Passive Fire Protection Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Passive Fire Protection Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

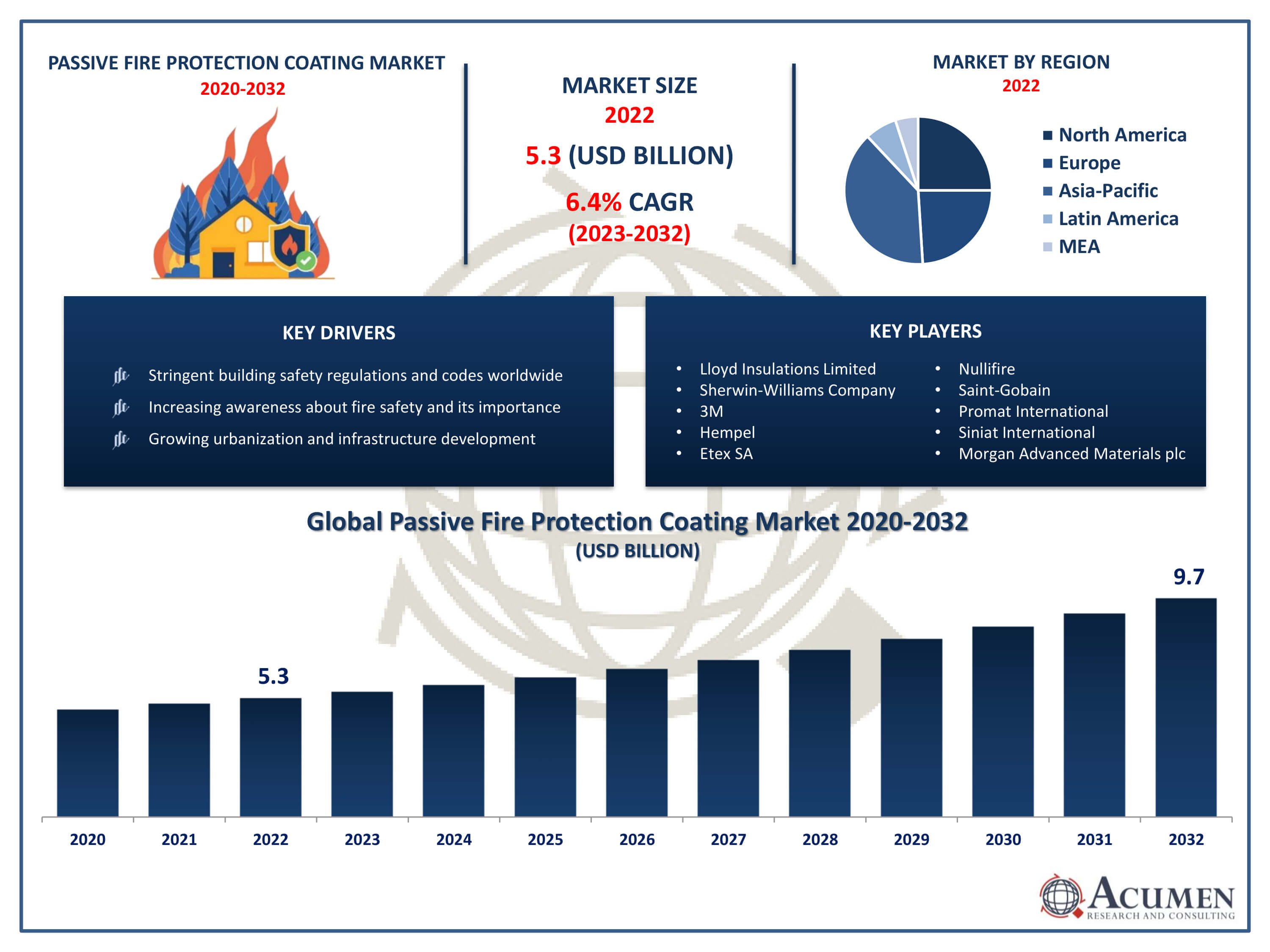

The Global Passive Fire Protection Coating Market Size accounted for USD 5.3 Billion in 2022 and is projected to achieve a market size of USD 9.7 Billion by 2032 growing at a CAGR of 6.4% from 2023 to 2032.

Passive Fire Protection Coating Market Highlights

- Global passive fire protection coating market revenue is expected to increase by USD 9.7 Billion by 2032, with a 6.4% CAGR from 2023 to 2032

- Asia-Pacific region led with more than 38% of passive fire protection coating market share in 2022

- By product, the intumescent coatings segment held the largest share of the market in 2022

- By application, the compartmentation segment captured more than 48% of revenue share in 2022.

- By industry, the building & construction segment is projected to expand at the fastest CAGR over the projected period

- Increasing awareness about fire safety and its importance, drives the passive fire protection coating market value

Passive fire protection (PFP) coatings are essential elements in fire safety measures, designed to limit the spread of fire and mitigate its impact by providing resistance to high temperatures. These coatings are applied to structural elements such as steel beams, columns, and walls to delay the heating of the substrate and prevent structural failure during a fire event. Passive fire protection coatings work by insulating the underlying material, thus slowing down the rate at which it heats up when exposed to fire. This crucial time extension provides occupants with more time to evacuate and emergency responders with a better chance to contain the fire.

The market for passive fire protection coatings has been experiencing significant growth in recent years, driven by stringent safety regulations and increased awareness of fire hazards across various industries including construction, oil and gas, and transportation. As governments worldwide enact stricter building codes and safety standards, the demand for PFP coatings continues to rise. Additionally, rapid urbanization and infrastructure development in emerging economies contribute to the expansion of the market. Technological advancements have also played a vital role in the growth of the PFP coatings market, with manufacturers continuously innovating to develop more efficient and environmentally friendly solutions.

Global Passive Fire Protection Coating Market Trends

Market Drivers

- Stringent building safety regulations and codes worldwide

- Increasing awareness about fire safety and its importance

- Technological advancements leading to more effective coating materials

- Growing urbanization and infrastructure development

- Government initiatives to enhance building safety standards

Market Restraints

- High initial investment costs for advanced passive fire protection systems

- Limited adoption in certain industries due to perceived cost barriers

Market Opportunities

- Development of eco-friendly and sustainable fire protection coatings

- Integration of passive fire protection solutions into smart building technologies

Passive Fire Protection Coating Market Report Coverage

| Market | Passive Fire Protection Coating Market |

| Passive Fire Protection Coating Market Size 2022 | USD 5.3 Billion |

| Passive Fire Protection Coating Market Forecast 2032 |

USD 9.7 Billion |

| Passive Fire Protection Coating Market CAGR During 2023 - 2032 | 6.4% |

| Passive Fire Protection Coating MarketAnalysis Period | 2020 - 2032 |

| Passive Fire Protection Coating Market Base Year |

2022 |

| Passive Fire Protection Coating Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By Industry, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Lloyd Insulations Limited, Sherwin-Williams Company, 3M, Hempel, Etex SA, Nullifire, Saint-Gobain, Promat International, Siniat International, Morgan Advanced Materials plc, TecresaProtecciónPasiva, S.L., and Contego International Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Passive Fire Protection Coating Market Dynamics

Passive fire protection coatings are specialized materials applied to surfaces within buildings and structures to enhance their fire resistance. These coatings work by creating a barrier that insulates the underlying materials from high temperatures and prevents the spread of flames and smoke in the event of a fire. Typically, they are applied to structural elements such as steel beams, columns, walls, and ceilings, as well as to other building components like doors, ductwork, and electrical cables. By delaying the onset of fire or slowing down its progression, passive fire protection coatings provide valuable time for occupants to evacuate safely and for firefighters to contain the blaze. The applications of passive fire protection coatings span across various industries and sectors, including commercial and residential construction, industrial facilities, transportation infrastructure, and oil and gas installations. In commercial buildings, these coatings are commonly used to protect steel structures, ensuring the integrity of the building's framework in the event of a fire.

The passive fire protection coating market has been experiencing robust growth in recent years, driven by several factors contributing to increased demand for fire safety solutions across various industries. Stringent building safety regulations and codes imposed by governments and regulatory bodies worldwide have propelled the adoption of passive fire protection coatings. These regulations mandate the use of fire-resistant materials and systems to enhance the safety of buildings and infrastructure, thereby creating a significant market opportunity for manufacturers and suppliers of passive fire protection materials. Additionally, rising awareness among building owners, operators, and consumers about the importance of fire safety has further fueled market growth. The devastating consequences of fire incidents have underscored the necessity for effective fire protection measures, leading to heightened investments in advanced passive fire protection solutions.

Passive Fire Protection Coating Market Segmentation

The globalpassive fire protection coatingmarket segmentation is based on product, application, industry, and geography.

Passive Fire Protection Coating Market By Product

- Sealants

- Foams & boards

- Intumescent coatings

- Others

According to the passive fire protection coating industry analysis, the intumescent coatings segment accounted for the largest market share in 2022. Intumescent coatings are specially formulated to expand and form a thick, insulating layer when exposed to high temperatures, thereby protecting the underlying substrate from fire damage. This unique property makes intumescent coatings highly effective in enhancing the fire resistance of structural elements such as steel beams, columns, and walls, driving their demand across various industries. One of the key drivers behind the growth of the intumescent coatings segment is the increasing stringency of building safety regulations and codes globally. Governments and regulatory bodies are mandating the use of fire-resistant materials and systems in construction projects to mitigate the risk of fire incidents and minimize property damage. As a result, building owners, developers, and contractors are increasingly turning to intumescent coatings as a reliable passive fire protection solution to ensure compliance with regulatory requirements.

Passive Fire Protection Coating Market By Application

- Structural

- Opening protection

- Compartmentation

- Firestopping materials

In terms of applications, the compartmentation segment is expected to witness significant growth in the coming years. Compartmentation involves dividing a building into smaller compartments or fire zones using fire-resistant barriers such as walls, floors, and doors to contain fire and smoke, thereby limiting its spread and providing occupants with more time to evacuate safely. As building safety regulations become increasingly stringent, the demand for effective compartmentation solutions has surged across various industries, driving the growth of this segment in the passive fire protection coating market growth. One of the primary drivers behind the growth of compartmentation coatings is the rising awareness of the importance of compartmentalizing buildings to minimize the risk of fire incidents and enhance occupant safety. Governments and regulatory bodies worldwide are implementing stricter building codes and standards that mandate the use of fire-resistant materials and systems to improve building safety.

Passive Fire Protection Coating Market By Industry

- Building & construction

- Transportation

- Oil & gas

- Others

According to the passive fire protection coating market forecast, the building & construction segment is expected to witness significant growth in the coming years. This growth is fueled by increasing investments in infrastructure development and rising awareness of fire safety regulations. As urbanization continues to drive construction activities globally, there is a growing emphasis on incorporating robust fire protection measures into building designs. Passive fire protection coatings play a crucial role in enhancing the fire resistance of structural elements such as steel, concrete, and wood, thus mitigating the risk of fire spread and minimizing property damage. One of the key drivers behind the growth of passive fire protection coatings in the building and construction segment is the implementation of stringent building codes and regulations by governments and regulatory authorities worldwide. These regulations mandate the use of fire-resistant materials and systems in construction projects to ensure the safety of occupants and protect valuable assets. As a result, architects, engineers, and builders are increasingly specifying passive fire protection coatings to comply with these regulations and enhance the overall fire safety of buildings.

Passive Fire Protection Coating Market Regional Outlook

North America

- United State

- Canada

Europe

- Germany

- France

- U.K.

- Spain

- Rest of Europe

Latin America

- Brazil

- Mexico

- Rest of Latin America

Asia-Pacific

- India

- China

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

The Middle East & Africa

- South Africa

- UAE

- Rest of the Middle East & Africa (ME&A)

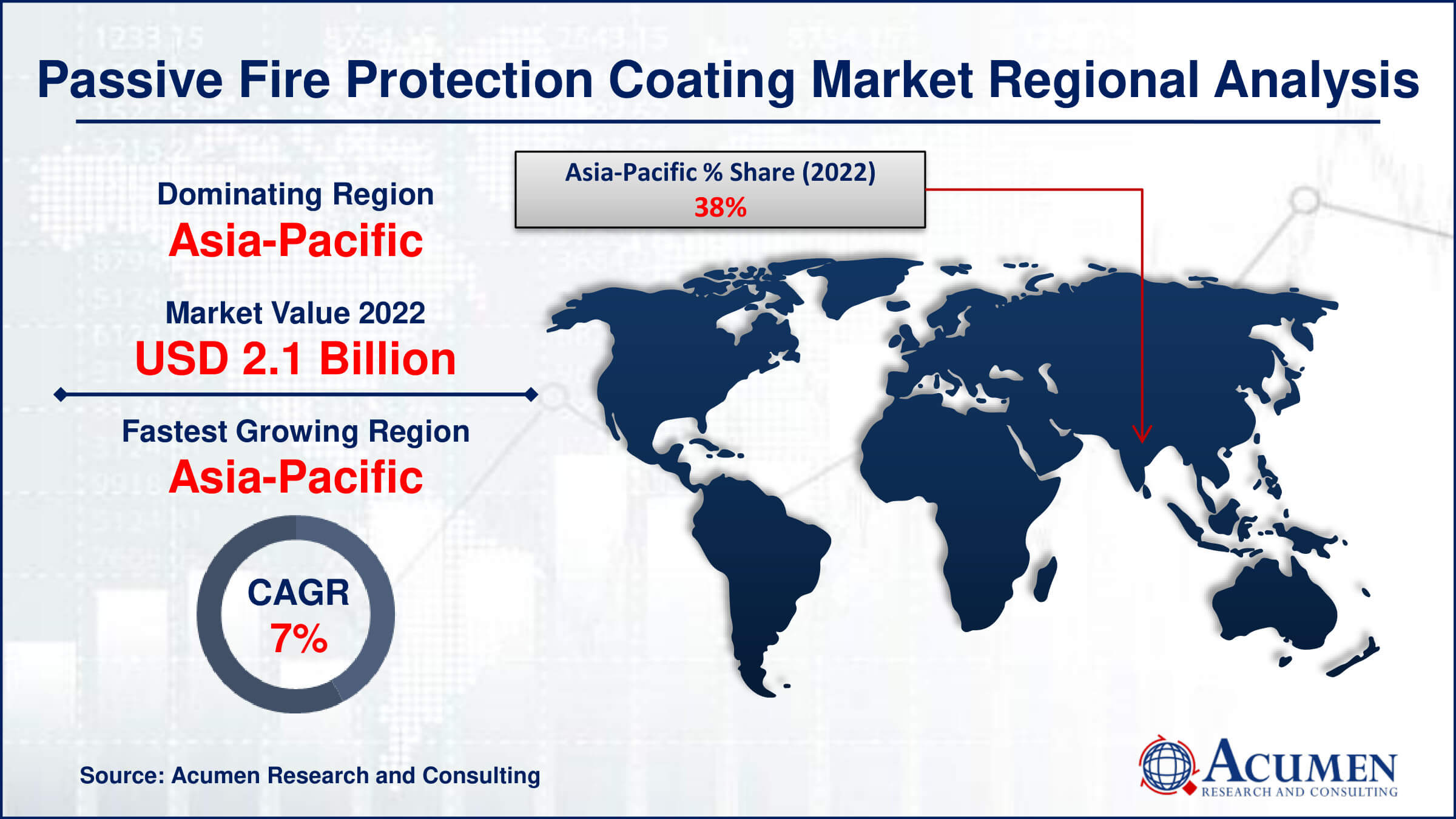

Passive Fire Protection Coating Market Regional Analysis

The Asia-Pacific region has emerged as a dominating force in the passive fire protection coating market due to several key factors driving its growth. One of the primary reasons is the rapid urbanization and industrialization taking place across countries in this region. With expanding populations and increasing construction activities, there is a heightened focus on building safety standards, including the implementation of stringent fire protection regulations. This has led to a surge in demand for passive fire protection coatings to enhance the fire resistance of structures in commercial, residential, and industrial buildings. Moreover, economic development and infrastructure projects in countries like China, India, and Southeast Asian nations are driving significant investments in construction and building projects. Governments in these regions are prioritizing infrastructure development to support economic growth, which has created a favorable environment for the passive fire protection coating market to thrive. Additionally, increasing awareness among stakeholders, including building owners, developers, and regulatory bodies, about the importance of fire safety has further accelerated the adoption of passive fire protection coatings in the Asia-Pacific region. Furthermore, the presence of a large manufacturing base and a growing number of local and international players in the coatings industry contribute to the dominance of the Asia-Pacific region in the passive fire protection coating market.

Passive Fire Protection Coating Market Player

Some of the top passive fire protection coating market companies offered in the professional report includeLloyd Insulations Limited, Sherwin-Williams Company, 3M, Hempel, Etex SA, Nullifire, Saint-Gobain, Promat International, Siniat International, Morgan Advanced Materials plc, TecresaProtecciónPasiva, S.L., and Contego International Inc.

Frequently Asked Questions

How big is the passive fire protection coating market?

The passive fire protection coating market size was USD 5.3 Billion in 2022.

What is the CAGR of the global passive fire protection coating market from 2023 to 2032?

The CAGR of passive fire protection coating is 6.4%during the analysis period of 2023 to 2032.

Which are the key players in the passive fire protection coating market?

The key players operating in the global market are including Lloyd Insulations Limited, Sherwin-Williams Company, 3M, Hempel, Etex SA, Nullifire, Saint-Gobain, Promat International, Siniat International, Morgan Advanced Materials plc, TecresaProtecci�nPasiva, S.L., and Contego International Inc.

Which region dominated the global passive fire protection coating market share?

Asia-Pacific held the dominating position in passive fire protection coating industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of passive fire protection coating during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global passive fire protection coating industry?

The current trends and dynamics in the passive fire protection coating industry include stringent building safety regulations and codes worldwide, increasing awareness about fire safety and its importance, and technological advancements leading to more effective coating materials.

Which application held the maximum share in 2022?

The compartmentation application held the maximum share of the passive fire protection coating industry.