Passive Fire Protection Market | Acumen Research and Consulting

Passive Fire Protection Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

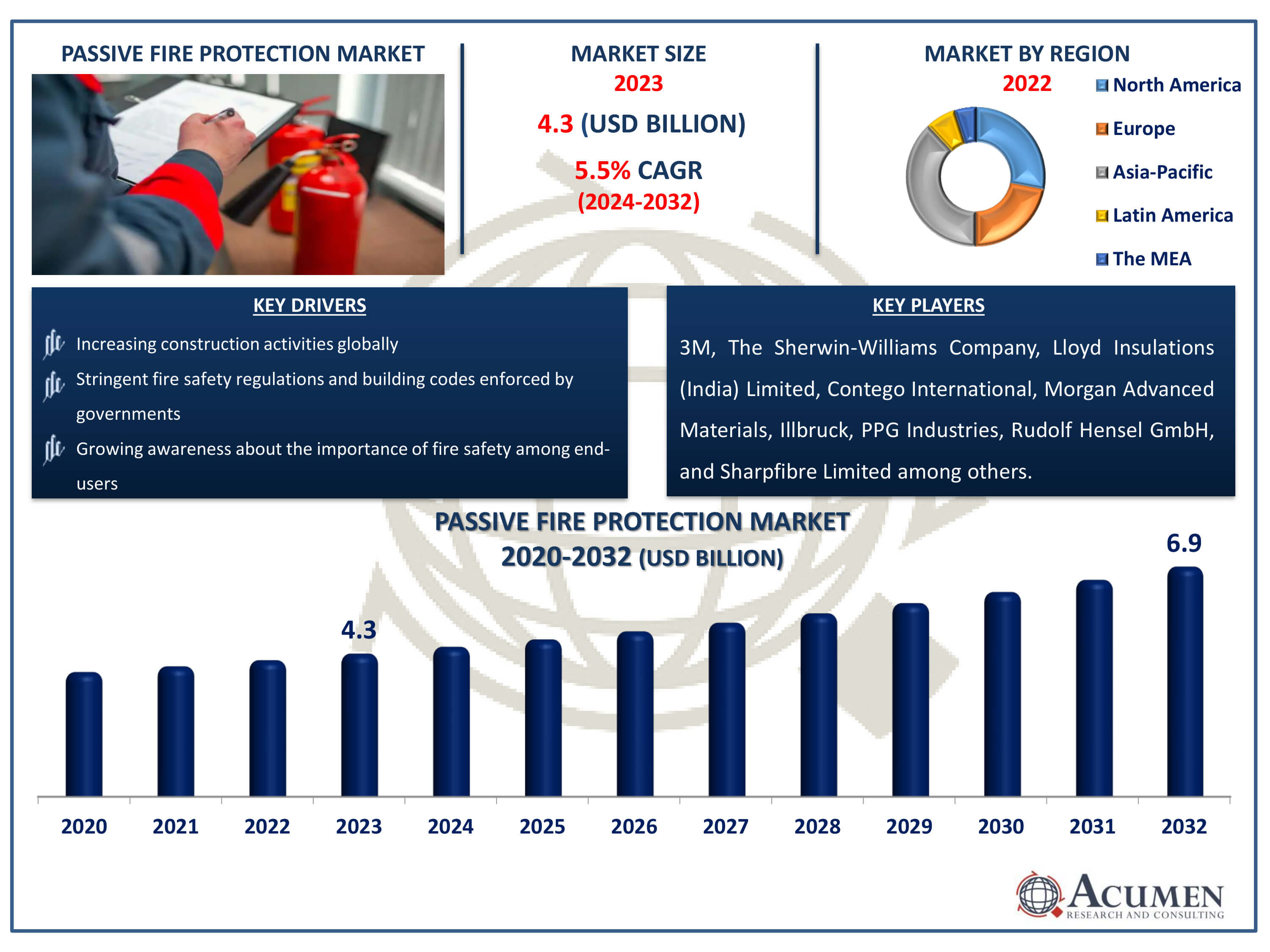

The Passive Fire Protection Market Size accounted for USD 4.3 Billion in 2023 and is estimated to achieve a market size of USD 6.9 Billion by 2032 growing at a CAGR of 5.5% from 2024 to 2032.

Passive Fire Protection Market Highlights

- Global passive fire protection market revenue is poised to garner USD 6.9 billion by 2032 with a CAGR of 5.5% from 2024 to 2032

- Asia Pacific passive fire protection market value occupied around USD 1.6 billion in 2023

- North America passive fire protection market growth will record a CAGR of more than 6.2% from 2024 to 2032

- Among product, the cementitious materials sub-segment generated 42% of the market share in 2023

- Based on end-use, the construction sub-segment generated 31% of market share in 2023

- Increasing adoption of intumescent coatings for structural steel protection due to their effectiveness in fire resistance and aesthetic appeal is the passive fire protection market trend that fuels the industry demand

A comprehensive fire safety strategy must include passive fire protection, which is integrated into a building's structure to safeguard lives and minimize the financial impact of damage to the building and its contents. Passive fire protection plays a crucial role in limiting the spread of fire and smoke by containing them within a designated compartment, thereby protecting escape routes and ensuring essential means of outlet. Additionally, it enhances the building's structural integrity, contributing to its long-term viability. Passive fire protection is incorporated into the building to stabilize walls and floors, effectively dividing the structure into manageable risk compartments. These compartments are designed to limit fire spread, facilitating resident migration and providing a safer environment for firefighters. This type of protection is achieved either through the materials used in construction or by adding elements that improve the building's fire resistance.

Global Passive Fire Protection Market Dynamics

Market Drivers

- Increasing construction activities globally, especially in commercial and residential sectors

- Stringent fire safety regulations and building codes enforced by governments

- Growing awareness about the importance of fire safety among end-users

Market Restraints

- High installation and maintenance costs of passive fire protection systems

- Limited awareness and understanding in developing regions

- Technical challenges and compatibility issues with existing infrastructure

Market Opportunities

- Expansion in emerging markets with rapid urbanization and industrial growth

- Technological advancements in fire-resistant materials and coatings

- Integration of passive fire protection with smart building technologies

Passive Fire Protection Market Report Coverage

| Market | Passive Fire Protection Market |

| Passive Fire Protection Market Size 2022 | USD 4.3 Billion |

| Passive Fire Protection Market Forecast 2032 | USD 6.9 Billion |

| Passive Fire Protection Market CAGR During 2023 - 2032 | 5.5% |

| Passive Fire Protection Market Analysis Period | 2020 - 2032 |

| Passive Fire Protection Market Base Year |

2022 |

| Passive Fire Protection Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-Use Industry Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 3M, The Sherwin-Williams Company, Lloyd Insulations (India) Limited, Morgan Advanced Materials plc, Illbruck, PPG Industries, Inc., Rudolf Hensel GmbH, Contego International Inc, Sharpfibre Limited, Isolatek International, Carboline, Tecresa Protección Pasiva, S.L., Hempel A/S, and Etex Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Passive Fire Protection Market Insights

The surge in global construction, particularly in commercial and residential sectors, drives expansion of the passive fire protection market. For instance, by 2025, it is anticipated that the construction industry in India will attain a value of $1.4 trillion, according to Invest India. With heightened concerns over safety and compliance, there is a growing emphasis on implementing effective fire prevention measures. Passive fire protection systems, such as fire-resistant materials and structural barriers, are integral in safeguarding buildings and occupants against fire hazards. This market growth is further propelled by stringent regulatory standards mandating the incorporation of fire safety features in construction projects. As demand for reliable fire protection solutions escalates, the passive fire protection market is poised for sustained expansion worldwide.

Limited awareness and understanding of passive fire protection measures in developing regions present significant barriers to the growth of the market. Without proper knowledge, there's often a lack of demand for these crucial safety solutions, hindering market expansion. Educational initiatives and outreach programs can play a pivotal role in raising awareness about the importance of passive fire protection, fostering demand, and stimulating market growth. Collaborations between governments, industry players, and non-profit organizations are essential to distribute information effectively and overcome these obstacles. Ultimately, addressing these knowledge gaps is vital to enhancing fire safety standards and promoting sustainable development in developing regions.

The rapid urbanization and industrial growth seen in emerging markets create a significant opportunity for passive fire protection solutions. For instance, urbanization in China accelerated significantly after the implementation of the reform and opening policy. As of the conclusion of 2023, China had achieved an urbanization rate of 66.2%, with projections indicating a rise to 75-80% by the year 2035. As cities expand and industrial activities intensify, the risk of fire incidents escalates, making effective fire protection systems essential. This demand presents a significant opportunity for the passive fire protection market to thrive. By offering solutions that mitigate fire risks in buildings, infrastructure, and industrial facilities, companies can capitalize on this burgeoning market. Strategic expansion and innovative product development will further prompted market in coming years.

Passive Fire Protection Market Segmentation

The worldwide market for passive fire protection is split based on product, application, end use industry, and geography.

Passive Fire Protection Products

- Cementitious Materials

- Intumescent Coatings

- Fireproofing Cladding

- Others

According to the passive fire protection industry analysis, cementitious materials dominate passive fire protection industry due to their exceptional fire-resistant properties. These materials form a dense barrier when applied, shielding structures from the shocking effects of fire by retarding its spread. Their versatility allows for application across various substrates, from steel structures to walls and ceilings. Cementitious coatings provide an effective and durable solution, often meeting stringent regulatory standards for fire safety. Moreover, key players further focusing on innovations in coating system for protection of walls and ceilings. For instance, in March 2023, Envirograf launched MOULDBLOK, a comprehensive three-part coating system designed to provide both mold resistance and fire protection for walls and ceilings. The system comprises MOULDBLOK AP, which serves as the initial internal wall coating, MOULDBLOK FR for enhanced protection, and MOULDBLOK EX for safeguarding external walls against dampness and mold. As a result, they are extensively utilized in commercial, industrial, and residential buildings to enhance fire resistance and ensure resident safety.

Passive Fire Protection Applications

- Structural

- Compartmentation

- Opening Protection

- Firestopping Material

The structural segment is the largest application category in the passive fire protection market and it is expected to increase over the industry, due to its vital role in safeguarding buildings and infrastructure against fire hazards. With stringent regulations and heightened awareness of fire safety, demand for structural fire protection solutions is projected to surge. These solutions encompass fire-resistant coatings, intumescent paints, and fireproof barriers, essential for preserving structural integrity during fires. As urbanization continues and construction activities rise, the need for effective passive fire protection measures remains high.

Passive Fire Protection End-Use Industries

- Oil & Gas

- Construction

- Industrial

- Warehousing

- Others

According to the passive fire protection industry forecast, construction segment as end-users expected to dominates passive fire protection market. Construction, including architects, engineers, and builders, prioritize fire safety to safeguard both property and lives. With a growing emphasis on sustainable and resilient construction practices, demand for advanced passive fire protection solutions is escalating. This trend is further fueled by an increasing awareness of the demoralizing impact of fire incidents, compelling stakeholders to invest in robust fire-resistant materials and systems. As the construction industry continues to evolve, the demand for innovative passive fire protection technologies is remains high.

Passive Fire Protection Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Passive Fire Protection Market Regional Analysis

For several reasons, Asia-Pacific dominates passive fire protection market, driven by rapid industrialization, stringent safety regulations, and increased construction activities. Countries like China and India are witnessing significant growth in the adoption of passive fire protection measures across various sectors including residential, commercial, and industrial. Moreover, an increase in the need for fire-resistant infrastructure in both commercial and residential sectors, coupled with rising awareness among a expanding consumer demographic, are driving factors behind the worldwide demand for passive fire protection.

North America emerges as the fastest-growing region in the passive fire protection market, fueled by a surge in infrastructure development projects, heightened awareness regarding fire safety, and presence of robust key players. For instance, PPG Industries, Inc. introduced PPG STEELGUARD 951 in February 2023, an epoxy intumescent fire protection coating designed to meet the evolving needs of architectural steel. It provides up to three hours of cellulosic fire protection. In the event of a fire, the coating expands from a thin film to a foam-like thick layer, safeguarding the steel and preserving its structural stability. With a robust construction industry and increasing investments in advanced fire protection technologies, North America is poised for substantial growth in the coming years, presenting opportunities for market players.

Passive Fire Protection Market Players

Some of the top passive fire protection companies offered in our report include 3M, The Sherwin-Williams Company, Lloyd Insulations (India) Limited, Morgan Advanced Materials plc, Illbruck, PPG Industries, Inc., Rudolf Hensel GmbH, Contego International Inc, Sharpfibre Limited, Isolatek International, Carboline, Tecresa Protección Pasiva, S.L., Hempel A/S, and Etex Group.

Frequently Asked Questions

How big is the passive fire protection market?

The passive fire protection market size was valued at USD 4.3 billion in 2023.

What is the CAGR of the global passive fire protection market from 2024 to 2032?

The CAGR of passive fire protection is 5.5% during the analysis period of 2024 to 2032.

Which are the key players in the passive fire protection market?

The key players operating in the global market are including 3M, The Sherwin-Williams Company, Lloyd Insulations (India) Limited, Morgan Advanced Materials plc, Illbruck, PPG Industries, Inc., Rudolf Hensel GmbH, Contego International Inc, Sharpfibre Limited, Isolatek International, Carboline, Tecresa Protección Pasiva, S.L., Hempel A/S, and Etex Group.

Which region dominated the global passive fire protection market share?

Asia-Pacific held the dominating position in passive fire protection industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of passive fire protection during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global passive fire protection industry?

The current trends and dynamics in the passive fire protection industry include increasing construction activities globally, especially in commercial and residential sectors, stringent fire safety regulations and building codes enforced by governments, and growing awareness about the importance of fire safety among end-users.

Which product held the maximum share in 2023?

The cementitious materials product held the maximum share of the passive fire protection industry.