P2P Lending Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

P2P Lending Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global P2P Lending Market Size gathered USD 82.3 Billion in 2021 and is set to garner a market size of USD 804.2 Billion by 2030 growing at a CAGR of 29.1% from 2022 to 2030.

Peer-to-peer (P2P) lending is a type of financial transaction wherein individuals lend and borrow money from each other without the use of a traditional financial mediator, such as a bank. P2P lending platforms directly connect borrowers and lenders and streamline the loan process, typically providing a more streamlined and effective alternative to traditional lending. Borrowers who use peer-to-peer lending platforms can often get loans faster and at lower interest rates than they could through a traditional bank or other financial institution. P2P lending, on the other hand, may provide lenders with a higher return on investment than other types of financial instruments such as savings accounts or certificates of deposit. Overall, peer-to-peer lending can be a useful tool for both borrowers and lenders, but it's critical to weigh the risks and potential drawbacks, such as the dearth of FDIC insurance and the possibility of default.

P2P Lending Market Report Statistics

- Global peer to peer P2P lending market revenue is estimated to reach USD 804.2 Billion by 2030 with a CAGR of 29.1% from 2022 to 2030

- North America P2P lending market value gathered more than USD 31.3 billion in 2021

- Asia-Pacific peer-to-peer P2P lending market growth will record a CAGR of more than 30% from 2022 to 2030

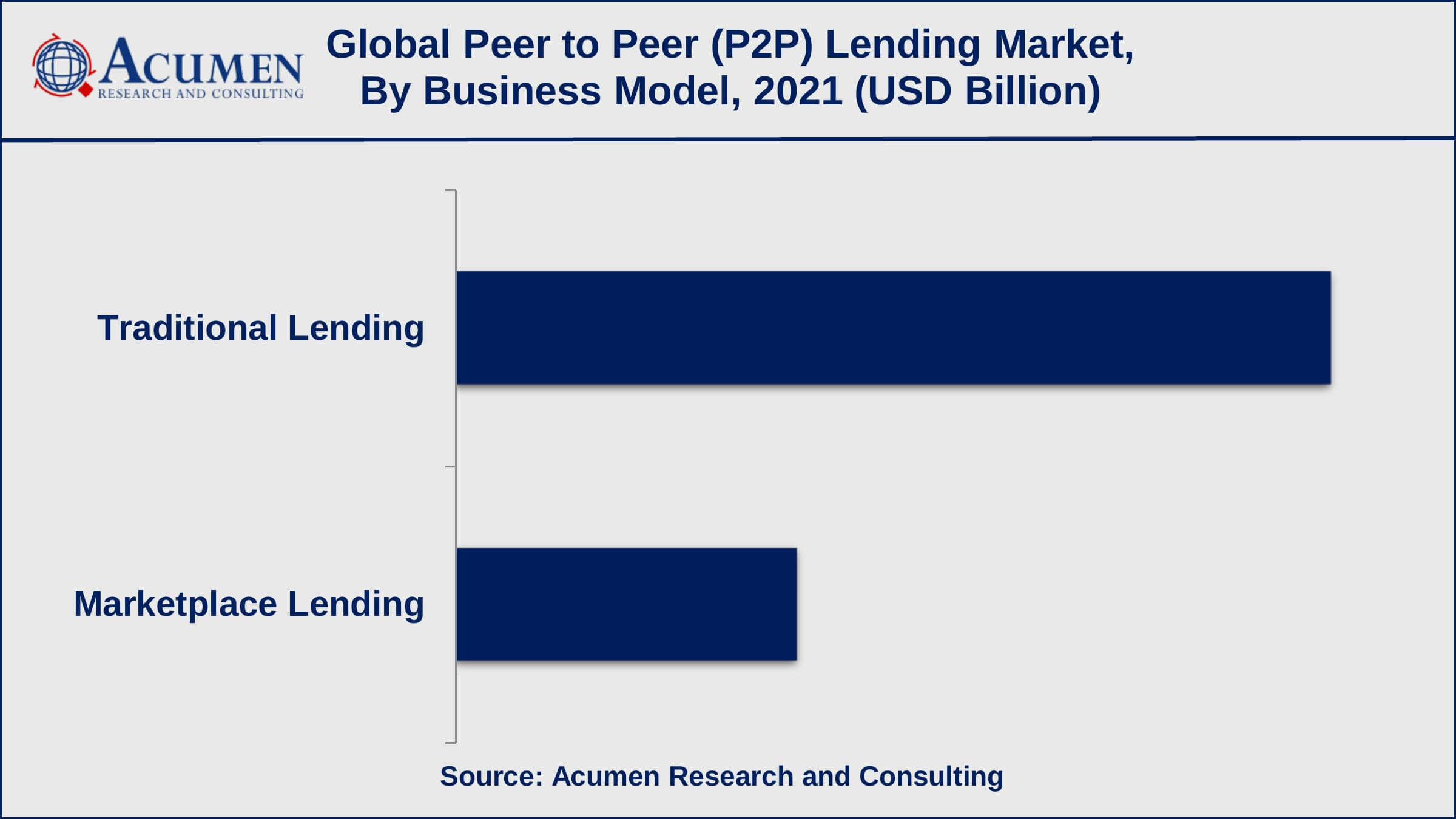

- Among business models, traditional lending collected revenue of around US$ 59.3 billion in 2021

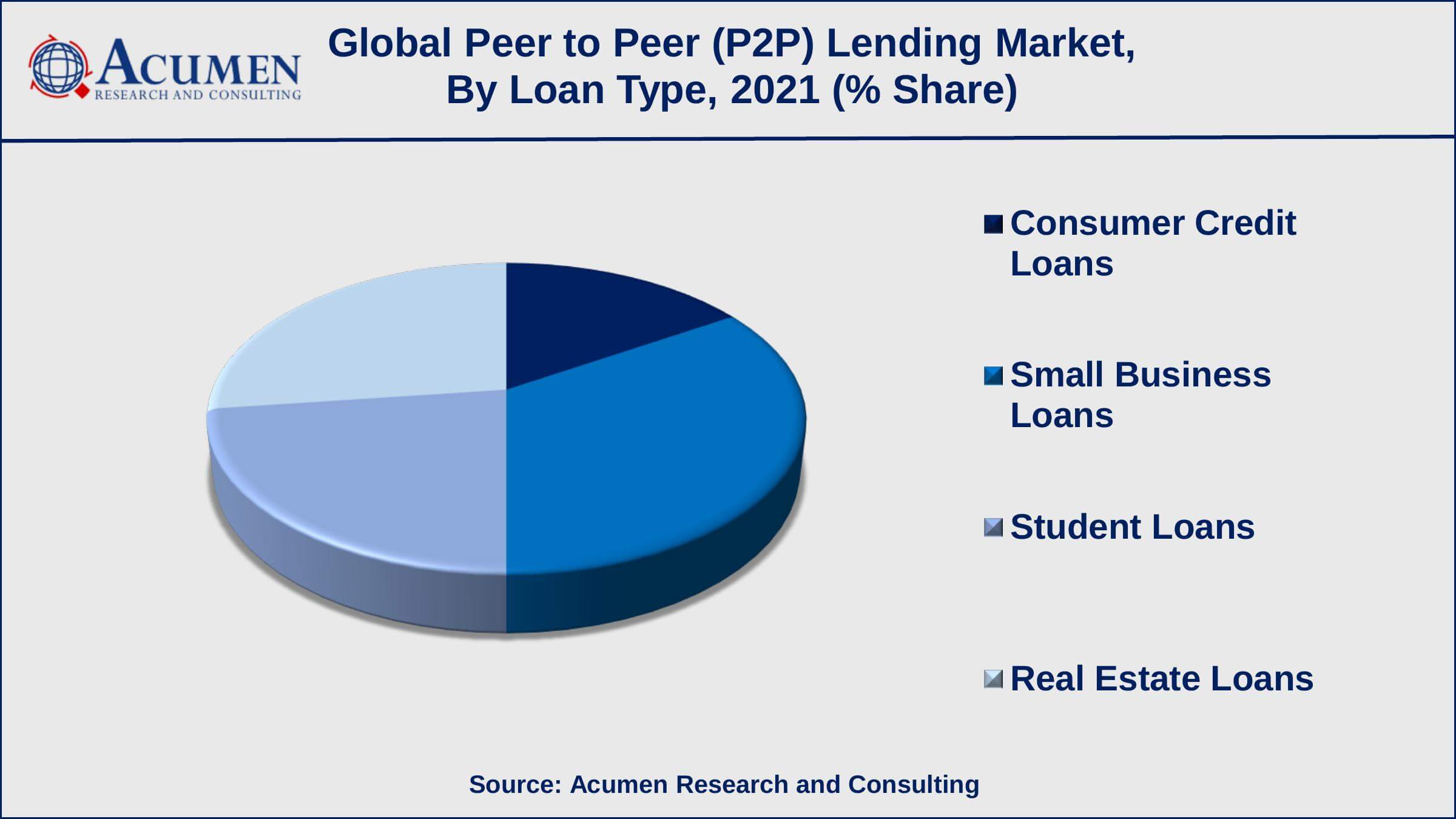

- Based on the loan type, the small business loans sub-segment achieved 34% shares in 2021

- The increasing demand for small business lending is a popular P2P lending market trend that drives the industry demand

Global Peer-to-Peer Lending Market Dynamics

Market Drivers

- Increased access to credits

- Alternative investment opportunities

- Lower interest rates and convenience of use

Market Restraints

- Strict regulations

- Lack of FDIC insurance

Market Opportunities

- Technological advancement in peer-to-peer lending

- Huge opportunities from APAC countries

P2P Lending Market Report Coverage

| Market | P2P Lending Market |

| P2P Lending Market Size 2021 | USD 82.3 Billion |

| P2P Lending Market Forecast 2030 | USD 804.2 Billion |

| P2P Lending Market CAGR During 2022 - 2030 | 29.1% |

| P2P Lending Market Analysis Period | 2018 - 2030 |

| P2P Lending Market Base Year | 2021 |

| P2P Lending Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Business Model, By Loan Type, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Avant LLC, Funding Circle, Kabbage Inc., Lending Club Corporation, LendingTree LLC, Prosper Funding LLC, RateSetter, Social Finance Inc., OnDeck, and Zopa Bank Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Peer-to-Peer (P2P) Lending Market Growth Factors

Increased credit availability is a key driver of the peer-to-peer lending market. Peer-to-peer P2P lending platforms frequently have more lenient lending criteria than traditional financial institutions, making credit available to individuals who might not otherwise qualify. Lower interest rates on these types of loans drive market demand. Because they have lower overhead costs than traditional banks, peer-to-peer P2P lending platforms are capable of providing lower interest rates to borrowers. Furthermore, alternative investment opportunities are assisting the lending industry to grow positively. P2P lending can offer investors an alternative to traditional financial instruments such as stocks and bonds, as well as the possibility of higher returns on investment.

Stringent government regulation, on the other hand, would limit the peer-to-peer P2P market growth. P2P lending is a new industry that is still undergoing regulatory scrutiny in many countries. This can pose risks for both borrowers and lenders and may discourage market participation. Furthermore, peer-to-peer lending platforms may lack the same standard of credit analysis and risk management as traditional financial institutions, potentially increasing lenders' default risk. However, unlike traditional banks, peer to peer (P2P) lending platforms are not FDIC-insured, so lenders' deposits are not protected in the event of platform failure.

P2P Lending Market Segmentation

The worldwide peer to peer P2P lending market is categorized based on business model, loan type, end-user, and geography.

P2P Lending Market By Business Model

- Traditional Lending

- Marketplace Lending

In terms of business model, the traditional lending sub-segment dominated in 2021. One of the primary benefits of traditional P2P lending is that it can provide borrowers with credit at potentially lower interest rates than they could obtain from a traditional financial institution. It can also provide lenders with a higher return on investment than other types of financial instruments, such as savings accounts or deposit certificates.

P2P Lending Market By Loan Type

- Consumer Credit Loans

- Real Estate Loans

- Small Business Loans

- Student Loans

Small business loans generated the most revenue among all loan types in 2021 and are anticipated to remain in the coming years. P2P lending platforms can be a good source of small business loans, especially for businesses that do not qualify for traditional financing from banks or other financial institutions. P2P lending platforms frequently have more lenient lending standards than traditional lenders and may be able to provide credit to small businesses at potentially lower interest rates. On the other hand, student loans are expected to grow at the fastest CAGR from 2022 to 2030, owing to an increase in the number of students who study abroad.

P2P Lending Market By End-User

- Consumer Lending

- Business Lending

According to our P2P lending industry analysis, business lending could provide massive growth opportunities in the upcoming years. Businesses that borrow money through P2P lending platforms may be able to access credit more instantly and at potentially lower interest rates than traditional lending channels. However, businesses must carefully consider the risks and potential disadvantages of P2P lending, such as the scarcity of FDIC insurance and the risk of default. Before committing to a loan, it's also a good idea to make comparisons offers from multiple P2P lending platforms and conduct extensive research on the platform's reputation and track record.

P2P Lending Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

P2P Lending Market Regional Analysis

According to our P2P lending market forecast, North America gathered a significant amount of shares in 2021 and is expected to continue gathering a massive amount of shares in the coming years from 2022 to 2030. The United States is the largest market for P2P lending, with several well-established platforms in operation. In recent years, the European peer-to-peer lending market has expanded significantly, with several platforms operating in countries such as the UK, Germany, and France. Asia-Pacific region is expected to witness the fastest growth throughout the projected years owing to the high demand in developing countries such as China and India. China's peer-to-peer lending market has expanded rapidly in recent years, and it is now the world's second-largest. However, the industry has faced regulatory challenges, and several high-profile failures of P2P lending platforms have occurred in the country.

P2P Lending Market Players

Some of the leading P2P lending companies include Avant LLC, Funding Circle, Kabbage Inc., Lending Club Corporation, LendingTree LLC, OnDeck, Prosper Funding LLC, RateSetter, Social Finance Inc., and Zopa Bank Limited.

Frequently Asked Questions

What was the market size of the global P2P lending in 2021?

The market size of P2P lending was USD 82.3 Billion in 2021.

What is the CAGR of the global P2P lending market during forecast period of 2022 to 2030?

The CAGR of P2P lending market is 29.1% during the analysis period of 2022 to 2030.

Which are the key players operating in the market?

The key players operating in the global P2P lending market are Avant LLC, Funding Circle, Kabbage Inc., Lending Club Corporation, LendingTree LLC, OnDeck, Prosper Funding LLC, RateSetter, Social Finance Inc., and Zopa Bank Limited.

Which region held the dominating position in the global P2P lending market?

North America held the dominating position in P2P lending market during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for P2P lending market during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global P2P lending market?

The current trends and dynamics in the P2P Lending industry include the increased access to credits, alternative investment opportunities, and lower interest rates and convenience of use.

Which business model held the maximum share in 2021?

The traditional lending business model held the maximum share of the P2P lending market.