Pain Management Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 � 2030

Published :

Report ID:

Pages :

Format :

Pain Management Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 � 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

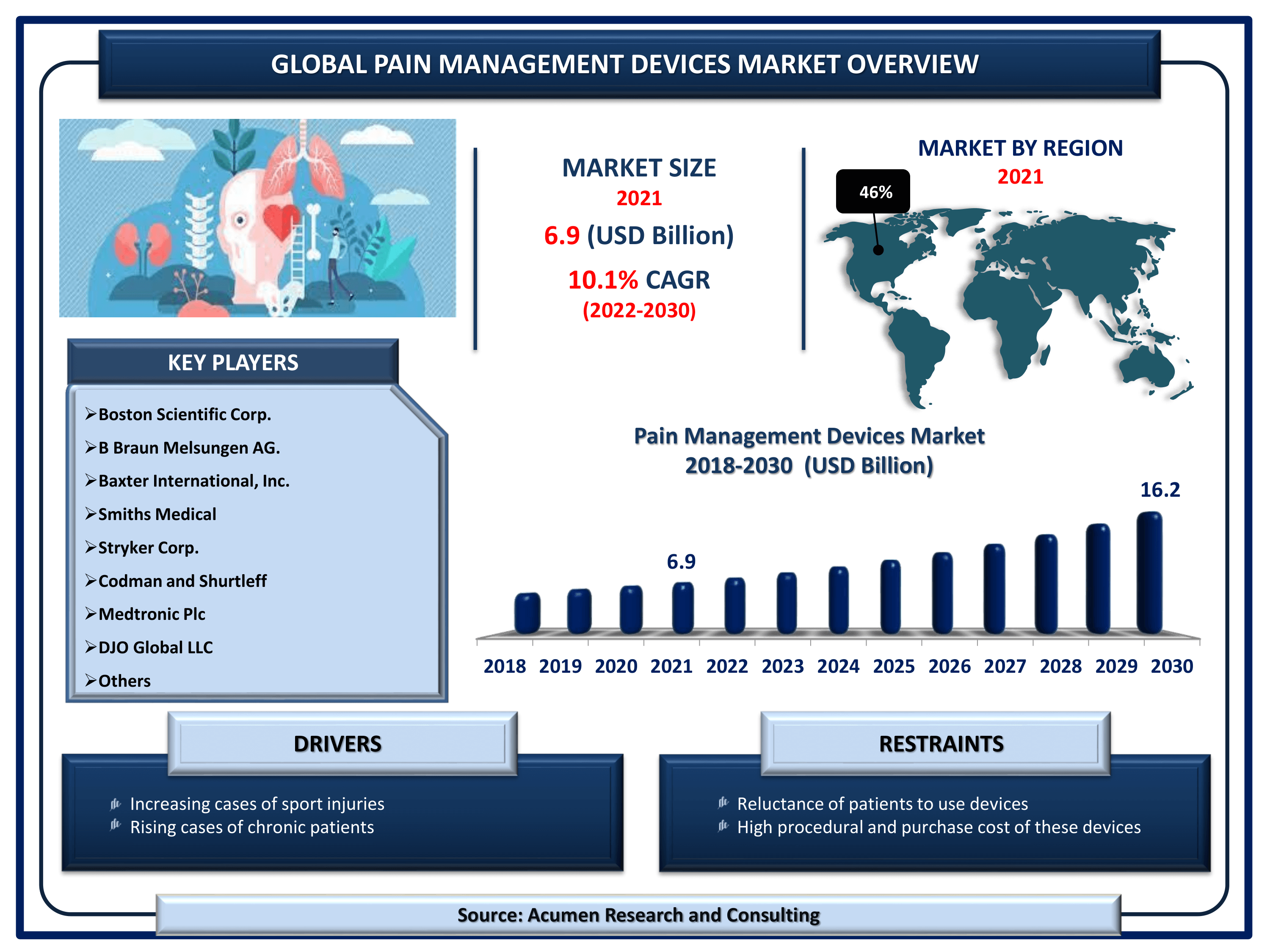

The Global Pain Management Devices Market Size accounted for USD 6.9 Billion in 2021 and is estimated to garner a market size of USD 16.2 Billion by 2030 rising at a CAGR of 10.1% from 2022 to 2030. The growing prevalence of chronic disorders is a primary aspect that is fueling the global pain management devices market revenue. Additionally, rising technological advancements in these devices is a recent trend in pain management devices market that is strengthening the industry growth.

Pain Management Devices Market Report Key Highlights

- Global pain management devices market revenue is estimated to reach USD 16.2 Billion by 2030 with a CAGR of 10.1% from 2022 to 2030

- North America pain management devices market share accounted for over 46% shares in 2021

- According to Centers for Disease Control and Prevention (CDC) data, 65% of elderly population in America suffered from chronic pain in 2019

- Based on type, neurostimulation devices accounted for over 60% of the overall market share in 2021

- Asia-Pacific pain management devices market growth will attain fastest CAGR from 2022 to 2030

- Rising cases of elderly population fuels the global pain management devices market value

During last few years, there is a significant increase in the number of pain management devices. Pain management therapy involves various treatments such as acupuncture, chiropractic treatment, yoga, hypnosis, biofeedback, aromatherapy, relaxation, herbal remedies, massage, therapeutic touch, medication and many others. According to the Institute of Neurological Disorder and Stroke, approximately 80% of adults suffer from back pain due to various factors such as job-related disability, repeated heavy lifting, and osteoporosis. Increasing prevalence of cervical spinal stenosis among women is likely to spur the prevalence of back pain which in turn is expected to drive the pain management devices market. In postmenopausal women body produces less estrogen which leads to decrease in calcium absorption. Thereby, increasing breakdown of bones and other bone related diseases further supporting the pain management devices market growth.

Global Pain Management Devices Market Dynamics

Market Drivers

- Increasing cases of sport injuries

- Rising cases of chronic patients

- Growing volume of surgical procedures

- Rapidly growing geriatric population

Market Restraints

- Reluctance of patients to use devices

- High procedural and purchase cost of these devices

Market Opportunities

- Introduction of novel devices by different key players

- High growth prospects in emerging countries

Pain Management Devices Market Report Coverage

| Market | Pain Management Devices Market |

| Pain Management Devices Market Size 2021 | USD 6.9 Billion |

| Pain Management Devices Market Forecast 2030 | USD 16.2 Billion |

| Pain Management Devices Market CAGR During 2022 - 2030 | 10.1% |

| Pain Management Devices Market Analysis Period | 2018 - 2030 |

| Pain Management Devices Market Base Year | 2021 |

| Pain Management Devices Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Boston Scientific Corp.; B Braun Melsungen AG.; Baxter International, Inc.; Smiths Medical; Stryker Corp.; Codman and Shurtleff; Medtronic Plc; DJO Global LLC; Pfizer, Inc.; and St. Jude Medical. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Pain Management Devices Market Dynamics

The factors driving the global pain management devices market are the raising prevalence of various diseases and disorders, increasing demand for minimally invasive therapy, a huge population pool in developing countries, and technological advancements such as the introduction of novel pain management devices and engineering strategies. On the other hand, the high cost of the devices may slow the growth of the pain management devices market.

Pain Management Devices Market Segmentation

The worldwide pain management devices market is split based on type, application, and geography.

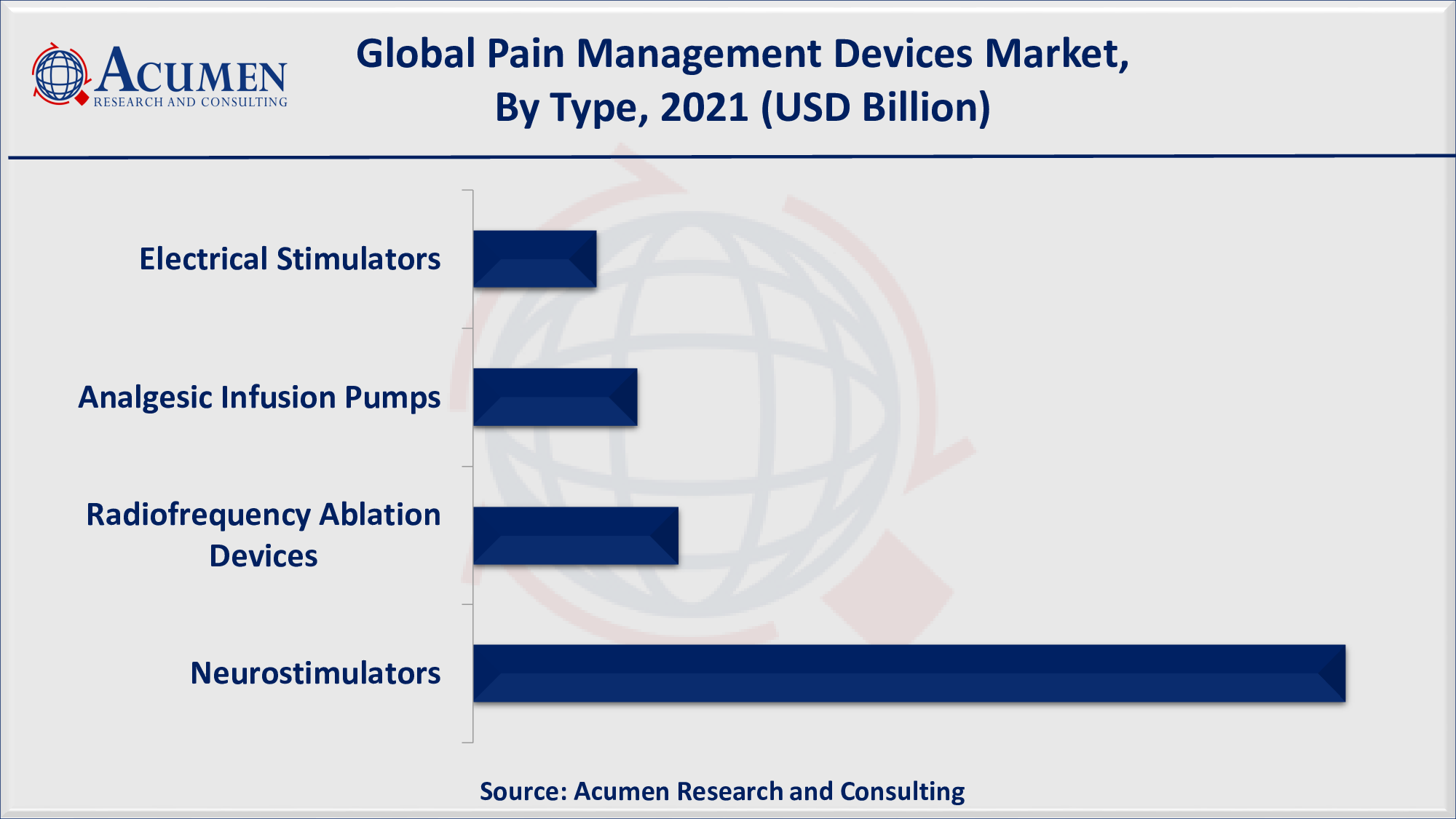

Pain Management Devices Market By Type

- Electrical Stimulators

- TENS

- Others

- Analgesic Infusion Pumps

- Intrathecal Pumps

- External Pumps

- Radiofrequency Ablation Devices

- Neurostimulators

- Spinal Cord Stimulators (SPS)

- Sacral Nerve Stimulators (SNS)

- Deep Brain Stimulators (DBS)

According to the pain management devices industry analysis, neurostimulators dominated the type segment in 2021 and are expected to do so in the coming year from 2022 to 2030. The dominant market share of the segment can be credited to the surged incidence of neurological disorders. On the other hand, the radiofrequency ablation device segment is expected to grow at the fastest CAGR during 2022 – 2030 owing to the increasing prevalence of various diseases, and rising adoption of the radiofrequency ablation device in the treatment of various diseases.

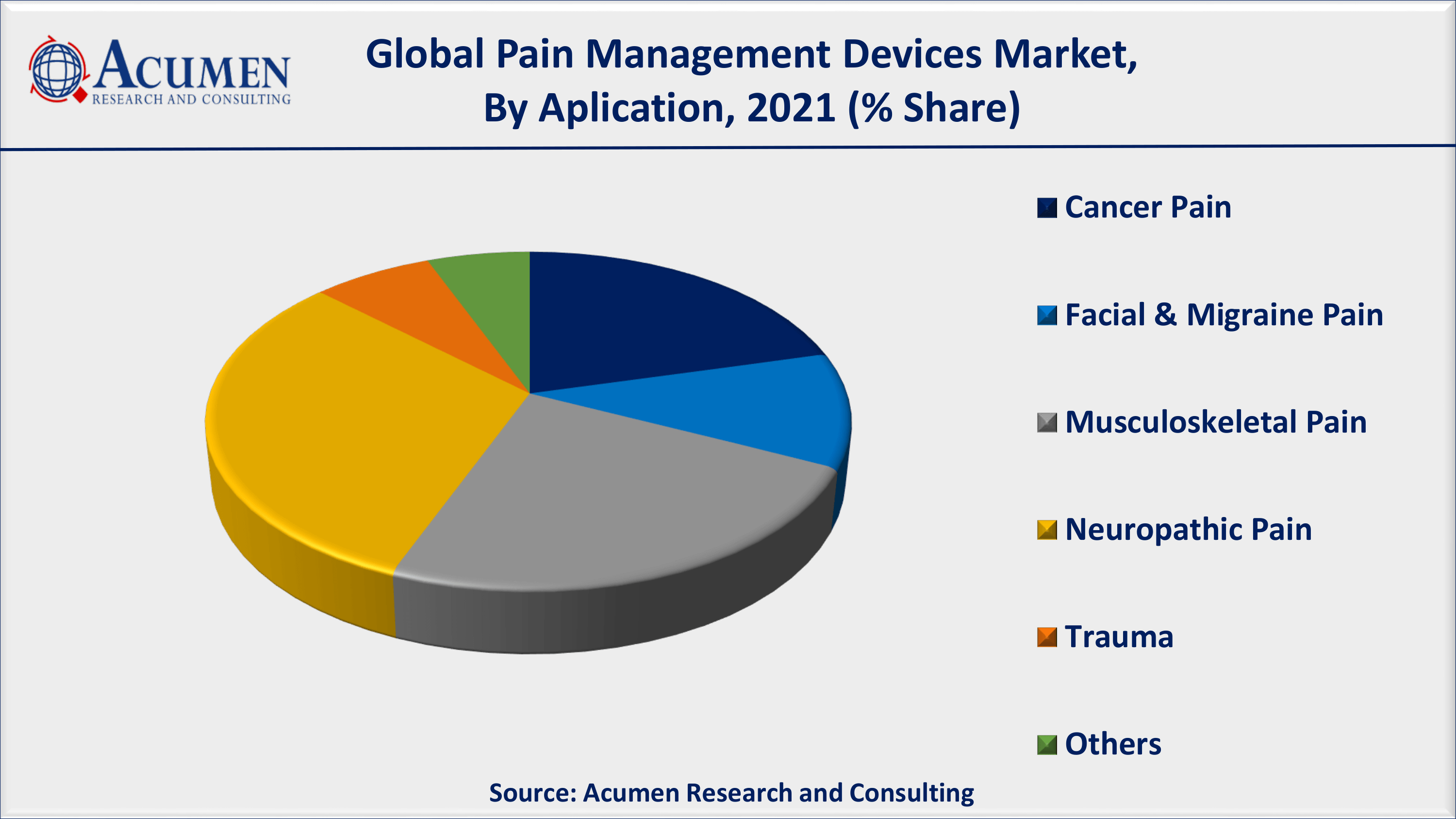

Pain Management Devices Market By Application

- Cancer Pain

- Facial & Migraine Pain

- Musculoskeletal Pain

- Neuropathic Pain

- Trauma

- Others

As per the pain management devices market forecast, neuropathic pain will account for a considerable market share. The presence of a large patient population is a critical factor driving up market demand for pharmaceuticals. Neuropathic pain affects 3% to 17% of people. Furthermore, cancer pain is expected to grow at the fastest rates during the forecast timeframe, attributed to an increase in the number of operations performed globally and an increase in the prevalence of chronic diseases that cause back pain.

Pain Management Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Pain Management Devices Market Regional Analysis

North America is expected to hold the major share of the global pain management devices market owing to the presence of a huge baby boomer population suffering from back pain. For instance, in 2016, according to the Population Reference Bureau, over 46 million people in America are of age above 65. Furthermore, chronic diseases such as cancer have a major impact on North America. For instance, in 2017, according to the National Cancer Institute, around 1.7 million new cases of cancer were diagnosed in the U.S. Thus, the increasing prevalence of cancer is likely to fuel the market growth over the forecast period 2019–2026. The rising aging population in this region will sport the growth of the pain management devices market.

Europe has several opportunities in the pain management devices market on account of the growing prevalence of osteoporosis due to aging, calcium deficiency, and increasing alcohol consumption. According to the International Osteoporosis Foundation (IOF), in 2015, approximately 20 million people above the age of 50 suffered from osteoporosis. Germany and U.K are expected to be the major market holder owing to the well-developed healthcare sector and high spending on pain management devices.

The Asia Pacific is expected to be the fastest growing market for pain management devices. The increasing prevalence of various diseases such as depression, migraine, and spondylitis supports the pain management devices market growth. For instance, according to the World Health Organization (WHO), 4.5 % of the Indian population suffered from depression in 2016. The increasing prevalence of depression due to unhealthy diets and modernization is anticipated to positively influence the pain management devices market growth.

Latin America offers slow growth prospects on account of osteoporosis which is more common in Latin American people. The increasing number of incidences of osteoporosis in Mexico, Brazil, Argentina, Bolivia, Puerto Rico, and Colombia countries is expected to boost the market growth in the coming years. In the Middle East and Africa growing population and rise in per capita income are driving the market. The African region is expected to hold a healthy market opportunity owing to the developing healthcare sector, rising healthcare spending and increasing prevalence of various diseases, and increasing investment in this region. The presence of huge untapped opportunity in this region will support the pain management devices market growth.

Pain Management Devices Market Players

The global pain management devices companies profiled in the report include Boston Scientific Corp.; B Braun Melsungen AG.; Baxter International, Inc.; Smiths Medical; Stryker Corp.; Codman and Shurtleff; Medtronic Plc; DJO Global LLC; Pfizer, Inc.; and St. Jude Medical.

In September 2017, Sanofi launched CombiflamIcyhot pain relief topical in India for expansion of its distribution network. In June 2017, Daiichi Sankyo launched Naruvein Injection Japan. Naruvein Injection is Hydromorphone hydrochloride an opium-based narcotic analgesic. In March 2017, lupin launched Hydrocodone Bitartrate and Acetaminophen drug in the U.S. market for expansion of its distribution network. In May 2015, Iroko Pharmaceuticals launched Zorvolexi (diclofenac) a nonsteroidal anti-inflammatory drug (NSAID), available for acute and chronic pain outside of the U.S.

Frequently Asked Questions

What is the size of global pain management devices market in 2021?

The market size of pain management devices market in 2021 was accounted to be USD 6.9 Billion.

What is the CAGR of global pain management devices market during forecast period of 2022 to 2030?

The projected CAGR of pain management devices market during the analysis period of 2022 to 2030 is 10.1%.

Which are the key players operating in the market?

The prominent players of the global pain management devices market are Boston Scientific Corp.; B Braun Melsungen AG.; Baxter International, Inc.; Smiths Medical; Stryker Corp.; Codman and Shurtleff; Medtronic Plc; DJO Global LLC; Pfizer, Inc.; and St. Jude Medical.

Which region held the dominating position in the global pain management devices market?

North America held the dominating pain management devices during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for pain management devices during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global pain management devices market?

Growing prevalence of hearing problems, increasing incidence of impairment, and rising base of elderly population drives the growth of global pain management devices market.

Which type held the maximum share in 2021?

Based on type, neurostimulators segment is expected to hold the maximum share pain management devices market.