Pallet Racking System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Pallet Racking System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

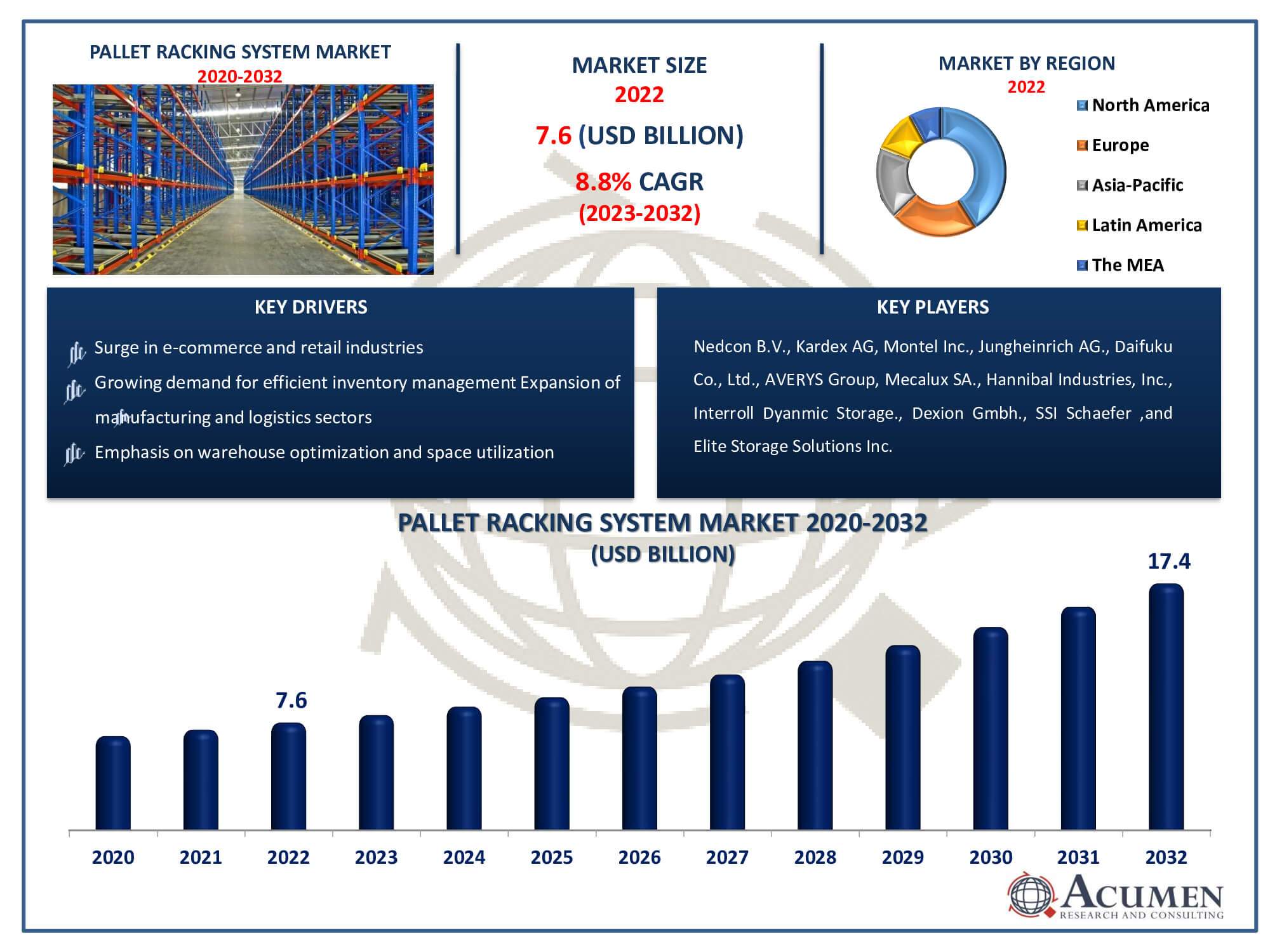

The Pallet Racking System Market Size accounted for USD 7.6 Billion in 2022 and is estimated to achieve a market size of USD 17.4 Billion by 2032 growing at a CAGR of 8.8% from 2023 to 2032.

Pallet Racking System Market Highlights

- Global pallet racking system market revenue is poised to garner USD 17.4 billion by 2032 with a CAGR of 8.8% from 2023 to 2032

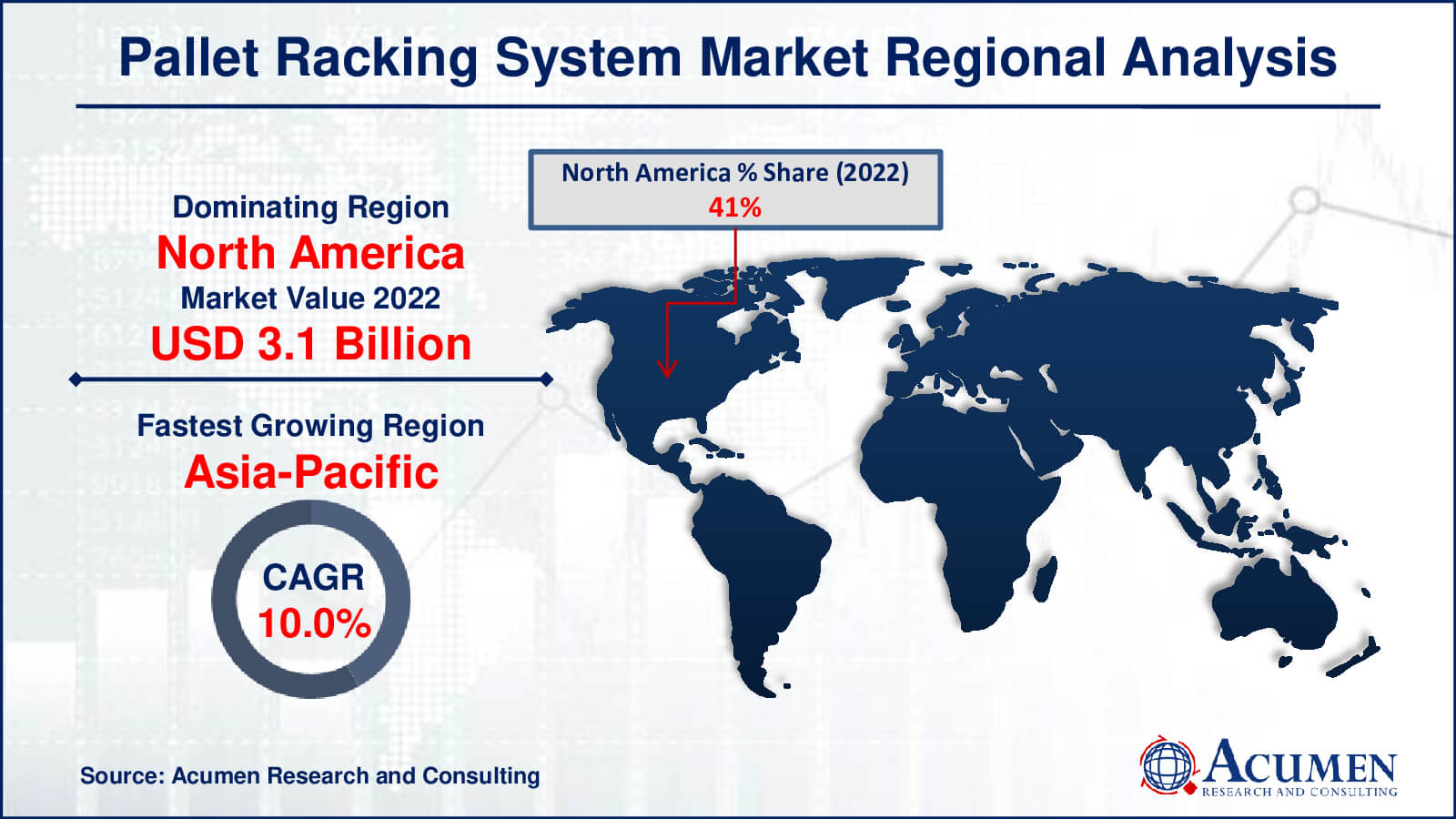

- North America pallet racking system market value occupied around USD 3.1 billion in 2022

- Asia-Pacific pallet racking system market growth will record a CAGR of more than 10% from 2023 to 2032

- Among racking system type, the selective pallet rack sub-segment generated over US$ 2.6 billion revenue in 2022

- Based on frame load capacity, the 5-15 ton sub-segment generated around 55% share in 2022

- Expansion into emerging markets with evolving logistics needs is a popular pallet racking system market trend that fuels the industry demand

Pallet racking systems are storage solutions for storing goods on pallets in warehouses and distribution centres. These systems are intended to maximise vertical space and storage density, allowing for effective product organisation and retrieval. The increased demand for end-to-end services driven by established end-users (e.g. drugs, food & drinks, cars, textiles, and other engineering products) creates new storage/warehouse space requirements. The demand is growing. In turn, this has given organized warehouses with enhanced value-added facilities and services growth opportunities. In particular, increasing imports & exports between various economic belts support the growth of pallet racking systems in the market.

Global Pallet Racking System Market Dynamics

Market Drivers

- Surge in e-commerce and retail industries

- Emphasis on warehouse optimization and space utilization

- Growing demand for efficient inventory management

- Expansion of manufacturing and logistics sectors

Market Restraints

- High initial implementation costs

- Limited availability of warehouse space in urban areas

- Safety and regulatory compliance challenges

Market Opportunities

- Adoption of automated storage and retrieval systems

- Integration of IoT and AI for warehouse management

- Focus on sustainable and eco-friendly storage solutions

Pallet Racking System Market Report Coverage

| Market | Pallet Racking System Market |

| Pallet Racking System Market Size 2022 | USD 7.6 Billion |

| Pallet Racking System Market Forecast 2032 | USD 17.4 Billion |

| Pallet Racking System Market CAGR During 2023 - 2032 | 8.8% |

| Pallet Racking System Market Analysis Period | 2020 - 2032 |

| Pallet Racking System Market Base Year |

2022 |

| Pallet Racking System Market Forecast Data | 2023 - 2032 |

| Segments Covered | By System Type, By Racking System Type, By Frame Load Capacity, By Application, By End Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Nedcon B.V., Kardex AG, Montel Inc., Jungheinrich AG, Daifuku Co., Ltd., AVERYS Group, Mecalux SA, Hannibal Industries, Inc., Interroll Dyanmic Storage, Dexion Gmbh., SSI Schaefer, and Elite Storage Solutions Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Pallet Racking System Market Insights

Over the last decade, labor costs have steadily risen alongside warehousing rents, prompting companies to optimize their storage space efficiently. End users must closely monitor these cost factors, leading to increased attention on pallet manufacturers. Within every economy, the logistics industry manages the flow from production sites to product usage, encompassing warehousing, material handling, packaging, transport, procurement, stock management, and supply chain activities. These recent developments have positively impacted the pallet racking systems market. Innovative space-efficient storage solutions, including pallet racking systems, have emerged to meet this demand. Automation is expected to further decrease labor costs, as evidenced by the growing trend in warehouse automation. Many companies are focusing on enhancing and upgrading existing warehouse management systems rather than implementing entirely new ones.

The global market for industrial racking systems is expected to strengthen due to increased installations in E-commerce and 3PL for retail and general purposes, alongside rising demand from the food and beverage industry. Logistics and warehousing play crucial roles in global goods transportation, with warehouses being key contributors to the global supply chain and business infrastructure. Procurements, manufacturing, and distribution services form the centerpiece of robust economic development collectively. The emerging Asian subcontinent increasingly requires organized logistics to enhance time, cost, and quality efficiencies, presenting opportunities for expanding the pallet racking systems market. Additionally, the burgeoning e-commerce sector offers 3PLPs unique opportunities by aggregating vendors and services, prompting pallet racking systems manufacturers to adapt capacities to meet the rising demand for new and differentiated services.

Pallet Racking System Market Segmentation

The worldwide market for pallet racking system is split based on system type, racking system type, frame load capacity, application, end use industry, and geography.

Pallet Racking System Market By System Types

- Conventional

- Shuttle Racking

- Mobile Racking

- Hybrid/Customized Racking

According to pallet racking system industry analysis, the conventional pallet racking system segment has been the largest in recent years. These systems are frequently used in a variety of industries because they provide versatility, quick access to each pallet, and are cost-effective. Despite the introduction of novel solutions such as shuttle, mobile, and hybrid/customized racking systems, the traditional approach remains dominant due to its familiarity, dependability, and appropriateness for a wide range of warehouse requirements. While modern systems serve to specific needs such as high-density storage or greater automation, the broad use and adaptability of traditional pallet racking systems has kept them as the market's largest category.

Pallet Racking System Market By Racking System Types

- Narrow Aisle Rack

- Drive-in Rack

- Push-back Rack

- Selective Pallet Rack

- Mezzanine

- Gravity Flow Rack

- Others

The selective pallet rack sector has grown to be the market's largest. Its appeal originates from its versatility, which allows for direct access to each pallet while optimising storage flexibility and inventory control. While alternative storage systems, such as narrow aisle, drive-in, push-back, mezzanine, gravity flow rack, and customised solutions, suit specific storage demands, the selective pallet rack's adaptability and efficiency for a wide range of products and industries has accelerated its supremacy. Its ability to maximise warehouse space while offering easy access to individual pallets has cemented its position as the market leader in pallet racking systems.

Pallet Racking System Market By Frame Load Capacity

- Up to 5 Ton

- 5-15 Ton

- Above 15 Ton

The 5-15 ton frame load capacity category is poised to continue dominating the market in the pallet racking system market forecast period. This category strikes a perfect balance, catering to an extensive array of industrial storage needs while ensuring structural integrity without unnecessary high load capacities. Renowned for its versatility, it adeptly addresses diverse warehouse requirements, providing a robust framework for handling heavy loads. Its sustained popularity signifies its pivotal role as a preferred choice for sectors needing substantial load-bearing capabilities. This segment is expected to maintain its market prominence, serving as an ideal solution for various industries seeking reliable yet adaptable storage solutions without necessitating the extreme capabilities offered by higher load capacity segments.

Pallet Racking System Market By Applications

- Cases & Boxes

- Rigid Sheets

- Pipes & Panels, Tires

- Timber & Rolls

- Drums & Pails

- Trays & Crates

- Others

In terms of pallet racking system market analysis, the cases & boxes application sector emerges as the leader in the market. Its prominence reflects the extensive use and demand for storage solutions for smaller, packaged goods in a variety of industries. The adaptability of this category allows for the storage of a wide range of products, including electronics, medications, consumer goods, and more. Cases & Boxes' importance emphasises the necessity for organised and accessible storage for packaged products, emphasising the market's reliance on effective handling and storage of smaller-sized items. Its position as a leader reflects the critical role it plays in supporting improved inventory management and guaranteeing efficient warehouse operations across numerous industries.

Pallet Racking System Market By End Use Industry

- Packaging

- Healthcare

- Metal Processing & Manufacturing

- Building & Construction

- Food & Beverage

- Chemical

- Logistics & Warehousing

- Electrical & Electronics

- Mining

- Other

The pallet racking system market is dominated by the packaging segment. This dominance reflects the critical role of effective storage systems in handling a wide range of packaged goods across multiple industries. This section caters to the storage needs of a wide range of products, from consumer goods to pharmaceuticals, emphasising the market's need on organised and accessible storage for packaged commodities. The predominance of the packaging industry emphasises its important role in guaranteeing streamlined inventory management and optimising warehouse operations. Its sizable market share demonstrates the huge demand and requirement for adept storage solutions in the packaging industry, facilitating the effective handling and accessibility of packed products.

Pallet Racking System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Pallet Racking System Market Regional Analysis

The United States and Canada are pivotal in the North American pallet racking systems market. With the United States boasting substantial trade exports and experiencing robust e-commerce growth, it emerges as a significant player in this market. The expanding third-party logistics (3PLs) sector within North America further fuels the sales of pallet racking systems. However, the Latin American market for these systems remains considerably fragmented. Mexico, benefiting from its geographical proximity to the US and the Free Trade Agreements (FTAs), has witnessed a surge in demand for automated pallet racking systems. In the US, the lack of modern warehouse equipment intensifies space competition among e-commerce entities, necessitating the development of new warehouses or the modernization of existing ones to meet contemporary demands.

The European market encompasses Italy, France, Germany, Spain, the UK, Poland, Russia, and the Rest of Europe. Within this market, Germany stands out prominently for pallet racking system installations. Meanwhile, Italy, France, and Spain are among the world's largest exporters of these systems, closely followed by the United States and China. Looking ahead, during the forecast period, Asia Pacific is poised to capitalize on significant growth opportunities for pallet racking systems.

Asia-Pacific is expected to hold the largest share and witness the highest Compound Annual Growth Rate (CAGR) in the projected period. Regions like China, South East Asia (SEAP), and India are experiencing a growing demand for organized logistics, consequently driving the pallet racking systems market. India, specifically, anticipates substantial trade growth in the coming decade. This surge in trade volumes is set to drive demand for logistics services and automated solutions. Policy initiatives such as GST and Make in India aim to streamline logistics and enhance operations for third-party logistics providers (3PLs). Furthermore, the Indian government's efforts to improve connectivity between major cities, ports, and freight corridors through infrastructure development will create a favorable environment for the pallet racking systems market.

Pallet Racking System Market Players

Some of the top pallet racking system companies offered in our report includes Nedcon B.V., Kardex AG, Montel Inc., Jungheinrich AG, Daifuku Co., Ltd., AVERYS Group, Mecalux SA, Hannibal Industries, Inc., Interroll Dyanmic Storage, Dexion Gmbh., SSI Schaefer, and Elite Storage Solutions Inc.

Frequently Asked Questions

How big is the pallet racking system market?

The market size of pallet racking system was USD 7.6 billion in 2022.

What is the CAGR of the global pallet racking system market from 2023 to 2032?

The CAGR of pallet racking system is 8.8% during the analysis period of 2023 to 2032.

Which are the key players in the pallet racking system market?

The key players operating in the global market are including Nedcon B.V., Kardex AG, Montel Inc., Jungheinrich AG., Daifuku Co., Ltd., AVERYS Group, Mecalux SA., Hannibal Industries, Inc., Interroll Dyanmic Storage., Dexion Gmbh., SSI Schaefer, and Elite Storage Solutions Inc.

Which region dominated the global pallet racking system market share?

North America held the dominating position in pallet racking system industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of pallet racking system during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global pallet racking system industry?

The current trends and dynamics in the pallet racking system industry include surge in e-commerce and retail industries, emphasis on warehouse optimization and space utilization, growing demand for efficient inventory management, and expansion of manufacturing and logistics sectors.

Which end use industry held the maximum share in 2022?

The packaging end use industry held the maximum share of the pallet racking system industry.?