Perfusion Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Perfusion Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

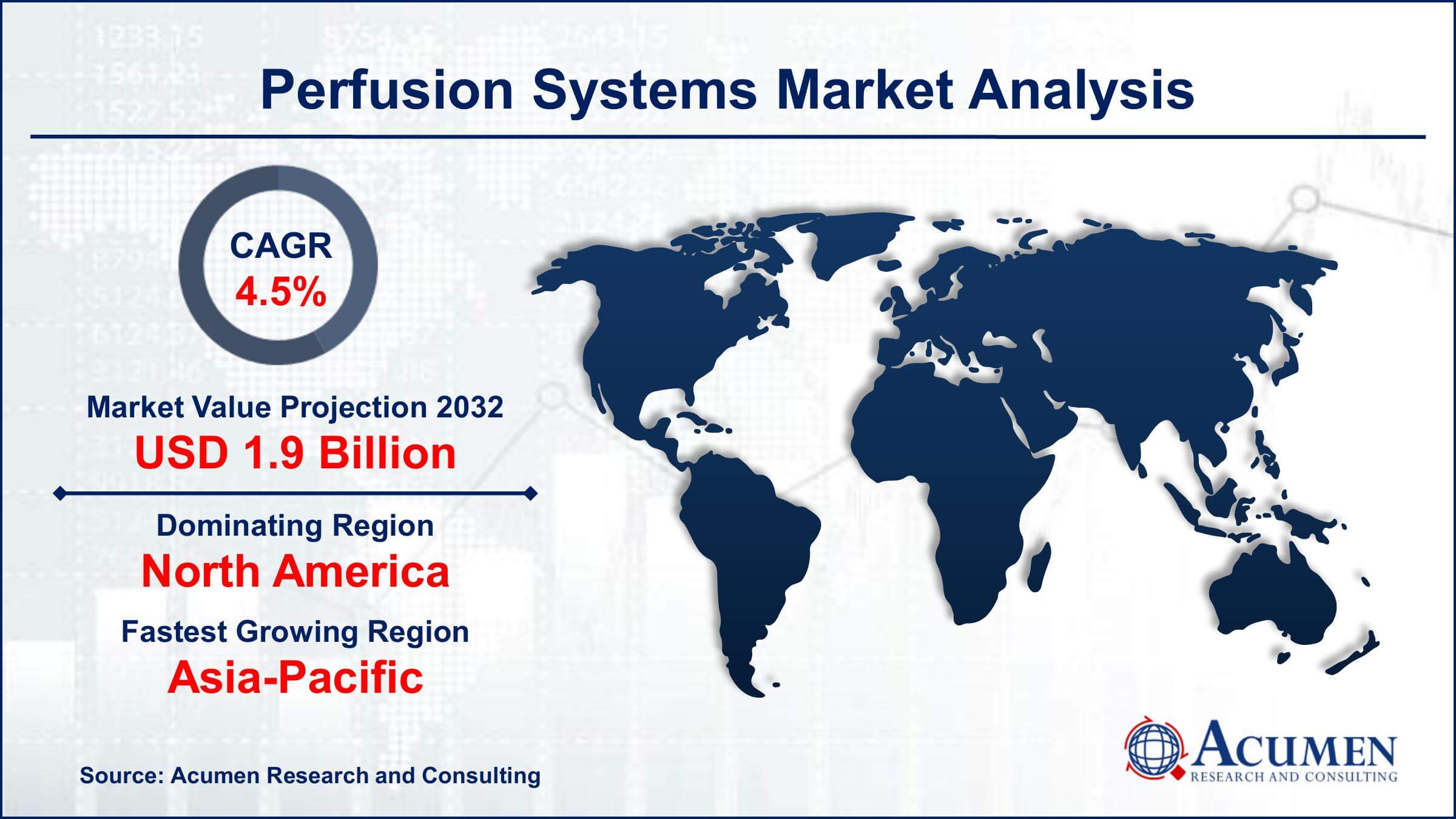

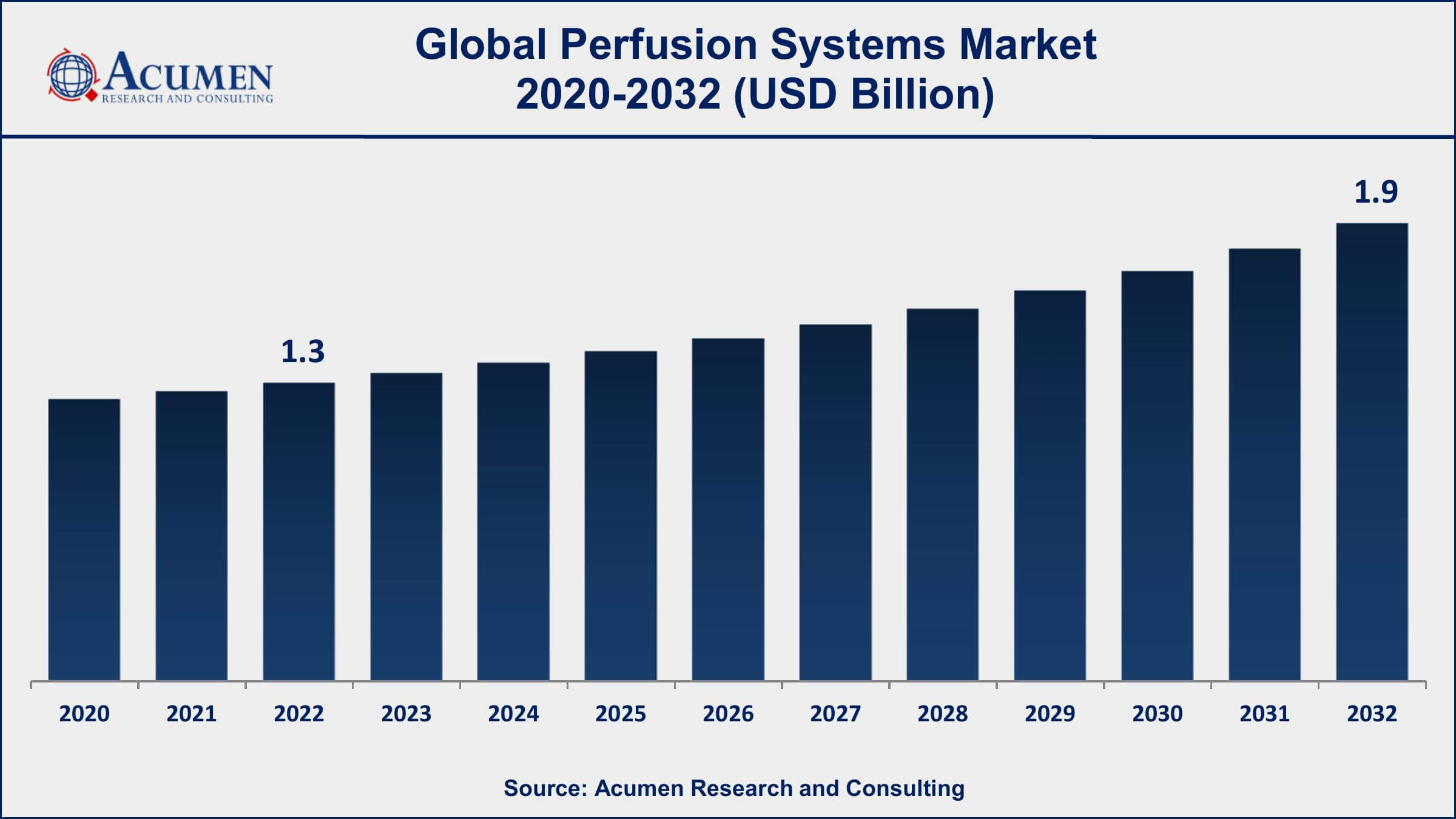

The Global Perfusion Systems Market Size accounted for USD 1.3 Billion in 2022 and is projected to achieve a market size of USD 1.9 Billion by 2032 growing at a CAGR of 4.5% from 2023 to 2032.

Perfusion Systems Market Highlights

- Global Perfusion Systems Market revenue is expected to increase by USD 1.9 Billion by 2032, with a 4.5% CAGR from 2023 to 2032

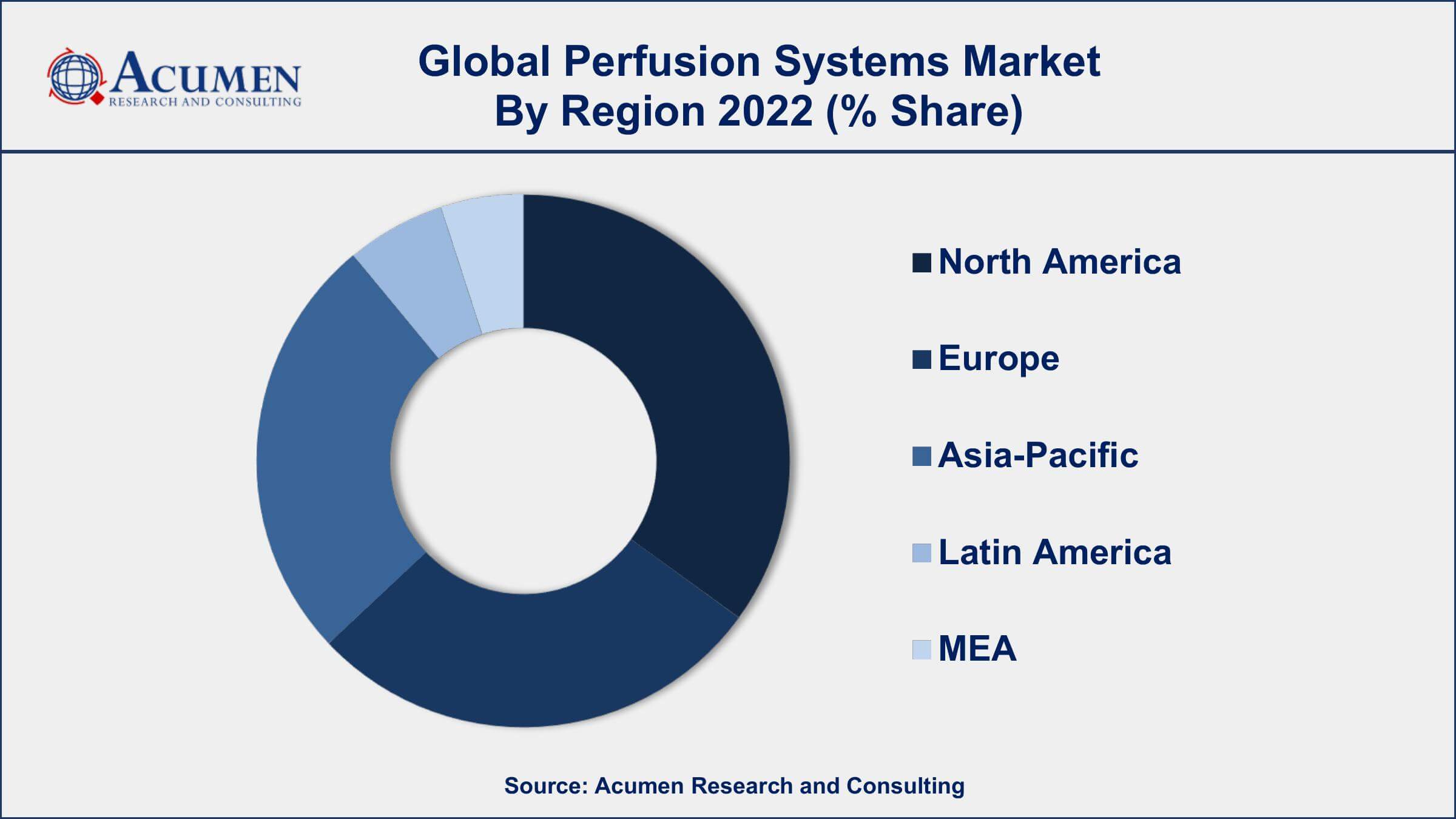

- North America region led with more than 40% of Perfusion Systems Market share in 2022

- Asia-Pacific Perfusion Systems Market growth will record a CAGR of around 5% from 2023 to 2032

- By End-use, the lithium-ion segment is the largest segment in the market, accounting for over 47% of the market share in 2022

- By components, the electrode segment has recorded more than 38% of the revenue share in 2022

- Rising demand for minimally invasive procedures, drives the Perfusion Systems Market value

Perfusion systems are medical devices used to supply oxygenated blood and nutrients to organs, tissues, or cells outside of the body in order to maintain their viability and function during medical procedures. These systems are commonly employed during surgeries that involve organ transplantation, cardiothoracic procedures, and certain cancer treatments, where the temporary removal of an organ from the body is necessary. Perfusion systems ensure that the removed organ remains well-oxygenated and nourished, reducing the risk of damage and enabling successful transplantation or treatment.

The perfusion systems market has witnessed steady growth in recent years due to several factors. Advances in medical technology and surgical techniques have increased the demand for effective perfusion systems, as more complex procedures become feasible. The growing prevalence of chronic diseases such as cardiovascular disorders and the increasing number of organ transplantations also contribute to the expansion of the market. Additionally, the aging global population has led to a higher incidence of age-related organ failures, driving the need for improved perfusion technologies. As medical science continues to evolve, the market is expected to experience further growth, with innovations in both hardware and software enhancing the efficiency and safety of these systems.

Global Perfusion Systems Market Trends

Market Drivers

- Technological advancements in extracorporeal circulation techniques

- Increasing investments in healthcare infrastructure

- Rising demand for minimally invasive procedures

- Growing research in regenerative medicine and tissue engineering

Market Restraints

- Challenges in maintaining optimal perfusion conditions for different organs

- Limited reimbursement policies for perfusion-related procedures

Market Opportunities

- Expansion of perfusion applications beyond traditional surgeries

- Adoption of telemedicine for remote monitoring and consultation

Perfusion Systems Market Report Coverage

| Market | Perfusion Systems Market |

| Perfusion Systems Market Size 2022 | USD 1.3 Billion |

| Perfusion Systems Market Forecast 2032 | USD 1.9 Billion |

| Perfusion Systems Market CAGR During 2023 - 2032 | 4.5% |

| Perfusion Systems Market Analysis Period | 2020 - 2032 |

| Perfusion Systems Market Base Year | 2022 |

| Perfusion Systems Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technique, By Component, By Application, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Medtronic plc, Terumo Corporation, LivaNova PLC, Getinge AB, Sorin Group, XVIVO Perfusion AB, Organ Assist B.V., Spectrum Medical, Eurosets Srl, Waters Medical Systems LLC, SynCardia Systems, LLC, and Paragonix Technologies, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Perfusion systems are advanced medical devices designed to maintain the viability and function of organs, tissues, or cells outside of the body by continuously supplying them with oxygenated blood and essential nutrients. These systems play a crucial role in various medical procedures where temporary removal or isolation of an organ is required, such as organ transplantation, cardiovascular surgeries, and certain cancer treatments. Perfusion systems ensure that the isolated organ remains well-oxygenated, preventing damage and preserving its functionality throughout the procedure.

The applications of perfusion systems are diverse and have revolutionized the field of medicine. One primary application is organ transplantation, where perfusion systems allow for the transportation and assessment of organs before transplantation, significantly extending the window of time in which organs can be utilized. In cardiothoracic surgeries, perfusion systems maintain circulation during procedures like heart surgeries, enabling surgeons to work on a still and bloodless field. Moreover, perfusion systems find application in research and development, aiding in the study of organs and tissues under controlled conditions, as well as in drug testing and development.

The perfusion systems market has exhibited significant growth in recent years, driven by a convergence of factors that have reshaped the healthcare landscape. One of the primary drivers has been the increasing prevalence of chronic diseases, such as cardiovascular disorders and organ failures, necessitating advanced medical interventions. The demand for perfusion systems has surged as these devices play a crucial role in maintaining the viability of organs during procedures like organ transplantation and cardiothoracic surgeries. Additionally, technological advancements in medical equipment and surgical techniques have propelled the market forward, enhancing the efficiency and safety of perfusion procedures.

Perfusion Systems Market Segmentation

The global Perfusion Systems Market segmentation is based on technique, component, application, end-use, and geography.

Perfusion Systems Market By Technique

- Normothermic Machine Perfusion

- Hypothermic Machine Perfusion

According to the perfusion systems industry analysis, the hypothermic machine perfusion segment accounted for the largest market share in 2022. This technique involves preserving organs at lower temperatures while continuously perfusing them with a specialized solution. The growth of this segment can be attributed to its ability to significantly improve organ preservation compared to traditional methods, leading to enhanced transplant success rates. Hypothermic machine perfusion's capacity to mitigate ischemic damage, extend the preservation window, and facilitate assessment of organ viability has spurred its adoption in various transplant scenarios. One of the primary factors contributing to the segment's growth is its potential to address critical challenges in organ transplantation.

Perfusion Systems Market By Component

- Oxygenators

- Bioreactor Perfusion System

- Heart-Lung Machine

- Monitoring System

- Perfusion Pumps

- Others

In terms of components, the oxygenators segment is expected to witness significant growth in the coming years. Oxygenators are essential components that facilitate the exchange of oxygen and carbon dioxide in the blood, ensuring adequate oxygenation of the patient's blood outside of the body. This segment's growth can be attributed to the increasing demand for advanced oxygenators that offer improved gas exchange efficiency, biocompatibility, and ease of integration into perfusion systems. Advancements in medical technology and materials have played a crucial role in propelling the growth of the oxygenators segment.

Perfusion Systems Market By Application

- Cardiopulmonary Perfusion System

- Ex-Vivo Organ Perfusion System

- Cell Perfusion System

According to the perfusion systems market forecast, the cardiopulmonary perfusion system segment is expected to witness significant growth in the coming years. Cardiopulmonary perfusion systems are designed to temporarily take over the functions of the heart and lungs, maintaining blood circulation and oxygenation while the patient's own organs are surgically accessed and treated. The growth of this segment can be attributed to the increasing prevalence of cardiovascular diseases, rising demand for cardiac surgeries, and the continuous pursuit of safer and more efficient surgical techniques. The advancements in both hardware and software components of cardiopulmonary perfusion systems have significantly contributed to their market growth. Improved pump technologies, advanced oxygenators, and enhanced monitoring capabilities have collectively contributed to the successful execution of complex cardiothoracic procedures.

Perfusion Systems Market By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

Based on the end-use, the hospitals segment is expected to continue its growth trajectory in the coming years. Hospitals serve as the primary centers for medical interventions, including organ transplantation, cardiovascular surgeries, and critical care treatments, all of which often require perfusion systems to ensure successful outcomes. As the global burden of chronic diseases and the need for life-saving procedures grow, hospitals' reliance on perfusion systems has intensified, fueling the expansion of this market segment. The growth of the hospitals segment is further supported by ongoing investments in healthcare infrastructure, particularly in both developed and developing economies.

Perfusion Systems Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Perfusion Systems Market Regional Analysis

North America's dominance in the perfusion systems market can be attributed to a combination of factors that have collectively propelled the region to the forefront of this industry. One key driver is the high prevalence of chronic diseases such as cardiovascular disorders and organ failures, necessitating a substantial demand for advanced medical interventions and transplantation procedures. The well-established healthcare infrastructure in North America, with a network of sophisticated hospitals and medical centers, enables efficient integration of perfusion systems into a wide array of medical procedures, further driving market growth. Moreover, North America boasts a robust ecosystem of medical research and innovation, leading to the development of cutting-edge perfusion technologies and techniques. The region is home to numerous renowned research institutions, medical universities, and technology companies that collaborate to push the boundaries of medical science. This environment fosters the creation of innovative perfusion systems that offer enhanced capabilities, such as real-time monitoring, automation, and personalized treatment approaches. The combination of clinical demand and technological innovation has propelled North America's perfusion systems market to a leading position globally.

Perfusion Systems Market Player

Some of the top perfusion systems market companies offered in the professional report include Medtronic plc, Terumo Corporation, LivaNova PLC, Getinge AB, Sorin Group, XVIVO Perfusion AB, Organ Assist B.V., Spectrum Medical, Eurosets Srl, Waters Medical Systems LLC, SynCardia Systems, LLC, and Paragonix Technologies, Inc.

Frequently Asked Questions

What was the market size of the global perfusion systems in 2022?

The market size of perfusion systems was USD 1.3 Billion in 2022.

What is the CAGR of the global perfusion systems market from 2023 to 2032?

The CAGR of perfusion systems is 4.5% during the analysis period of 2023 to 2032.

Which are the key players in the perfusion systems market?

The key players operating in the global market are including Medtronic plc, Terumo Corporation, LivaNova PLC, Getinge AB, Sorin Group, XVIVO Perfusion AB, Organ Assist B.V., Spectrum Medical, Eurosets Srl, Waters Medical Systems LLC, SynCardia Systems, LLC, and Paragonix Technologies, Inc.

Which region dominated the global perfusion systems market share?

North America held the dominating position in perfusion systems industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of perfusion systems during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global perfusion systems industry?

The current trends and dynamics in the perfusion systems industry include rising demand for minimally invasive procedures, and growing research in regenerative medicine and tissue engineering.

Which technique held the maximum share in 2022?

The hypothermic machine perfusion technique held the maximum share of the perfusion systems industry.