Payment Bank Solutions Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Payment Bank Solutions Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

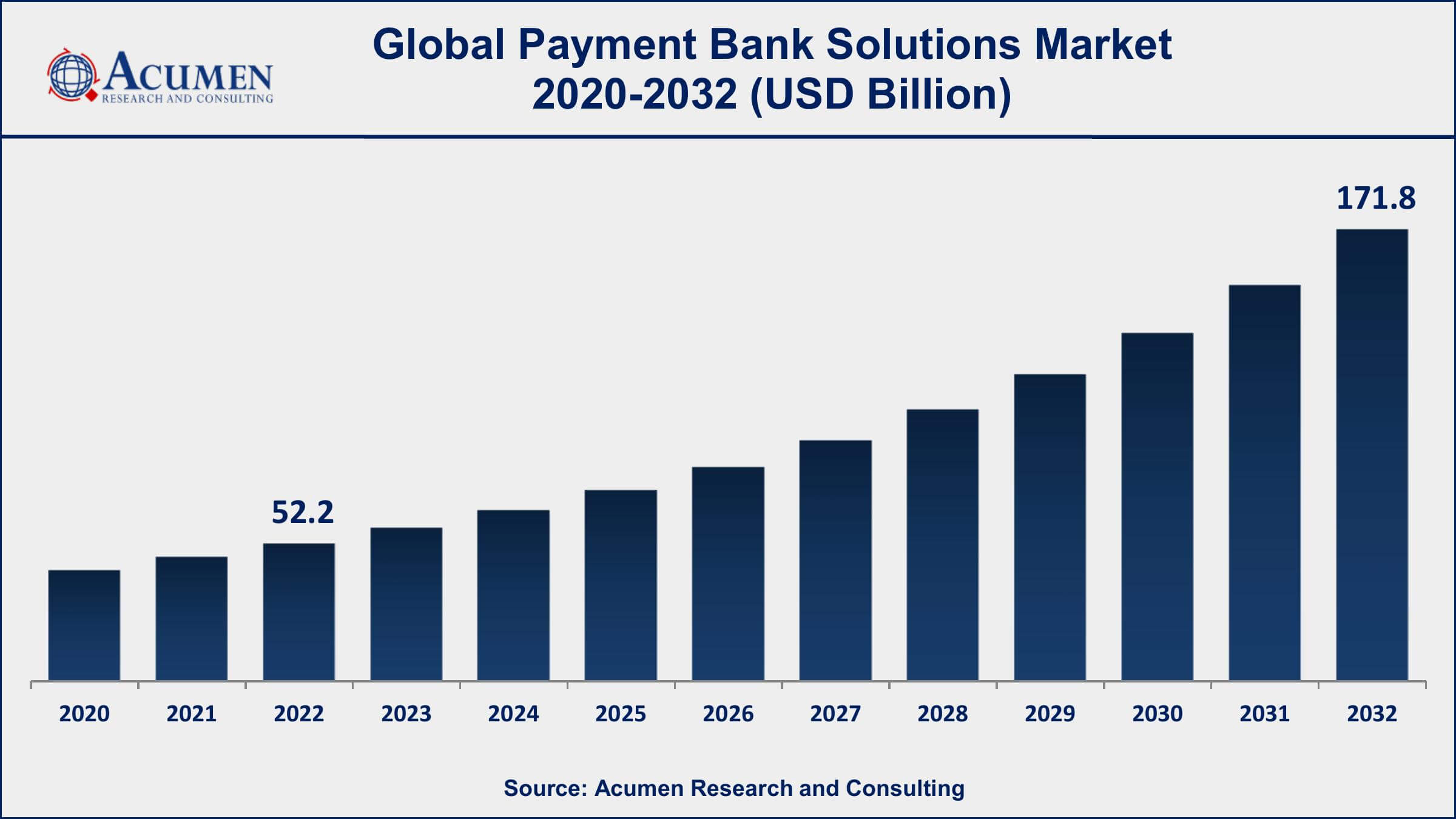

The Global Payment Bank Solutions Market Size accounted for USD 52.2 Billion in 2022 and is projected to achieve a market size of USD 171.8 Billion by 2032 growing at a CAGR of 12.8% from 2023 to 2032.

Payment Bank Solutions Market Highlights

- Global Payment Bank Solutions Market revenue is expected to increase by USD 171.8 Billion by 2032, with a 12.8% CAGR from 2023 to 2032

- North America region led with more than 38% of Payment Bank Solutions Market share in 2022

- Asia-Pacific Payment Bank Solutions Market growth will record a CAGR of more than 13.4% from 2023 to 2032

- By type, the software segment contributed the largest revenue share of 66% in 2022

- By end user, the retail segment captured the largest market share of 34% in 2022

- Increasing internet and smartphone penetration and growing e-commerce industry, drives the Payment Bank Solutions Market value

Payment bank solutions refer to the financial services and technologies that facilitate electronic transactions and money transfers, typically through digital channels and mobile devices. These solutions encompass a wide range of services, including online payments, mobile wallets, peer-to-peer transfers, digital wallets, and various other forms of electronic transactions. Payment bank solutions have gained significant traction in recent years due to the increasing adoption of smartphones, internet connectivity, and digital payment infrastructure in many countries. These solutions offer convenience, security, and efficiency, making them popular among consumers and businesses alike.

In terms of market growth, the payment bank solutions market has been witnessing robust expansion globally. Factors such as the growing e-commerce industry, government initiatives to promote digital payments, and the shift from cash-based transactions to digital methods have fueled the demand for payment bank solutions. Additionally, advancements in technologies like blockchain, artificial intelligence, and biometric authentication have enhanced the security and user experience of these solutions, further driving their adoption. The increasing focus on financial inclusion, especially in developing economies, is driving the adoption of digital payment services. Moreover, the ongoing innovations in payment technologies, such as contactless payments and real-time settlement systems, are further propelling the market forward.

Global Payment Bank Solutions Market Trends

Market Drivers

- Increasing internet and smartphone penetration

- Government initiatives promoting digital payments

- Growing e-commerce industry

- Advancements in payment technologies (Blockchain, AI)

- Financial inclusion efforts in developing economies

Market Restraints

- Security concerns and cyber threats

- Limited digital literacy in certain regions

- Regulatory challenges and compliance issues

Market Opportunities

- Expansion of contactless payment solutions

- Rising demand for real-time payment settlements

- Integration of biometric authentication technologies

Payment Bank Solutions Market Report Coverage

| Market | Payment Bank Solutions Market |

| Payment Bank Solutions Market Size 2022 | USD 52.2 Billion |

| Payment Bank Solutions Market Forecast 2032 | USD 171.8 Billion |

| Payment Bank Solutions Market CAGR During 2023 - 2032 | 12.8% |

| Payment Bank Solutions Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | EdgeVerve Systems, Comviva, MasterCard Incorporated, IBM, Gemalto (Thales Group), BPC, ACI Worldwide, Authorize.net., and Adyen N.V. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Payment bank solutions are instrumental in enabling secure, convenient, and efficient online payments, catering to both individual consumers and businesses. Payment bank solutions encompass diverse tools such as mobile wallets, digital payment platforms, peer-to-peer payment apps, online banking services, and contactless payment methods. These technologies leverage the power of digital communication and mobile devices, allowing users to make transactions, pay bills, transfer funds, and manage their finances without the need for physical currency or traditional banking infrastructure.

The payment bank solutions market has been experiencing remarkable growth in recent years, driven by several key factors. One of the primary drivers is the rapid digital transformation across various sectors globally. With the widespread adoption of smartphones and increasing internet penetration, consumers are increasingly shifting towards digital payment methods. This shift is further accelerated by the convenience and security offered by payment bank solutions, allowing users to conduct transactions, pay bills, and transfer money with just a few clicks on their mobile devices. Moreover, the ongoing initiatives by governments and financial institutions to promote digital payments as part of the financial inclusion agenda have played a significant role in expanding the market. These initiatives aim to bring unbanked and underbanked populations into the formal financial system, creating a vast customer base for payment bank solutions.

Additionally, the growing e-commerce industry has been a major catalyst for the payment bank solutions industry. As more consumers prefer online shopping, digital payment methods have become integral to the e-commerce ecosystem. Payment bank solutions enable seamless and secure transactions, enhancing the overall shopping experience for consumers. Businesses, too, benefit from these solutions as they reduce cash handling costs and provide a more efficient way to manage transactions. Furthermore, advancements in payment technologies, such as mobile wallets, contactless payments, and real-time settlement systems, have not only improved the user experience but also fostered trust among consumers, further driving the market growth.

Payment Bank Solutions Market Segmentation

The global Payment Bank Solutions Market segmentation is based on type, end user, and geography.

Payment Bank Solutions Market By Type

- Hardware

- Forex Cards

- Debit Cards

- ATM Cards

- Software

- Mobile Apps

- Platforms

In terms of types, the software segment accounted for the largest market share in 2022. One of the primary factors fueling this growth is the rapid advancement in software technologies. Payment bank solutions heavily rely on sophisticated software systems to ensure seamless transactions, robust security measures, and user-friendly interfaces. As a result, there is a continuous emphasis on developing cutting-edge software solutions that can adapt to the evolving needs of consumers and businesses. Additionally, the increasing adoption of mobile payment applications and digital wallets has propelled the demand for specialized software solutions. These applications offer a wide array of features, including peer-to-peer transfers, mobile recharges, bill payments, and contactless payments, all of which require advanced software capabilities. Furthermore, the integration of artificial intelligence and machine learning algorithms in payment software has enhanced fraud detection mechanisms and personalized user experiences.

Payment Bank Solutions Market By End User

- Government

- Retail

- Healthcare

- BFSI

- Others

According to the payment bank solutions market forecast, the retail segment is expected to witness significant growth in the coming years. One of the key drivers of this growth is the widespread adoption of mobile payment applications and digital wallets by retailers. These solutions offer retailers a secure and convenient way to process transactions, reducing the reliance on traditional cash-based payments. With the integration of mobile payment options at retail outlets, consumers can make purchases swiftly using their smartphones or other digital devices, leading to enhanced customer satisfaction and improved efficiency in retail operations. Additionally, the rise of e-commerce has significantly contributed to the growth of payment bank solutions in the retail segment. Online retailers and e-commerce platforms are integrating diverse digital payment methods to cater to a global customer base. The convenience of making secure online payments using credit/debit cards, digital wallets, and other electronic payment systems has revolutionized the way people shop. As a result, retailers are increasingly investing in robust payment gateways and software solutions to provide a seamless and secure online shopping experience.

Payment Bank Solutions Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Payment Bank Solutions Market Regional Analysis

North America has emerged as a dominating region in the payment bank solutions market due to several interconnected factors that have collectively fostered a thriving digital payment ecosystem. One of the primary reasons is the region's robust technological infrastructure. North America boasts advanced telecommunications networks and high internet penetration rates, providing a fertile ground for the proliferation of digital payment platforms. This widespread connectivity ensures seamless access to online and mobile payment services, enabling both consumers and businesses to engage effortlessly in digital transactions. Furthermore, the presence of numerous established technology companies and financial institutions in North America has significantly contributed to the region's dominance in the payment bank solutions industry. Silicon Valley, in particular, serves as a global hub for fintech innovation. The constant influx of investments in research and development has led to the creation of cutting-edge payment technologies and solutions. These innovations range from mobile payment apps and digital wallets to sophisticated payment processing systems, giving North American companies a competitive edge in the global market.

Payment Bank Solutions Market Player

Some of the top payment bank solutions market companies offered in the professional report include EdgeVerve Systems, Comviva, MasterCard Incorporated, IBM, Gemalto (Thales Group), BPC, ACI Worldwide, Authorize.net., and Adyen N.V.

Frequently Asked Questions

How big is payment bank solutions market?

The market size of payment bank solutions was USD 52.2 Billion in 2022.

What is the CAGR of the global payment bank solutions market from 2023 to 2032?

The CAGR of payment bank solutions is 12.8% during the analysis period of 2023 to 2032.

Which are the key players in the payment bank solutions market?

The key players operating in the global market are including EdgeVerve Systems, Comviva, MasterCard Incorporated, IBM, Gemalto (Thales Group), BPC, ACI Worldwide, Authorize.net., and Adyen N.V.

Which region dominated the global payment bank solutions market share?

North America held the dominating position in payment bank solutions industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of payment bank solutions during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global payment bank solutions industry?

The current trends and dynamics in the payment bank solutions market growth include increasing internet and smartphone penetration, government initiatives promoting digital payments, and growing e-commerce industry.

Which type held the maximum share in 2022?

The software type held the maximum share of the payment bank solutions industry.