Performance Chemicals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Performance Chemicals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

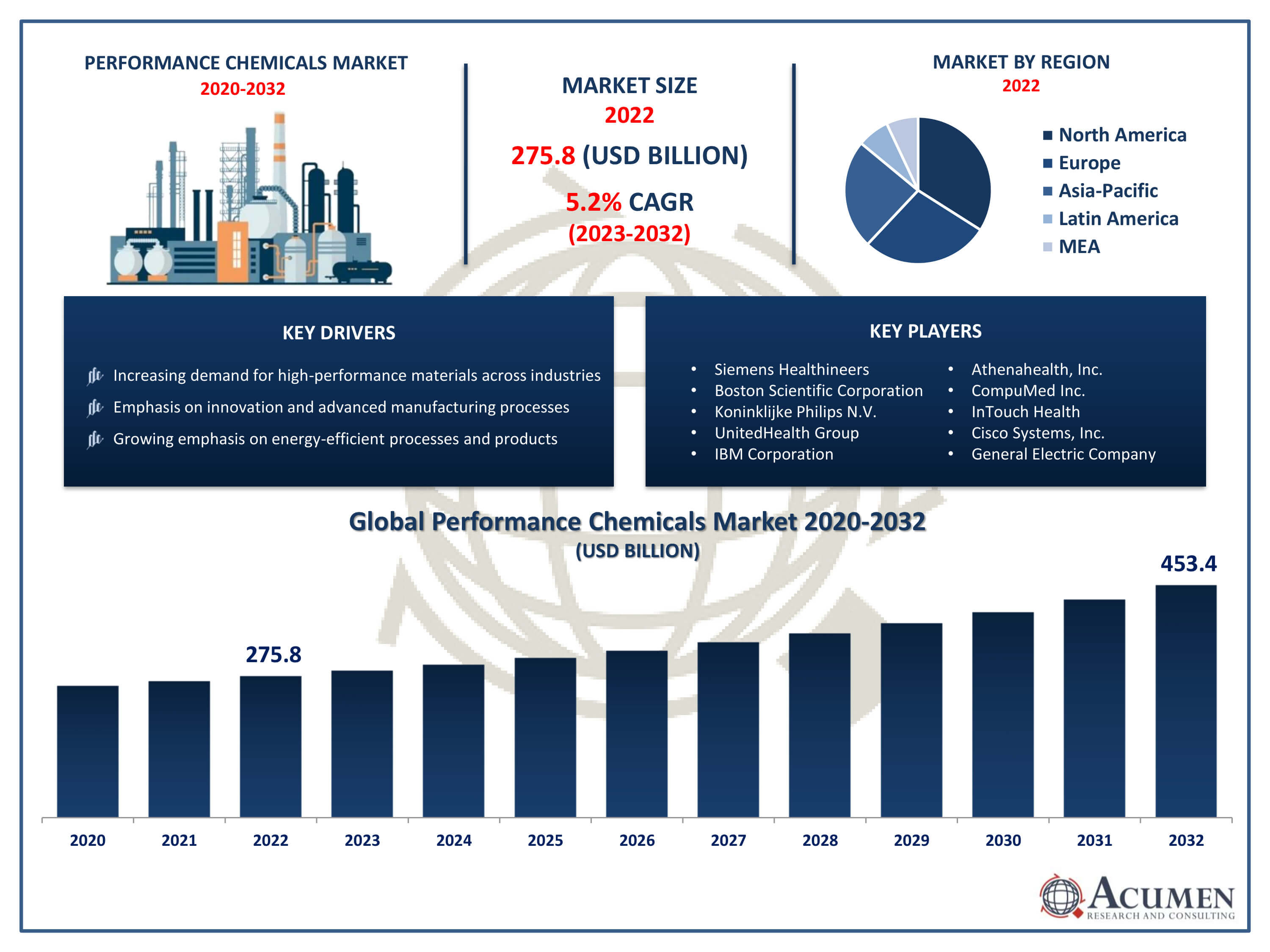

The Performance Chemicals Market Size accounted for USD 275.8 Billion in 2022 and is projected to achieve a market size of USD 453.4 Billion by 2032 growing at a CAGR of 5.2% from 2023 to 2032.

Performance Chemicals Market Highlights

- Global Performance Chemicals Market revenue is expected to increase by USD 453.4 Billion by 2032, with a 5.2% CAGR from 2023 to 2032

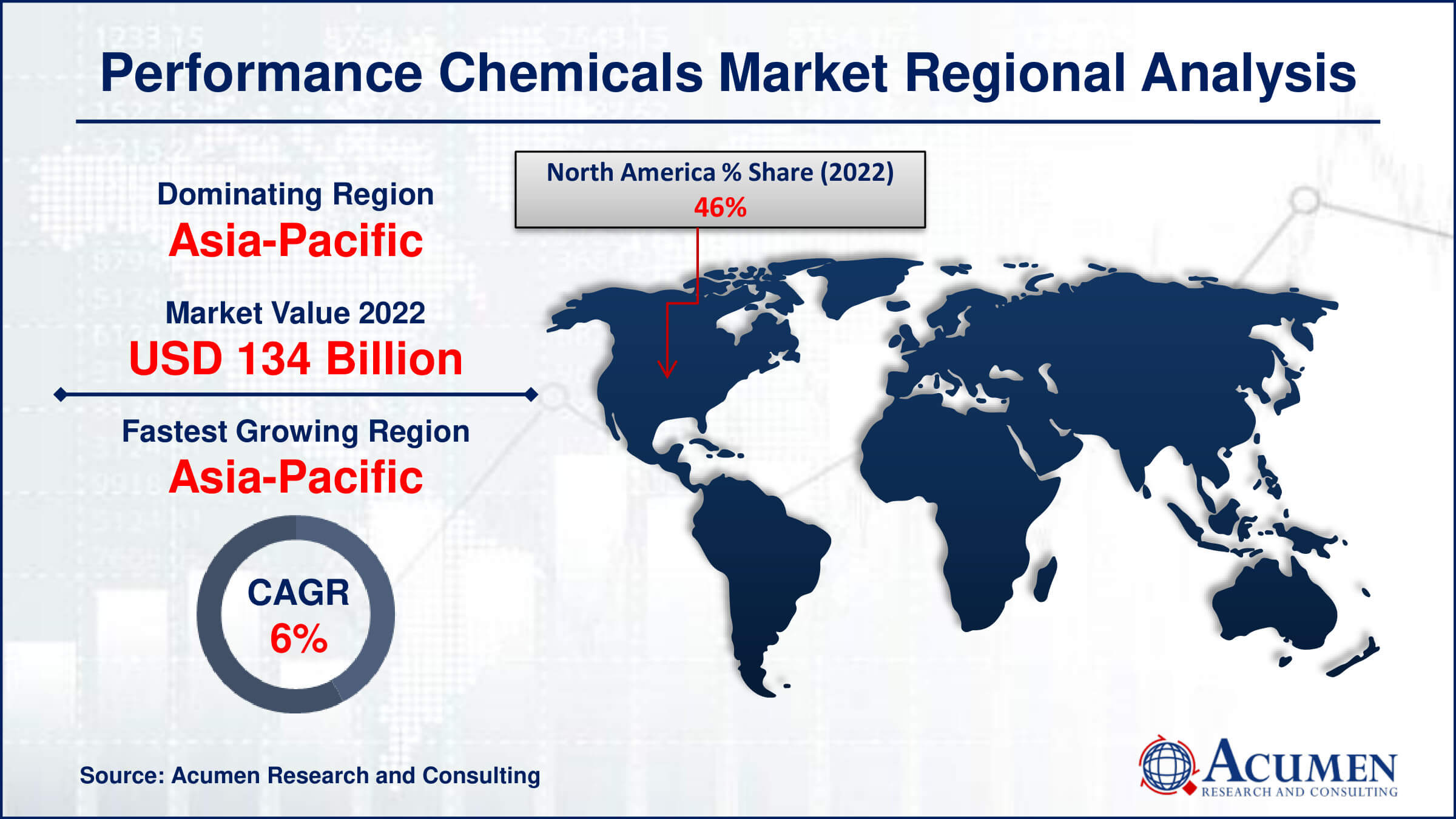

- Asia-Pacific region led with more than 46% of Performance Chemicals Market share in 2022

- Asia-Pacific Performance Chemicals Market growth will record a CAGR of more than 5.9% from 2023 to 2032

- By type, the antioxidants segment captured more than 38% of revenue share in 2022.

- By end-users, the agrochemicals segment is projected to expand at the fastest CAGR over the projected period

- Increasing demand for high-performance materials across industries, drives the Performance Chemicals Market value

Performance chemicals are a diverse category of specialty chemicals that play a crucial role in enhancing the performance of various products and processes across industries. These chemicals are designed to provide specific and often unique properties, such as improved durability, efficiency, or functionality, to the end products. The market for performance chemicals encompasses a wide range of sectors, including automotive, construction, electronics, agriculture, and consumer goods. Examples of performance chemicals include adhesives, sealants, specialty polymers, additives, and catalysts, among others.

The market for performance chemicals has experienced significant growth in recent years, driven by increasing demand for high-performance materials and advanced manufacturing processes. Industries are increasingly relying on these chemicals to meet stringent performance requirements, comply with regulatory standards, and achieve sustainability goals. The growing emphasis on innovation, coupled with the need for customized solutions, has further fueled the expansion of the performance chemicals industry. Additionally, as industries continue to evolve and adopt new technologies, the demand for specialty chemicals that enhance the performance and properties of materials is expected to remain robust, driving further growth in this dynamic and evolving sector.

Global Performance Chemicals Market Trends

Market Drivers

- Increasing demand for high-performance materials across industries

- Emphasis on innovation and advanced manufacturing processes

- Stringent regulatory standards driving the need for specialized solutions

- Growing emphasis on energy-efficient processes and products

Market Restraints

- Environmental concerns and regulatory challenges

- High development and production costs

Market Opportunities

- Growing focus on sustainability and eco-friendly solutions

- Emerging applications in the healthcare and electronics sectors

Performance Chemicals Market Report Coverage

| Market | Performance Chemicals Market |

| Performance Chemicals Market Size 2022 | USD 275.8 Billion |

| Performance Chemicals Market Forecast 2032 | USD 453.4 Billion |

| Performance Chemicals Market CAGR During 2023 - 2032 | 5.2% |

| Performance Chemicals Market Analysis Period | 2020 - 2032 |

| Performance Chemicals Market Base Year |

2022 |

| Performance Chemicals Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End-Users, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Evonik Industries AG, Akzo Nobel N.V., Albemarle Corporation, Clariant, BASF SE, Indo Amines Limited, Solvay, Dow, Henkel AG & Co. KGaA, Chevron Phillips Chemical Company LLC, Himadri Speciality Chemical Limited, and Chembond Chemicals Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Performance chemicals are formulated to meet specific and often demanding requirements, providing unique characteristics such as improved durability, efficiency, and functionality. Performance chemicals find applications in a wide range of sectors, including automotive, construction, electronics, agriculture, and consumer goods. Examples of performance chemicals include specialty polymers, adhesives, sealants, additives, and catalysts. In the automotive industry, performance chemicals are used to formulate advanced lubricants, fuel additives, and specialty polymers, contributing to fuel efficiency, engine durability, and emission reduction. In construction, these chemicals are employed in the development of high-performance coatings, adhesives, and sealants, enhancing the longevity and resilience of structures.

The performance chemicals market has witnessed robust growth in recent years, driven by a confluence of factors that underscore the increasing demand for specialized and high-performance materials across various industries. One of the key drivers of this growth is the relentless pursuit of innovation and advanced manufacturing processes. Industries are continuously seeking ways to enhance the performance, durability, and efficiency of their products, and performance chemicals play a pivotal role in achieving these objectives. As a result, the market has experienced a surge in demand for specialty chemicals, including adhesives, sealants, and catalysts, among others, which are designed to impart specific and often unique properties to the end products. Despite the impressive growth, the performance chemicals industry faces challenges, including environmental concerns and regulatory pressures. The industry is grappling with the need to develop solutions that not only meet high-performance standards but also adhere to stringent environmental and safety regulations. However, these challenges have also spurred opportunities for growth, as there is a growing emphasis on sustainability and eco-friendly solutions.

Performance Chemicals Market Segmentation

The global Performance Chemicals Market segmentation is based on type, application, end-users, and geography.

Performance Chemicals Market By Type

- Antioxidants

- Surfactants

- Biocides

- Others

According to the performance chemicals industry analysis, the antioxidants segment accounted for the largest market share in 2022. Antioxidants are substances that inhibit the oxidation of materials, preventing degradation and extending the lifespan of products. In sectors such as plastics, rubber, and polymers, antioxidants are widely used to enhance the durability and stability of materials exposed to environmental factors like heat and light. The automotive industry, in particular, has been a significant driver of growth for antioxidants, as these chemicals are essential for preserving the integrity of rubber components, such as tires and seals, contributing to the overall longevity and performance of vehicles. Moreover, the expanding demand for antioxidants is closely linked to the rising awareness of environmental sustainability. As industries seek to minimize waste and enhance the recyclability of materials, antioxidants become crucial in prolonging the life of products and reducing the frequency of replacements.

Performance Chemicals Market By Application

- Macromolecular Additive

- Electronic Chemical

- Construction Chemicals

- Business Cleaner

- Others

In terms of applications, the macromolecular additive segment is expected to witness significant growth in the coming years. Macromolecular additives, often polymers or large molecules, are incorporated into formulations to impart specific properties to the end product. These additives play a crucial role in enhancing the performance of materials such as plastics, coatings, and adhesives. In the plastics industry, for example, macromolecular additives are used to improve the strength, flexibility, and thermal stability of plastic products, meeting the evolving requirements of modern applications. The growth of the macromolecular additive segment is closely tied to the expanding applications in industries like construction, automotive, and packaging. In construction, these additives contribute to the development of high-performance concrete and durable coatings. In the automotive sector, they are utilized to manufacture lightweight yet strong components, enhancing fuel efficiency and overall performance.

Performance Chemicals Market By End-Users

- Agrochemicals

- Chemical Industry

- Food Industry

- Medicine

- Textile

- Other

According to the performance chemicals market forecast, the agrochemicals segment is expected to witness significant growth in the coming years. Agrochemicals encompass a range of chemicals, including pesticides, herbicides, and fertilizers, designed to enhance crop yields, protect against pests and diseases, and optimize soil fertility. The increasing global population and the need to ensure food security have led to a growing reliance on agrochemicals to maximize agricultural productivity. One of the key drivers of growth in the agrochemicals segment is the continuous innovation in formulations and the development of more effective and sustainable solutions. With a focus on minimizing environmental impact and adhering to stringent regulatory standards, the agrochemical industry is investing in research and development to create products that are not only highly efficient but also environmentally responsible. Additionally, the adoption of precision agriculture techniques and the integration of technology in farming practices have further propelled the demand for advanced agrochemical solutions.

Performance Chemicals Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Performance Chemicals Market Regional Analysis

Asia-Pacific has emerged as a dominating region in the performance chemicals market, experiencing robust growth driven by factors such as rapid industrialization, urbanization, and a burgeoning middle class. The region's diverse and expanding industrial base, including sectors such as automotive, electronics, construction, and agriculture, has fueled the demand for performance chemicals. Countries like China and India, with their large populations and dynamic economies, have become key players in driving the growth of the performance chemicals industry. The increasing manufacturing activities, coupled with a growing emphasis on product innovation and efficiency, have contributed to the rising adoption of performance chemicals across various industries in the Asia-Pacific region. Moreover, the region's commitment to sustainable development and environmental regulations has spurred the demand for eco-friendly and specialty chemicals markets. As industries strive to meet stringent environmental standards, the performance chemicals sector in Asia-Pacific has responded with the development of solutions that address both performance requirements and environmental concerns. Additionally, the strong presence of key market players, as well as a robust supply chain and infrastructure, has further propelled Asia-Pacific to the forefront of the performance chemicals market.

Performance Chemicals Market Player

Some of the top performance chemicals market companies offered in the professional report include Evonik Industries AG, Akzo Nobel N.V., Albemarle Corporation, Clariant, BASF SE, Indo Amines Limited, Solvay, Dow, Henkel AG & Co. KGaA, Chevron Phillips Chemical Company LLC, Himadri Speciality Chemical Limited, and Chembond Chemicals Limited.

Frequently Asked Questions

How big is the performance chemicals market?

The performance chemicals market size was USD 275.8 Billion in 2022.

What is the CAGR of the global performance chemicals market from 2023 to 2032?

The CAGR of performance chemicals is 5.2% during the analysis period of 2023 to 2032.

Which are the key players in the performance chemicals market?

The key players operating in the global market are including Evonik Industries AG, Akzo Nobel N.V., Albemarle Corporation, Clariant, BASF SE, Indo Amines Limited, Solvay, Dow, Henkel AG & Co. KGaA, Chevron Phillips Chemical Company LLC, Himadri Speciality Chemical Limited, and Chembond Chemicals Limited.

Which region dominated the global performance chemicals market share?

Asia-Pacific held the dominating position in performance chemicals industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of performance chemicals during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global performance chemicals industry?

The current trends and dynamics in the Performance Chemicals industry include increasing demand for high-performance materials across industries, emphasis on innovation and advanced manufacturing processes, and stringent regulatory standards driving the need for specialized solutions.

Which type held the maximum share in 2022?

The antioxidants type held the maximum share of the performance chemicals industry.