Pathological Examination Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Pathological Examination Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

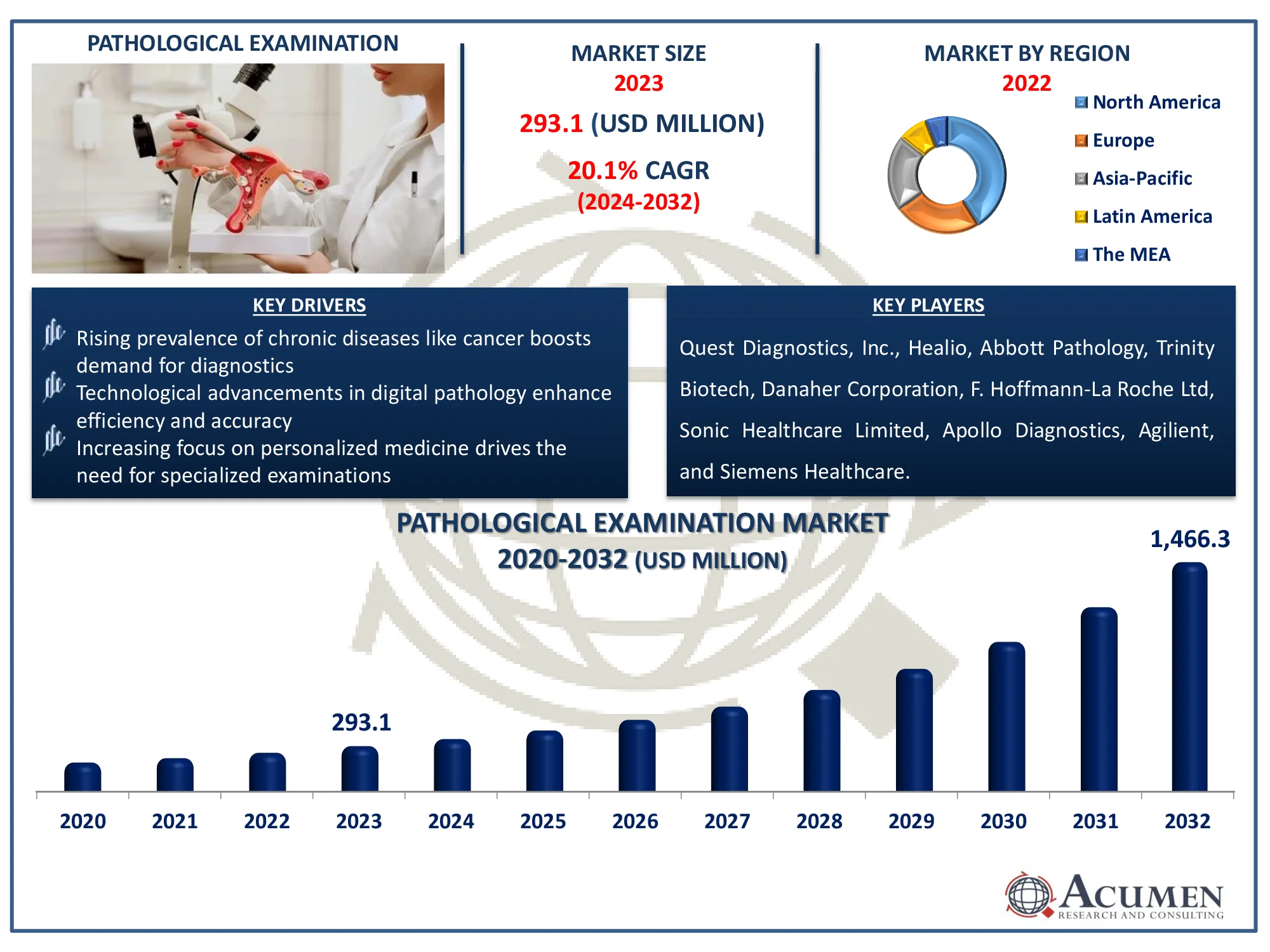

Request Sample Report

The Global Pathological Examination Market Size accounted for USD 293.1 Million in 2023 and is estimated to achieve a market size of USD 1,466.3 Million by 2032 growing at a CAGR of 20.1% from 2024 to 2032.

Pathological Examination Market (By Test: Digital Pathology, Traditional Pathology; By Service: Anatomic Pathology, Surgical Pathology, Molecular Pathology, Cytopathology, Clinical Pathology; By Application: Digestive Organ, Others; By End-User: Hospitals, Diagnostic Laboratories, Research Institutes, Others; and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Pathological Examination Market Highlights

- Global pathological examination market revenue is poised to garner USD 1,466.3 million by 2032 with a CAGR of 20.1% from 2024 to 2032

- North America pathological examination market value occupied around USD 120.2 million in 2023

- Asia-Pacific pathological examination market growth will record a CAGR of more than 21.7% from 2024 to 2032

- Among test, the digital pathology sub-segment generated significant of the market share in 2023

- Based on service, the anatomic pathology sub-segment generated notable market share in 2023

- Surge in personalized medicine and precision diagnostics is the pathological examination market trend that fuels the industry demand

Pathological examination is the study and analysis of tissue and bodily fluid samples to detect diseases such as cancer, infections, and chronic disorders. This industry is vital in healthcare because it provides essential diagnostic tools that allow clinicians to make informed treatment decisions. The market comprises services such as anatomic, clinical, and molecular pathology, which use both traditional and digital methods. Demand for these services is increasing as the prevalence of chronic diseases rises and tailored therapy becomes more popular. According to the World Health Organization, precise diagnostics are critical for lowering disease burden and improving patient outcomes worldwide. Digital pathology and AI breakthroughs are further changing the landscape, increasing accuracy and efficiency.

Global Pathological Examination Market Dynamics

Market Drivers

- Rising prevalence of chronic diseases like cancer boosts demand for diagnostics

- Technological advancements in digital pathology enhance efficiency and accuracy

- Increasing focus on personalized medicine drives the need for specialized examinations

Market Restraints

- High costs of advanced diagnostic tools limit access in low-income regions

- Shortage of skilled pathologists slows down diagnostic processes

- Strict regulatory policies hinder the speed of market entry for new technologies

Market Opportunities

- Expansion of telepathology and remote diagnostics in underserved areas

- AI-driven solutions promise faster, more accurate pathology services

- Emerging markets, especially in Asia-Pacific, offer significant growth potential with rising healthcare investments

Pathological Examination Market Report Coverage

| Market | Pathological Examination Market |

| Pathological Examination Market Size 2022 |

USD 293.1 Million |

| Pathological Examination Market Forecast 2032 | USD 1,466.3 Million |

| Pathological Examination Market CAGR During 2023 - 2032 | 20.1% |

| Pathological Examination Market Analysis Period | 2020 - 2032 |

| Pathological Examination Market Base Year |

2022 |

| Pathological Examination Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Test, By Service, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Sonic Healthcare Limited, Quest Diagnostics, Inc., Abbott Pathology, Healio, Danaher Corporation, F. Hoffmann-La Roche Ltd, Agilient Technologies, Trinity Biotech, Apollo Diagnostics, and Siemens Healthcare Private Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Pathological Examination Market Insights

The increasing frequency of chronic diseases is expected to drive growth in the worldwide pathology examination market. Chronic disorders such as cardiovascular disease, cancer, chronic lung illnesses, stroke, and type 2 diabetes account for the majority of deaths in the United States and around the world. Chronic illnesses account for the majority of health-care spending and seven out of ten deaths in the United States each year. The World Health Organization (WHO) predicts that chronic diseases would account for 70% of all deaths worldwide by 2030. Chronic diseases, commonly known as noncommunicable diseases (NCDs), cause 41 million deaths per year, accounting for 74% of all fatalities worldwide. Then, as the market for pathological exams grows, the prevalence of chronic diseases rises.

There has been a global shortage of pathologists and skilled technicians as demand for diagnosis has increased due to the growing population. In the United States, there will be 14,000 pathologists in 2030 and 17,500 pathologists were in 2010. Pathologists that are currently practicing in 2030. The pressure on the medical care system is predicted to rise dramatically, impeding market growth in pathology examination by limiting the number of pathology examinations

Emerging markets, notably in the Asia-Pacific region, provide significant potential prospects for the pathological testing market due to increased healthcare investments and infrastructure development. As countries such as China, India, and Southeast Asia improve their healthcare systems, the demand for advanced diagnostic services increases. Furthermore, the rising middle class and government attempts to improve illness identification and management are propelling market growth. These elements create a favorable climate for both local and international pathology service providers to enter and expand in these markets.

Pathological Examination Market Segmentation

The worldwide market for pathological examination is split based on test, service, application, end-user, and geography.

Pathological Examination Based on Test

- Digital Pathology

- Traditional Pathology

According to the pathological examination industry analysis, digital pathology has dominated the market because of its capacity to improve diagnostic accuracy, expedite operations, and offer remote consultations. Converting traditional glass slides into high-resolution digital photos enables speedier analysis and data sharing among healthcare practitioners. The integration of artificial intelligence (AI) increases disease detection efficiency. Its expanding popularity is fueled by rising demand for precise diagnostics and telemedicine services.

Pathological Examination Based on Service

- Anatomic Pathology

- Surgical Pathology

- Molecular Pathology

- Cytopathology

- Clinical Pathology

According to the pathological examination industry analysis, anatomic pathology expected to show notable growth in market due to its critical role in diagnosing a wide range of disorders, including cancer. Tissue samples, such as biopsies and surgical specimens, are examined to discover cellular abnormalities. The rising frequency of cancer and chronic disorders has heightened the need for thorough tissue examination. Anatomic pathology's complete approach makes it critical for directing treatment decisions, assuring its sustained dominance.

Pathological Examination Based on Application

- Digestive Organ

- Others

According to the pathological examination market forecast, the digestive organ application anticipated to dominates the market due to the high frequency of gastrointestinal disorders such as colorectal cancer, liver disease, and inflammatory bowel disease. Digestive organs are regularly biopsied and inspected to discover malignancies, infections, and chronic diseases, making them a top priority for pathology services. The rising prevalence of digestive problems, combined with advances in diagnostic tools, drives the demand for pathological exams in this category.

Pathological Examination Based on End-User

- Hospitals

- Diagnostic Laboratories

- Research Institutes

- Others

According to the pathological examination industry forecast, hospitals dominate the market because they are primary healthcare providers that handle a high number of patients and provide in-house diagnostics. Hospitals frequently have integrated pathology labs that perform critical tests, such as anatomic and clinical pathology, to aid in rapid diagnosis and treatment decisions. Hospitals are a desirable end user due to their superior equipment and ability to perform a wide range of tests. Furthermore, the demand for quick diagnoses in emergency and surgical cases improves their market position.

Pathological Examination Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

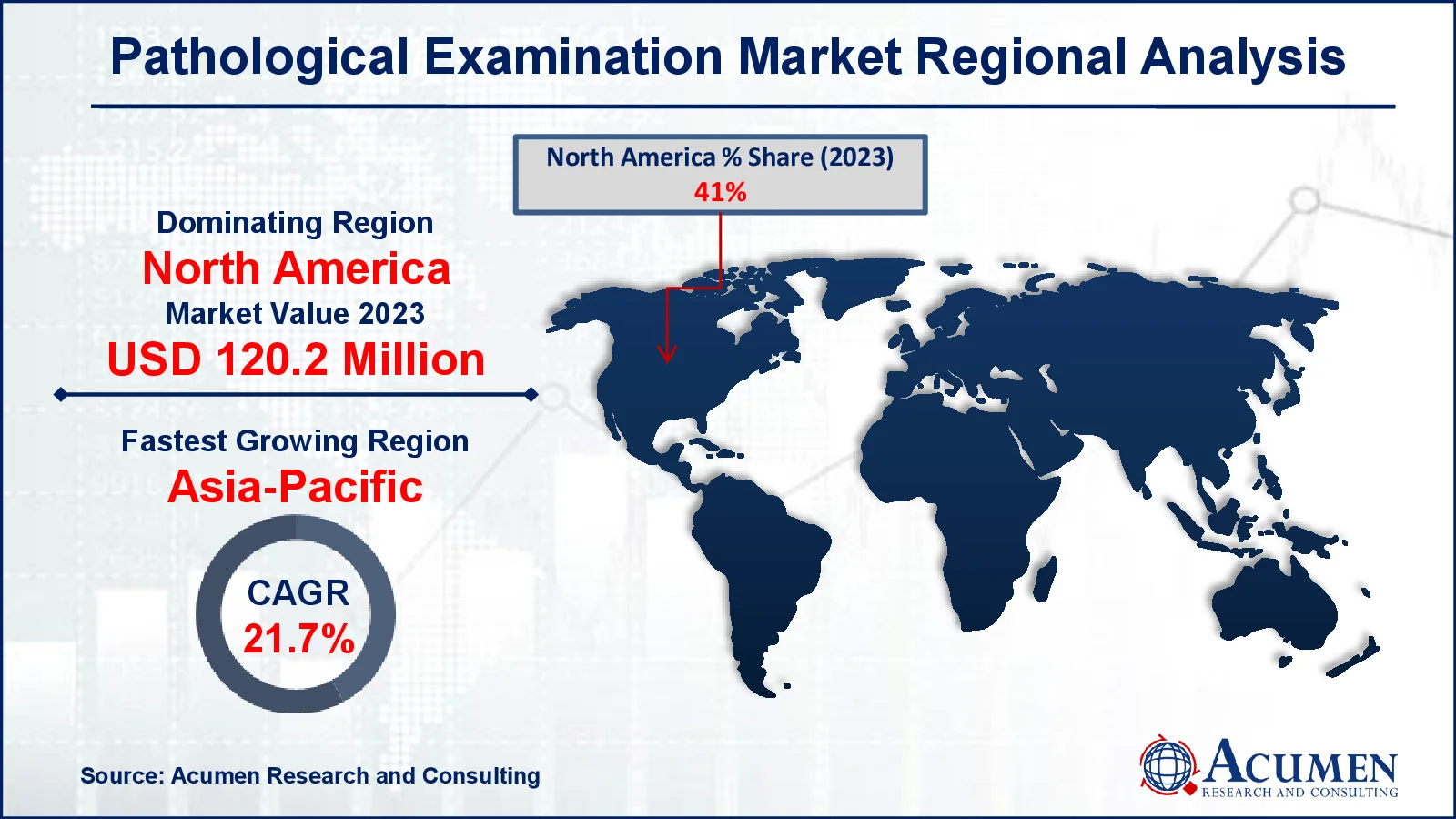

Pathological Examination Market Regional Analysis

For several reasons, the North America was the largest market in 2023, and it is predicted to gain more than half of the market share and dominate by 2032. This can be attributed to early diagnosis, strong purchasing capability, widespread availability of new technology, and improved repayment strategies in the region. Rising healthcare industry further contributes to regional market growth. For instance, according to Centers for Medicare & Medicaid Services, U.S. health-care spending increased by 4.1% to $4.5 trillion in 2022, faster than the 3.2% growth in 2021.

However, in Asia-Pacific, the quickest CAGR throughout the projection period would be 21.7%. As a result, the frequency of chronic diseases has increased, health infrastructures have been developed, health care knowledge has increased, and early detection has become more prevalent. For instance, according to National Library of Medicine, increased human longevity is related with an increased risk of noncommunicable diseases. Currently, over 77% (31.4 million) of all NCD fatalities occur in low- and middle-income countries (LMICs).4. While population aging has contributed to chronic illness fatalities among the elderly worldwide, the early emergence of chronic disorders in LMICs impacts both working and older populations5, 6. For example, an estimated 15 million individuals die annually owing to NCDs in the working age group of 30 to 69 years, with 85% coming from LMICs4. The paper analyzes regions such as Europe and the world.

Pathological Examination Market Players

Some of the top pathological examination companies offered in our report include Sonic Healthcare Limited, Quest Diagnostics, Inc., Abbott Pathology, Healio, Danaher Corporation, F. Hoffmann-La Roche Ltd, Agilient Technologies, Trinity Biotech, Apollo Diagnostics, and Siemens Healthcare Private Limited.

Frequently Asked Questions

How big is the Pathological Examination market?

The pathological examination market size was valued at USD 293.1 Million in 2023.

What is the CAGR of the global Pathological Examination market from 2024 to 2032?

The CAGR of pathological examination is 20.1% during the analysis period of 2024 to 2032.

Which are the key players in the Pathological Examination market?

The key players operating in the global market are including Sonic Healthcare Limited, Quest Diagnostics, Inc., Abbott Pathology, Healio, Danaher Corporation, F. Hoffmann-La Roche Ltd, Agilient Technologies, Trinity Biotech, Apollo Diagnostics, and Siemens Healthcare Private Limited.

Which region dominated the global Pathological Examination market share?

North America held the dominating position in pathological examination industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of pathological examination during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Pathological Examination industry?

The current trends and dynamics in the pathological examination industry include rising prevalence of chronic diseases like cancer boosts demand for diagnostics, technological advancements in digital pathology enhance efficiency and accuracy, and increasing focus on personalized medicine drives the need for specialized examinations.

Which test held the maximum share in 2023?

The digital pathology test held the maximum share of the pathological examination industry.