Palatants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Palatants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Palatants Market Size accounted for USD 1.4 Billion in 2022 and is estimated to achieve a market size of USD 2.4 Billion by 2032 growing at a CAGR of 5.8% from 2024 to 2032.

Palatants Market Highlights

- Global palatants market revenue is poised to garner USD 2.4 billion by 2032 with a CAGR of 5.8% from 2024 to 2032

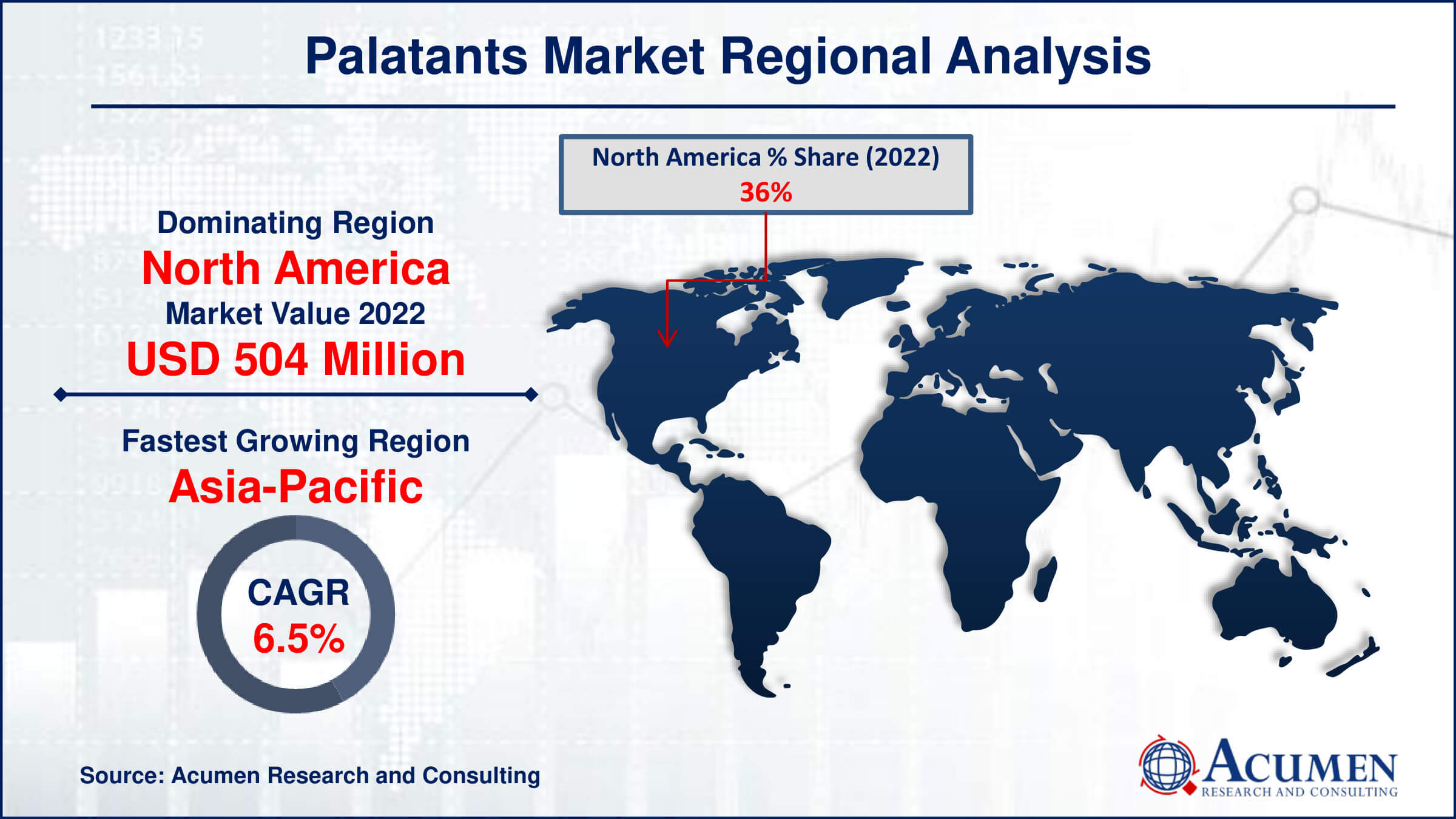

- North America palatants market value occupied around 36% market share in 2022

- Asia-Pacific palatants market growth will record a CAGR of more than 6.5% from 2024 to 2032

- Among form, dry sub-segment generated USD 742 million market revenue in 2022

- Based on nature, the conventional sub-segment generating 85% market share in 2022

- Growing awareness about nutritional benefits for poultry products is a popular palatants market trend

Palatants are substances added to pet foods to enhance their flavor, making them more appealing to animals. These additives are designed to stimulate the appetite of pets and encourage them to eat their food. Palatants can be derived from natural sources like meat, poultry, or fish, or they can be synthetic compounds that mimic these flavors. By incorporating palatants into pet food formulations, manufacturers can ensure that their products are more palatable, which can be particularly beneficial for particular eaters or pets with specific dietary needs. Ultimately, palatants play a crucial role in improving the overall eating experience for pets, contributing to their health and well-being.

Global Palatants Market Dynamics

Market Drivers

- Rapidly increasing pet population

- Growing disposable income of customers

- Advancements in technology for feed formulations

Market Restraints

- Stringent rules and regulations

- Raw material sourcing challenges

Market Opportunities

- Growing awareness about nutritional benefits for poultry products

- Rising humanization of pets

Palatants Market Report Coverage

| Market | Palatants Market |

| Palatants Market Size 2022 | USD 1.4 Billion |

| Palatants Market Forecast 2032 |

USD 2.4 Billion |

| Palatants Market CAGR During 2024 - 2032 | 5.8% |

| Palatants Market Analysis Period | 2020 - 2032 |

| Palatants Market Base Year |

2022 |

| Palatants Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Form, By Nature, By Source, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Pet Flavors, AFB International, Kemin, Kerry Group, Jiangsu Uniwell Biotechnology, Trilogy, Wing Biotech., Zhishang Biology, Hisynergi, Rosapis, and Symrise AG/Diana Pet Food. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Palatants Market Insights

The rapidly increasing pet population worldwide is a key driver behind the growing demand for palatants in the global market. Since 2010, the percentage of households owning pets has remained relatively stable. However, the total number of pet-owning households in the U.S. has increased alongside the growing population. In 2010, there were 73 million households with pets, a figure that has risen to 82 million by 2024. Moreover, palatants are additives used in pet food to enhance its taste and appeal to pets, ensuring they consume necessary nutrients. As more households welcome pets into their families, particularly in emerging markets where pet ownership is rising, the demand for high-quality pet food and palatants is surging. Additionally, pet owners are increasingly seeking premium and specialized products for their animals, further fueling the expansion of the global palatants market. This driver is expected to continue to grow globally, driving innovation and competition within the pet food industry. Furthermore, the growing disposable income of customers and advancements in technology for food formulation further boost the demand for the palatants market. For instance, the announcement of the launching of new Zoetis palatant by Zoetis in April 2023. It’s a natural plant designed to improve feed palatability.

However, the palatants market faces significant hindrances due to stringent rules and regulations governing the industry. These regulations often involve strict requirements for the safety and efficacy of palatants used in animal feed formulations. Compliance with such regulations necessitates extensive testing, documentation, and approval processes, adding time and cost burdens to market participants. Moreover, stringent regulations may limit the introduction of innovative palatants and slow down the speed of product development, thereby impeding market growth. Additionally, compliance challenges can excessively affect smaller players in the market. Furthermore, raw material sourcing challenges create barriers to the expansion of the palatants market.

Additionally, the rising humanization of pets presents a significant opportunity for the pet food palatants market in the forecast year. As pet owners increasingly treat their pets as members of the family, they seek out high-quality, flavorful food options for them. Palatants, which enhance the taste and aroma of pet food, play a crucial role in satisfying both pets and their owners. With the growing demand for premium pet food products that imitate human food trends, such as organic and natural ingredients, there is a parallel demand for palatants that can meet these preferences. As a result, manufacturers in the pet food industry are likely to invest more in developing innovative palatants to provide to this evolving market trend and capture a larger share of the growing pet food market. Furthermore, growing awareness about nutritional benefits for poultry products becomes an opportunity in the coming years.

Palatants Market Segmentation

The worldwide market for palatants is split based on form, nature, source, and geography.

Palatants Forms

- Dry

- Liquid

According to palatants industry analysis, dry form dominates the market in 2022. Dry palatants offer several advantages, including ease of handling, storage, and transportation, making them preferred by manufacturers in the pet food industry. These dry formulations often come in powdered or granular forms, providing versatility for incorporation into various pet food products. Additionally, dry palatants offer longer shelf life compared to their liquid counterparts, further contributing to their popularity among pet food producers. As consumer demand for high-quality and flavorful pet food continues to rise, the dry palatants segment is expected to maintain its dominance in the market.

Palatants based on Nature

- Organic

- Conventional

As per the palatants market forecast, conventional nature continues to dominate the market throughout 2023 to 2032, driven by its widespread acceptance and established use in the pet food industry. Palatants are additives used to enhance the taste and aroma of pet food, making it more appealing to pets. Despite advancements in natural and organic alternatives, conventional palatants remain preferred due to their cost-effectiveness, reliability, and efficacy in meeting consumer preferences. The dominance of conventional palatants underscores the importance of balancing natural trends with practical considerations in the pet food industry, where taste remains a crucial factor in consumer choice.

Palatants based on Source

- Plant Derived

- Meat Derived

- Others

According to the palatants market forecast, meat derived source is anticipated to rise in the coming years. Palatants, which are flavor enhancers added to pet foods to make them more edible, are seeing a shift towards more natural and recognizable ingredients. Meat-derived sources offer a rich and aromatic flavor profile that appeals to pets, and preferences. This trend is driven by growing consumer awareness of pet nutrition and a desire for products that closely imitate a pet's natural diet. As a result, manufacturers are likely to invest more in developing palatants derived from various meats, such as chicken, beef, and fish, to meet this rising demand expanding pet food market.

Palatants Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Palatants Market Regional Analysis

In terms of palatants market analysis, North America dominates the palatants market, driven primarily by the significant presence of pet food manufacturers and the high pet ownership rates in the region. Palatants, which are flavor enhancers added to pet foods to make them more appealing to animals, witness robust demand due to the region's large population of pet owners who prioritize quality and variety in pet food. So, for the enhancement of food palatability key players in this region focus on new development. For instance, on May 2022, two novel products launched by Kemin that are palasurance A D370-380, and Palasurance C-75-90 dry. Additionally, stringent regulations regarding pet food safety and quality in North America have contributed to the growth of the palatants market, as manufacturers seek to meet these standards while ensuring deliciousness. Major players in the pet food industry, often headquartered in North America, further fuel the demand for palatants through their extensive product lines catering to diverse pet preferences and dietary needs. For instance, ADM announced to launch of new products designed to improve food palatability of young animals on November 2022. ADM is the global organizer of pet diet market. This region's dominance is expected to continue in the forecast year, driven by ongoing innovations in pet food formulations.

Additionally, Asia-Pacific is the fastest growing region in the palatants market, fueled by several factors. The growing pet population, rising disposable incomes, and increasing awareness about pet health and nutrition are driving the demand for palatants. Palatants, which enhance the taste and aroma of pet food, are becoming increasingly popular among pet owners in the region who seek high-quality products. Additionally, the growing urbanization and changing lifestyles are leading to a shift towards packaged pet food, further boosting the demand for palatants. With growing pet care industry, the Asia-Pacific region is poised to maintain its status as the fastest-growing market for palatants in the coming years.

Palatants Market Players

Some of the top palatants companies offered in our report include Pet Flavors, AFB International, Kemin, Kerry Group, Jiangsu Uniwell Biotechnology, Trilogy, Wing Biotech., Zhishang Biology, Hisynergi, Rosapis, and Symrise AG/Diana Pet Food.

Frequently Asked Questions

How big is the palatants market?

The palatants market size was valued at USD 1.4 billion in 2022.

What is the CAGR of the global palatants market from 2024 to 2032?

What is the CAGR of the global palatants market from 2024 to 2032?

Which are the key players in the palatants market?

The key players operating in the global market are Pet Flavors, AFB International, Kemin, Kerry Group, Jiangsu Uniwell Biotechnology, Trilogy, Wing Biotech., Zhishang Biology, Hisynergi, Rosapis, and Symrise AG/Diana Pet Food.

Which region dominated the global palatants market share?

North America held the dominating position in palatants industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia Pacific region exhibited fastest growing CAGR for market of palatants during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global palatants industry?

The current trends and dynamics in the palatants market are rapidly increasing pet population, growing disposable income of customers, and advancements in technology for feed formulations.

Which form held the maximum share in 2022?

Dry form held the maximum share of the palatants market.