Ophthalmic Drugs Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Ophthalmic Drugs Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

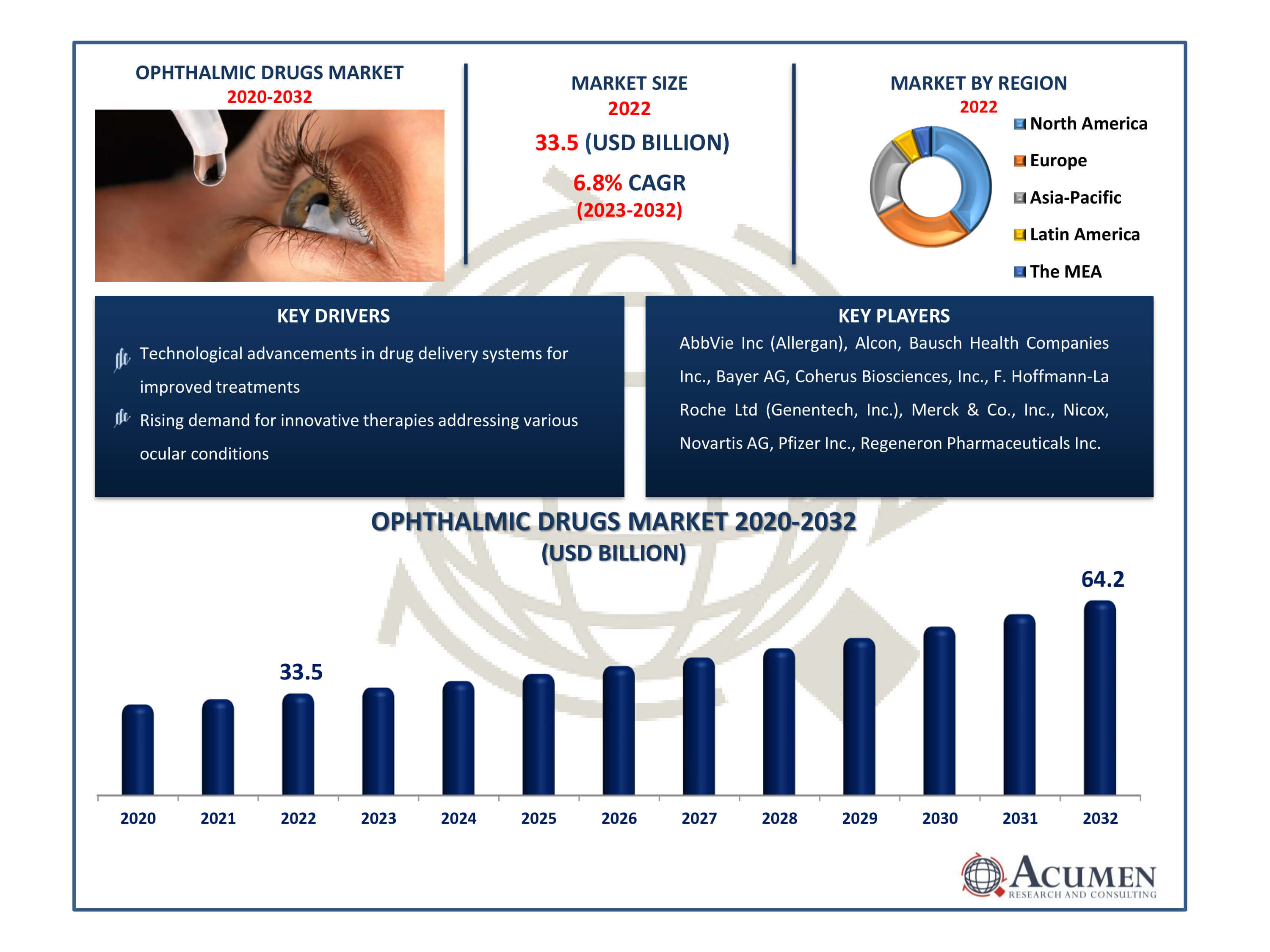

The Ophthalmic Drugs Market Size accounted for USD 33.5 Billion in 2022 and is estimated to achieve a market size of USD 64.2 Billion by 2032 growing at a CAGR of 6.8% from 2023 to 2032.

Ophthalmic Drugs Market Highlights

- Global ophthalmic drugs market revenue is poised to garner USD 64.2 billion by 2032 with a CAGR of 6.8% from 2023 to 2032

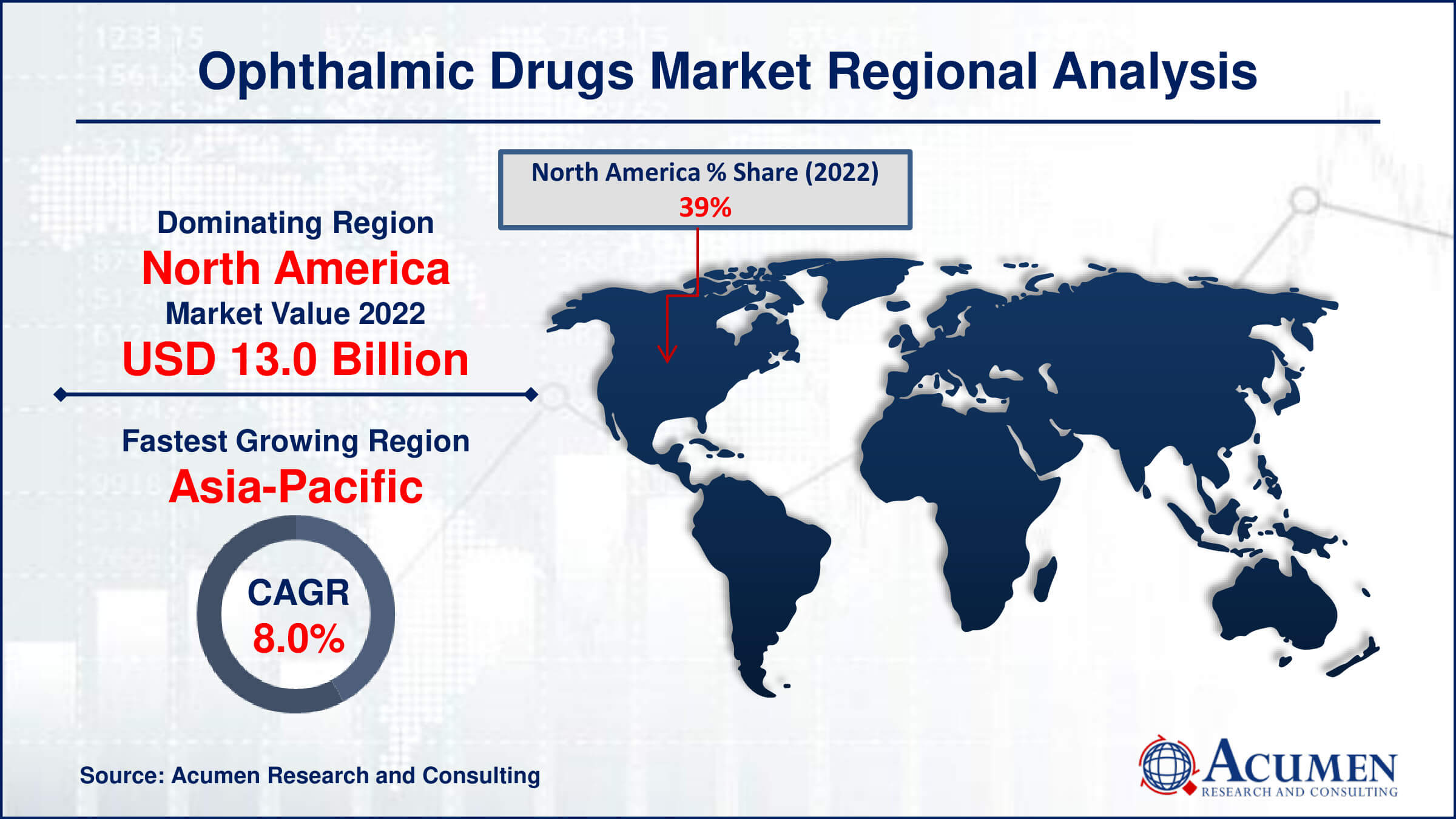

- North America ophthalmic drugs market value occupied around USD 13 billion in 2022

- Asia-Pacific ophthalmic drugs market growth will record a CAGR of more than 8% from 2023 to 2032

- Among class, the anti-VEGF agents sub-segment generated over US$ 11 billion revenue in 2022

- Based on disease, the retinal disorders sub-segment generated around 35% share in 2022

- Collaborations and partnerships for novel drug development and market expansion is a popular ophthalmic drugs market trend that fuels the industry demand

Ophthalmic drugs are pharmaceutical chemicals that are especially designed to treat, manage, or prevent a variety of eye-related disorders and diseases. These medications are available in a variety of forms, including eye drops, ointments, gels, and oral medications, and are designed to treat a wide range of eye illnesses, including glaucoma, cataracts, infections, inflammation, allergies, dry eyes, macular degeneration, and other vision-related difficulties. Ophthalmic Drugs are designed to target specific eye structures or functions, with the goal of alleviating symptoms, controlling conditions, inhibiting infections, or slowing the evolution of certain eye illnesses, hence contributing to better vision and ocular health. The introduction of new delivery approaches for ocular pharmaceuticals has driven manufacturers to develop innovative therapies for treating various eye disorders. According to the American Academy of Ophthalmology, approximately 11 million people in the U.S. are affected by age-related macular degeneration (AMD), with about 10% suffering from wet AMD. These global trends in eye diseases significantly contribute to the growth of the market.

Global Ophthalmic Drugs Market Dynamics

Market Drivers

- Increasing prevalence of eye disorders globally

- Technological advancements in drug delivery systems for improved treatments

- Growing aging population prone to age-related eye ailments

- Rising demand for innovative therapies addressing various ocular conditions

Market Restraints

- Stringent regulatory approvals for ophthalmic drugs

- High costs associated with research and development

- Limited awareness about eye health in certain demographics

Market Opportunities

- Expanding untapped markets in developing regions

- Surging demand for combination therapies in eye care

- Advancements in personalized medicine for targeted ocular treatments

Ophthalmic Drugs Market Report Coverage

| Market | Ophthalmic Drugs Market |

| Ophthalmic Drugs Market Size 2022 | USD 33.5 Billion |

| Ophthalmic Drugs Market Forecast 2032 | USD 64.2 Billion |

| Ophthalmic Drugs Market CAGR During 2023 - 2032 | 6.8% |

| Ophthalmic Drugs Market Analysis Period | 2020 - 2032 |

| Ophthalmic Drugs Market Base Year |

2022 |

| Ophthalmic Drugs Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Class, By Disease, By Dosage Form, By Product Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AbbVie Inc (Allergan), Alcon, Bausch Health Companies Inc., Bayer AG, Coherus Biosciences, Inc., F. Hoffmann-La Roche Ltd (Genentech, Inc.), Merck & Co., Inc., Nicox, Novartis AG, Pfizer Inc., and Regeneron Pharmaceuticals Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Ophthalmic Drugs Market Insights

The growth of the ophthalmic medicines market is primarily attributed to several key factors. These include the escalating incidence and prevalence of eye-related conditions, increased research and development efforts in crafting new pharmaceuticals, and a heightened focus on developing combination therapies. The global demand for ophthalmic drugs is surging in tandem with the rise in eye diseases observed across developed and developing nations, posing potential threats to individuals' eyesight. Notably, diabetic retinopathy has emerged as a prioritized concern due to the escalating prevalence of diabetes in numerous countries. Additionally, glaucoma, a condition challenging to diagnose early, continues to persist as a longstanding public health concern due to the necessity for lifelong treatment.

WHO estimated a significant global burden of vision impairment, affecting billions of individuals. This impairment included poor visibility, moderate to severe vision issues, and blindness. Uncorrected refractive errors and cataracts stand out as the primary causes of vision impairment globally, particularly among individuals over 50 years old. Chronic eye diseases rank as the foremost reason for vision loss, with refractive errors and untreated cataracts being the top culprits. These conditions predominantly affect low- and middle-income countries, where accessibility to eye care is limited. Remarkably, more than 80 percent of visual impairments are treatable or preventable, underscoring the necessity of medications for effective disease management. The increasing prevalence of eye disorders is anticipated to significantly impact the growth trajectory of the market for these medicines.

Ophthalmic Drugs Market Segmentation

The worldwide market for ophthalmic drugs is split based on class, disease, dosage form, product type, and geography.

Ophthalmic Drug Classes

- Antiallergy

- Anti-Vascular Endothelial Growth Factor (Anti-VEGF) Agents

- Anti-inflammatory

- Nonsteroidal Drugs

- Steroidal Drugs

- Antiglaucoma

- Others

The primary drug classes encompass anti-allergies, anti-bluetongue agents, anti-inflammatories, and anti-VEGF agents. In 2022, anti-VEGF agents dominated the market, securing a market share of over 33% owing to their extensive use in treating Age-related Macular Degeneration (AMD), diabetic retinopathy, and retinal vein occlusion. The anti-VEGF segment is projected to maintain rapid growth, primarily due to the introduction of new treatments, including Macugen (pegaptanib), Lucentis (ranibizumab), and Avastin (bevacizumab), aimed at addressing AMD. Additionally, the anti-inflammatory segment, classified into steroidal and non-steroidal medicines, saw non-steroidal drugs as the largest segment in 2022. However, the steroid drug segment is estimated to exhibit the fastest growth in the ophthalmic drugs market forecast period.

Ophthalmic Drug Diseases

- Dry Eye

- Gels

- Eye Solutions

- Capsules & Tablets

- Eye Drops

- Ointments

- Allergies

- Gels

- Eye Solutions

- Capsules & Tablets

- Eye drops

- Ointments

- Glaucoma

- Gels

- Eye Solutions

- Capsules & Tablets

- Eye drops

- Ointments

- Inflammation/Infection

- Gels

- Eye Solutions

- Capsules & Tablets

- Eye drops

- Ointments

- Retinal Disorders

- Gels

- Eye Solutions

- Capsules & Tablets

- Eye drops

- Ointments

- Uveitis

- Gels

- Eye Solutions

- Capsules & Tablets

- Eye drops

- Ointments

- Others

The market segments based on diseases include dry eye, glaucoma, retinal disorders, inflammation/infection, allergy, and uveitis. In 2022, the retinal diseases segment held the market lead. Predicted to grow at a higher CAGR between the ophthalmic drugs industry forecast period from 2023 to 2032, retinal disorders are expected to become the fastest-growing segment due to the escalating prevalence of diabetes. According to a study by the VISION Loss Expert Group of the Global Burden of Disease Study, individuals with diabetes face a 2.4 times higher risk of blindness compared to those without diabetes. With several pipeline drugs in development, glaucoma stands as the second-largest segment. For instance, Ocular Therapeutix, Inc.'s OTX-TP is currently undergoing phase three trials to assess its efficacy in reducing intraocular pressure associated with both eye blood pressure and glucose levels.

Ophthalmic Drug Dosage Forms

- Gels

- Eye Solutions

- Capsules & Tablets

- Eye Drops

- Ointments

According to the ophthalmic drugs market analysis, eye drops held the market lead and are anticipated to continue growing rapidly, mainly due to their cost-effectiveness compared to other dosage forms. The segment's growth is further fueled by advancements in innovative treatments delivered in the form of eye drops. Notably, Bausch & Lomb Inc. received FDA approval for LUMIFY, the first low-dose brimonidine over-the-counter (OTC) eye drop designed to treat eye redness.

Ophthalmic Drug Product Types

- Prescription Drugs

- OTC Drugs

As per the ophthalmic drugs industry analysis, prescription drugs hold dominance in the market due to their specialized formulations and targeted treatment approaches for complex eye conditions. These medications, which are frequently prescribed for serious illnesses such as glaucoma or post-surgical inflammations, have a higher efficacy and must be administered under medical care. prescription drugs' specialised nature, focused on complex eye illnesses, puts them as the top choice among healthcare professionals, adding significantly to their market domination in the ophthalmic drugs sector.

Ophthalmic Drugs Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Ophthalmic Drugs Market Regional Analysis

North America is the largest area in the ophthalmic drugs market due to its rich healthcare infrastructure and excellent research capabilities. The region has a high rate of adoption of new ophthalmic treatments, owing to a large patient pool and rising prevalence of eye illnesses. A proactive regulatory environment, as well as significant investments in healthcare, contributes to North America's supremacy in this market category.

The Asia-Pacific area, on the other hand, is experiencing tremendous expansion as a result of increased healthcare access and more awareness about eye health. This increase is fueled by factors such as an ageing population, lifestyle changes, and an increase in diabetic cases resulting in eye-related issues. Furthermore, technological advances and increased treatment affordability contribute to the Asia-Pacific market's quick rise. This region is making tremendous advances in the development of Ophthalmic Drugs to meet the demands of various populations and healthcare systems. As healthcare access improves and new medications become available, Asia-Pacific remains a critical area poised for significant growth in the ophthalmic drugs market.

Ophthalmic Drugs Market Players

Some of the top ophthalmic drugs companies offered in our report include AbbVie Inc (Allergan), Alcon, Bausch Health Companies Inc., Bayer AG, Coherus Biosciences, Inc., F. Hoffmann-La Roche Ltd (Genentech, Inc.), Merck & Co., Inc., Nicox, Novartis AG, Pfizer Inc., and Regeneron Pharmaceuticals Inc.

Frequently Asked Questions

How big is the ophthalmic drugs market?

The ophthalmic drugs market size was USD 33.5 Billion in 2022.

What is the CAGR of the global ophthalmic drugs market from 2023 to 2032?

The CAGR of ophthalmic drugs is 6.8% during the analysis period of 2023 to 2032.

Which are the key players in the ophthalmic drugs market?

The key players operating in the global market are including AbbVie Inc (Allergan), Alcon, Bausch Health Companies Inc., Bayer AG, Coherus Biosciences, Inc., F. Hoffmann-La Roche Ltd (Genentech, Inc.), Merck & Co., Inc., Nicox, Novartis AG, Pfizer Inc., and Regeneron Pharmaceuticals Inc.

Which region dominated the global ophthalmic drugs market share?

North America held the dominating position in ophthalmic drugs industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of ophthalmic drugs during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global ophthalmic drugs industry?

The current trends and dynamics in the ophthalmic drugs industry include increasing prevalence of eye disorders globally, technological advancements in drug delivery systems for improved treatments, growing aging population prone to age-related eye ailments, and rising demand for innovative therapies addressing various ocular conditions.

Which dosage form held the maximum share in 2022?

The eye drops dosage form held the maximum share of the ophthalmic drugs industry.