Painting Tools Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Painting Tools Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

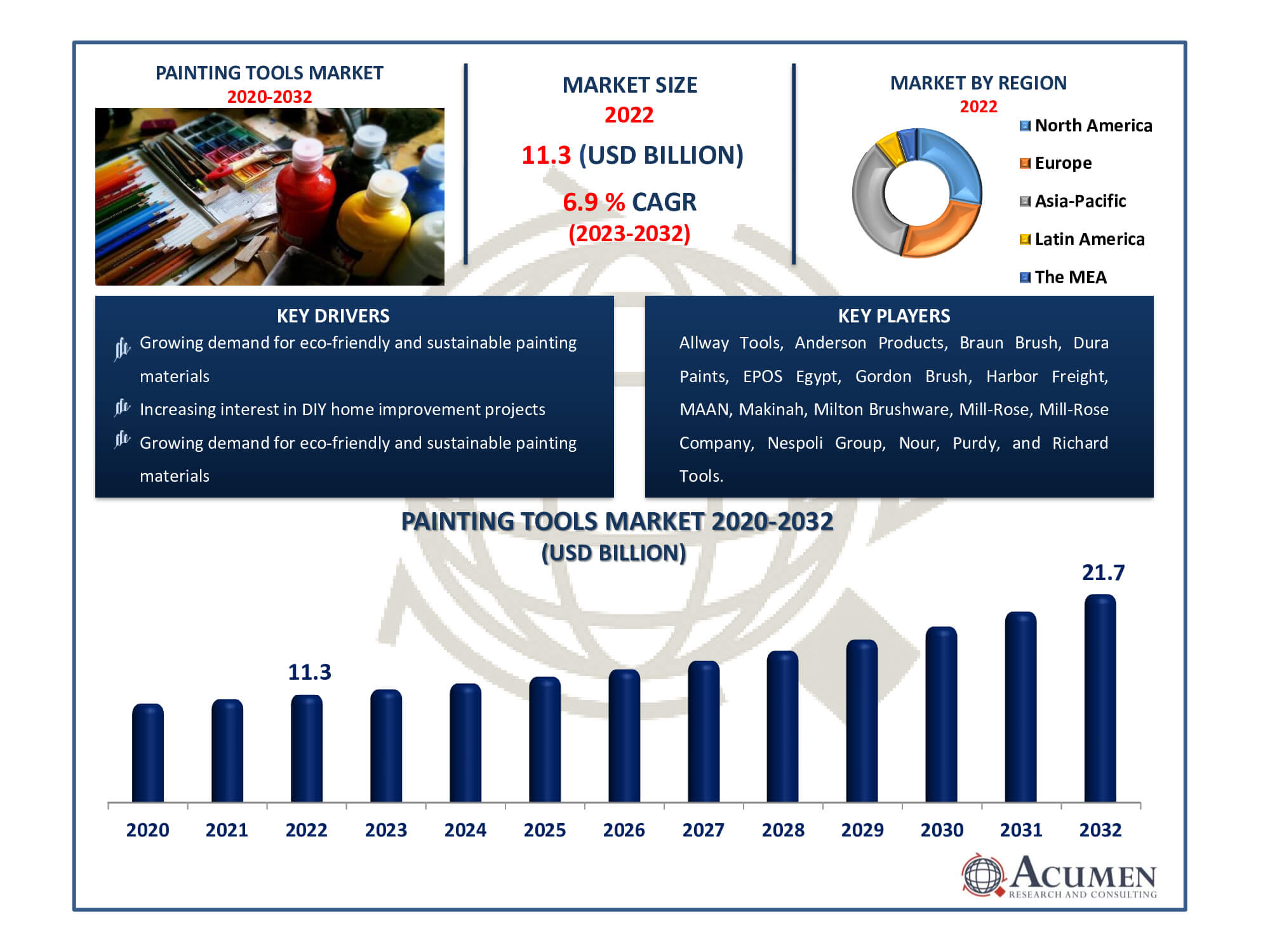

The Painting Tools Market Size accounted for USD 11.3 Billion in 2022 and is estimated to achieve a market size of USD 21.7 Billion by 2032 growing at a CAGR of 6.9% from 2023 to 2032.

Painting Tools Market Highlights

- Global painting tools market revenue is poised to garner USD 21.7 billion by 2032 with a CAGR of 6.9% from 2023 to 2032

- Asia-Pacific painting tools market value occupied around USD 4 billion in 2022

- Europe painting tools market growth will record a CAGR of more than 7% from 2023 to 2032

- Among product, the brushes sub-segment generated over US$ 2.3 billion revenue in 2022

- Based on application, the construction sub-segment generated around 71% share in 2022

- Demand for customization leading to niche product opportunities in the market is a popular painting tools market trend that fuels the industry demand

The painting tools market includes a wide range of tools and materials used in the production and execution of visual art through painting. This market serves to artists, hobbyists, and professionals alike, offering a vast array of mediums, surfaces, and accessories ranging from conventional brushes to modern digital tools. The evolution of the industry has been distinguished by technical advances, which have introduced sophisticated software, digital brushes, and interactive platforms that supplement traditional processes. Simultaneously, classic tools retain their importance, with advances in materials and ergonomic designs increasing their usability and appeal. The dynamic of the market is impacted by the convergence of artistry, technology, and customer demand, which drives ongoing innovation and diversity. Sustainability, accessibility, and ergonomic design are increasingly shaping product development, reflecting the changing demands and tastes of artists around the world. Because creativity has no bounds, the painting tools market exists at the crossroads of tradition and innovation, adapting to meet the broad and expanding terrain of artistic expression.

Global Painting Tools Market Dynamics

Market Drivers

- Increasing interest in DIY home improvement projects

- Technological advancements enhancing digital painting tools

- Growing demand for eco-friendly and sustainable painting materials

- Expansion of the global art education sector

Market Restraints

- Fluctuating raw material prices impacting manufacturing costs

- Limited adoption due to high initial investment in advanced painting technology

- Environmental regulations affecting the production and disposal of painting materials

Market Opportunities

- Rising online sales channels for painting tools

- Innovations in smart painting tools leveraging AI and IoT integration

- Emerging markets with untapped potential for artistic tools and materials

Painting Tools Market Report Coverage

| Market | Painting Tools Market |

| Painting Tools Market Size 2022 | USD 11.3 Billion |

| Painting Tools Market Forecast 2032 | USD 21.7 Billion |

| Painting Tools Market CAGR During 2023 - 2032 | 6.9% |

| Painting Tools Market Analysis Period | 2020 - 2032 |

| Painting Tools Market Base Year |

2022 |

| Painting Tools Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Allway Tools, Anderson Products, Braun Brush, Dura Paints, EPOS Egypt, Gordon Brush, Harbor Freight, MAAN, Makinah, Milton Brushware, Mill-Rose Company, Nespoli Group, Nour, Purdy, Richard Tools, Roller Factory, Shawky Brush, and USA Tools. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Painting Tools Market Insights

With the escalating demand for residential buildings, the global market for painting tools is expected to witness significant growth during the forecast period, driven by overall expansion in the construction industry. Anticipated growth stems from increasing consumer preferences for affordable housing and government initiatives aimed at providing commercial and residential amenities at subsidized rates. The product portfolio is poised to expand further to meet the heightened demand for both residential and commercial equipment. Strong market growth prospects are expected due to stringent regulations and standards limiting the use of VOCs in certain paints and coatings. However, the overall market size for painting tools may face impediments due to low awareness and the costliness of certain products, including spray guns and sanding tools.

The increasing demand for modern painting instruments is expected to create new avenues for growth in the painting instruments market due to their low costs, easy availability, and consumer-friendly features compared to traditional tools. These instruments offer key benefits such as ease in wall and ceiling painting applications, improved aesthetic appeal of walls, and reduced paint wastage. Additionally, the growing population and rising parity in purchasing power are driving demand for consumer goods and automotive products, fostering robust industrialization and overall business expansion.

The rising demand in the painting tools market is expected to be fueled by decorative paints and industrial protective lacquers. Anticipated high demand for decorative products is projected to increase market penetration. There's also potential to diversify the product range by emphasizing wood and furniture coatings. Moreover, increasing income levels and a focus on eco-friendly products are set to enhance product penetration, especially in developing economies like India, South Korea, and South Africa.

Increased domestic and international demand will propel industry growth. The rise of nuclear families has spurred residential demand, contributing to overall industry expansion. Shifting consumer preferences toward smaller families, alongside growing populations, will further drive industry demand. Additionally, tool properties such as ease of application and affordability will bolster product penetration.

Painting Tools Market Segmentation

The worldwide market for painting tools is split based on product, application, distribution channel, and geography.

Painting Tools Products

- Brushes

- Trays

- Scrapers

- Rollers

- Knives

- Spray Gun

- Masking Tapes

As per the painting tools industry analysis, brush products gathered significant share in 2022. This positive outlook is attributed to several advantages offered by brushes, including reduced paint usage, ease of handling, improved surface coverage, and seamless mixing of different colors. Moreover, market expansion is anticipated due to key brush properties such as high bristle elasticity, thicker bases with split ends, and tapered ends.

Rollers are poised for sales growth in the overall tool market. Shifting consumer trends towards coated furniture and wood to enhance product durability will drive industry development. Key properties fueling product demand in the market include efficient painting within shorter timeframes and minimized paint wastage. Furthermore, the overall business expansion is expected to yield advantages such as reduced paint applications, enhanced finishing quality, and proficiency in complex painting techniques.

Painting Tools Applications

- Construction

- Commercial

- Residential

- Industrial

- Appliances

- Automotive

- Furniture

- Packaging

- Industrial Machineries & Equipment

The global market in the construction application segment is anticipated to experience significant growth. The integration of green technology into construction projects, aimed at enhancing building structure sustainability, will be a driving force in this market. Paints and coatings offer key advantages such as increased surface resistance, weather protection, and rust prevention, making them highly applicable in the industry. The rapid expansion of residential and commercial buildings in developing countries like the United Arab Emirates and Saudi Arabia will further amplify their usage.

Over the forecast period, the overall market for painting tools in the automotive application has seen a considerable increase. The burgeoning automotive industry demands high-quality lacquers and coatings for vehicle protection and aesthetic enhancement, contributing significantly to automotive economies. Additionally, favorable weather conditions and ease of employment play pivotal roles in driving the growth of the automotive sector, thereby expanding the overall market size

Painting Tools Distribution Channels

- Online Channel

- Offline Channel

As per the painting tools market forecast, the online channel is expected to dominate the industry due to its ease, large product selection, and accessibility. Online platforms provide a plethora of tools, catering to a wide range of consumer needs with thorough product information and customer reviews. Furthermore, the ease of comparison, low pricing, and fast doorstep delivery add to its allure. With the digital revolution in shopping behaviours, the online channel's seamless experience and capacity to reach a larger audience contribute considerably to its market leadership.

Painting Tools Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Painting Tools Market Regional Analysis

In the painting tools market, Asia Pacific commands a significant revenue share, driven by robust commercial and residential projects in economies like the USA, Saudi Arabia, and South Africa. Rapid urbanization and infrastructure growth in key nations such as China, India, and South Korea propel the region's industry expansion.

The European painting tools market is expected to booming due to a variety of factors. The region is constantly in need of remodeling and restoration initiatives, which drives the demand for painting gear. Furthermore, strict environmental rules favor eco-friendly paints and coatings, fueling innovation and market growth. The emphasis in Europe on excellent craftsmanship and design aesthetics drives up demand for a wide range of painting instruments. Furthermore, an increase in home renovation activities and a developing DIY culture add to the region's steady development rate, producing a dynamic market scenario for painting tools.

Latin America foresees substantial advancements in the painting tools market, supported by government-backed PPP Development Plans. Increased demand for decorations, general industrial, and architectural applications fuels industry growth. Additionally, a swift annual automotive production, boosted by rising income and improved consumer purchasing power, further amplifies the market's presence across Latin America.

Painting Tools Market Players

Some of the top painting tools companies offered in our report includes Allway Tools, Anderson Products, Braun Brush, Dura Paints, EPOS Egypt, Gordon Brush, Harbor Freight, MAAN, Makinah, Milton Brushware, Mill-Rose Company, Nespoli Group, Nour, Purdy, Richard Tools, Roller Factory, Shawky Brush, and USA Tools.

Frequently Asked Questions

How big is the painting tools market?

The market size of painting tools was USD 11.3 billion in 2022.

What is the CAGR of the global painting tools market from 2023 to 2032?

The CAGR of painting tools is 6.9% during the analysis period of 2023 to 2032.

Which are the key players in the painting tools market?

The key players operating in the global market are including Allway Tools, Anderson Products, Braun Brush, Dura Paints, EPOS Egypt, Gordon Brush, Harbor Freight, MAAN, Makinah, Milton Brushware, Mill-Rose Company, Nespoli Group, Nour, Purdy, Richard Tools, Roller Factory, Shawky Brush, and USA Tools.

Which region dominated the global painting tools market share?

Asia-Pacific held the dominating position in painting tools industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of painting tools during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global painting tools industry?

The current trends and dynamics in the painting tools industry include increasing interest in DIY home improvement projects, technological advancements enhancing digital painting tools, growing demand for eco-friendly and sustainable painting materials, and expansion of the global art education sector.

Which product held the maximum share in 2022?

The brushes product held the maximum share of the painting tools industry.