Penicillin Active Pharmaceutical Ingredients Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Penicillin Active Pharmaceutical Ingredients Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

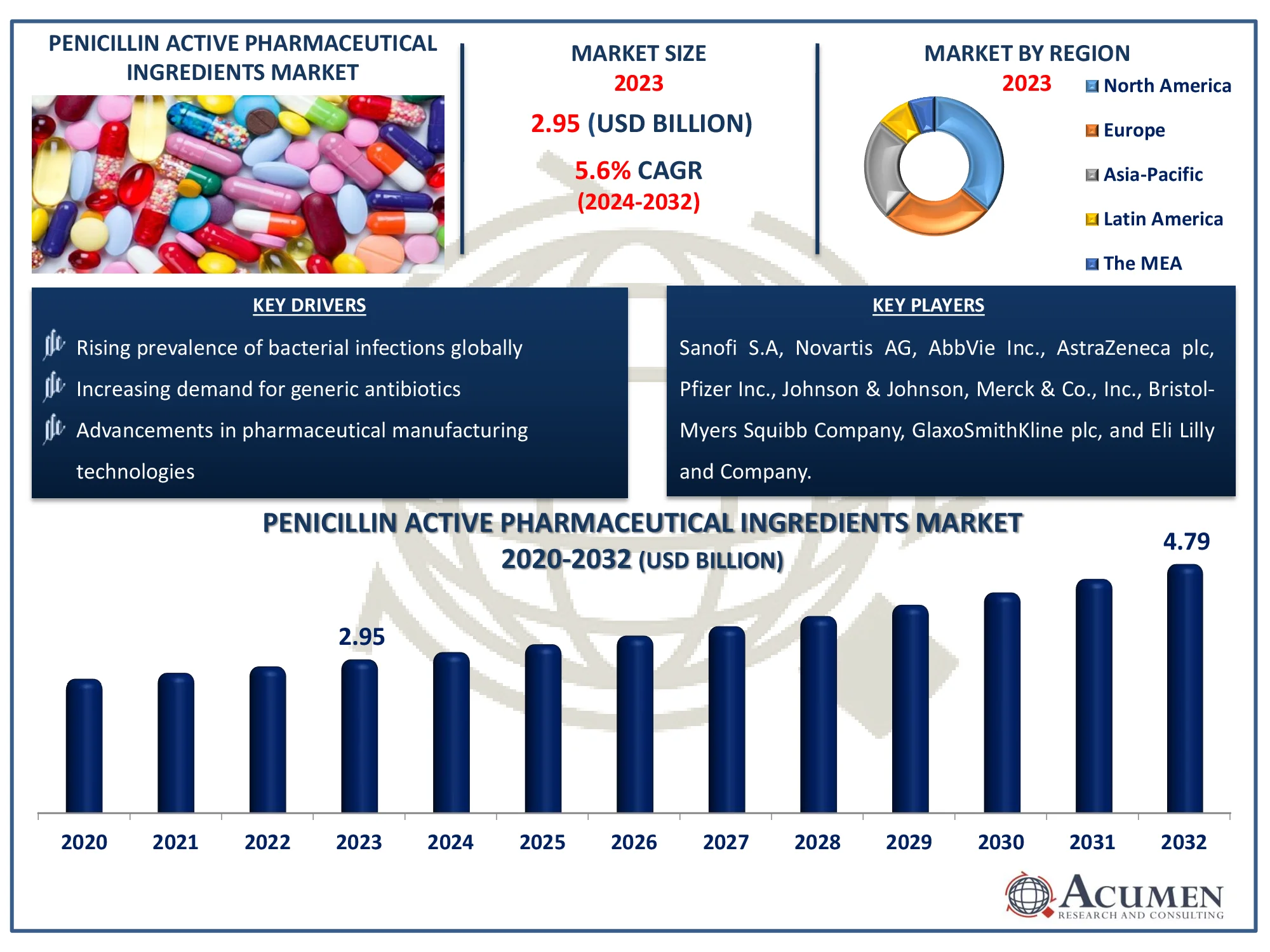

The Global Penicillin Active Pharmaceutical Ingredients Market Size accounted for USD 2.95 Billion in 2023 and is estimated to achieve a market size of USD 4.79 Billion by 2032 growing at a CAGR of 5.6% from 2024 to 2032.

Penicillin Active Pharmaceutical Ingredients Market Highlights

- Global penicillin active pharmaceutical ingredients market revenue is poised to garner USD 4.79 billion by 2032 with a CAGR of 5.6% from 2024 to 2032

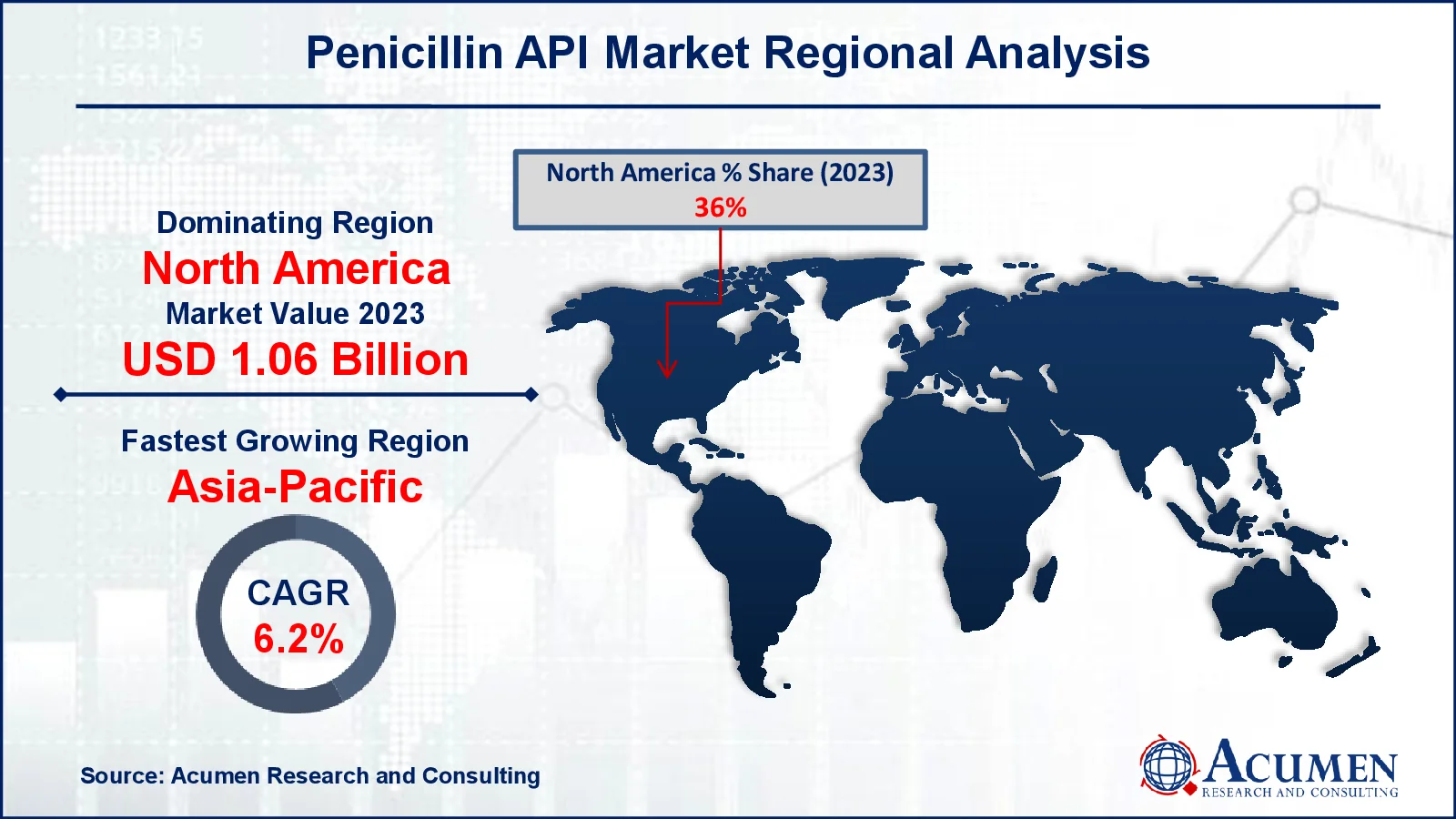

- North America penicillin active pharmaceutical ingredients market value occupied around USD 1.06 billion in 2023

- Asia-Pacific penicillin active pharmaceutical ingredients market growth will record a CAGR of more than 6.2% from 2024 to 2032

- Among type, the amoxicillin sub-segment generated 25% of the market share in 2023

- Based on route of administration, the for oral sub-segment generated 62% market share in 2023

- Increased use of amoxicillin and combination therapies to combat antibiotic resistance is the penicillin active pharmaceutical ingredients market trend that fuels the industry demand

Penicillin active pharmaceutical ingredients (APIs) are the key molecules utilized in the manufacturing of penicillin-based antibiotics, which are commonly recommended for bacterial infections. These APIs include amoxicillin, ampicillin, piperacillin, and others, which address a wide range of medicinal demands. According to the National Institute of Health (NIH), penicillin is one of the most widely used broad-spectrum antibiotics in the world, with multiple clinical applications. Penicillin works against infections produced by gram-positive cocci, gram-positive rods, most anaerobes, and gram-negative cocci. The NIH has highlighted the widespread use of penicillin as a broad-spectrum antibiotic, which is likely to promote growth in the penicillin active pharmaceutical ingredients (API) market by raising demand for its manufacturing and supply.

Global Penicillin Active Pharmaceutical Ingredients Market Dynamics

Market Drivers

- Rising prevalence of bacterial infections globally

- Increasing demand for generic antibiotics

- Advancements in pharmaceutical manufacturing technologies

Market Restraints

- Growing antibiotic resistance limiting effectiveness

- Stringent regulatory requirements for API production

- Supply chain disruptions affecting raw material availability

Market Opportunities

- Expansion into emerging markets with increasing healthcare access

- Development of new formulations and combination therapies

- Rising investments in R&D for improved penicillin derivatives

Penicillin Active Pharmaceutical Ingredients Market Report Coverage

|

Market |

Penicillin Active Pharmaceutical Ingredients Market |

|

Penicillin Active Pharmaceutical Ingredients Market Size 2023 |

USD 2.95 Billion |

|

Penicillin Active Pharmaceutical Ingredients Market Forecast 2032 |

USD 4.79 Billion |

|

Penicillin Active Pharmaceutical Ingredients Market CAGR During 2024 - 2032 |

5.6% |

|

Penicillin Active Pharmaceutical Ingredients Market Analysis Period |

2020 - 2032 |

|

Penicillin Active Pharmaceutical Ingredients Market Base Year |

2023 |

|

Penicillin Active Pharmaceutical Ingredients Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Production Method, By Route Of Administration, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Sanofi S.A, Novartis AG, AbbVie Inc., AstraZeneca plc, Pfizer Inc., Johnson & Johnson, Merck & Co., Inc., Bristol-Myers Squibb Company, GlaxoSmithKline plc, and Eli Lilly and Company. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Penicillin Active Pharmaceutical Ingredients Market Insights

The rising number of bacterial diseases, such as pneumonia, TB, and skin infections, is driving the demand for penicillin active pharmaceutical ingredients (API) market. According to the Centers for Disease Control and Prevention, CIDTs were used to diagnose 78% of all bacterial infections in the historic catchment region in 2023, with 46% being diagnosed solely using CIDT. Developing countries, in particular, are seeing an increase in infectious diseases as a result of inadequate sanitation and healthcare facilities. According to Gavi, the Vaccine Alliance Organization, the three infectious illnesses that public health experts are most concerned about are malaria (a parasite), HIV (a virus), and tuberculosis (a bacteria). They collectively kill almost 2 million individuals per year. As a result, the demand for effective and economical antibiotics such as penicillin APIs continues to rise.

Rising healthcare expenses worldwide are pressuring governments and providers to adopt cost-effective treatment options, increasing demand for generic antibiotics. According to the National Institute of Health, the Hatch-Waxman Act aided the growth of the generic antibiotic business by making it simpler for generics to obtain FDA approval while safeguarding brand-name medicine manufacturers. It permitted generics to use bioequivalence studies for clearance and granted a 30-month hold on patent challenges, guaranteeing a balance between innovation and competition. As a result, generic antibiotics became more widely available and expanded their market share. Furthermore, patent expirations for branded antibiotics are increasing the demand for generic alternatives.

Overuse and misuse of medicines, particularly penicillin, has resulted in the emergence of antibiotic-resistant bacterial strains, lowering their effectiveness. This has spurred regulatory bodies and healthcare groups to establish tougher antibiotic stewardship programs, thereby reducing needless prescriptions. As a result, demand for classic penicillin APIs may suffer, prompting a move to new antibiotics., hindered penicillin active pharmaceutical ingredients (API) market growth.

Emerging economies, particularly in Asia, Africa, and Latin America, are rapidly improving healthcare infrastructure and access. According to Invest India, India's healthcare sector, which serves more than 1.3 billion people, includes hospitals, medical devices, telemedicine, medical tourism, and more. The Union Budget 2023-24 prioritized healthcare by devoting major amounts to Ayushman Bharat, the world's largest government-funded health initiative, which serves 500 million people. This increases healthcare access for the disadvantaged, generates demand for medical services and infrastructure, and provides a substantial potential for API makers to expand their penicillin active pharmaceutical ingredients (API) market presence and increase income.

Penicillin Active Pharmaceutical Ingredients Market Segmentation

The worldwide market for penicillin active pharmaceutical ingredients is split based on type, production method, route of administration, end-user, and geography.

Penicillin API Market By Type

- Penicillin G Potassium

- Sulbactam Sodium

- Clavulanic Acid

- Piperacillin

- Ampicillin

- Amoxicillin

- Tazobactam

According to the penicillin active pharmaceutical ingredients industry analysis, amoxicillin is the leading antibiotic due to its excellent efficacy and broad use in the treatment of bacterial infections. It is a popular choice in human and veterinary medicine, resulting in steady global demand. Furthermore, its cost and inclusion on the World Health Organization's Essential Medicines List reinforce its market dominance. Ampicillin has a significant market share since it is used to treat respiratory and urinary tract infections. Other APIs, including piperacillin, tazobactam, and clavulanic acid, are frequently employed in combination therapy to improve bacterial coverage and prevent antibiotic resistance.

Penicillin API Market By Production Method

- Chemical Synthesis

- Fermentation-Based Production

According to the penicillin active pharmaceutical ingredients industry analysis, fermentation-based production is rapidly expanding due to its low cost, high yield, and long-term large-scale manufacturing capabilities. This process, which employs penicillium mold, is the major means of generating essential penicillin derivatives such as amoxicillin and ampicillin. Furthermore, fermentation provides a steady supply of high-quality APIs, making it the favored option. Chemical synthesis is utilized to improve the stability and efficacy of penicillin derivatives, as well as to produce semi-synthetic penicillins.

Penicillin API Market By Route of Administration

- For Oral

- For Injection

According to the penicillin active pharmaceutical ingredients market forecast, the oral route is preferred because of its ease, patient compliance, and extensive use in outpatient treatments. Amoxicillin and ampicillin, two important oral penicillins, are frequently recommended for respiratory, urinary, and skin infections. Furthermore, the availability of oral formulations in tablet, pill, and liquid formats increases their accessibility and global demand. The injectable method is necessary for critical care, but its use is limited as compared to oral formulations due to the necessity for medical supervision and greater administration expenses.

Penicillin API Market By End-User

- Pharmaceutical Companies

- Research Institutes

- Others

According to the penicillin active pharmaceutical ingredients (API) market forecast, pharmaceutical corporations expect to dominate because they are the principal makers of antibiotics for global distribution. These companies manufacture substantial amounts of penicillin-based medications to address the growing demand for infection treatments in both developed and emerging countries. Their solid supply chains, regulatory approvals, and significant R&D investments contribute to their market supremacy. Penicillin APIs are used by research institutes to study bacterial resistance and develop new formulations, despite their comparatively low consumption.

Penicillin Active Pharmaceutical Ingredients Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Penicillin Active Pharmaceutical Ingredients Market Regional Analysis

For several reasons, North America dominates the penicillin API market due to its well-established pharmaceutical industry, considerable healthcare spending, and strong regulatory environment. According to the Congressional Budget Office, the United States pharmaceutical sector creates a number of new pharmaceuticals each year that give substantial medical advantages. Many of these drugs are expensive, contributing to increased health-care expenses for both the private and federal governments. The number of new pharmaceuticals licensed each year has increased during the last decade. The existence of large pharmaceutical businesses and advanced R&D facilities fosters innovation and long-term demand for penicillin-based drugs.

The penicillin API market in Asia-Pacific is expanding rapidly, owing to increased healthcare infrastructure, rising antibiotic demand, and a burgeoning pharmaceutical sector. For example, the cumulative FDI equity inflow in the Drugs and Pharmaceuticals business was $22.52 billion between April 2000 and March 2024, accounting for over 3.4% of all inflows across sectors. Countries such as China and India are major API producers, serving both home and international markets. Furthermore, rising government attempts to promote healthcare access and control infectious diseases are accelerating the region's penicillin API market growth.

Penicillin Active Pharmaceutical Ingredients Market Players

Some of the top penicillin active pharmaceutical ingredients companies offered in our report include Sanofi S.A, Novartis AG, AbbVie Inc., AstraZeneca plc, Pfizer Inc., Johnson & Johnson, Merck & Co., Inc., Bristol-Myers Squibb Company, GlaxoSmithKline plc, and Eli Lilly and Company.

Frequently Asked Questions

How big is the Penicillin Active Pharmaceutical Ingredients market?

The penicillin active pharmaceutical ingredients market size was valued at USD 2.95 Billion in 2023.

What is the CAGR of the global Penicillin Active Pharmaceutical Ingredients market from 2024 to 2032?

The CAGR of penicillin active pharmaceutical ingredients is 5.6% during the analysis period of 2024 to 2032.

Which are the key players in the Penicillin Active Pharmaceutical Ingredients market?

The key players operating in the global market are including Sanofi S.A, Novartis AG, AbbVie Inc., AstraZeneca plc, Pfizer Inc., Johnson & Johnson, Merck & Co., Inc., Bristol-Myers Squibb Company, GlaxoSmithKline plc, and Eli Lilly and Company.

Which region dominated the global Penicillin Active Pharmaceutical Ingredients market share?

North America held the dominating position in penicillin active pharmaceutical ingredients industry during the analysis period of 2024 to 2032.

Which region registered fastest-growing CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest-growing CAGR for market of penicillin active pharmaceutical ingredients during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Penicillin Active Pharmaceutical Ingredients industry?

The current trends and dynamics in the penicillin active pharmaceutical ingredients industry include rising prevalence of bacterial infections globally, increasing demand for generic antibiotics, and advancements in pharmaceutical manufacturing technologies

Which type held the maximum share in 2023?

The amoxicillin held the maximum share of the penicillin active pharmaceutical ingredients industry.