Organic Wine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Organic Wine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

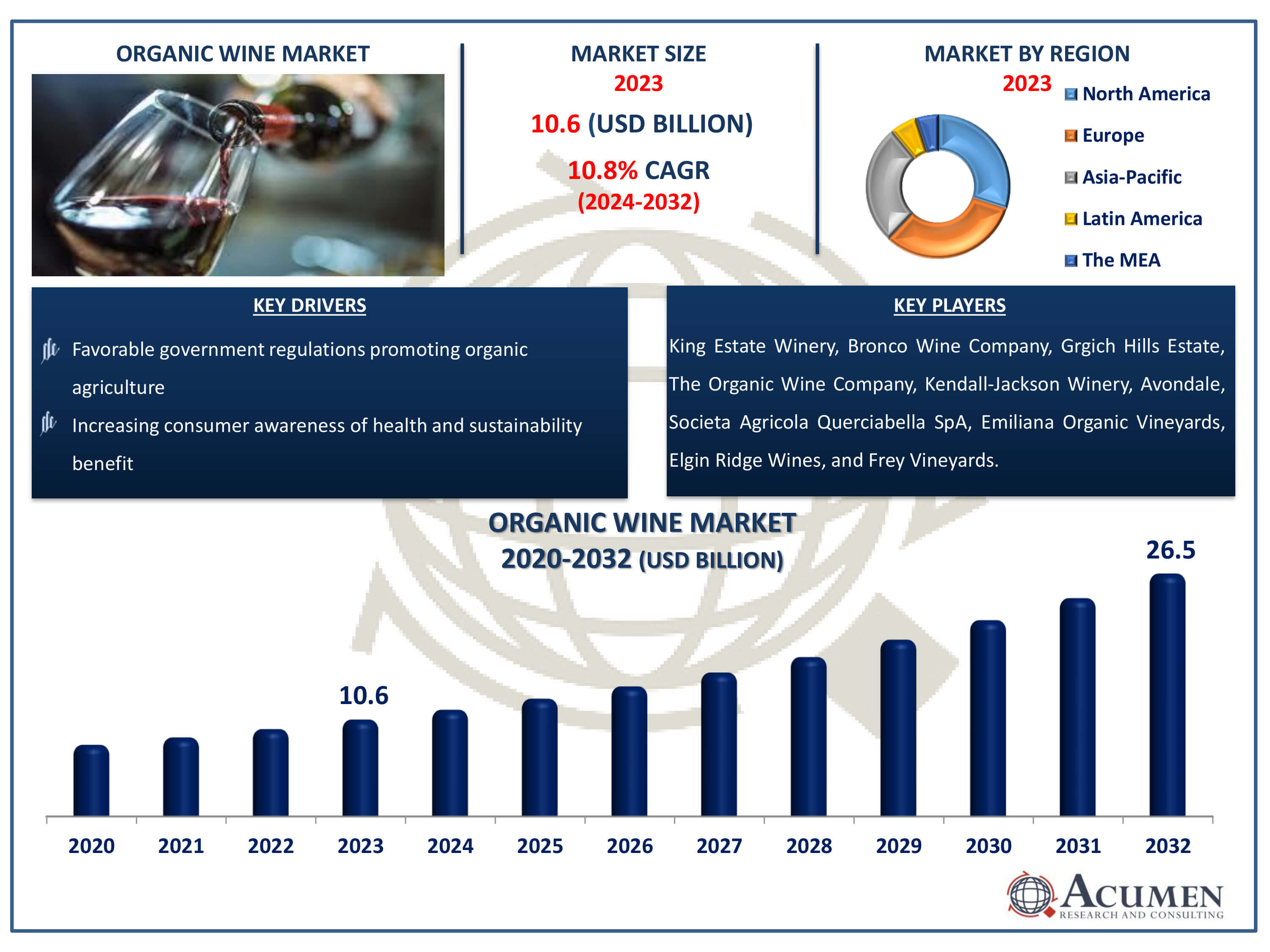

The Organic Wine Market Size accounted for USD 10.6 Billion in 2023 and is estimated to achieve a market size of USD 26.5 Billion by 2032 growing at a CAGR of 10.8% from 2024 to 2032.

Organic Wine Market Highlights

- Global organic wine market revenue is poised to garner USD 26.5 billion by 2032 with a CAGR of 10.8% from 2024 to 2032

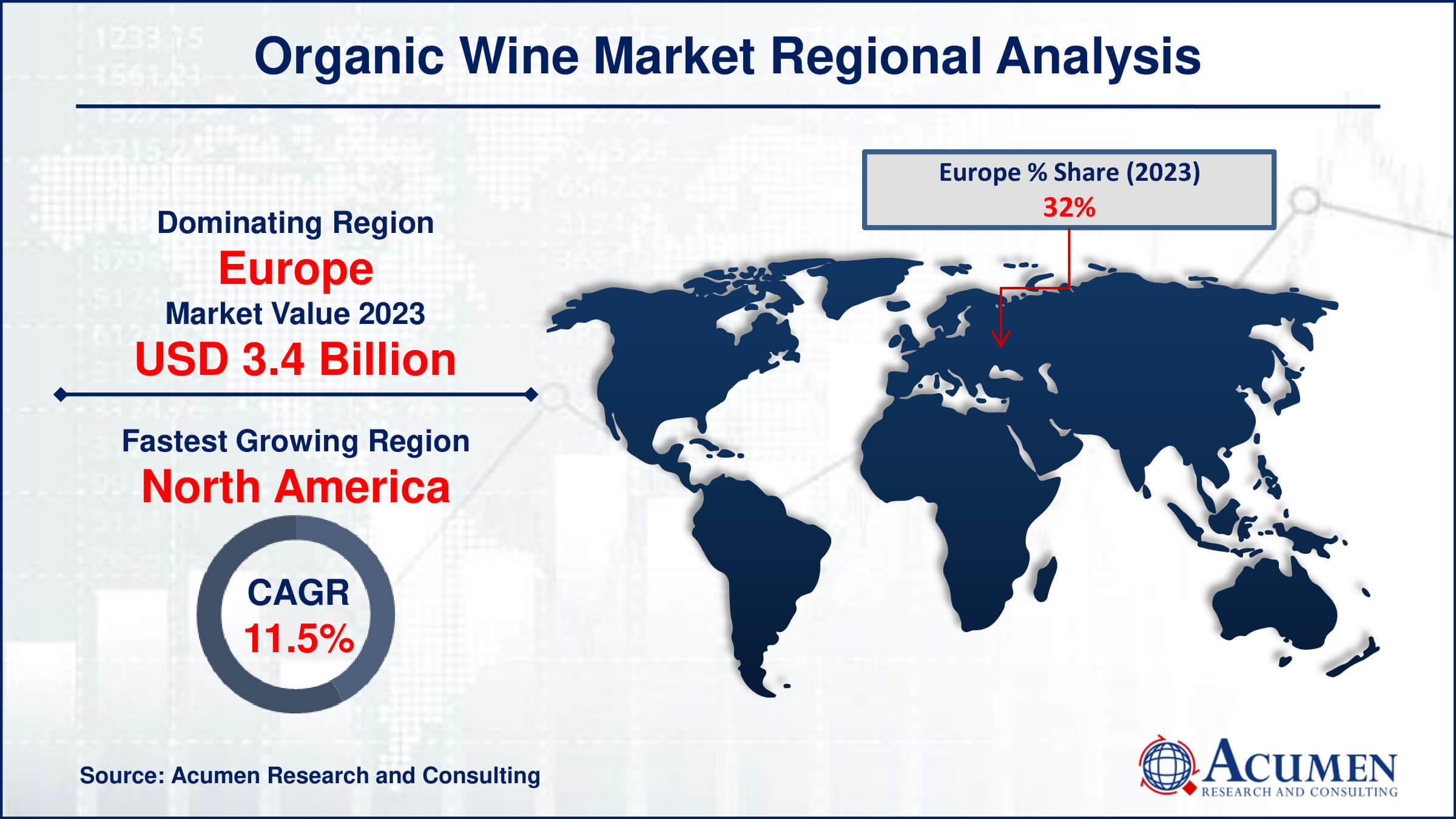

- Europe organic wine market value occupied around USD 3.4 billion in 2023

- North America organic wine market growth will record a CAGR of more than 11.5% from 2024 to 2032

- Among product, the red organic wine sub-segment generated more than USD 5.7 billion revenue in 2023

- Based on distribution channel, the supermarket/hypermarket sub-segment generated around 28% market share in 2023

- Rising interest in eco-friendly and ethical consumer choices is a popular organic wine market trend that fuels the industry demand

Organic wine, crafted from grapes grown without chemical industrial fertilizers, pesticides, fungicides, or herbicides, aligns with the principles of organic farming. This commitment to natural cultivation methods not only reflects environmental stewardship but also caters to the growing consumer demand for healthier choices. As health and well-being become paramount considerations for many wine enthusiasts, the allure of organic wines continues to rise. By embracing organic practices, winemakers not only produce wines of exceptional quality but also contribute to sustainable agriculture. This emphasis on purity and sustainability resonates with discerning consumers who prioritize both the quality of their wine and the health of the planet. Organic Wine embodies a commitment to craftsmanship, health-consciousness, and environmental responsibility, offering a taste of uncompromised excellence.

Global Organic Wine Market Dynamics

Market Drivers

- Increasing consumer awareness of health and sustainability benefits

- Growing demand for natural and chemical-free products

- Favorable government regulations promoting organic agriculture

- Rise in organic farming practices globally

Market Restraints

- Higher production costs associated with organic viticulture

- Limited availability of organic-certified vineyards

- Challenges in maintaining consistent quality due to natural variability

Market Opportunities

- Expansion of organic wine offerings in emerging markets

- Collaborations between wineries and organic certification bodies

- Innovations in organic farming techniques to enhance efficiency and yield

Organic Wine Market Report Coverage

| Market | Organic Wine Market |

| Organic Wine Market Size 2022 | USD 10.6 Billion |

| Organic Wine Market Forecast 2032 |

USD 26.5 Billion |

| Organic Wine Market CAGR During 2023 - 2032 | 10.8% |

| Organic Wine Market Analysis Period | 2020 - 2032 |

| Organic Wine Market Base Year |

2022 |

| Organic Wine Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Packaging, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | King Estate Winery, Bronco Wine Company, Grgich Hills Estate, The Organic Wine Company, Kendall-Jackson Winery, Avondale, Societa Agricola Querciabella SpA, Emiliana Organic Vineyards, Elgin Ridge Wines, and Frey Vineyards. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Organic Wine Market Insights

Over the past decade, there has been a notable surge in the popularity of organic and natural food and beverage products, particularly among millennials, on a global scale. This shift is largely driven by a growing aversion to conventional agricultural practices and a heightened awareness of health and environmental concerns. In response, the organic wine sector has witnessed a significant uptick in demand, especially in traditional wine-drinking regions such as Australia, New Zealand, France, Italy, and Argentina.

Organic wine production eschews the use of agricultural chemicals, sulphur, yeast, and artificial additives, opting instead for sustainable vineyard practices and indigenous yeast fermentation. This approach not only appeals to environmentally conscious consumers but also caters to preferences for vegan-friendly, preservative-free, biodynamic, and carbon-neutral beverages. As a result, the market, while still niche, is poised for rapid expansion in the organic wine industry forecast period, with forecasts suggesting a transition to mainstream status.

The momentum behind this growth is fueled by an increasingly health-conscious consumer base, which favors organic food and beverage options. Furthermore, the industry's commitment to transparency and ethical production practices is expected to further bolster consumer confidence and drive market expansion. Overall, the organic wine sector is poised to capitalize on evolving consumer preferences and emerge as a prominent player in the global beverage industry landscape.

Wine Consumption Witnessed Downturn Amid Covid-19 Pandemic

The COVID-19 pandemic dealt a severe blow to numerous primary manufacturing sectors, including the organic wine industry. With stringent government-imposed containment measures bringing the food and hospitality sectors to a standstill worldwide, organic wine sales suffered a significant downturn. Although the immediate future forecasts slow sales, certain regions may witness steady growth amidst the ongoing crisis. By the final quarter of 2020, there is a potential for a resurgence in global import and export of organic wine, as barriers to exchange and transportation are anticipated to ease. However, offline sales are expected to decline, prompting industry players to pivot towards online platforms to maintain market presence and adapt to the prevailing health crisis. Despite the challenges posed by COVID-19, strategic emphasis on online sales channels could help sustain the organic wine market during these uncertain times.

Organic Wine Market Segmentation

The worldwide market for organic wine is split based on product, packaging distribution channel, and geography.

Organic Wine Products

- Red Organic Wine

- White Organic Wine

According to organic wine industry analysis, the red organic wine segment has the biggest market share due to a variety of variables. Red wine has long been popular among customers worldwide, and this desire extends to the organic wine category. Furthermore, red wine is frequently thought to provide health benefits, such as antioxidant capabilities, which are consistent with the wellness-conscious preferences of organic product buyers. Furthermore, the production of red organic wine usually incorporates vigorous grape types that thrive in organic vineyard environments, resulting in high-quality goods that appeal to discerning wine lovers. As a result, the red organic wine segment continues to dominate the market, thanks to its innate appeal, supposed health benefits, and high-quality products.

Organic Wine Packaging

- Bottles

- Cans

- Others

Bottles continue to be the most popular packaging option in the organic wine market forecast peiord, owing to tradition, perceived quality, and environmental considerations. Glass bottles are preferred for preserving wine quality because they do not transmit any flavor or scent. Furthermore, they are easily recyclable and fit well with the eco-conscious mindset of organic wine buyers. Bottles popularity stems from their classic aesthetic appeal, which is frequently associated with premium quality and authenticity. While cans and other packaging options provide convenience and mobility, bottles remain popular due to their perceived superiority in retaining taste, supporting environmentally responsible activities, and maintaining the upmarket image generally associated with organic wine.

Organic Wine Distribution Channels

- Supermarket/Hypermarket

- Liquor Stores

- Online Channels

- Convenience Stores

- Others

Several significant reasons contribute to supermarket and hypermarket distribution channels dominance in the organic wine market. First example, these retail behemoths provide ample shelf space, allowing a diverse range of organic wine brands to be exhibited to customers. Furthermore, supermarkets and hypermarkets have considerable foot traffic, which provides good visibility and exposure for organic wine products. Their established supply chains offer regular availability and efficient delivery, allowing them to efficiently satisfy consumer demands. Furthermore, supermarkets frequently use promotional methods, such as discounts and special offers, to encourage organic wine purchases, enticing both returning and new customers. Given their ease, accessibility, and promotional activities, supermarket/hypermarket distribution channels are well-positioned to maintain their lead in the organic wine market.

Organic Wine Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Organic Wine Market Regional Analysis

In terms of organic wine market analysis, the European region stands as a promising hub for producers venturing into the burgeoning industry. With Spain, Italy, and France at its forefront, Europe has long been revered as the epicenter of wine culture, drawing enthusiasts from around the globe. In recent years, there has been a notable shift towards chemical-free practices, gaining significant traction among consumers. European wine drinkers increasingly seek transparency regarding ingredients, processing methods, and nutritional content. Natural yeast fermentation has emerged as a focal point for concerns among wine producers, reflecting a growing emphasis on preserving the authenticity of the winemaking process. Moreover, various initiatives have been initiated to enhance the efficiency of viticulture while simultaneously reducing the ecological footprint, underlining Europe's commitment to sustainable wine production.

Organic Wine Market Players

Some of the top organic wine companies offered in our report includes King Estate Winery, Bronco Wine Company, Grgich Hills Estate, The Organic Wine Company, Kendall-Jackson Winery, Avondale, Societa Agricola Querciabella SpA, Emiliana Organic Vineyards, Elgin Ridge Wines, and Frey Vineyards.

Frequently Asked Questions

How big is the organic wine market?

The organic wine market size was valued at USD 10.6 billion in 2023.

What is the CAGR of the global organic wine market from 2024 to 2032?

The CAGR of organic wine is 10.8% during the analysis period of 2024 to 2032.

Which are the key players in the organic wine market?

The key players operating in the global market are including King Estate Winery, Bronco Wine Company, Grgich Hills Estate, The Organic Wine Company, Kendall-Jackson Winery, Avondale, Societa Agricola Querciabella SpA, Emiliana Organic Vineyards, Elgin Ridge Wines, and Frey Vineyards.

Which region dominated the global organic wine market share?

Europe held the dominating position in organic wine industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of organic wine during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global organic wine industry?

The current trends and dynamics in the organic wine industry include increasing consumer awareness of health and sustainability benefits, growing demand for natural and chemical-free products, favorable government regulations promoting organic agriculture, and rise in organic farming practices globally.

Which product held the maximum share in 2023?

The red organic wine held the maximum share of the organic wine industry.