Organ Transplant Rejection Medication Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Organ Transplant Rejection Medication Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

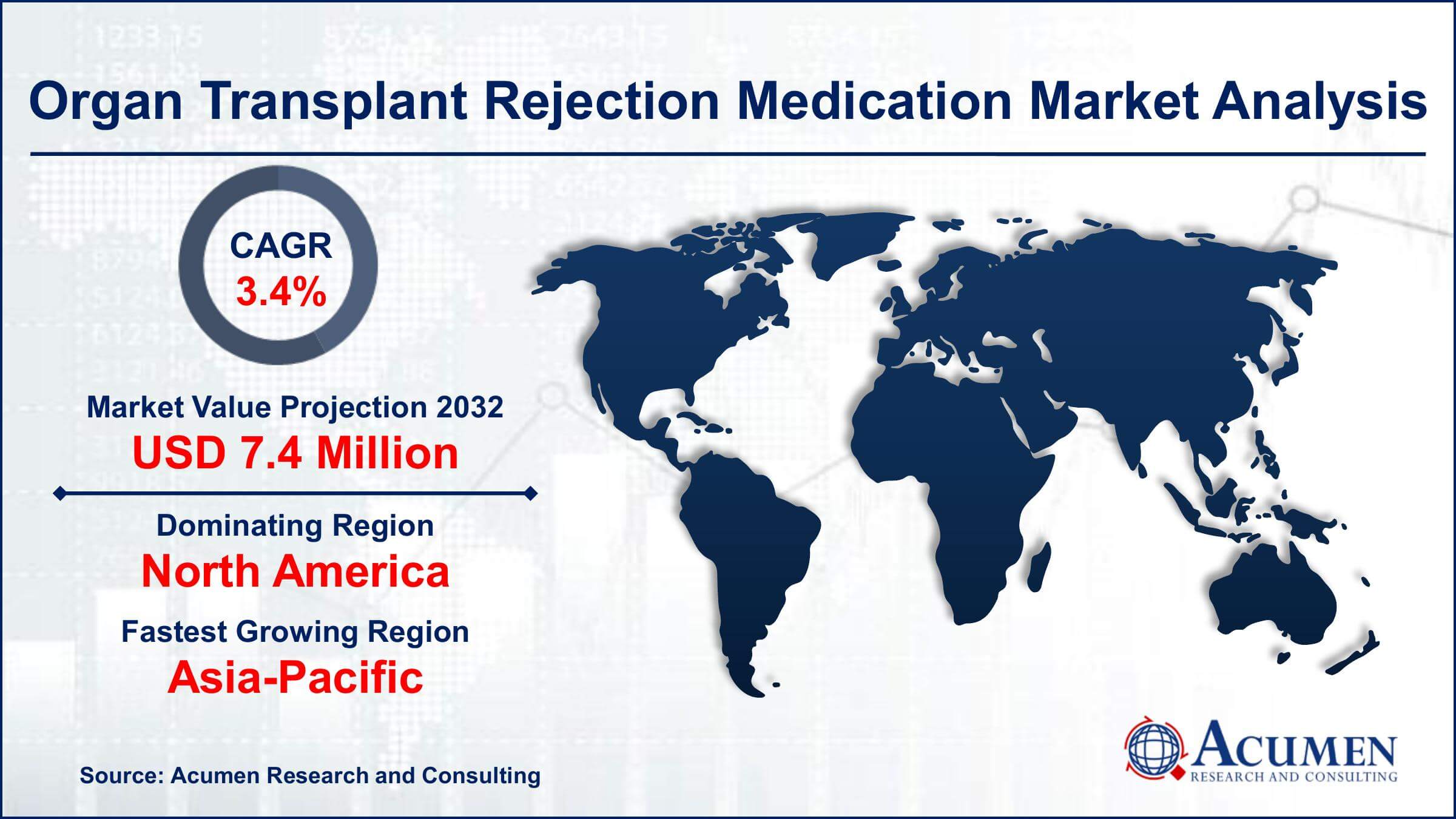

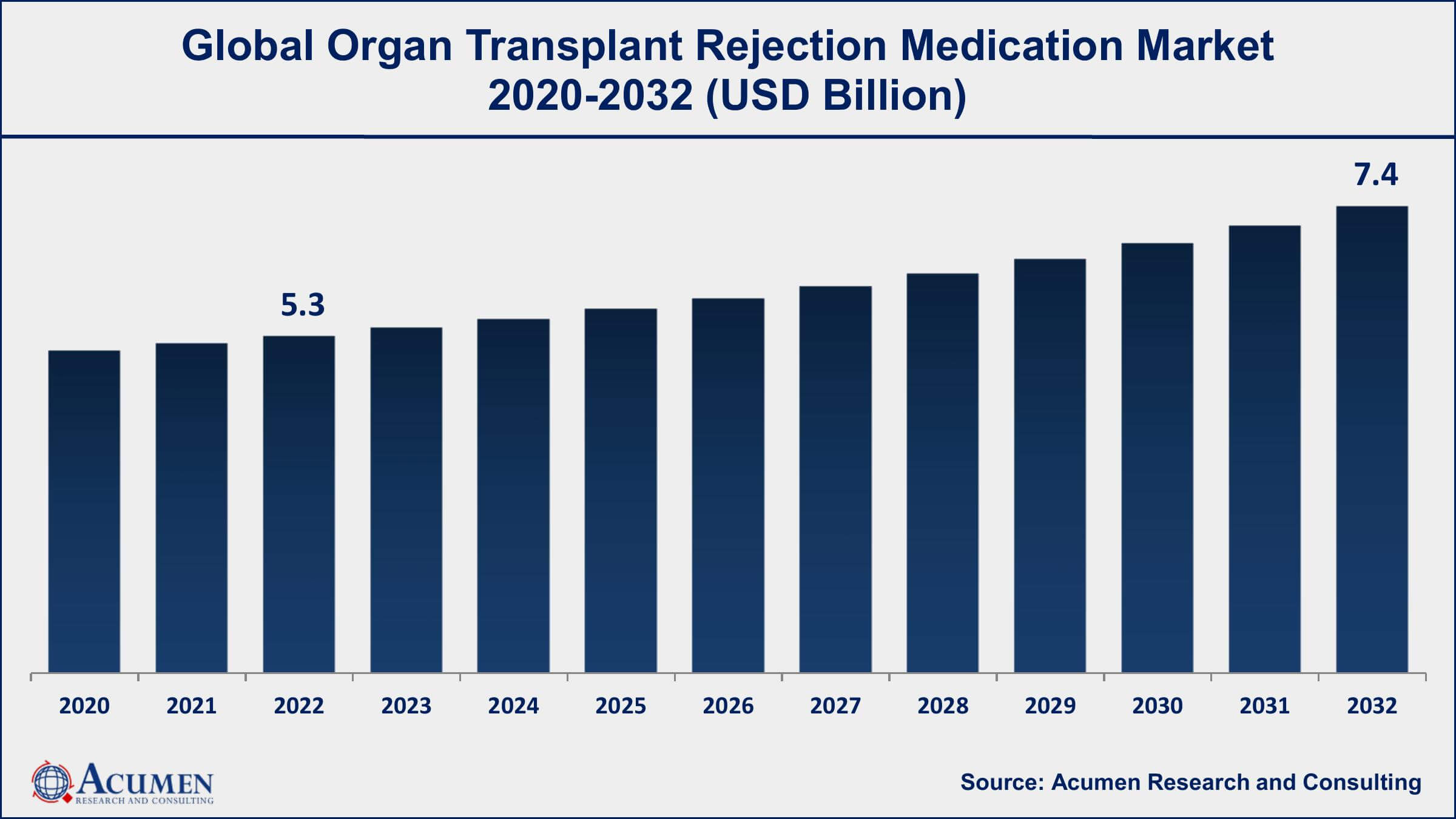

The Global Organ Transplant Rejection Medication Market Size accounted for USD 5.3 Billion in 2022 and is projected to achieve a market size of USD 7.4 Billion by 2032 growing at a CAGR of 3.4% from 2023 to 2032.

Organ Transplant Rejection Medication Market Highlights

- Global Organ Transplant Rejection Medication Market revenue is expected to increase by USD 7.4 Billion by 2032, with a 3.4% CAGR from 2023 to 2032

- North America region led with more than 43% of Organ Transplant Rejection Medication Market share in 2022

- Asia-Pacific Organ Transplant Rejection Medication Market growth will record a CAGR of around 3.9% from 2023 to 2032

- By drug class, the calcineurin inhibitors is the largest segment of the market, accounting for over 36% of the global market share

- By transplant type, the kidney is one of the largest and fastest-growing segments of the pruritus therapeutics industry

- Rising prevalence of organ failure and chronic diseases, drives the Organ Transplant Rejection Medication Market value

Organ transplant rejection medication, often referred to as immunosuppressive drugs or immunosuppressants, are pharmaceuticals used to suppress the recipient's immune system in organ transplant recipients. When a person receives a donated organ, their immune system may recognize the new organ as foreign and mount an immune response to attack it. To prevent this rejection, patients are prescribed immunosuppressive medications that help dampen the immune response, reducing the chances of organ rejection and allowing the transplanted organ to function properly.

The market for organ transplant rejection medication has witnessed significant growth in recent years due to several factors. First and foremost, the rising prevalence of organ failure and the increasing number of organ transplant procedures being performed globally have driven the demand for these medications. Additionally, advancements in medical technology and drug development have led to the introduction of more effective and targeted immunosuppressive drugs, improving patient outcomes and reducing the risk of complications. Furthermore, expanding healthcare infrastructure in emerging markets, along with better access to healthcare services, has contributed to the growth of this market.

Global Organ Transplant Rejection Medication Market Trends

Market Drivers

- Rising prevalence of organ failure and chronic diseases

- Advancements in transplantation techniques

- Increasing awareness of the importance of early intervention

- The aging population and longer life expectancy

Market Restraints

- High cost of immunosuppressive medications

- Potential adverse effects and long-term complications

Market Opportunities

- Development of more targeted and personalized immunosuppressive therapies

- Growing focus on regenerative medicine and tissue engineering

Organ Transplant Rejection Medication Market Report Coverage

| Market | Organ Transplant Rejection Medication Market |

| Organ Transplant Rejection Medication Market Size 2022 | USD 5.3 Billion |

| Organ Transplant Rejection Medication Market Forecast 2032 | USD 7.4 Billion |

| Organ Transplant Rejection Medication Market CAGR During 2023 - 2032 | 3.4% |

| Organ Transplant Rejection Medication Market Analysis Period | 2020 - 2032 |

| Organ Transplant Rejection Medication Market Base Year |

2022 |

| Organ Transplant Rejection Medication Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Drug Class, By Transplant Type, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Novartis AG, Pfizer Inc., Roche Holdings AG, Bristol-Myers Squibb Company, Astellas Pharma Inc., Johnson & Johnson, AbbVie Inc., Mylan N.V. (now Viatris Inc.), Sanofi, Merck & Co., Inc., Allergan (now part of AbbVie), and Teva Pharmaceutical Industries Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Organ transplant rejection medication, also known as immunosuppressive drugs, is a class of pharmaceuticals designed to prevent the recipient's immune system from rejecting a transplanted organ or tissue. When a person undergoes an organ transplant, such as a kidney, heart, or liver transplant, their immune system may perceive the new organ as foreign and mount an immune response to eliminate it. This immune response, if left unchecked, can lead to the rejection of the transplanted organ, jeopardizing the success of the transplant and the patient's health.

These medications work by suppressing the recipient's immune system, reducing its activity and its ability to recognize and attack the transplanted organ. Commonly used immunosuppressive drugs include calcineurin inhibitors like tacrolimus and cyclosporine, antimetabolites like mycophenolate mofetil, and corticosteroids. The goal is to find the right balance between suppressing the immune system enough to prevent rejection while still allowing it to function adequately to protect the body against infections and other threats. These medications play a crucial role in ensuring the long-term viability of transplanted organs and are typically administered for the duration of the patient's life post-transplant.

The organ transplant rejection medication market has experienced significant growth over the years and continues to expand due to various factors. One of the primary drivers of this growth is the rising prevalence of chronic diseases such as kidney disease, liver disease, and heart disease, which often necessitate organ transplantation as a life-saving treatment option. As these conditions become more prevalent globally, the demand for organ transplant rejection medications has surged, contributing to market expansion. Advancements in medical technology, surgical techniques, and transplant procedures have also played a pivotal role in boosting the market.

Organ Transplant Rejection Medication Market Segmentation

The global Organ Transplant Rejection Medication Market segmentation is based on drug class, transplant type, distribution channel, and geography.

Organ Transplant Rejection Medication Market By Drug Class

- Calcineurin inhibitors

- mTOR inhibitor

- Antiproliferative agents

- Antibodies

- Steroids

According to the organ transplant rejection medication industry analysis, the calcineurin inhibitors segment accounted for the largest market share in 2022. This growth due to their essential role in preventing graft rejection in organ transplant recipients. CNIs, such as tacrolimus and cyclosporine, are the cornerstone of immunosuppressive therapy and have demonstrated remarkable efficacy in suppressing the immune system's response to transplanted organs. One significant factor contributing to the growth of the CNI segment is the continuous refinement and development of these drugs. Pharmaceutical companies have been investing in research and development to create more potent and targeted CNIs with improved safety profiles. These efforts have resulted in new formulations and delivery methods, enhancing patient compliance and reducing the risk of side effects. As a result, CNIs have become increasingly effective at preventing transplant rejection while minimizing adverse reactions.

Organ Transplant Rejection Medication Market By Transplant Type

- Kidney

- Heart

- Liver

- Pancreas

- Lung

- Others

In terms of transplant types, the kidney segment is expected to witness significant growth in the coming years. Kidney transplantation is one of the most common organ transplant procedures worldwide, owing to the high prevalence of kidney disease and the significant improvement in the quality of life it offers to patients. Consequently, the demand for immunosuppressive medications, including calcineurin inhibitors (CNIs) like tacrolimus and cyclosporine, has surged in this segment. One of the primary drivers of growth in the kidney segment is the increasing number of patients suffering from end-stage renal disease (ESRD) and chronic kidney disease (CKD). These conditions often lead to kidney failure, necessitating transplantation as a life-saving option. As the incidence of ESRD and CKD continues to rise due to factors like hypertension, diabetes, and lifestyle changes, the kidney transplant market has expanded significantly.

Organ Transplant Rejection Medication Market By Distribution Channel

- Hospital pharmacies

- Online pharmacies

- Retail pharmacies

According to the organ transplant rejection medication market forecast, the hospital pharmacies segment is expected to witness significant growth in the coming years. Hospital pharmacies serve as critical intermediaries between pharmaceutical manufacturers, transplant centers, and patients, ensuring the timely availability and safe administration of immunosuppressive drugs. One of the primary drivers of growth in this segment is the increasing number of organ transplant procedures performed in hospital settings. Hospitals remain the primary location for transplant surgeries and post-transplant care, making them central hubs for the procurement and distribution of immunosuppressive medications. As the demand for organ transplantation continues to rise, hospital pharmacies have been tasked with efficiently managing and dispensing these medications, thus contributing to market growth. Additionally, the growing emphasis on patient-centered care and the need for personalized medication regimens have underscored the significance of hospital pharmacies.

Organ Transplant Rejection Medication Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Organ Transplant Rejection Medication Market Regional Analysis

Geographically, North America has emerged as a dominant region in the organ transplant rejection medication market in 2022. The United States and Canada have well-established healthcare infrastructures and a high level of medical expertise, making them leaders in organ transplantation procedures. This region boasts a large pool of skilled transplant surgeons, specialized transplant centers, and advanced medical research facilities, contributing to the growth and success of organ transplantation. As a result, North America has a higher number of transplant surgeries, driving the demand for immunosuppressive medications. Moreover, the North American region has a robust pharmaceutical industry with numerous key players engaged in the development and manufacturing of organ transplant rejection medications. Many of the leading pharmaceutical companies, headquartered in the United States, are actively involved in producing innovative and effective immunosuppressive drugs. These companies invest heavily in research and development, resulting in the introduction of new formulations and treatment options that enhance patient outcomes and reduce the risk of rejection. This innovation-driven approach has further solidified North America's position as a dominant player in the market.

Organ Transplant Rejection Medication Market Player

Some of the top organ transplant rejection medication market companies offered in the professional report include Novartis AG, Pfizer Inc., Roche Holdings AG, Bristol-Myers Squibb Company, Astellas Pharma Inc., Johnson & Johnson, AbbVie Inc., Mylan N.V. (now Viatris Inc.), Sanofi, Merck & Co., Inc., Allergan (now part of AbbVie), and Teva Pharmaceutical Industries Ltd.

Frequently Asked Questions

What was the market size of the global organ transplant rejection medication in 2022?

The market size of organ transplant rejection medication was USD 5.3 Billion in 2022.

What is the CAGR of the global organ transplant rejection medication market from 2023 to 2032?

The CAGR of organ transplant rejection medication is 3.4% during the analysis period of 2023 to 2032.

Which are the key players in the organ transplant rejection medication market?

The key players operating in the global market are including Novartis AG, Pfizer Inc., Roche Holdings AG, Bristol-Myers Squibb Company, Astellas Pharma Inc., Johnson & Johnson, AbbVie Inc., Mylan N.V. (now Viatris Inc.), Sanofi, Merck & Co., Inc., Allergan (now part of AbbVie), and Teva Pharmaceutical Industries Ltd.

Which region dominated the global organ transplant rejection medication market share?

North America held the dominating position in organ transplant rejection medication industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of organ transplant rejection medication during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global organ transplant rejection medication industry?

The current trends and dynamics in the organ transplant rejection medication industry include rising prevalence of organ failure and chronic diseases, advancements in transplantation techniques, and increasing awareness of the importance of early intervention.

Which transplant type held the maximum share in 2022?

The kidney transplant type held the maximum share of the organ transplant rejection medication industry.