Osteoporosis Treatment Market | Acumen Research and Consulting

Osteoporosis Treatment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

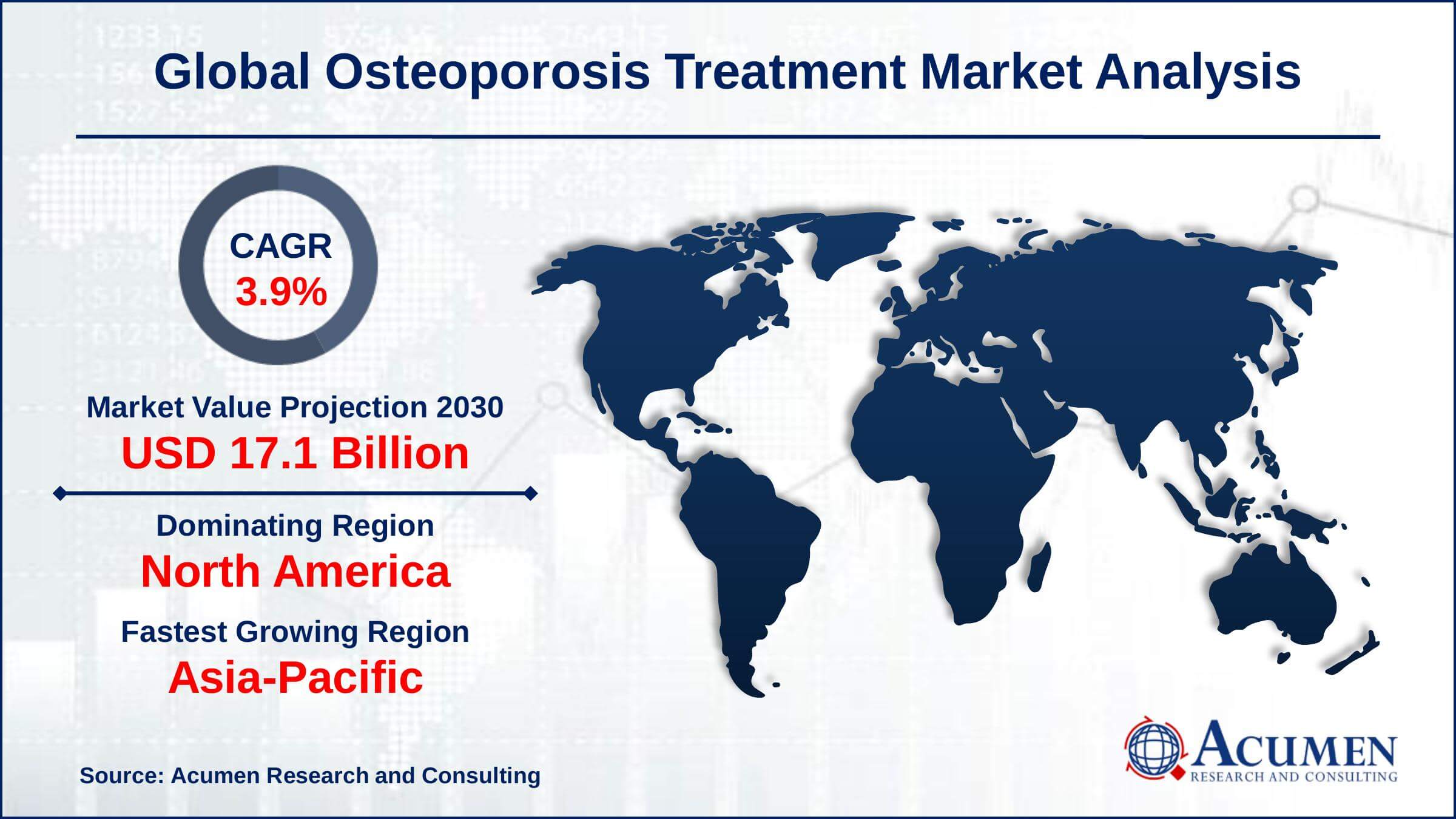

The Global Osteoporosis Treatment Market Size gathered USD 12.2 Billion in 2021 and is set to garner a market size of USD 17.1 Billion by 2030 growing at a CAGR of 3.9% from 2022 to 2030.

Osteoporosis treatment is a collection of measures aimed at preventing fractures and increasing bone density in people suffering from osteoporosis, a condition characterized by weak and fragile bones. It is significant because osteoporosis can cause bones to become so fragile that even minor falls or impacts can result in fractures, which can be debilitating and have a negative impact on quality of life. Early detection and treatment can help to slow or even stop the progression of osteoporosis, lowering the risk of fractures. Treatments can also help to relieve pain, improve mobility, and lower the risk of disability. Treatment may even help to increase bone density and strength in some cases, lowering the risk of future fractures. Because osteoporosis is a progressive disease, it is critical to begin treatment as soon as possible for the best results.

Osteoporosis Treatment Market Report Statistics

- Global osteoporosis treatment market revenue is estimated to reach USD 17.1 billion by 2030 with a CAGR of 3.9% from 2022 to 2030

- North America osteoporosis treatment market value gathered more than USD 4.8 billion in 2021

- Asia-Pacific osteoporosis treatment market growth will record a CAGR of more than 4% from 2022 to 2030

- Among drug classes, the bisphosphonate sub-segment collected around 40% share in 2021

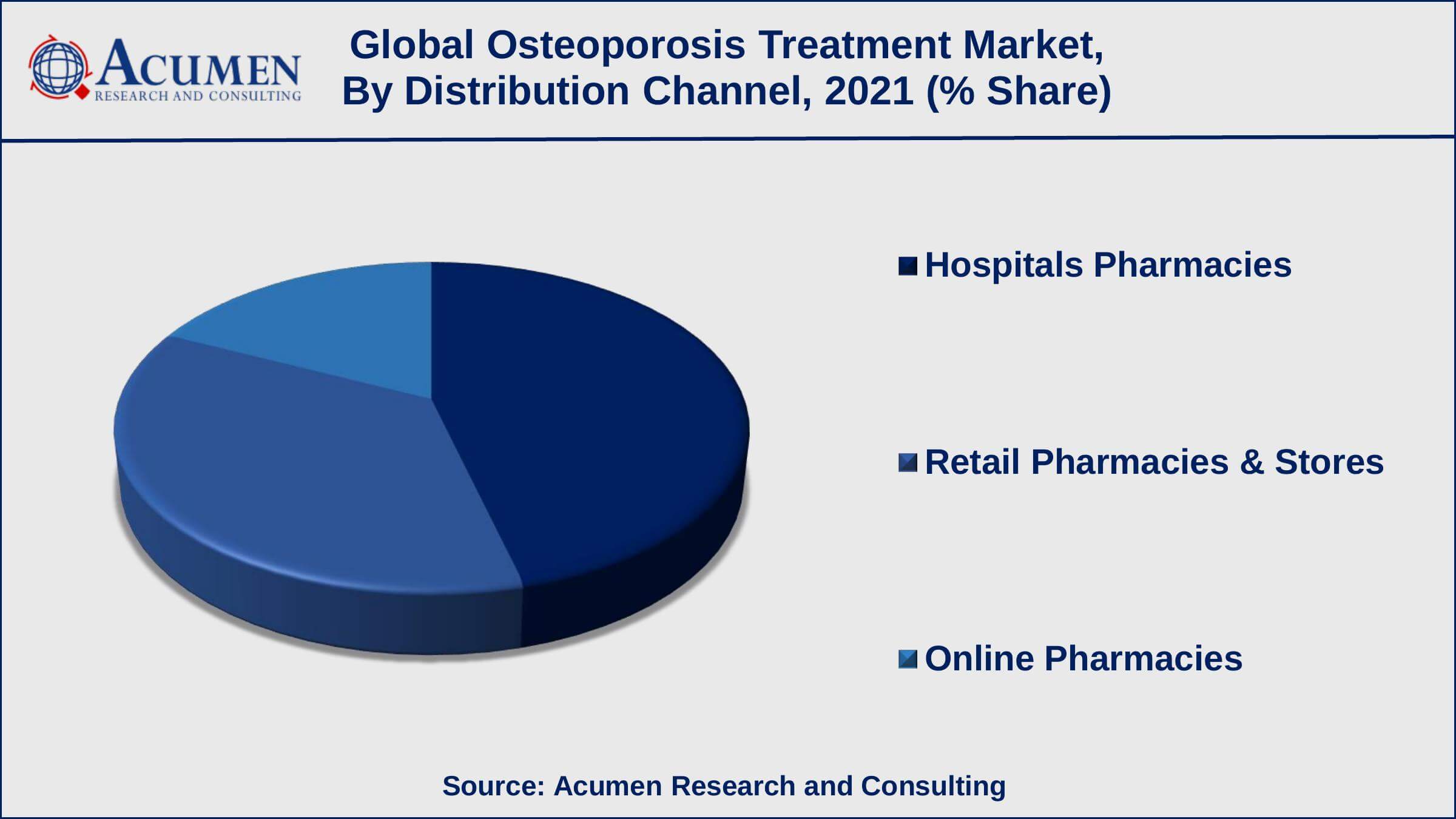

- Based on distribution channel, the hospital pharmacies sub-segment achieved US$ 5.6 billion in revenue in 2021

- The growing popularity of personalized medicine is a popular osteoporosis treatment market trend that drives the industry demand

Global Osteoporosis Treatment Market Dynamics

Market Drivers

- Growing elderly population

- Increased occurrence of osteoporosis

- Advancement in drug development technology

Market Restraints

- High cost of treatments

- Lack of awareness and diagnostic tools in developing countries

- Stringent regulatory requirements

Market Opportunities

- Government initiatives and strong support

- Rising economies and healthcare expenditure

Osteoporosis Treatment Market Report Coverage

| Market | Osteoporosis Treatment Market |

| Osteoporosis Treatment Market Size 2021 | USD 12.2 Billion |

| Osteoporosis Treatment Market Forecast 2030 | USD 17.1 Billion |

| Osteoporosis Treatment Market CAGR During 2022 - 2030 | 3.9% |

| Osteoporosis Treatment Market Analysis Period | 2018 - 2030 |

| Osteoporosis Treatment Market Base Year | 2021 |

| Osteoporosis Treatment Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Drug Class, By Route of Administration, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amgen Inc., Asahi Kasei Corporation, DAIICHI SANKYO COMPANY, LIMITED, Dr. Reddy’s Laboratories Ltd., Eli Lilly and Company, F. Hoffmann-La Roche Ltd, GSK plc., Ligand Pharmaceuticals Incorporated, Merck & Co., Inc., Novartis AG, Pfizer Inc., Teva Pharmaceutical Industries Ltd., and Viatris Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Osteoporosis Treatment Market Growth Factors

As the population of older adults grows, so does the prevalence of osteoporosis, driving demand for treatments. Increased public awareness of the condition, as well as the advantages of early detection and treatment, are driving growth in the osteoporosis treatment market. Technological advancements and drug development are expected to drive up demand in the coming years. The development of new, more effective osteoporosis medications, as well as advancements in bone density testing, is also driving the market growth. Government support and initiatives aimed at improving bone health and lowering the incidence of osteoporosis-related fractures are also fueling the market growth.

However, many osteoporosis treatments, particularly medications, can be prohibitively expensive for some patients. Some developing countries may have limited access to diagnostic tools and a lack of public awareness about osteoporosis, which can limit the market growth. The osteoporosis treatment market is highly competitive, with generic drugs potentially reducing demand for more costly brand treatments. Furthermore, the approval process for new osteoporosis treatments is stringent, which may limit the introduction of new products and market growth.

Growing economies and healthcare expenditures are two significant factors that are expected to generate numerous growth opportunities between 2022 and 2030. As economies grow and healthcare spending rises, so does the market for osteoporosis treatments. Furthermore, the prevalence of osteoporosis is increasing: As people live longer lives, the prevalence of osteoporosis rises, creating a greater need for treatment.

Osteoporosis Treatment Market Segmentation

The worldwide osteoporosis treatment market is categorized based on drug class, route of administration, distribution channel, and geography.

Osteoporosis Treatment Market By Drug Class

- Bisphosphonate

- Alendronate

- Risedronate

- Ibandronate

- Zoledronic Acid

- Others

- Calcitonin

- Hormone Replacement Therapy

- Parathyroid Hormone-Related Protein (PTHrP) Analog

- RANK ligand (RANKL) Inhibitor

- Selective Estrogen Receptor Modulator (SERMs)

According to an osteoporosis treatment industry analysis, the bisphosphonate sub-segment generate the largest revenue in 2021. Bisphosphonates are a commonly used drug class for the treatment of osteoporosis and be effective in reducing the risk of fractures and increasing bone density. Bisphosphonates work by inhibiting the activity of cells that break down bone, thereby slowing down bone loss. They are often used as first-line treatments for osteoporosis and are well-tolerated by most patients. Examples of bisphosphonates include alendronate, ibandronate, risedronate, and zoledronic acid. The high revenue generated by bisphosphonates is a testament to their efficacy and popularity as a treatment option for osteoporosis.

Osteoporosis Treatment Market By Route of Administration

- Oral

- Injectables

- Others

In the osteoporosis treatment market, the oral route of administration has gained significant traction. This is most likely due to the ease and convenience of taking oral medications, as well as the lower cost of oral medications compared to intravenous treatments. Bisphosphonates, a common class of drugs used to treat osteoporosis, are typically taken orally. The popularity of oral bisphosphonates and other osteoporosis medications has fueled growth in the oral treatment market. However, it is important to note that intravenous treatments for osteoporosis, such as zoledronic acid, can also be effective and may be favored by some patients or healthcare providers.

Osteoporosis Treatment Market By Distribution Channel

- Hospitals Pharmacies

- Retail Pharmacies & Stores

- Online Pharmacies

As per the osteoporosis treatment market forecast, hospital pharmacies are a leading distribution channel for osteoporosis treatments, and they have generated significant revenue in the osteoporosis treatment market. This is since many patients with osteoporosis are treated in a hospital setting, particularly for intravenous treatments or treatment after a fracture. Hospital pharmacies are well-equipped to provide patients with the medications they require, as well as the infrastructure to manage inventory, fill prescriptions, and ensure that patients receive the correct medication dose.

Osteoporosis Treatment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Osteoporosis Treatment Market Regional Analysis

The North American osteoporosis treatment market is mature and well-established, with high levels of demand for effective osteoporosis treatments and strong healthcare infrastructure. North America has a large and aging population, with many people at risk for and in need of osteoporosis treatment. As a result, the North American osteoporosis treatment market is one of the world's largest and most profitable.

The Asia-Pacific osteoporosis treatment market is rapidly expanding, driven by rising levels of demand for effective osteoporosis treatments and expanding healthcare infrastructure. The Asia-Pacific region has a large and aging population, with many people at risk for and in need of osteoporosis treatment. Furthermore, the region's economy is rapidly expanding, which is driving growth in the healthcare sector and intensifying access to medical services and treatments.

Osteoporosis Treatment Market Players

Some of the leading osteoporosis treatment companies include Amgen Inc., Asahi Kasei Corporation, DAIICHI SANKYO COMPANY, LIMITED, Dr. Reddy’s Laboratories Ltd., Eli Lilly and Company, F. Hoffmann-La Roche Ltd, GSK plc., Ligand Pharmaceuticals Incorporated, Merck & Co., Inc., Novartis AG, Pfizer Inc., Teva Pharmaceutical Industries Ltd., and Viatris Inc.

Frequently Asked Questions

What was the market size of the global osteoporosis treatment in 2021?

The market size of osteoporosis treatment was USD 12.2 Billion in 2021.

What is the CAGR of the global osteoporosis treatment market during forecast period of 2022 to 2030?

The CAGR of osteoporosis treatment market is 3.9% during the analysis period of 2022 to 2030.

Which are the key players operating in the market?

The key players operating in the global market are Amgen Inc., Asahi Kasei Corporation, DAIICHI SANKYO COMPANY, LIMITED, Dr. Reddy’s Laboratories Ltd., Eli Lilly and Company, F. Hoffmann-La Roche Ltd, GSK plc., Ligand Pharmaceuticals Incorporated, Merck & Co., Inc., Novartis AG, Pfizer Inc., Teva Pharmaceutical Industries Ltd., and Viatris Inc.

Which region held the dominating position in the global osteoporosis treatment market?

North America held the dominating position in osteoporosis treatment market during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for osteoporosis treatment market during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global osteoporosis treatment market?

The current trends and dynamics in the osteoporosis treatment industry include growing elderly population, increased occurrence of osteoporosis, and advancement in drug development technology.

Which drug class held the maximum share in 2021?

The bisphosphonate drug class held the maximum share of the osteoporosis treatment market.