats are carnivores and need a lot of protein in their diets to stay healthy. Animal-based proteins are also thought to be more biologically appropriate for pets because they contain all of the essential amino acids required for growth. However, there has been a growing trend in recent years towards plant-based pet food products, primarily for ethical and environmental reasons. Plant-based proteins, such as soy, peas, and lentils, are increasingly being used as a substitute for animal-based proteins in pet food formulations. This trend is especially prevalent in the vegan and vegetarian pet food market, which caters to pet owners who prefer a plant-based diet and want to provide a similar diet for their pets. However, animal-based protein sources continue to dominate the pet food market, and plant-based sources are unlikely to overtake them in the near future.

Pet Food Distribution Channel Outlook

- Supermarkets/Hypermarkets

- Specialty Pet Food Stores

- Online Channel

- Others

The online channel is the largest and fastest-growing segment of the pet food market, and it is projected to continue to dominate in the coming years. The online channel is appealing to pet owners because it provides the convenience of home delivery, a wide range of products, and competitive pricing. Online retailers such as Amazon, Chewy, and Petco have invested heavily in their e-commerce platforms, including personalized product recommendations, subscription services, and simple-to-use mobile apps, fueling the online channel's growth.

Pet food specialty stores, such as PetSmart and Petco, are also significant players in the pet food market, offering pet owners a wide range of products, including premium and specialized diets. Supermarkets and hypermarkets play an important role in the distribution of pet food products. These stores provide a diverse selection of products at reasonable prices, making them a convenient option for many pet owners.

Pet Food Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Pet Food Market Regional Analysis

North America dominates the pet food market owing to the spending capacity of consumers, government rules for pets, and rising concern of consumers towards the health of pets. The United States is the largest market in this region, accounting for a significant share of the global pet food market. The European pet food market is the world's second largest, driven by the growing trend of pet humanization and demand for premium and organic pet food products. The largest markets in this region are the United Kingdom, Germany, and France.

The Asia-Pacific pet food market is one of the world's fastest growing, owing to rising pet ownership rates and rising demand for premium and high-quality pet food products. The largest markets in this region are China and Japan.

Pet Food Market Players

Some of the pet food companies include Blue Buffalo Pet Products, Inc., Diamond Pet Foods, Hill’s Pet Nutrition, Inc, Lupus Alimentos, Mars Incorporated, Nestlé Purina, The Hartz Mountain Corporation, The J.M. Smucker Company, Total Alimentos SA, and WellPet LLC. The leading companies in the pet food market are committed to focus on continuous R&D for development of high quality pet food. The pet food industry provides high profit margin to the companies thereby, many small and medium sized companies are looking for opportunities by entering in the market.

Frequently Asked Questions

What was the market size of the global pet food in 2022?

The market size of pet food was USD 97.6 Billion in 2022.

What is the CAGR of the global pet food market from 2023 to 2032?

The CAGR of pet food is 4.3% during the analysis period of 2023 to 2032.

Which are the key players in the pet food market?

The key players operating in the global market are including Blue Buffalo Pet Products, Inc., Diamond Pet Foods, Hill�s Pet Nutrition, Inc, Lupus Alimentos, Mars Incorporated, Nestl� Purina, The Hartz Mountain Corporation, The J.M. Smucker Company, Total Alimentos SA, and WellPet LLC.

Which region dominated the global pet food market share?

North America held the dominating position in pet food industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of pet food during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global pet food industry?

The current trends and dynamics in the pet food industry include increasing pet ownership, growing awareness about pet health, and innovation in pet food products.

Which type held the maximum share in 2022?

The dry food type held the maximum share of the pet food industry.